Tax-Deferred Exchanges, also known as 1031 exchanges or like-kind exchanges, are a specialized tax strategy that allows individuals or businesses to defer paying taxes on the capital gains realized from the sale of certain types of investment or business properties. This powerful tax provision, outlined in Section 1031 of the Internal Revenue Code, enables taxpayers to reinvest the proceeds from the sale of a property into another similar property without triggering immediate tax liabilities. In a tax-deferred exchange, the property being sold, referred to as the relinquished property, is exchanged for a replacement property of equal or greater value. The exchange must meet specific criteria to qualify for tax deferral. Firstly, both the relinquished property and the replacement property must be held for productive use in a trade or business or as an investment. Secondly, the properties must be of a like-kind, which generally means they are of the same nature or character, regardless of differences in quality or grade. The primary purpose of tax-deferred exchanges is to allow investors to defer capital gains tax on the sale of a property by reinvesting the proceeds into a like-kind property. This encourages investment and economic growth. A simultaneous exchange occurs when the relinquished and replacement properties are transferred simultaneously. This type of exchange is less common due to the difficulty in coordinating the transfer of properties at the exact same time. A delayed exchange, also known as a Starker exchange, allows an investor to sell their relinquished property and acquire a replacement property within a specified time frame. This is the most common type of tax-deferred exchange due to its flexibility. In a reverse exchange, the replacement property is acquired before the relinquished property is sold. This type of exchange is more complex and may require additional financing, but it can provide investors with greater control over their investments. A build-to-suit exchange allows an investor to use the proceeds from the sale of their relinquished property to construct improvements on the replacement property. This enables investors to tailor the replacement property to their specific needs. The primary benefit of a tax-deferred exchange is the deferral of capital gains tax. By reinvesting the proceeds from the sale of a property into a like-kind property, investors can defer the taxes on their gains. Tax-deferred exchanges help preserve investment capital by allowing investors to reinvest the full amount of their proceeds from the sale of a property. This maximizes the potential return on investment and facilitates portfolio growth. Tax-deferred exchanges allow investors to diversify their investment portfolio by exchanging properties in different locations or asset classes. This can help reduce risk and improve the overall performance of an investor's portfolio. Tax-deferred exchanges restrict investors to exchanging properties of like-kind, limiting their investment choices. This may prevent investors from pursuing alternative investment opportunities that could provide higher returns. A tax-deferred exchange may result in a lower basis for the replacement property, which could increase the investor's future tax liability when the property is eventually sold. This reduction in basis must be considered when evaluating the long-term benefits of a tax-deferred exchange. Tax-deferred exchanges can be complex and time-consuming, requiring strict adherence to IRS regulations and deadlines. The process may also involve coordinating with multiple parties, including qualified intermediaries, attorneys, and tax advisors. If the requirements for a tax-deferred exchange are not met, the transaction may result in unexpected tax consequences. Investors must carefully navigate the rules and regulations to avoid potentially costly mistakes. The identification period is the 45-day window following the sale of the relinquished property during which the investor must identify potential replacement properties. Failing to identify a property within this period can disqualify the exchange. The exchange period is the 180-day time frame within which the investor must complete the acquisition of the replacement property. This period begins on the date the relinquished property is sold and runs concurrently with the identification period. Failure to meet this deadline can result in the disqualification of the tax-deferred exchange. A qualified intermediary (QI) is an independent third party that facilitates the tax-deferred exchange by holding and transferring the proceeds from the sale of the relinquished property. The QI must be involved in the transaction to ensure compliance with IRS regulations. To qualify for a tax-deferred exchange, the relinquished and replacement properties must be considered like-kind, meaning they are of the same nature or character. Generally, real property is considered like-kind to other real property, regardless of improvements or differences in grade or quality. A tax-deferred exchange involves a complex process that must be followed carefully to ensure compliance with IRS regulations. The process typically involves the following steps: To initiate a tax-deferred exchange, the investor must first identify the property they intend to relinquish. This property will be sold, and the proceeds will be used to acquire the replacement property. The relinquished property must be a business or investment property and must be held for productive use in a trade or business or for investment purposes. During the 45-day identification period, the investor must identify potential replacement properties. They may identify up to three properties, or more if they meet certain valuation criteria. The replacement property must also be a business or investment property and must be of like-kind to the relinquished property. Once the relinquished property is sold, the proceeds are transferred to a qualified intermediary (QI). The QI holds the funds until the replacement property is acquired. It is important to note that the investor must not have actual or constructive receipt of the sale proceeds; otherwise, the exchange will not qualify for tax deferral. The investor acquires the replacement property using the proceeds held by the qualified intermediary. The QI transfers the funds to the seller of the replacement property, completing the exchange. The replacement property must be acquired within 180 days from the date of the sale of the relinquished property, or by the due date of the investor's tax return, including extensions, whichever is earlier. The tax-deferred exchange is considered complete when the investor has acquired the replacement property and met all requirements and deadlines set forth by the IRS. The investor must also file the appropriate tax forms to report the exchange. It is important to consult with a qualified tax professional to ensure compliance with the rules and regulations governing tax-deferred exchanges. Tax-deferred exchanges offer significant benefits, including the deferral of capital gains tax, preservation of investment capital, and diversification of investment portfolios. However, investors must adhere to strict requirements, such as the identification period, exchange period, and like-kind property rules. While tax-deferred exchanges can provide substantial benefits, they also come with potential drawbacks, such as limited investment flexibility, reduced basis, complexity, and potential tax consequences. It is crucial for investors to carefully evaluate the pros and cons and consult with a tax services professional for guidance before engaging in a tax-deferred exchange.What Are Tax-Deferred Exchanges?

Types of Tax-Deferred Exchanges

Simultaneous Exchange

Delayed Exchange

Reverse Exchange

Build-To-Suit Exchange

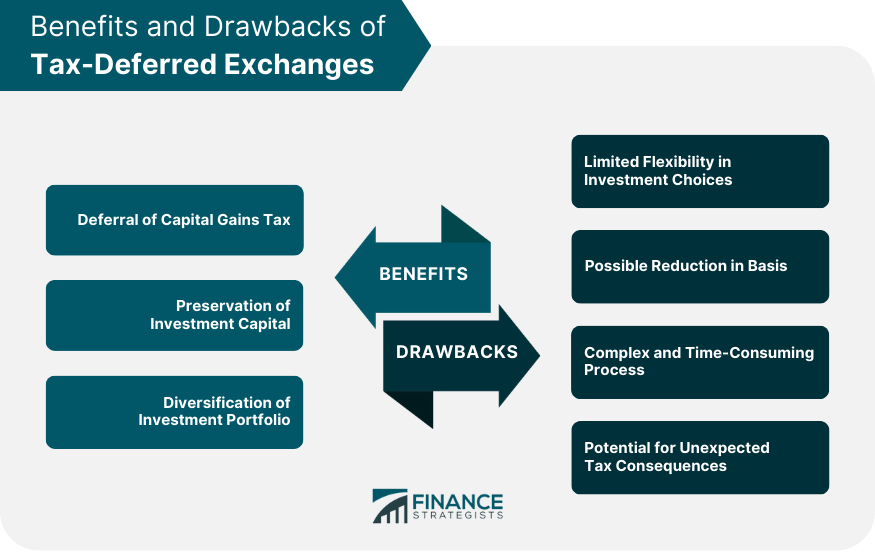

Benefits of Tax-Deferred Exchanges

Deferral of Capital Gains Tax

Preservation of Investment Capital

Diversification of Investment Portfolio

Drawbacks of Tax-Deferred Exchanges

Limited Flexibility in Investment Choices

Possible Reduction in Basis

Complex and Time-Consuming Process

Potential for Unexpected Tax Consequences

Requirements for Tax-Deferred Exchanges

Identification Period

Exchange Period

Qualified Intermediary

Like-Kind Property Requirement

Process of a Tax-Deferred Exchange

Identification of Relinquished Property

Selection of Replacement Property

Transfer of Relinquished Property to the Intermediary

Acquisition of Replacement Property Through the Intermediary

Completion of the Exchange

Bottom Line

Tax-Deferred Exchanges FAQs

A tax-deferred exchange is a transaction in which an asset is exchanged for a like-kind asset, allowing the taxpayer to defer paying capital gains tax.

The benefits of a tax-deferred exchange include deferring capital gains tax, preserving investment capital, and diversifying your investment portfolio.

The requirements for a tax-deferred exchange include identifying the replacement property within 45 days and completing the exchange within 180 days, using a qualified intermediary, and exchanging like-kind property.

The drawbacks of a tax-deferred exchange include limited flexibility in investment choices, possible reduction in basis, complex and time-consuming process, and potential for unexpected tax consequences.

No, only like-kind property can be exchanged in a tax-deferred exchange. This means that the properties being exchanged must be of the same nature, character, or class.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.