Short-term capital gains refer to profits earned from the sale of an asset, such as stocks, bonds, or property, which is held for one year or less. The critical factor distinguishing short-term gains from long-term is the holding period. Assets held for a year or less are subject to short-term capital gains tax. The tax rate on these gains is usually higher than for long-term capital gains and is determined based on the individual's ordinary income tax bracket. Therefore, it can be as high as 37% for individuals in the highest tax bracket. Given the high tax rates, understanding and planning for short-term capital gains taxes can significantly affect an investor's net return. It's also important to note that short-term losses can offset short-term gains, reducing the total tax liability. Short-term capital gains tax rates mirror those of ordinary income tax brackets. The U.S. operates under a progressive tax system, meaning rates increase incrementally with the taxpayer's income. Each rate corresponds to a specific income range, defining how much tax is owed on that portion of the income. The holding period of your asset is the primary determinant of whether your gain is considered short or long-term. As stated earlier, a short-term gain results from assets held for less than a year. This temporal component of the tax system influences investment strategy and market behavior. Your tax bracket, based on your taxable income, determines the rate at which your short-term capital gain is taxed. The higher your taxable income, the higher your short-term capital gains tax rate. It's crucial to know your bracket to understand the tax implications of your short-term capital gains. The kind of asset sold also affects your capital gains tax. For example, collectibles and certain small business stocks are subject to unique tax rules and rates. This variety is due to the wide range of assets that can be owned and sold for profit, each with its own implications for the tax system. Your capital gain is the difference between your asset's selling price and its "basis". The basis is usually what you paid for the asset, including commissions or other costs related to the purchase. If you inherited the asset, different rules may apply. Understanding your basis is a vital first step in computing potential capital gains. Certain deductions and exemptions may reduce your short-term capital gain. For instance, capital loss from another asset sale could offset the gain. However, the IRS sets annual limits on how much loss you can claim against your gain. Navigating these rules is crucial to effectively reducing your tax liability. Let's consider a scenario: you bought a stock for $5,000, and a year later, you sell it for $7,000. Your capital gain would be $2,000. If you fall into the 24% tax bracket, you'd owe $480 in short-term capital gains tax. This practical example serves to illustrate the calculation and the direct impact of your tax bracket on your payable tax. Timing is a crucial factor in capital gains tax. By holding an asset for over a year, you could significantly reduce your tax liability as long-term capital gains tax rates are typically lower. Effective timing can mean the difference between a hefty tax bill and substantial savings. If you've incurred capital losses in the same year, you can use these to offset your gains. This strategy, known as tax-loss harvesting, can help manage your tax liability. It's a proactive approach that requires careful tracking of your investments and market movements. Another way to minimize short-term capital gains tax is by investing through tax-advantaged accounts like 401(k)s or IRAs. Earnings within these accounts grow tax-free or tax-deferred, providing significant tax savings. It's a long-term strategy that, coupled with wise investment choices, can pay off in considerable tax advantages. Consider using strategies like a swap, where you sell a security and simultaneously buy a similar one, to postpone recognizing the capital gain. While complex, such strategies can be beneficial for managing tax liability, especially in volatile markets. While the focus here is short-term capital gains tax, long-term financial planning is equally crucial. By considering the long-term implications of your investment decisions, you can better manage your tax obligations. The balance between short-term and long-term strategies is a key to effective financial planning. Tax professionals can play a vital role in managing your taxes. They can help devise strategies that align with your financial goals while minimizing your tax liability. In the ever-changing landscape of tax law, their expertise can be invaluable. They stay abreast of changes and provide insights that could significantly impact your financial trajectory. Short-term capital gains tax, tied to the profits made from the sale of assets held for a year or less, is a pivotal factor that can influence an investor's net return. The tax rate mirrors that of the individual's ordinary income tax bracket and can be as high as 37%. Several elements such as the asset's holding period, the taxpayer's income bracket, and the type of asset sold, influence the final tax figure. A solid comprehension of these elements, alongside strategies to minimize tax such as timing the sale of assets, offsetting gains with losses, investing in tax-advantaged accounts, and considering swap strategies, can significantly reduce tax liabilities. Professional advice can be pivotal in navigating these complexities. It's never too early or too late to start planning - consider seeking professional help today to streamline your tax planning and maximize your financial gains.Overview of Short-Term Capital Gains

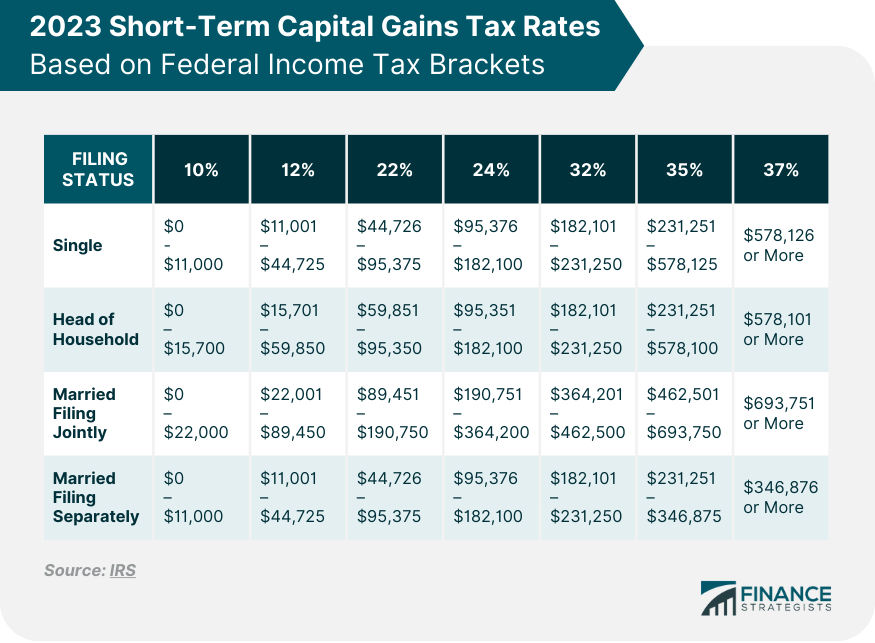

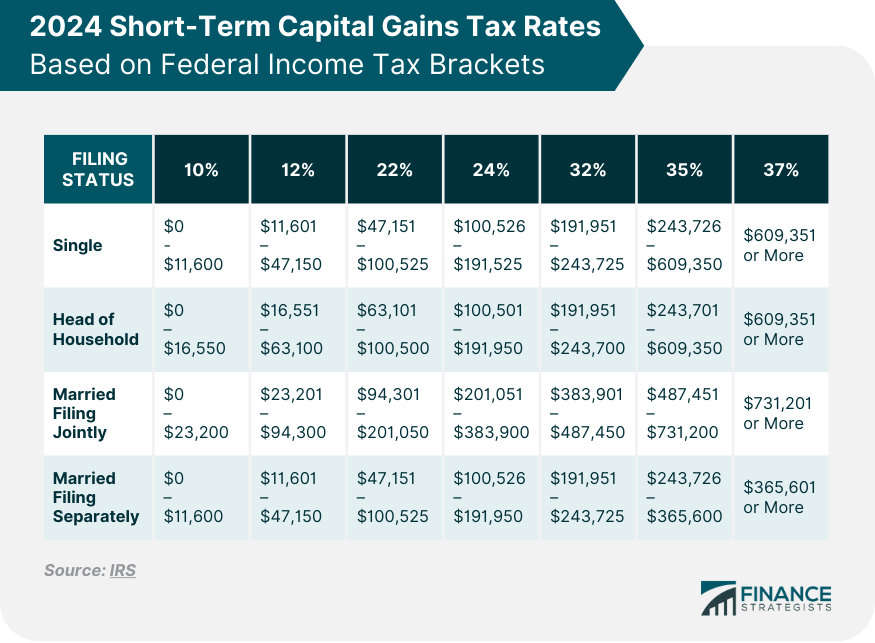

Short-Term Capital Gains Tax Rate for 2023-2024

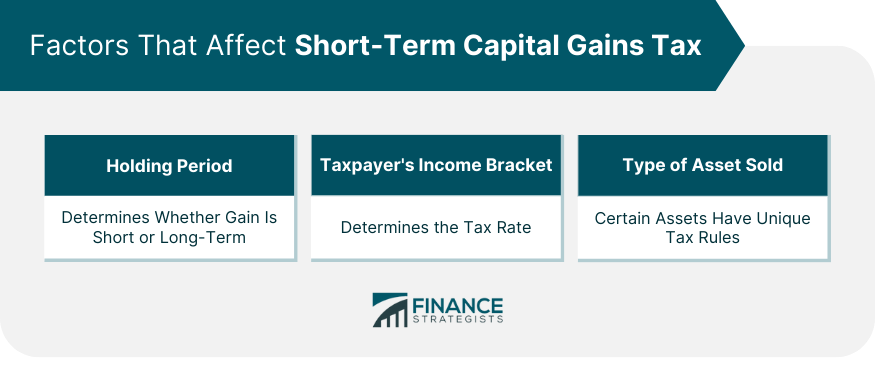

Factors That Affect Short-Term Capital Gains Tax

Holding Period

Taxpayer's Income Bracket

Type of Asset Sold

Understanding How Short-Term Capital Gains Are Calculated

Calculating Basis and Capital Gain

Deductions and Exemptions

Example Scenarios

Strategies to Minimize Short-Term Capital Gains Tax

Timing of Selling Assets

Using Capital Losses to Offset Gains

Investing in Tax-Advantaged Accounts

Considering Swap or Similar Investment Strategies

Importance of Tax Planning

Long-Term vs Short-Term Planning

Role of Tax Professionals

Bottom Line

Short-Term Capital Gains Tax Rate FAQs

The rate corresponds to ordinary income tax brackets, changing based on your income and filing status.

The tax is calculated as the difference between your asset's selling price and its "basis," taxed at your income tax rate.

Key factors include the holding period of the asset, taxpayer's income bracket, and the type of asset sold.

Strategies include timing of selling assets, offsetting gains with losses, investing in tax-advantaged accounts, and utilizing swap strategies.

Tax planning helps optimize decisions, minimize tax liability, and align strategies with financial goals, considering both short-term and long-term implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.