Commodities and inflation share a complex relationship. Commodities are basic goods used in commerce, such as grains, oil, or gold. Their prices can greatly influence inflation, which is the rate at which the general level of prices for goods and services is rising. When the price of a widely used commodity like oil increases, it can lead to higher production costs for many goods, pushing up their prices and causing inflation. Conversely, a decrease in commodity prices can put downward pressure on inflation. In the financial market, commodities are often used as a hedge against inflation because their prices usually rise when inflation increases, thereby maintaining purchasing power. Thus, understanding the dynamics between commodities and inflation is vital for both economic policy and investment strategies. These include food crops like corn, soybean, wheat, and other grains. Soft commodities or softs refer to goods that are grown, such as coffee, cocoa, sugar, and fruit. Energy commodities encompass crude oil, natural gas, heating oil, and gasoline, all traded globally on various commodities exchanges. These encompass precious metals such as gold, silver, platinum, and palladium, as well as base metals like copper, zinc, nickel, and aluminum. Livestock commodities include live cattle, feeder cattle, lean hogs, and pork bellies. These are significant parts of the agricultural commodities category. Geopolitical issues, such as wars, political unrest, and trade policies, can significantly impact the supply and demand of commodities, thereby influencing their prices. Changes in supply and demand for a commodity, caused by factors like changing consumption patterns, economic growth, or weather impacts on agricultural commodities, can greatly affect commodity prices. As commodities are typically priced in U.S. dollars, fluctuations in the value of the dollar can influence commodity prices. When the dollar strengthens, commodities become more expensive for buyers using other currencies, potentially decreasing demand and lowering prices. Advancements in technology can influence commodity prices by improving extraction or production processes, which can increase supply and potentially lower prices. Alternatively, they might boost demand for certain commodities, raising their prices. Speculation by traders can cause commodity prices to fluctuate. If speculators believe a commodity's price will rise in the future, their increased buying can drive up the commodity's current price. Demand-pull inflation occurs when demand for goods and services exceeds the supply. It can be caused by increased consumer spending due to factors like lower interest rates or increased government spending. Cost-push inflation occurs when the costs of production increase, causing producers to raise prices to maintain their profit margins. This can be due to rising wages, higher raw material prices, or increased taxes. Built-in inflation is inflation that is expected to occur in the future. It can be caused by past experiences with inflation or by expectations that inflationary forces will continue to drive prices up. Commodity prices can significantly impact inflation. For example, an increase in the price of oil can lead to higher transportation costs, which can then cause an increase in the prices of goods and services, leading to inflation. Increased commodity prices, especially those that are directly linked to consumers such as food and energy, often lead to an increase in the cost of living, thereby causing inflation. Similarly, decreased commodity prices can lead to deflation. The law of supply and demand plays a crucial role in both commodity prices and inflation. For example, a shortage of a commodity can lead to an increase in its price. This can then lead to increased costs for manufacturers, who may pass these costs onto consumers, leading to inflation. A commodity price shock is a sudden, unexpected change in the price of a commodity. These shocks can significantly impact economies, particularly those heavily dependent on the export or import of the affected commodity. Examples of commodity price shocks include the oil crises of the 1970s, the spike in grain prices due to adverse weather conditions, and the more recent price swings in the global oil market due to geopolitical tensions. Commodity price shocks can cause inflation if they lead to increased costs for producers that are passed onto consumers. For example, an unexpected increase in oil prices can lead to higher transportation costs, which can then translate into higher prices for goods and services, causing inflation. Mitigating the effects of commodity price shocks can involve a variety of strategies, including diversifying the economy, building up foreign exchange reserves, and implementing appropriate monetary and fiscal policies. Commodities can be used as a hedge against inflation because their prices tend to rise with inflation, providing a natural protection against the loss of purchasing power. Commodities can provide diversification benefits in an investment portfolio. They offer a hedge against inflation and geopolitical risks, and their prices often move independently of stocks and bonds. Commodities can act as an inflation hedge as their prices often increase with inflation. This is particularly the case for commodities like gold, which is often seen as a store of value during inflationary periods. While commodities can provide a hedge against inflation, they come with risks. Commodity prices can be volatile, and there are costs and practicalities associated with storing and insuring physical commodities. Inflation can impact commodity trading in several ways. For example, if traders expect inflation to rise, they may increase their demand for commodities as a hedge, driving up prices. If market participants expect higher inflation in the future, they may purchase commodities to protect against the eroding purchasing power of money. This increased demand can drive up commodity prices. Inflation expectations can influence commodity trading strategies. For example, traders expecting higher inflation may increase their holdings of commodities, particularly those seen as a store of value like gold. Policy responses to commodity-driven inflation can involve monetary and fiscal measures. Central banks, in particular, play a crucial role in managing inflation. Central banks often have the mandate to maintain price stability. They use tools such as interest rates and open market operations to manage inflation. To combat inflation, central banks can increase interest rates, reducing the money supply in the economy and dampening demand. They can also use open market operations to sell government securities, effectively removing money from the financial system and reducing inflationary pressures. Government fiscal policies, such as taxation and spending, can also impact commodity-driven inflation. For example, a reduction in subsidies on certain commodities can lead to an increase in their prices and potentially contribute to inflation. The intricate interplay between commodities and inflation shapes global economic landscapes. Commodity prices, influenced by factors like geopolitical events, supply-demand dynamics, and market speculation, play a crucial role in driving inflation. Fluctuations in commodity prices, whether due to regular market dynamics or sudden shocks, can significantly impact inflation rates. Conversely, inflation expectations can alter commodity trading strategies. Therefore, policy responses, particularly from central banks and government fiscal policies, are essential to managing commodity-driven inflation. Additionally, commodities serve as a valuable hedge against inflation, adding a layer of protection for investors. As the world continues to grapple with economic uncertainties and environmental challenges, understanding the dynamics of commodities and their relationship with inflation remains a critical aspect for both investors and policymakers.Commodities and Inflation Overview

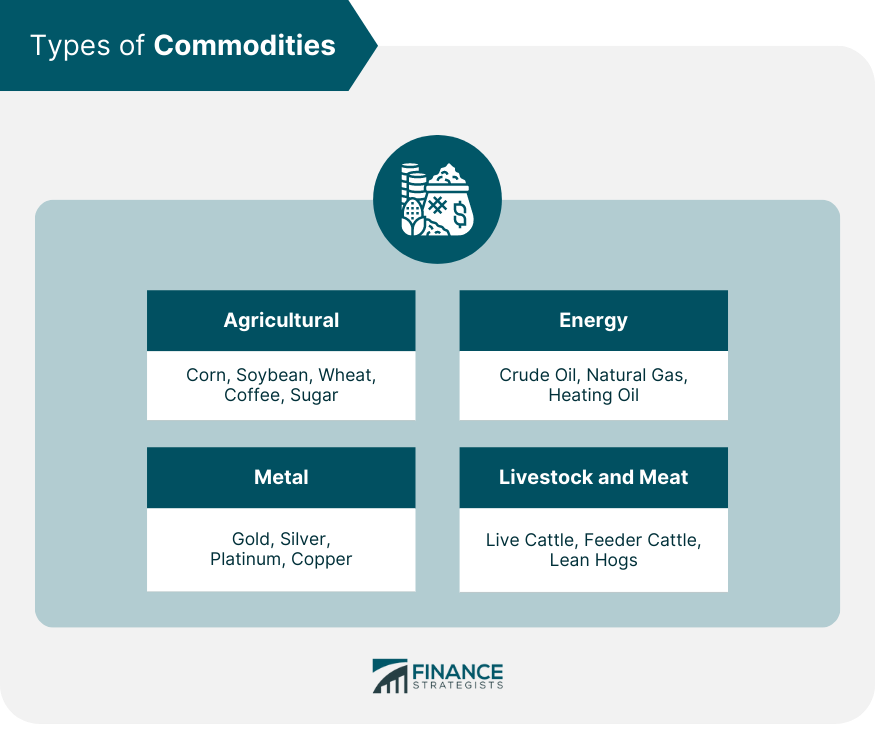

Types of Commodities

Agricultural Commodities

Energy Commodities

Metal Commodities

Livestock and Meat Commodities

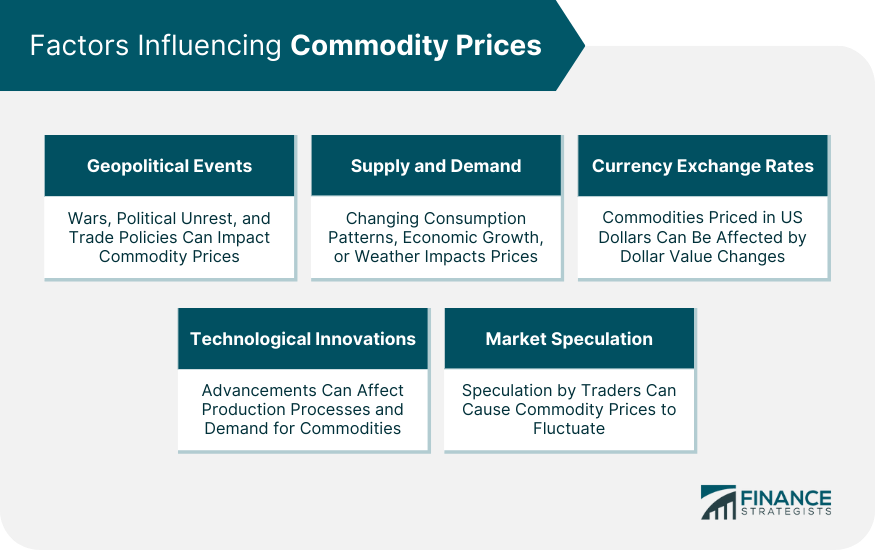

Factors Influencing Commodity Prices

Geopolitical Events

Supply and Demand Dynamics

Currency Exchange Rates

Technological Innovations

Market Speculation

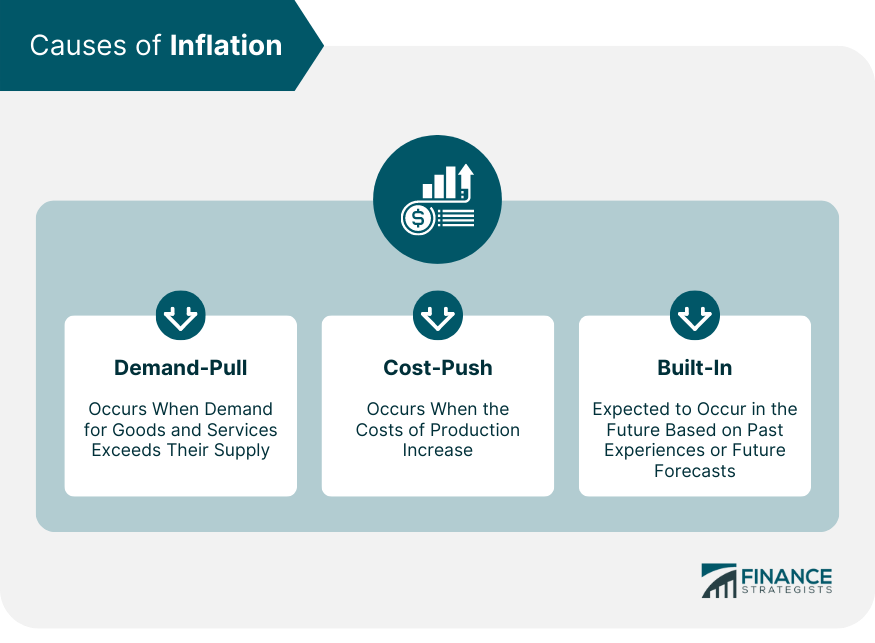

Causes of Inflation

Demand-Pull Inflation

Cost-Push Inflation

Built-In Inflation

Link Between Commodities and Inflation

How Commodity Prices Impact Inflation

Role of Supply and Demand in Commodity Prices and Inflation

Commodity Price Shocks and Inflation

Definition and Examples of Commodity Price Shocks

Impact of Commodity Price Shocks on Inflation

Mitigate the Effects of Commodity Price Shocks

Commodities as a Hedge Against Inflation

Role of Commodities in Investment Portfolios

How Commodities Can Hedge Against Inflation

Risks and Limitations of Using Commodities as an Inflation Hedge

Impact of Inflation on Commodity Trading

Influence of Inflation Expectations on Commodity Prices

Relationship Between Inflation and Commodity Trading Strategies

Policy Responses to Commodity-Driven Inflation

Role of Central Banks in Managing Inflation

Monetary Policy Tools to Combat Inflation

Impact of Fiscal Policies on Commodity-Driven Inflation

Conclusion

Commodities and Inflation FAQs

The relationship between commodities and inflation is intertwined. When the price of commodities, such as oil or grain, increases, it can lead to a rise in the production costs of many goods and services, which in turn can cause inflation. Conversely, a decrease in commodity prices can reduce inflation.

Commodities can serve as a hedge against inflation because their prices often rise when inflation increases. This helps maintain the real (inflation-adjusted) purchasing power of the money invested in these commodities.

Commodity price shocks, which are sudden and unexpected changes in commodity prices, can greatly impact inflation. For example, an unexpected increase in oil prices can lead to higher transportation and production costs, resulting in increased prices of goods and services, thereby causing inflation.

Several factors influence commodity prices, including geopolitical events, supply and demand dynamics, currency exchange rates, technological innovations, and market speculation.

Central banks manage commodity-driven inflation through monetary policy tools such as interest rates and open market operations. By adjusting these tools, central banks aim to maintain price stability and control inflation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.