Gifting appreciated assets refers to the transfer of assets that have increased in value since their acquisition to another person or entity. This process allows the giver to share their wealth while potentially receiving significant tax benefits. Incorporating gifting appreciated assets into financial planning and wealth management strategies can help individuals achieve philanthropic goals, provide financial support to loved ones, and minimize tax liabilities. Gifting appreciated assets can offer substantial tax advantages, including reduced capital gains tax, gift tax, and estate tax liabilities. However, it is essential to understand the associated tax implications and benefits to maximize the potential advantages.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Gifting appreciated assets, like stocks or real estate, to family or charities can be a savvy financial strategy. The recipient often inherits the asset's current market value as their cost basis, potentially reducing capital gains tax when they sell. For charitable gifts, you may also receive a tax deduction. Careful planning around the annual gift tax exclusion and lifetime exemption limits can help you maximize your overall finances. Let's craft your personalized gifting strategy today. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation These are common investment assets that can appreciate in value over time. Gifting appreciated stocks or bonds can provide financial support to recipients while mitigating capital gains tax liabilities for the giver. Real estate is another popular type of appreciated asset. Gifting real estate can help individuals transfer wealth to heirs, support charitable organizations, or achieve other financial goals while taking advantage of potential tax benefits. Unique and valuable items, such as artwork and collectibles, can appreciate significantly over time. Gifting these items can provide both financial and sentimental value to recipients while offering potential tax advantages to the giver. Gifting business interests, such as ownership shares or partnership stakes, can help owners pass on their legacy, support the next generation of leaders, and minimize tax liabilities associated with the transfer of business assets. Transferring appreciated assets to family members can help provide financial support, ensure the family's long-term financial stability, and minimize tax liabilities for both the giver and the recipient. Gifting appreciated assets to friends can be a meaningful way to share wealth and express gratitude. It is essential to understand the tax implications and potential gift tax consequences associated with this type of gift. Donor-advised funds (DAFs) are charitable giving vehicles that allow donors to make tax-deductible contributions while retaining advisory privileges over the distribution of funds. Gifting appreciated assets to a DAF can offer significant tax benefits and support the donor's philanthropic objectives. A charitable remainder trust (CRT) is a planned giving tool that provides income to the donor or beneficiaries for a specified period, with the remaining assets ultimately going to a designated charity. Gifting appreciated assets to a CRT can provide income tax deductions, reduce estate taxes, and support charitable causes. In contrast to a CRT, a charitable lead trust (CLT) provides income to a charity for a set period, with the remaining assets passing to the donor's heirs. Gifting appreciated assets to a CLT can reduce estate taxes, provide income tax deductions, and fulfill philanthropic goals. A charitable gift annuity is a contract between a donor and a charity, wherein the donor transfers appreciated assets to the charity in exchange for a lifetime income stream. This strategy can offer income tax deductions, reduce capital gains tax liabilities, and support the donor's chosen charity. A Grantor Retained Annuity Trust (GRAT) is an irrevocable trust that provides the grantor with a fixed income for a predetermined period, with the remaining assets passing to the trust's beneficiaries. An irrevocable life insurance trust (ILIT) is a trust designed to hold a life insurance policy outside of the grantor's estate, shielding policy proceeds from estate taxes. Funding an ILIT with appreciated assets can minimize estate tax liabilities and provide beneficiaries with a tax-free death benefit. A generation-skipping transfer trust (GSTT) allows assets to pass tax-free to beneficiaries two or more generations younger than the grantor. Gifting appreciated assets to a GSTT can reduce estate and gift taxes while providing long-term financial support for future generations. The tax basis is the original value of an asset, typically the purchase price, adjusted for any additional investments or improvements. When gifting appreciated assets, it is crucial to understand the tax basis to determine the potential capital gains tax liability. Capital gains tax rates depend on the holding period of the appreciated asset: short-term capital gains apply to assets held for one year or less, while long-term capital gains apply to assets held for more than one year. Gifting appreciated assets with long-term gains can result in lower tax rates for recipients. Some strategies to minimize capital gains tax when gifting appreciated assets include donating to charities, using trusts, or gifting assets with long-term gains. Each approach has its advantages and considerations, depending on the giver's goals and financial situation. The annual exclusion is the maximum amount an individual can gift to another person without incurring gift tax liabilities. The lifetime exemption represents the cumulative amount that can be gifted without gift tax consequences. Understanding these limits is essential when gifting appreciated assets. The unified credit is a tax credit that combines gift tax and estate tax exemptions, allowing taxpayers to transfer assets without incurring gift or estate taxes. Utilizing the unified credit strategically when gifting appreciated assets can help minimize tax liabilities. Gift-splitting allows married couples to share their gift tax exclusions, effectively doubling the annual exclusion amount. This strategy can help couples maximize their tax benefits when gifting appreciated assets. Gifting appreciated assets can be an effective way to reduce estate tax liability by removing the assets from the giver's taxable estate. Trusts, charitable donations, and other gifting strategies can help minimize estate tax exposure. Portability allows a surviving spouse to utilize any unused portion of their deceased spouse's estate tax exemption. Understanding portability is essential for married couples looking to maximize their tax benefits when gifting appreciated assets. Donating appreciated assets to qualified charitable organizations can result in an income tax deduction for the donor. The deduction is typically based on the fair market value of the gifted asset, offering potential tax savings to the giver. In addition to income tax deductions, gifts of appreciated assets to charities can also provide estate tax deductions. This benefit can help reduce estate tax liabilities for the giver's estate. Recipients of gifted appreciated assets generally do not owe income tax on the value of the gift. However, they may be responsible for capital gains tax if they later sell the asset at a profit. When recipients sell appreciated assets, they may be subject to capital gains tax on the difference between the asset's fair market value at the time of the gift and its sale price. Understanding capital gains tax implications is essential for recipients when managing gifted assets. The step-up in basis is a tax provision that adjusts the basis of inherited assets to their fair market value at the time of the decedent's death. This adjustment can reduce capital gains tax liabilities for heirs when they sell the inherited appreciated assets. Market volatility can impact the value of gifted appreciated assets, potentially resulting in decreased financial benefits for the giver or recipient. It is crucial to consider market conditions when gifting appreciated assets and manage risks accordingly. Changes in tax laws and regulations can affect the tax benefits and consequences of gifting appreciated assets. Staying informed about legal and regulatory changes is essential to ensure continued tax efficiency when gifting appreciated assets. Gifting appreciated assets can involve emotional and personal considerations, such as maintaining family harmony, preserving relationships, and fulfilling personal values. It is essential to weigh these factors when deciding on gifting strategies. Gifting appreciated assets can have a significant impact on an individual's overall financial plan. It is crucial to consider the long-term effects of gifting strategies on the giver's financial stability, retirement plans, and estate planning goals. Gifting appreciated assets means transferring assets that have increased in value to another entity, sharing wealth, and possibly gaining tax benefits. Gifting appreciated assets could offer long-term benefits, including tax savings, wealth preservation, philanthropic impact, and providing financial support to loved ones. Careful planning and execution of gifting strategies can result in lasting positive outcomes for all parties involved. Strategic gifting of appreciated assets can help individuals balance their personal and financial goals. Thoughtful planning and consideration of tax implications, risks, and personal values can create a successful gifting strategy that benefits both the giver and the recipient. If you are considering gifting appreciated assets, it is essential to consult with tax planning professionals to ensure you maximize the tax benefits and achieve your personal and financial goals. Reach out to a qualified tax advisor, financial planner, or estate planning attorney to explore your options and develop a customized gifting strategy.What Are Gifting Appreciated Assets?

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Types of Appreciated Assets

Stocks and Bonds

Real Estate

Artwork and Collectibles

Business Interests

Strategies for Gifting Appreciated Assets

Outright Gifts to Individuals

Family Members

Friends

Charitable Giving

Donor-Advised Funds

Charitable Remainder Trusts

Charitable Lead Trusts

Gift Annuities

Gifting Through Trusts

Grantor Retained Annuity Trusts

Irrevocable Life Insurance Trusts

Generation-Skipping Transfer Trusts

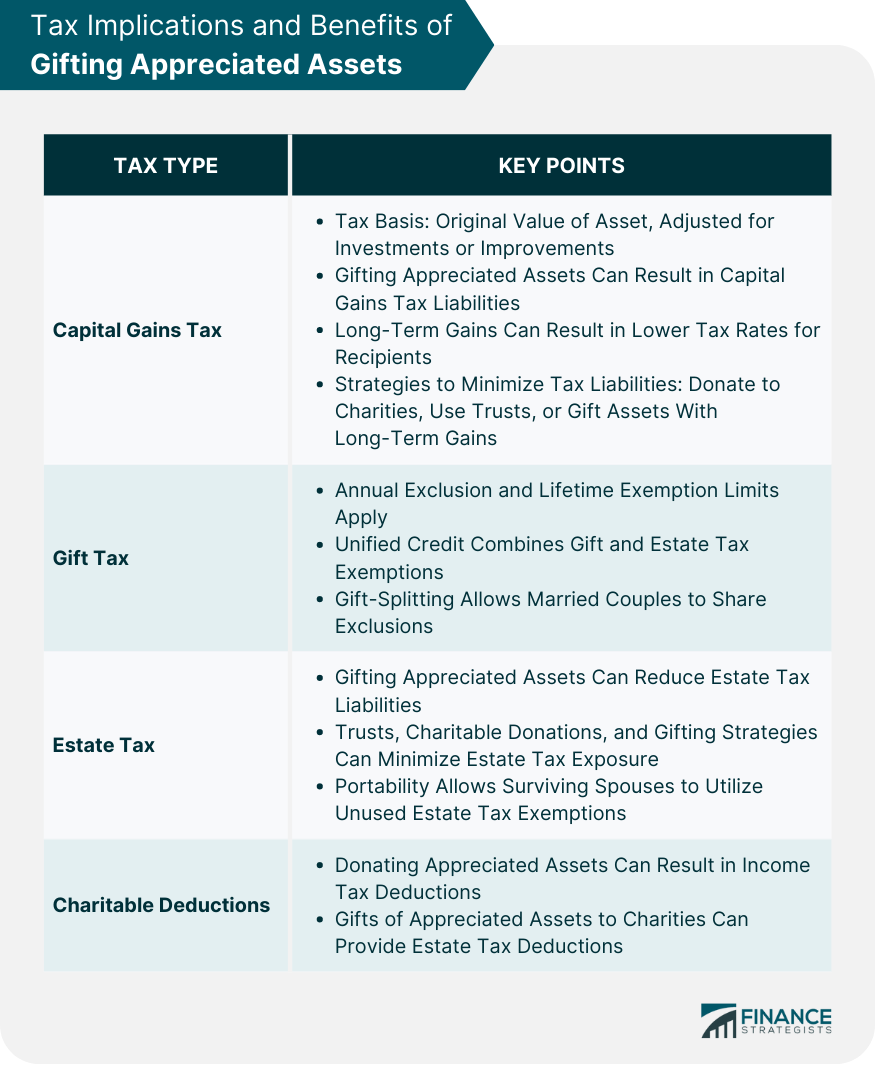

Tax Implications and Benefits of Gifting Appreciated Assets

Capital Gains Tax

Tax Basis

Long-Term vs Short-Term Capital Gains

Strategies to Minimize Capital Gains Tax

Gift Tax

Annual Exclusion and Lifetime Exemption

Unified Credit

Gift-Splitting

Estate Tax

Reducing Estate Tax Liability

Portability of the Estate Tax Exemption

Charitable Deductions

Income Tax Deduction

Charitable Estate Tax Deduction

Gifting Appreciated Assets and the Impact on the Recipient

Income Tax Considerations

Capital Gains Tax Considerations

Step-Up in Basis

Risks and Considerations Of Gifting Appreciated Assets

Market Volatility

Legal and Regulatory Changes

Emotional and Personal Considerations

Impact on Overall Financial Plan

Final Thoughts

Gifting Appreciated Assets FAQs

Gifting appreciated assets could provide tax benefits such as reduced capital gains tax, gift tax, and estate tax liabilities. It can also offer income tax deductions and charitable estate tax deductions when gifted to qualified charitable organizations.

Yes, gifting appreciated assets to family members can help with estate planning by reducing the giver's taxable estate and potentially minimizing estate tax liabilities. It also allows for the transfer of wealth to heirs in a tax-efficient manner.

The step-up in basis adjusts the tax basis of inherited assets to their fair market value at the time of the decedent's death. This adjustment can reduce capital gains tax liabilities for heirs when they sell the inherited appreciated assets, as they will only be taxed on the gain accrued since the decedent's death.

Common strategies for gifting appreciated assets to charities include donor-advised funds, charitable remainder trusts, charitable lead trusts, and gift annuities. These methods offer tax benefits, support philanthropic goals, and can provide income streams to the donor or beneficiaries.

Consulting professionals such as tax advisors, financial planners, or estate planning attorneys is essential when gifting appreciated assets due to the complexities involved in tax laws and regulations. Professionals can help ensure that gifting strategies align with personal and financial objectives while maximizing tax benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.