Capital gains tax is a levy imposed on the profit realized from the sale of a non-inventory asset like stocks, bonds, property, and precious metals. It is triggered when an asset is sold, and is calculated on the difference between the sale price and the purchase price, which is termed as 'gain'. Short-term capital gains tax applies to assets held for a year or less, and are typically taxed as regular income. Long-term capital gains tax applies to assets held for over a year, often taxed at a lower rate to incentivize long-term investment. However, rates can vary based on individual income levels and the asset type. Some countries, like the U.S., apply capital gains tax, while others, like Singapore and Switzerland, do not.

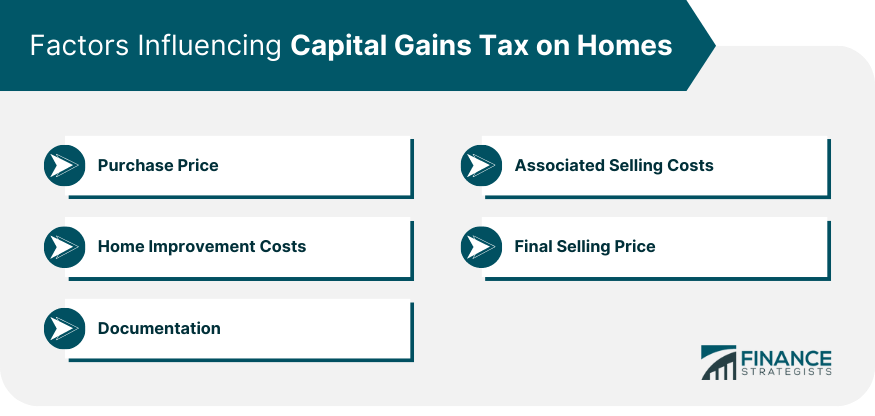

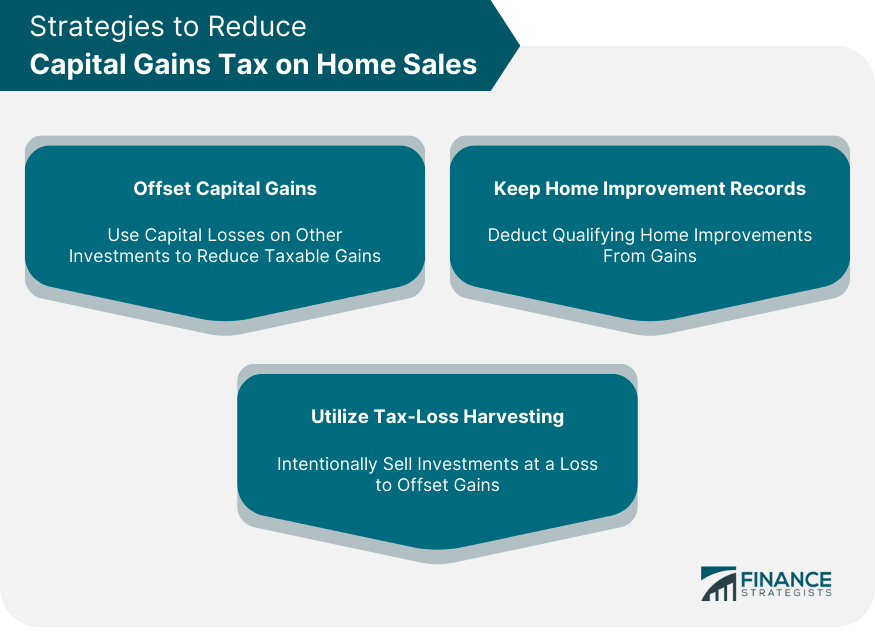

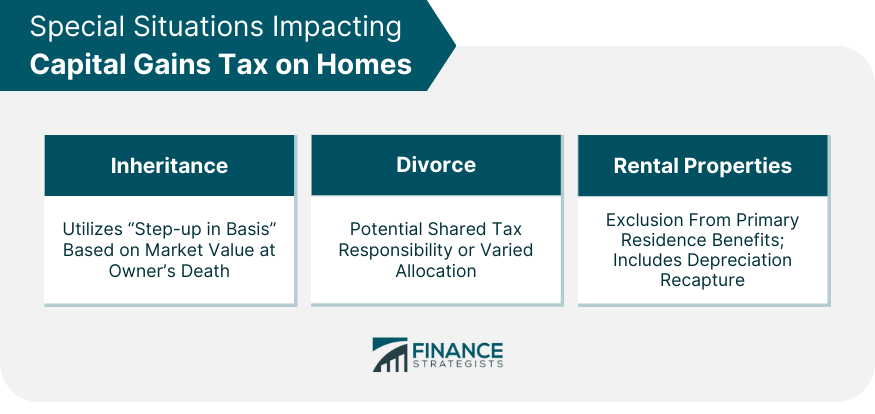

Homes, like other assets, can appreciate in value. If you bought a house for $200,000 and later sold it for $250,000, you've realized a capital gain of $50,000. However, the interplay between capital gains tax and homes is not as straightforward due to unique rules and exceptions. Recognizing these distinctions can be pivotal in understanding potential tax liabilities. Purchase Price: The initial purchase price of your home is the baseline for determining capital gains. This is the amount from which any increase (gain) is calculated. The lower the purchase price relative to the selling price, the higher the potential capital gain. Associated Selling Costs: Costs, such as agent commissions and legal fees, can be deducted from the selling price of the home when calculating capital gains. The higher the selling costs, the lower the capital gain, which reduces the capital gains tax. Home Improvement Costs: Significant improvements made to a home, like additions or major renovations, can effectively reduce the capital gain when the property is sold because these costs increase the total investment in the property. Final Selling Price: The final selling price of the home is the other key component in calculating capital gains. A higher selling price, relative to the purchase price and costs, results in higher capital gains and thus potentially more capital gains tax. Documentation: It's important to keep detailed records of all associated costs, as this documentation is necessary to calculate the capital gains tax correctly and to validate any claims during a tax audit. To determine whether you have a gain or loss when selling your home, start by taking the selling price and subtracting the purchase price, selling costs, and any improvement costs. If the result is positive, you have a gain. If it's negative, you have a loss. While this sounds straightforward, ensuring accuracy and considering all associated costs can influence the final calculations significantly. The rate at which you're taxed for capital gains depends on how long you've owned the asset. Short-term capital gains (assets held for a year or less) are taxed at ordinary income tax rates. Long-term capital gains (assets held for more than a year) often benefit from reduced tax rates, generally not exceeding 20% for most taxpayers. Being aware of these different rates can influence decisions on when to sell an asset. The IRS provides homeowners with a valuable tax break when selling their primary residence. Singles can exclude up to $250,000 of capital gains, while married couples can exclude up to $500,000. This means that many homeowners might not owe any capital gains tax on the sale of their property. It’s one of the most generous allowances offered by the tax code, giving homeowners substantial financial flexibility. To qualify for this exclusion, two primary criteria need to be met: Ownership Test: You must have owned the home for at least two years during the five years leading up to the sale. Use Test: The home must have been your primary residence for at least two of the past five years. Both these criteria were designed to ensure that this tax benefit goes to genuine homeowners and not property flippers or real estate developers. You don’t need to have lived in the home consecutively for those two years. They can be non-consecutive as long as they fall within the five-year window. For instance, living in a home for the first and fifth years of a five-year period would satisfy this rule. This flexibility is particularly beneficial for homeowners who may have temporarily rented out their homes or traveled for an extended period. If you've incurred capital losses on other investments, you can use them to offset capital gains. For example, if you've gained $30,000 from selling your home but lost $10,000 in the stock market, your net capital gain is only $20,000. This balancing act ensures that overall financial growth and losses are taken into account, preventing undue tax burdens. Keeping meticulous records of home improvements can be beneficial. Any money spent on qualifying improvements can be subtracted from your capital gains. Examples include additions, new roofs, or kitchen remodels. Routine maintenance, however, does not qualify. By maintaining these records, homeowners can essentially invest in their homes, knowing they'll see tax benefits down the line. This strategy involves intentionally selling an investment at a loss to offset capital gains in other areas. While typically used for stock portfolios, it's worth discussing with a financial planner when planning for a home sale. It's a sophisticated strategy that requires careful timing and understanding of market dynamics. When you inherit a property, the basis for capital gains tax isn't what the original owner paid, but the property's fair market value at their time of death. This "step-up in basis" can significantly reduce potential capital gains tax. It essentially levels the playing field, ensuring that inheritors are not penalized for previous appreciation they had no control over. Divorce can complicate property sales. Depending on agreements and local laws, the capital gains tax could be a responsibility shared between both parties or allocated differently. As property division can be a contentious issue in divorces, understanding potential tax implications can aid in smoother negotiations and fair outcomes. Rental properties don't qualify for the primary residence exclusion. When selling, you'll need to account for depreciation recapture and potential capital gains tax. Because these properties are seen as investments, their sale often carries different tax obligations. Understanding these distinctions is crucial for property investors. The best way to handle capital gains tax is to be proactive. Understand the potential tax liabilities before selling your home. Engage in tax planning strategies that minimize the overall tax burden. By being proactive, homeowners can anticipate tax obligations and structure their finances accordingly. Given the complexities of capital gains tax and its interplay with home sales, it's prudent to collaborate with tax professionals. An experienced tax advisor or CPA can provide insights specific to your situation, ensuring that you optimize your tax position. They can highlight opportunities and strategies you may not be aware of. Make it a habit to review your tax strategy annually, especially if you own multiple properties or plan to sell soon. Market conditions, changes in tax laws, and personal financial situations can evolve, necessitating adjustments in your strategy. Regular reviews ensure you stay ahead of any potential challenges. For those with investment properties, consider holding real estate in tax-advantaged accounts like IRAs. While there are limitations and specific rules to follow, these accounts can offer a shield against immediate capital gains tax implications. Such strategies not only defer tax liabilities but can also facilitate long-term wealth accumulation. Understanding the mechanics of capital gains tax and its implications for home sales is critical for homeowners. The tax, which applies to the profit realized from selling assets like homes, varies based on factors such as the purchase price, selling costs, home improvements, and the final selling price. However, various strategies can be employed to reduce the tax burden, including offsetting capital gains with losses, keeping home improvement records, and leveraging tax-loss harvesting. Special situations, such as inheritance, divorce, and rental properties, also influence the application of capital gains tax. Being proactive, seeking professional advice, conducting regular reviews of your tax strategy, and leveraging tax-advantaged accounts are prudent steps to navigating this complex landscape.Overview of Capital Gains Tax

Understanding Capital Gains Tax on Homes

Capital Gains and Homes

Factors Influencing Capital Gains Tax on Homes

Capital Gains Tax Implication on Selling Your Home

Calculating Gain or Loss

Tax Rates

Primary Residence Exclusion: An Exception to Capital Gains Tax

IRS Primary Residence Exclusion Rule

Criteria for Qualification

“Two Out of Five Years” Rule

How to Reduce Capital Gains Tax When Selling Your Home

Offset Capital Gains

Keep Home Improvement Records

Utilize Tax-Loss Harvesting

Special Situations Impacting Capital Gains Tax on Homes

Inheritance

Divorce

Rental Properties

Preparing for Capital Gains Tax

Be Proactive

Work With Professionals

Conduct Annual Review

Leverage Tax-Advantaged Accounts

Bottom Line

How Capital Gains Tax Works With Homes FAQs

It's a tax levied on the profit from selling a home that has appreciated in value.

You can offset gains with losses, keep records of home improvements, and consider tax-loss harvesting.

It allows singles to exclude up to $250,000 and couples up to $500,000 of capital gains when selling their primary home.

Inherited properties get a "step-up in basis," using the market value at the time of the original owner's death.

Yes, rental properties don't qualify for the primary residence exclusion and may have depreciation recapture considerations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.