Trusts are a valuable tool for individuals and families seeking to manage their wealth, protect their assets, and minimize tax liabilities. Gift taxation, an important aspect of the federal tax system, can impact trust transfers and the overall effectiveness of estate planning strategies. Trust gift taxation is the set of rules and regulations that govern the taxation of gifts made through a trust. It involves the transfer of assets from a grantor to a trustee, who manages those assets on behalf of the beneficiaries. The gift tax applies to the transfer of assets to a trust, and the amount of tax owed depends on the value of the assets transferred. Trust gift taxation also involves strategies to minimize gift taxes, such as utilizing the gift tax annual exclusion and structuring the trust to allow for tax-free distributions to the beneficiaries.

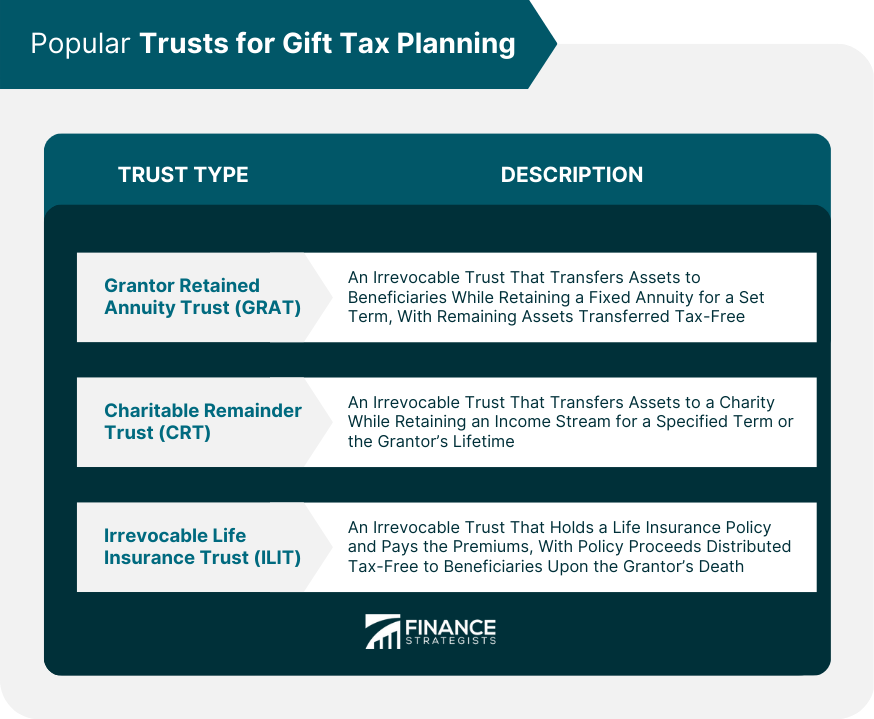

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Trust gift taxation involves understanding IRS rules on gifts placed into trusts. For 2024, individuals can gift up to $18,000 per recipient without incurring gift tax, utilizing the annual exclusion. Gifts above this amount require filing a gift tax return, potentially using part of the lifetime exemption ($13.61 million). Strategic use of these exclusions can reduce estate taxes. If you're looking to navigate these complex rules and maximize your gifting strategy, let's connect for clear and proper guidance. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation There are two primary types of trusts: revocable trusts and irrevocable trusts. Revocable trusts, also known as living trusts, can be altered or revoked by the grantor (the person who creates the trust) during their lifetime. In contrast, irrevocable trusts cannot be changed or terminated once they are established, except under specific circumstances and with court approval. The Internal Revenue Service (IRS) imposes a gift tax on transfers of wealth from one individual to another. However, there are two main exclusions that can help minimize or eliminate gift tax liability: Annual Exclusion: As of 2024, individuals can give up to $18,000 per recipient per year without incurring gift tax. Married couples can combine their annual exclusions, allowing them to give up to $36,000 per recipient per year. Lifetime Exclusion: In addition to the annual exclusion, individuals have a lifetime exclusion that allows them to give a certain amount of wealth during their lifetime without incurring gift tax. As of 2024, the lifetime exclusion is $13.61 million per individual or $27.22 million for married couples. If a gift exceeds the annual or lifetime exclusions, the donor may be subject to gift tax. Gift tax rates range from 18% to 40%, depending on the value of the gift. Trusts offer several advantages in gift tax planning, including: Control over assets: Trusts allow grantors to maintain control over their assets while providing for beneficiaries, making them an effective tool for wealth transfer and management. Tax benefits: Trusts can help minimize or eliminate gift tax liabilities, particularly when used in conjunction with annual and lifetime exclusions. Asset protection: Trusts can protect assets from creditors and lawsuits, ensuring that beneficiaries receive their intended inheritance. There are several types of trusts that are commonly used for gift tax planning, including: Grantor Retained Annuity Trust (GRAT): A GRAT is an irrevocable trust that allows the grantor to transfer assets to beneficiaries while retaining a fixed annuity for a set term. At the end of the term, any remaining assets are transferred to the beneficiaries tax-free. Charitable Remainder Trust (CRT): A CRT is an irrevocable trust that allows the grantor to transfer assets to a charity while retaining an income stream for a specified term or the grantor's lifetime. At the end of the term or the grantor's life, the remaining assets are transferred to the designated charity. Irrevocable Life Insurance Trust (ILIT): An ILIT is an irrevocable trust that holds a life insurance policy. The trust pays the policy premiums, and upon the grantor's death, the policy proceeds are distributed to the beneficiaries free of estate and gift taxes. When gifts to trusts exceed the annual or lifetime exclusions, they must be reported to the IRS. The following steps outline the reporting process: Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return: Donors are required to file Form 709 to report gifts that exceed the annual exclusion. This form is due on April 15th of the year following the gift transaction. Trustee responsibilities: Trustees are responsible for maintaining accurate records of trust assets, transactions, and distributions. They must also provide beneficiaries with annual reports detailing trust activity and any associated tax implications. Beneficiaries of trusts may face various tax consequences, including: Income tax implications: Beneficiaries may be required to pay income tax on certain trust distributions, depending on the nature of the assets and the trust terms. Inheritance tax considerations: Some states impose an inheritance tax on assets received from a trust. Beneficiaries should consult with a tax professional to understand their potential tax liability. There are several strategies that can help minimize gift taxes in trusts: Timing of Gifts: By strategically timing gifts, donors can take advantage of annual and lifetime exclusions to reduce or eliminate gift tax liability. Maximizing Exclusions and Deductions: Donors can maximize their gift tax exclusions and deductions by carefully planning trust contributions and distributions. Valuation Discounts: In some cases, donors can use valuation discounts to transfer assets to trusts at a lower value, reducing gift tax liability. Split-Interest Charitable Trusts: Donors can establish split-interest charitable trusts, such as CRTs, to minimize gift taxes while providing for both charitable causes and beneficiaries. Various tax reforms have been proposed that could impact trust gift taxation, including changes to gift tax rates, exclusions, and deductions. It is important for individuals and families to stay informed about potential legislative changes and adjust their estate planning strategies accordingly. Changes to gift tax laws may require adjustments to existing trust structures and gift tax planning strategies. Individuals and families should consult with professional advisors to ensure their estate plans remain effective and tax-efficient in light of potential legislative changes. Trusts play a crucial role in gift tax planning, offering valuable benefits such as control over assets, tax advantages, and asset protection. Understanding the complexities of trust gift taxation is essential for effective estate planning and wealth management. By staying informed about potential legislative changes and working with professional advisors, individuals and families can navigate the intricacies of trust gift taxation and maximize the benefits of their estate planning strategies.What Is Trust Gift Taxation?

Hear It From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Trusts and Gift Taxation: The Basics

Types of Trusts

Gift Tax Exclusions

Gift Tax Rates

Trusts as a Gift Tax Planning Tool

Advantages of Trusts in Gift Tax Planning

Popular Trusts for Gift Tax Planning

Trusts and Gift Tax Reporting

Reporting Gifts to Trusts

Tax Consequences for Beneficiaries

Strategies to Minimize Gift Taxes in Trusts

Potential Legislative Changes and Their Impact on Trust Gift Taxation

Proposed Tax Reforms

Implications for Trusts and Gift Tax Planning

Conclusion

Trust Gift Taxation FAQs

A trust is a legal arrangement in which a person transfers assets to a trustee who manages those assets on behalf of the beneficiaries. In gift taxation, a trust can be used as a way to transfer assets to heirs while minimizing taxes.

By transferring assets to a trust, the grantor can remove those assets from their taxable estate. Additionally, the trust can be structured to allow for tax-free distributions to the beneficiaries, reducing the amount of taxes owed on the transfer of those assets.

A revocable trust is one that the grantor can modify or revoke at any time. In gift taxation, assets in a revocable trust are still considered part of the grantor's taxable estate and subject to gift taxes.

While a trust can be used to minimize gift taxes, it cannot entirely avoid them. Any transfer of assets is subject to gift taxes, and the value of those assets may be included in the grantor's taxable estate even after transfer.

The gift tax annual exclusion allows for tax-free gifts up to a certain amount each year. This exclusion applies to gifts made directly to individuals as well as to trusts. If the trust is structured in a way that allows for tax-free distributions to the beneficiaries, those distributions will not be subject to gift taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.