A lease refers to a legal contract or agreement between a property owner, known as the landlord or lessor, and another party, referred to as the tenant or lessee, that allows the latter to use and occupy the property for a defined period in exchange for regular payments. Leases commonly apply to real estate, such as apartments, houses, and commercial spaces, but they can also be used for assets like vehicles and equipment. The purpose of a lease is to formalize the terms and conditions governing the rental relationship, thereby providing legal protections for both parties. Understanding the concept of a lease is crucial for anyone considering renting property or assets, as it outlines the rights, responsibilities, and potential liabilities involved. In the broader context, leases play a vital role in the real estate and finance sectors, shaping relationships between landlords, tenants, and financial institutions. In an operating lease, the lessee uses the asset for a period significantly shorter than its useful life. The lessor retains the risks and benefits of ownership, and the lease expenses are treated as operating expenses on the lessee's income statement. Also known as a capital lease, a finance lease is a longer-term lease in which the lessee essentially acquires all the risks and rewards of ownership, even though the legal title may remain with the lessor. The leased asset and the corresponding lease liability are recorded on the lessee's balance sheet. In a sale and leaseback arrangement, an asset's owner sells the asset to another party and then leases it back. This arrangement allows the original owner to continue using the asset while freeing up capital. In a direct lease, a lessor who is not the manufacturer or the seller of the asset purchases the asset and leases it to a lessee. The lessor acquires the asset specifically for the lease agreement. A leveraged lease involves a lessor, a lessee, and a lender. The lessor borrows funds from the lender to purchase the asset, which is then leased to the lessee. The lender is repaid from the lease payments. A lease agreement is composed of several key components. Lessor and Lessee: The lessor is the legal owner of the asset and the party that leases the asset to the lessee. The lessee is the party that obtains the right to use the asset in exchange for lease payments. Lease Term: The lease term is the duration for which the lease agreement is valid. During this period, the lessee has the right to use the asset under the terms specified in the lease agreement. Lease Payments: Lease payments are the regular payments that the lessee makes to the lessor for the use of the asset. The amount and frequency of these payments are detailed in the lease agreement. Residual Value: The residual value is the estimated value of the leased asset at the end of the lease term. It plays a crucial role in determining the lease payments. Under the U.S. Generally Accepted Accounting Principles (GAAP), leases are classified into capital and operating leases. For Lessee Accounting, a capital lease is recorded both as an asset and a liability, whereas operating lease expenses are recognized as rental expenses. For Lessor Accounting, a capital lease is recorded as a receivable, while an operating lease continues to be recorded as an owned asset. The International Financial Reporting Standards (IFRS) treat leases differently. Under IFRS 16, for Lessee Accounting, all leases are recorded on the balance sheet as a "right-of-use" asset and a lease liability. For Lessor Accounting, leases are classified as either a finance lease or an operating lease. The main difference lies in the classification and recognition of leases. GAAP differentiates between capital and operating leases for lessees, whereas IFRS does not. A lease affects a company's balance sheet based on how it's classified. For finance leases, the right-of-use asset and corresponding lease liability are recognized on the balance sheet. On the income statement, operating leases result in a single lease expense, whereas finance leases lead to the recognition of interest expense and depreciation. For finance leases, the part of the lease payment allocated to principal repayment is a financing activity, while the part attributed to interest is an operating activity. The decision depends on factors like the nature of the asset, the financial health of the company, tax implications, and the flexibility needed. Cost-Benefit Analysis: In a cost-benefit analysis, both the financial and non-financial benefits and costs associated with leasing or buying are considered. Accounting Implications: Leasing or buying impacts financial reporting. Buying increases assets and liability, while leasing may result in lesser reported assets and liabilities depending on the lease type. Tax Considerations: Leasing might offer tax advantages since lease payments can often be deducted as business expenses. Leasing often requires lower initial cash outlay compared to outright purchase, which leaves more funds available for other business operations. This improves the liquidity and financial flexibility of a business. Especially in sectors where technology rapidly evolves, leasing can provide businesses with the ability to use the latest equipment without committing to own it. This way, they can continually upgrade to newer models and stay competitive. When leasing, businesses often don't have to worry about maintenance, repair, or disposal of the assets, as these responsibilities typically lie with the leasing company. This can simplify asset management and reduce related operational burdens. While leasing can be cheaper upfront, over the long term, the cumulative costs of leasing may exceed the cost of outright purchase. This is due to the fact that leasing contracts usually include interest and potential fees. When leasing, the lessee does not own the asset and therefore may have restrictions on its use, such as mileage limitations on leased vehicles. Modifications to the asset might also be prohibited under the terms of the lease agreement. Lease agreements can sometimes be complex and filled with jargon, making them hard to understand for many. Also, they may contain terms that are unfavorable to the lessee, such as steep penalties for early termination or damage beyond normal wear and tear. Lease Agreement: The lease agreement details the terms and conditions of the lease, and both parties must adhere to these. Lease Termination: Termination can happen at the end of the lease term or prematurely under certain circumstances as outlined in the agreement. Default and Remedies: If a party fails to fulfill its obligations, this is considered a default. Remedies can include legal action, penalties, or forfeiture of the asset. Key players in the leasing industry are mainly financial institutions such as banks that offer various leasing products to both businesses and individuals. Also noteworthy are specialized leasing companies that focus on particular sectors like automotive, equipment, or real estate leasing. Additionally, many manufacturers have started offering lease financing options, allowing customers to use their products without large initial investments. Current trends in the leasing industry highlight the significant role of technology in lease management, including digitization, automation, and the use of data analytics for decision-making. Equipment leasing has seen a surge in popularity as businesses prefer to lease expensive machinery rather than buy. Green leasing is also emerging, focusing on environmentally friendly practices and energy efficiency, which aligns leasing with sustainable business operations. As companies continue to value flexibility, adaptability, and sustainability, the leasing industry's future looks promising. Leasing is expected to become an even more prevalent strategy in business operations and personal finance. In terms of technology, emerging technologies like blockchain could revolutionize lease management by improving transparency, efficiency, and security in transactions. Leases play a critical role in the real estate and finance sectors, formalizing rental relationships and offering legal protection to both parties. They come in various types like operating, finance, sale and leaseback, direct, and leveraged leases. Key components of a lease include the lessor, lessee, lease term, payments, and residual value. Leases also have significant accounting implications under GAAP and IFRS, influencing financial statements and requiring meticulous financial analysis. Choosing between leasing and buying requires careful consideration of cost-benefit analysis, accounting implications, and tax considerations. While leasing offers benefits such as improved cash flow and access to the latest technology, it also presents challenges such as higher long-term costs and limited control over assets. Leasing also carries legal aspects, with an emphasis on agreement adherence, termination procedures, and default remedies. Industry trends point towards the increasing significance of leasing, fueled by technology and sustainability.What Is a Lease?

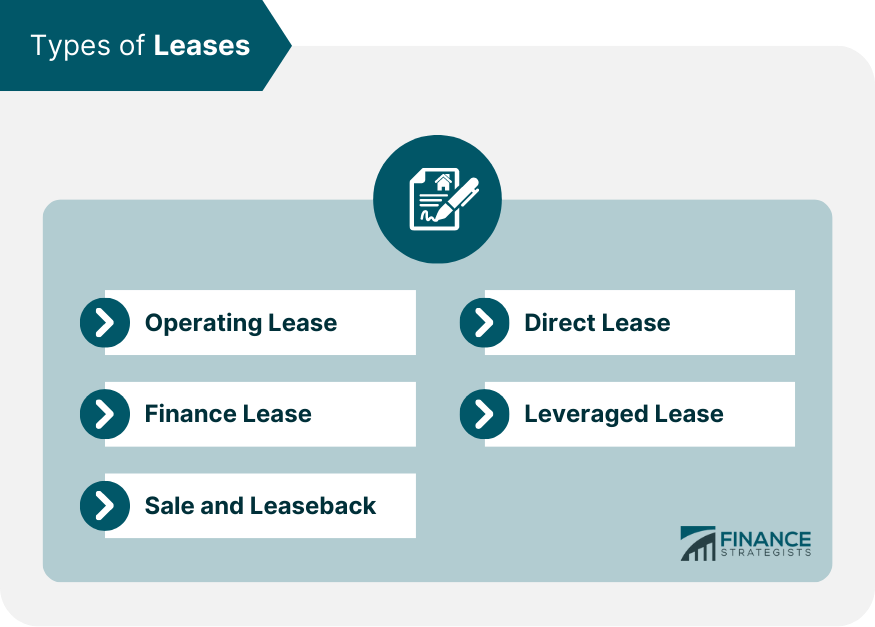

Types of Leases

Operating Lease

Finance Lease

Sale and Leaseback

Direct Lease

Leveraged Lease

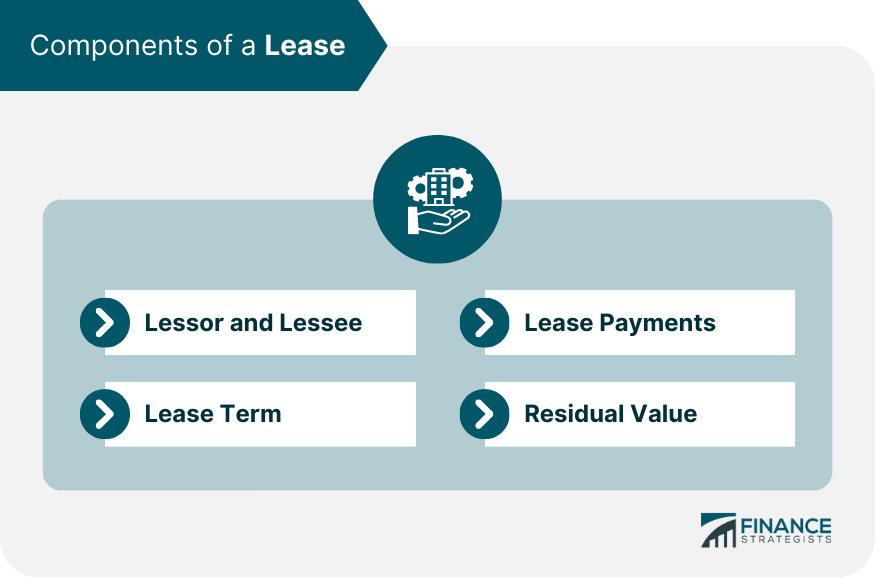

Components of a Lease

Accounting for Leases

Accounting Under GAAP

Accounting Under IFRS

Differences Between GAAP and IFRS in Lease Accounting

Financial Analysis of Leases

Impact on Balance Sheet

Impact on Income Statement

Impact on Cash Flow Statement

Factors Influencing Lease vs Buy Decision

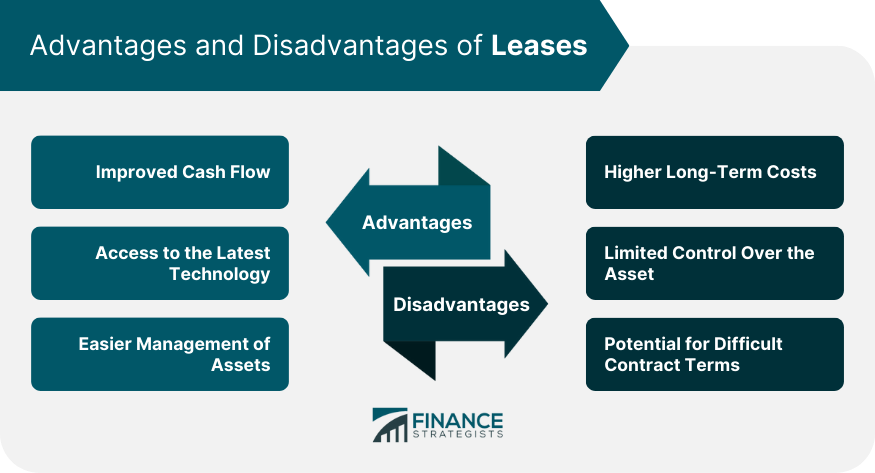

Advantages of Lease Financing

Improved Cash Flow

Access to the Latest Technology

Easier Management of Assets

Disadvantages of Lease Financing

Higher Long-Term Costs

Limited Control Over the Asset

Potential for Difficult Contract Terms

Legal Aspects of Leasing

Leasing Industry and Market Trends

Major Players in the Leasing Industry

Current Trends in Leasing

Future Prospects of Leasing

Final Thoughts

Lease FAQs

There are several types of leases, including operating leases, finance leases, sale and leaseback, direct leases, and leveraged leases. The nature of the lease is determined by factors such as the length of the lease term, who bears the risk and rewards of ownership, and the estimated residual value of the asset at the end of the lease term.

A lease can significantly impact a company's balance sheet, income statement, and cash flow statement. The type of lease (operating or finance) determines how it is accounted for. Finance leases typically lead to an asset and a corresponding liability on the balance sheet, while operating leases may not appear directly on the balance sheet under certain accounting standards.

Factors that a company should consider include the financial health of the company, the nature of the asset, tax implications, flexibility needs, cost, and accounting implications. Both leasing and buying have their advantages and disadvantages, and the decision will depend on the company's unique circumstances and strategic goals.

Legal aspects of a lease agreement include understanding the terms and conditions outlined in the agreement, procedures for lease termination, and potential remedies in case of a default. It's crucial to understand and negotiate the terms of a lease agreement before signing to avoid potential legal issues.

Current trends in the leasing industry include the growing use of technology in lease management, an increase in equipment leasing, and a rise in green leasing for sustainable business practices. Future prospects point towards an even greater prevalence of leasing, with technology like blockchain potentially revolutionizing lease management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.