Capital gains tax on gold and silver applies when these assets are sold at a profit. The Internal Revenue Service (IRS) categorizes gold and silver as "collectibles," with the gains taxed differently compared to assets like stocks or bonds. If you've held the precious metals for less than one year before selling, your gain is considered short-term and is taxed at your ordinary income tax rate, which can be between 10% to 37%. However, if you've held the metals for over a year, the gain is classified as long-term and is taxed at a maximum rate of 28%, regardless of your income level. These rates are subject to change based on legislation. It's important to maintain accurate records of your transactions for tax reporting purposes.

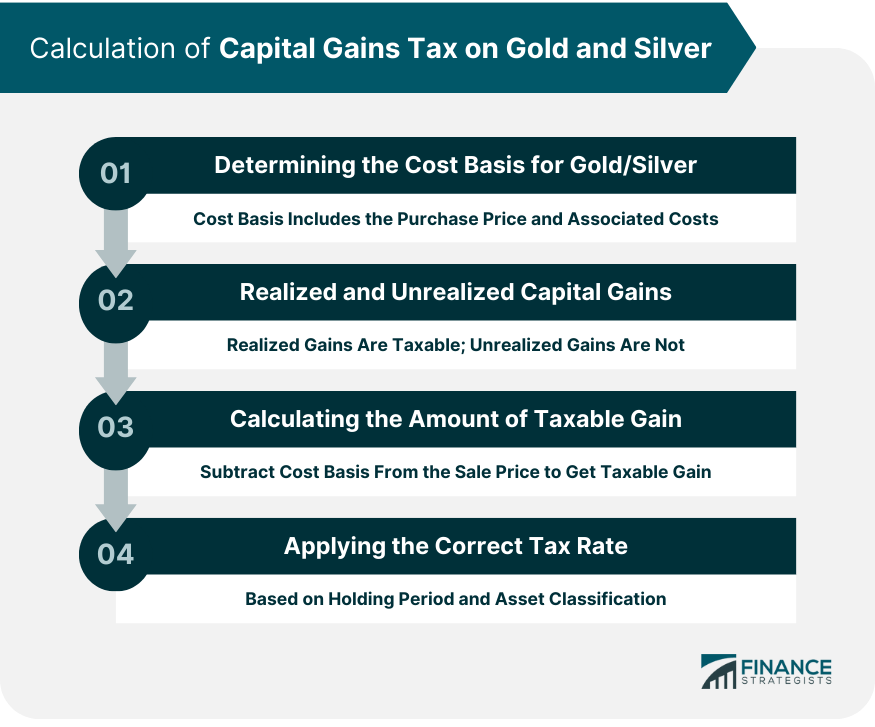

When you sell physical gold or silver, such as bars or coins, at a profit, you are liable to pay capital gains tax on the profit made. Exchange-Traded Funds (ETFs) that invest in gold and silver are also subject to capital gains tax. When shares of these funds are sold at a gain, capital gains tax applies. Like ETFs, mutual funds that invest in gold and silver or mining companies are subject to capital gains tax. This tax is due when shares are sold for more than the purchase price. When you sell stocks of mining companies that primarily deal with gold or silver at a profit, you'll have to pay capital gains tax on the gains. Futures contracts for gold and silver are also subject to capital gains tax. Gains realized from trading these contracts are taxed accordingly. Gold and silver ETFs are structured in two ways: physically-backed or futures-backed. Physically-backed ETFs directly own the metal and aim to track its spot price. When these ETFs are sold for a profit, the gain is subject to capital gains tax. However, the IRS treats these ETFs as "collectibles," so they're taxed at a maximum long-term capital gains rate of 28% if held for over a year. Like ETFs, mutual funds investing in gold and silver are subject to capital gains tax when sold for a profit. These funds can invest in physical bullion, mining stocks, or futures contracts. The capital gains tax rate depends on the type of asset the fund invests in and the duration the fund is held. Understanding the calculation of capital gains tax is pivotal for any investor. It involves determining the cost basis, realizing gains, and finally applying the correct tax rate. The cost basis of an asset is essentially its purchase price, plus any additional costs associated with the acquisition. For gold and silver, these additional costs might include broker's fees or auction costs. The cost basis is important because it is subtracted from the sale price to determine the capital gain. A capital gain is realized when the asset is sold. Conversely, an increase in value that isn't locked in through sale is considered an unrealized gain. Importantly, only realized capital gains are subject to tax. The taxable gain is determined by subtracting the cost basis from the sale price of the asset. If you sell gold or silver for a higher price than your cost basis, the difference is your taxable capital gain. If you sell for less, you realize a capital loss, which can offset other capital gains to reduce the tax liability. Once the taxable gain is calculated, the correct tax rate must be applied. As mentioned earlier, the tax rate depends on whether the gain is short-term or long-term and whether the asset is a collectible. The tax on gold and silver is influenced by various elements, including changes in tax laws, economic conditions, and the investor's decisions. Tax laws and rates are subject to changes based on economic conditions and legislative decisions. Any change in the capital gains tax rate or classification of gold and silver will impact the tax liability. Inflation erodes the purchasing power of money. In response, investors often flock to gold and silver as a store of value, driving their prices up. However, this can also result in higher capital gains when these assets are sold, thus leading to higher tax liability. Economic instability and market volatility can enhance the appeal of gold and silver as safe-haven investments. This, in turn, can increase their prices and potential capital gains, which might result in higher taxes. The duration for which an investor holds gold or silver before selling also affects the capital gains tax. Assets held for more than a year attract a lower tax rate than those sold within a year of acquisition. Prudent tax planning can help investors minimize their capital gains tax liability. This involves strategic buying and selling, using tax-advantaged accounts, and offsetting gains with losses. The timing of the purchase and sale of gold or silver can impact the capital gains tax. For instance, holding onto the assets for more than a year before selling can reduce the tax liability. Investing in gold and silver through certain tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans can defer or eliminate capital gains tax. However, there are specific rules regarding what kind of gold or silver can be included in these accounts. If an investor has capital losses, they can be used to offset capital gains, reducing the overall tax liability. This strategy, known as tax loss harvesting, requires careful planning and adherence to IRS rules. Gifting gold or silver can potentially reduce capital gains tax, as the cost basis is transferred to the recipient. Similarly, inherited gold or silver gets a "step-up" on a basis, potentially reducing the capital gains tax for the inheritor. Compliance with IRS rules and regulations is essential when dealing with capital gains tax on gold and silver. The IRS requires reporting of certain gold and silver transactions on Schedule D of Form 1040. Additionally, brokers and barter exchanges must report transactions involving precious metals on Form 1099-B. Failure to report and pay capital gains tax on gold and silver can lead to severe penalties, including fines and imprisonment. It's crucial for investors to understand their obligations and fulfill them in a timely manner. For international investors, tax treaties between their home country and the United States can impact the capital gains tax on gold and silver. Understanding these treaties can help them avoid double taxation and minimize their tax liability. The taxation on gold and silver is a significant aspect of investing in these precious metals. Classified as "collectibles" by the IRS, they are subject to unique tax rules. Types of investments subject to capital gains tax encompass physical bullion, ETFs, mutual funds, mining stocks, and futures contracts. The tax depends on the cost basis, the realization of gains, and the appropriate tax rate. Factors influencing tax liability include tax law changes, inflation, economic conditions, and holding period. Tax planning strategies can help minimize tax liability, including timed buying and selling, use of tax-advantaged accounts, loss harvesting, and gift strategies. Fulfilling IRS reporting requirements and understanding the legal ramifications of tax evasion are paramount to avoid penalties. International investors should be aware of tax treaties to avoid double taxation.Capital Gains Tax on Gold and Silver Overview

Types of Gold and Silver Investments Subject to Capital Gains Tax

Physical Gold and Silver

Gold and Silver ETFs

Gold and Silver Mutual Funds

Gold and Silver Mining Stocks

Gold and Silver Futures Contracts

Special Rules for Gold and Silver ETFs and Mutual Funds

Taxation of Gold and Silver ETFs

Mutual Funds Investing in Gold and Silver

Calculation of Capital Gains Tax on Gold and Silver

Determine the Cost Basis for Gold and Silver

Realized and Unrealized Capital Gains

Calculate the Amount of Taxable Gain

Apply the Correct Tax Rate

Factors That Affect Capital Gains Tax on Gold and Silver

Changes in Tax Laws and Rates

Impact of Inflation on Gold and Silver Prices

Role of Economic Conditions and Market Volatility

Effect of Holding Period on Capital Gains Tax

Strategies for Gold and Silver Investments

Timing of Buy and Sell Decisions

Utilizing Tax-Advantaged Accounts

Loss Harvesting and Offset Strategies

Gift and Inheritance Strategies for Gold and Silver

Legal and Regulatory Aspects of Capital Gains Tax on Gold and Silver

IRS Reporting Requirements for Gold and Silver Transactions

Legal Ramifications of Tax Evasion

Tax Treaties and International Investments in Gold and Silver

Conclusion

Capital Gains Tax on Gold and Silver FAQs

The capital gains tax rate on gold and silver depends on the holding period. For assets held for less than a year, the tax rate corresponds to the investor's income tax bracket. However, for assets held for more than a year, the maximum long-term capital gains tax rate is 28%, as gold and silver are classified as collectibles.

The capital gains tax on gold and silver is calculated by subtracting the cost basis (original purchase price plus any associated costs) from the sale price. The resulting amount is the capital gain, which is then subjected to the applicable tax rate.

No, if you sell your gold or silver for less than your cost basis, you have incurred a capital loss, not a gain. These losses can be used to offset other capital gains in your portfolio, reducing your overall tax liability.

Yes, there are several strategies to reduce or avoid capital gains tax on gold and silver, including holding the assets for more than a year, investing through tax-advantaged accounts, or offsetting gains with capital losses. Additionally, gifting or inheriting gold or silver can potentially reduce the tax liability.

Yes, the IRS requires certain gold and silver transactions to be reported on Schedule D of Form 1040. Additionally, brokers and barter exchanges must report transactions involving precious metals on Form 1099-B. It's important to consult with a tax professional to ensure compliance with all reporting requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.