A gift in trust refers to an arrangement in which an individual (grantor) transfers assets to a trust, managed by a trustee for the benefit of one or more beneficiaries. The trust acts as a legal entity, holding and managing the gifted assets according to the terms and conditions set by the grantor. The primary purpose of a gift in trust is to provide financial support and protection for beneficiaries, while allowing the grantor to maintain control over the assets. Advantages include tax benefits, asset protection, and preserving the grantor's intentions for the benefit of the beneficiaries.

A revocable trust, also known as a living trust, allows the grantor to change or terminate the trust during their lifetime. This flexibility ensures that the grantor can adapt the trust's provisions in response to changing circumstances or preferences, offering greater control over the trust assets. An irrevocable trust is a trust that cannot be altered or revoked by the grantor once established. This type of trust offers several benefits, including estate and gift tax advantages, asset protection, and the potential for long-term growth of trust assets. Lifetime trusts, also known as inter vivos trusts, are irrevocable trusts created and funded during the grantor's lifetime. These trusts provide immediate benefits to the designated beneficiaries, while allowing the grantor to transfer wealth outside of their estate and potentially reduce estate taxes. Testamentary trusts are irrevocable trusts created upon the grantor's death, typically as a provision within a will. This type of trust ensures that the grantor's assets are managed and distributed according to their wishes after death, providing financial support and protection for their beneficiaries. A special needs trust is designed to provide financial support to a beneficiary with disabilities without affecting their eligibility for government assistance programs. The trust can cover various expenses, such as medical care, education, and recreation, while preserving the beneficiary's access to essential public benefits. A charitable trust is a trust created to benefit a specific charity or a charitable purpose. This type of trust can provide the grantor with tax advantages, such as income tax deductions and estate tax reductions, while supporting a meaningful cause or organization. A spendthrift trust is designed to protect a beneficiary's interest in the trust assets from creditors and their own financial mismanagement. The trustee maintains control over the distribution of trust assets, ensuring that the beneficiary's needs are met while preserving the trust's assets for the intended purpose. The trustee plays a crucial role in managing and distributing the trust assets according to the grantor's wishes. Choosing a reliable, competent, and trustworthy individual or institution as trustee is essential for the successful execution and administration of the trust. The trust document outlines the terms, conditions, and provisions of the trust, including the powers and duties of the trustee. Drafting a comprehensive and legally sound trust document is crucial to ensure the trust's objectives are met and to minimize the risk of disputes or legal challenges. Funding the trust involves transferring assets, such as cash, real estate, or investments, from the grantor to the trust. Proper funding is essential for the trust to function effectively and achieve its intended purpose, as well as to secure the associated tax benefits and asset protection. Beneficiaries are the individuals or entities who will ultimately receive the benefits of the trust assets. Accurately designating beneficiaries is essential to ensure that the trust achieves the grantor's intended purpose and that the assets are distributed in accordance with their wishes. The terms and conditions of a trust govern how the trust assets will be managed, invested, and distributed to beneficiaries. Establishing clear and specific terms and conditions helps minimize confusion or disputes, while ensuring that the trust is administered in a manner consistent with the grantor's intentions. Gift tax may apply when a grantor transfers assets to a trust, depending on the value of the gift and the grantor's overall gift tax exclusion. Proper planning and the use of specific trust structures can help minimize or avoid gift tax liability while still achieving the desired benefits for beneficiaries. A gift in trust can potentially reduce or eliminate estate tax liability by removing assets from the grantor's taxable estate. Trusts such as irrevocable life insurance trusts (ILITs) and charitable remainder trusts (CRTs) are particularly effective for estate tax planning purposes. Generation-skipping transfer (GST) tax applies to gifts made to beneficiaries who are two or more generations younger than the grantor. GST tax planning can involve the strategic use of trusts, such as dynasty trusts, to minimize or avoid the tax while still providing for the financial needs of future generations. Trusts are subject to their own income tax rules, which can affect both the grantor and beneficiaries. The structure of the trust, such as whether it is a grantor trust or non-grantor trust, will determine the tax treatment and potential tax implications for all parties involved. Trustees have fiduciary duties to the beneficiaries, which include acting in the beneficiaries' best interests, managing trust assets prudently, and providing accurate and timely information. Failure to fulfill these duties can lead to legal disputes and potential liability for the trustee. Trust laws vary by state, which can affect the creation, administration, and taxation of a gift in trust. Consulting with an attorney familiar with state-specific trust laws is essential to ensure that the trust complies with all relevant regulations and that the grantor's goals are achieved. Establishing a gift in trust requires proper documentation, including the trust document and any required filings with state or federal agencies. Ensuring that all documentation is accurate and complete is crucial for the trust's legal validity and the protection of the grantor's intentions. Gifts in trust can provide significant asset protection for beneficiaries, shielding the trust assets from creditors, divorce settlements, and other financial risks. Trusts such as spendthrift trusts are specifically designed to offer this protection. Strategic use of gifts in trust can result in tax advantages for the grantor and beneficiaries. Trusts can help minimize or avoid gift, estate, and generation-skipping transfer taxes, as well as provide favorable income tax treatment. A gift in trust allows the grantor to maintain control over the management and distribution of assets to beneficiaries, ensuring that the assets are used in accordance with their wishes and intentions. Trusts offer a level of privacy and confidentiality not available through other estate planning tools, as the details of the trust and its assets are typically not subject to public scrutiny. Establishing and maintaining a gift in trust can be complex and costly, particularly for those with limited legal and financial expertise. The services of attorneys, accountants, and financial advisors may be necessary to properly create and administer the trust. Irrevocable trusts, once established, cannot be altered or revoked by the grantor, potentially limiting their ability to respond to changing circumstances or needs. This lack of flexibility can be a disadvantage for some grantors, particularly when compared to revocable trusts. Disagreements or conflicts may arise between beneficiaries and trustees regarding the management or distribution of trust assets. Such disputes can lead to costly litigation and may undermine the grantor's intended purpose for the trust. An educational trust can be established to fund the educational expenses of children or grandchildren, ensuring that they have access to the resources needed for their academic pursuits, while also providing potential tax advantages for the grantor. A special needs trust can be created to provide financial support for a person with disabilities without jeopardizing their eligibility for government assistance programs. This type of trust helps ensure that the beneficiary's needs are met while preserving their access to essential public benefits. An inheritance trust can be established to manage and distribute assets to young adults upon reaching a specified age or milestone, providing financial support while ensuring that the assets are used responsibly and in accordance with the grantor's wishes. A charitable remainder trust (CRT) can be used to support a grantor's philanthropic goals while also providing potential tax benefits. The CRT allows the grantor to receive income from the trust assets during their lifetime, with the remainder ultimately benefiting a designated charity or charitable purpose. Proper planning is crucial to ensure that a gift in trust achieves the grantor's intended purpose, complies with all relevant legal and tax requirements, and provides the desired benefits for the beneficiaries. Thorough preparation can help avoid potential disputes, minimize tax liabilities, and protect the grantor's legacy. Given the complexity and potential legal and tax implications of gifts in trust, consulting with legal and financial professionals is essential to ensure that the trust is properly structured and administered. Experienced advisors can provide guidance on the most appropriate trust structures and strategies to meet the grantor's goals and objectives.What Is a Gift in Trust?

Types of Trusts

Revocable Trust

Irrevocable Trust

Lifetime Trusts

Testamentary Trusts

Special Needs Trust

Charitable Trust

Spendthrift Trust

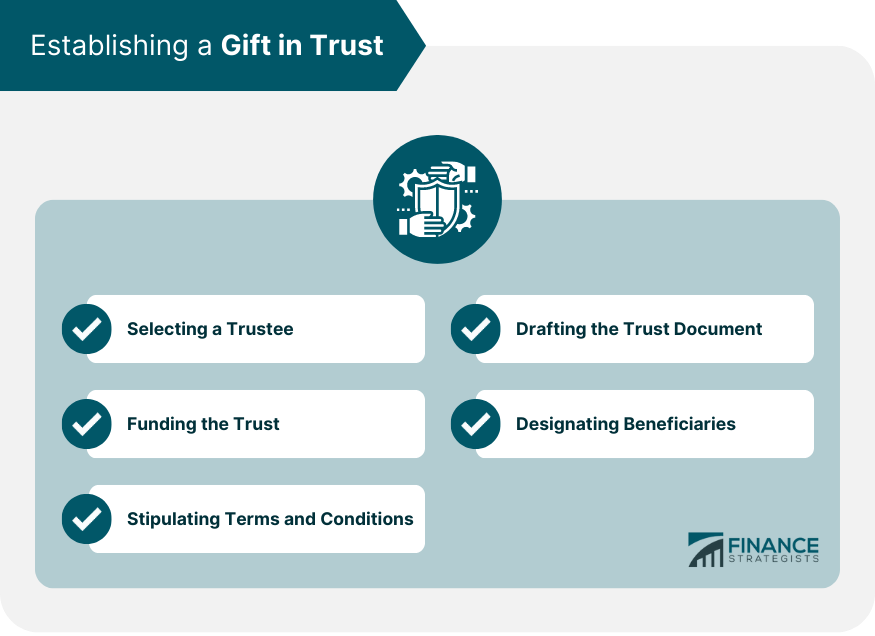

Establishing a Gift in Trust

Selecting a Trustee

Drafting the Trust Document

Funding the Trust

Designating Beneficiaries

Stipulating Terms and Conditions

Tax Implications of Gifts in Trust

Gift Tax

Estate Tax

Generation-Skipping Transfer Tax

Income Tax Considerations

Legal Considerations and Regulations

Fiduciary Duties of the Trustee

State-Specific Trust Laws

Required Documentation and Filings

Advantages and Disadvantages of Gifts in Trust

Advantages

Asset Protection

Tax Planning

Control and Management

Privacy and Confidentiality

Disadvantages

Complexity and Cost

Irrevocability and Lack of Flexibility

Potential Conflicts Between Beneficiaries and Trustees

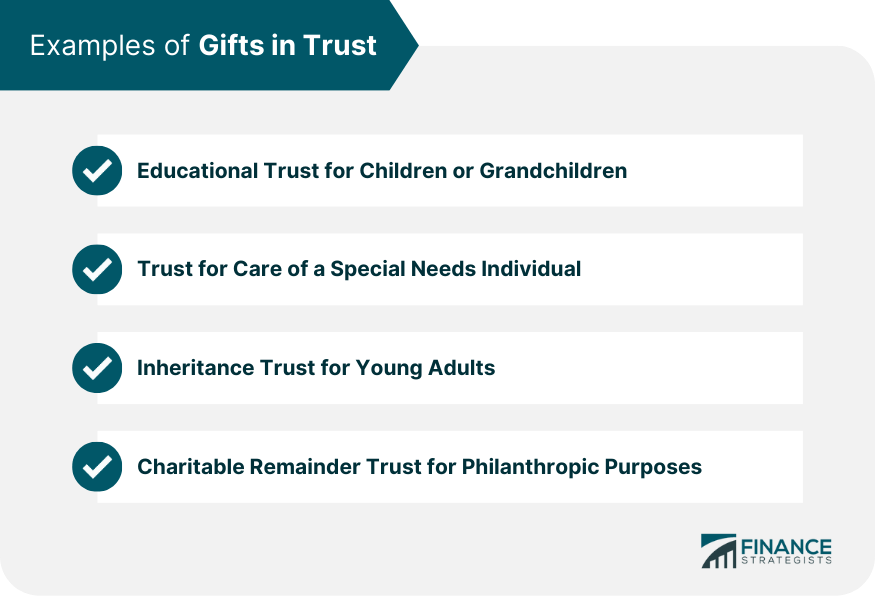

Examples of Gifts in Trust

Educational Trust for Children or Grandchildren

Trust for Care of a Special Needs Individual

Inheritance Trust for Young Adults

Charitable Remainder Trust for Philanthropic Purposes

Final Thoughts

Gift in Trust FAQs

A Gift in Trust is an arrangement in which an individual (grantor) transfers assets to a trust, managed by a trustee for the benefit of one or more beneficiaries. People consider creating a Gift in Trust to provide financial support and protection for beneficiaries, maintain control over assets, and take advantage of tax benefits, asset protection, and privacy.

A Revocable Trust, also known as a living trust, allows the grantor to change or terminate the trust during their lifetime. In contrast, an Irrevocable Gift in Trust cannot be altered or revoked by the grantor once established, offering estate and gift tax advantages, asset protection, and potential long-term growth of trust assets.

A Gift in Trust can offer several tax advantages, including potential reductions in gift, estate, and generation-skipping transfer taxes. Additionally, certain types of trusts can provide favorable income tax treatment for both the grantor and beneficiaries, depending on the trust's structure.

Some disadvantages of establishing a Gift in Trust include the complexity and cost involved in creating and maintaining the trust, the irrevocability and lack of flexibility associated with certain types of trusts, and potential conflicts between beneficiaries and trustees regarding the management or distribution of trust assets.

Examples of situations where a Gift in Trust might be appropriate include creating an educational trust for children or grandchildren, establishing a special needs trust for a disabled individual, setting up an inheritance trust for young adults, or forming a charitable remainder trust for philanthropic purposes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.