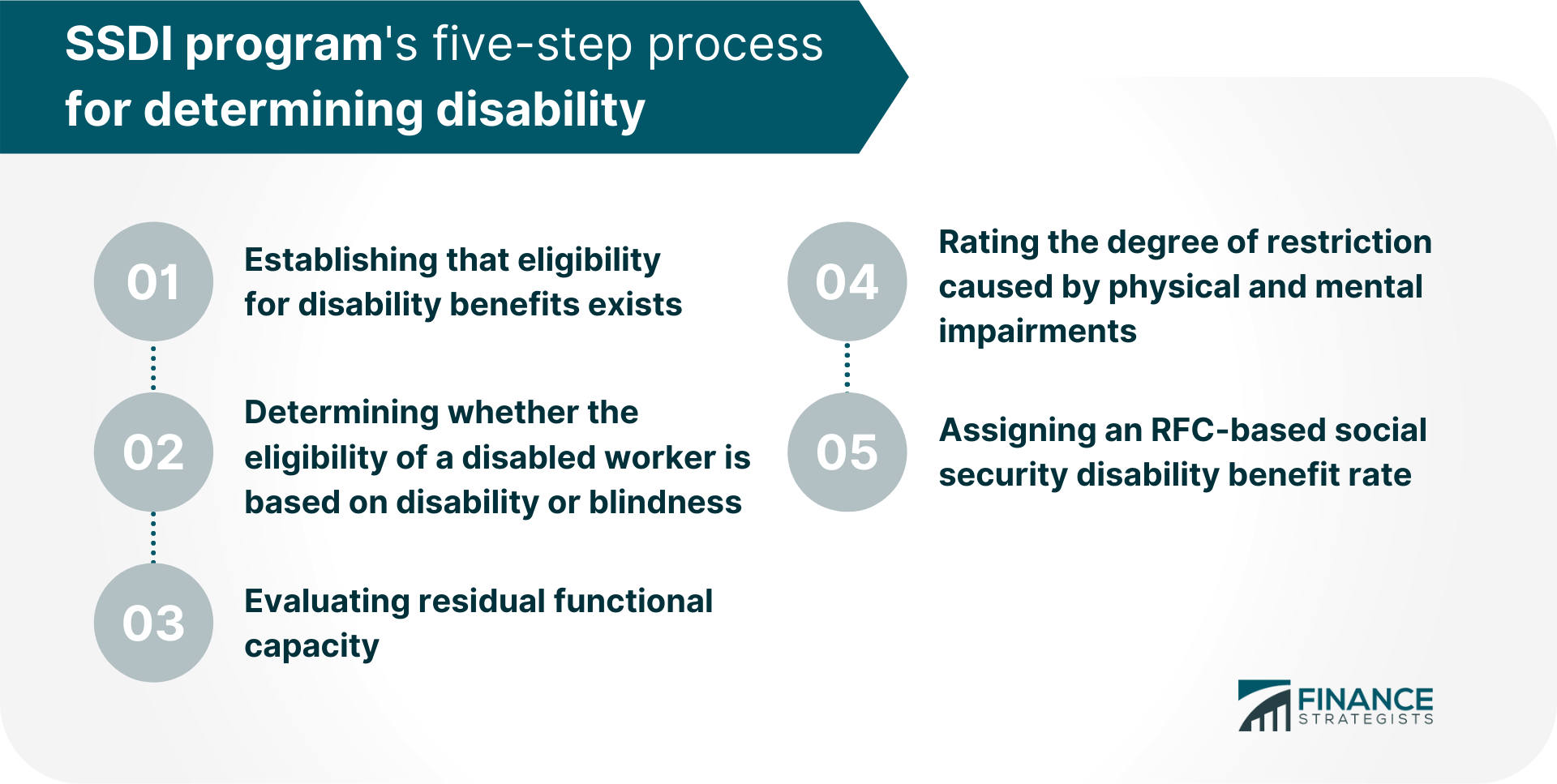

Supplemental Security Income (SSI) is a federal program that provides monthly cash payments to low-income elderly, blind, or disabled individuals who have little or no income. In addition, SSI recipients automatically qualify for Medicaid coverage. The SSI program is funded through general tax revenues, not Social Security taxes. The federal government does not provide SSI payments directly to recipients; instead, the Social Security Administration (SSA) contracts with local and state governments and private agencies to administer the program. Have a financial question? Click here. The SSA will administer the SSI application process. To qualify for SSI, applicants must meet both financial and non-financial requirements that are outlined by the SSA. You may be eligible for SSI if you: You may also be eligible if you: Social Security Disability Insurance (SSDI) — sometimes called simply Social Security Disability (SSD) — is a federal insurance program that pays benefits to people who can no longer work because of a severe, long-lasting medical condition. The SSDI program also is funded through general tax revenues, not Social Security taxes. Like SSI, the federal government does not provide SSDI payments directly to recipients. Rather, the SSA administers the program by contracting with state agencies to handle its day-to-day operations. The process of applying for disability benefits under the SSDI program begins with a call from an applicant to one of Social Security's 800-number representatives, or in person at a local Social Security office. The representative gathers the necessary information, which includes prior work history and contact information for the current employers of the applicant. Once all of this preliminary information has been gathered, Social Security will send an appointment letter to the applicant to attend their "work test". During the work test, more detailed questions are answered and records will be inspected. If the "work test" shows that the applicant is indeed disabled, he or she will undergo a battery of medical tests to prove disability. The SSDI program uses a five-step process for determining disability: Once a patient has undergone the SSDI process, their Social Security disability benefit will be determined by a formula called "the determination of disability", which is based on four variables: age, years of work experience, Social Security credits, and medical eligibility. Both programs are federal, not state programs. Payments can be made to individuals or households. Both programs provide cash benefits only. If you lose your SSI/SSDI income, you do not qualify for food stamps (unless you have other income). SSI is need-based while SSDI is a contributory program. If you are not disabled, you can't get SSDI. SSI disregards earned income but SSDI does not. Income from unearned sources such as interest, dividends and rental income will reduce your SSI benefits dollar for dollar; however, it won't reduce your SSDI benefit. The Bottom Line The Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI) programs are two of the most important income security programs in the United States. While both SSI and SSDI offer critical support to Americans with disabilities, there are significant differences between these two benefit programs. To make a valid claim for either SSI or SSDI, it is vital to understand the program in which you are applying. To learn more about Social Security Disability Insurance (SSDI) and how it differs from the Supplemental Security Income (SSI) program, review this brief overview of SSDI eligibility requirements. However, before you make your claim for either SSI or SSDI, you may want to speak with a disability lawyer in your area to ensure that you fully understand the eligibility requirements for these two very complex programs. What Is SSI?

How Does SSI Work?

What Is SSDI?

How Social Security Disability Insurance (SSDI) Works

The Similarities and Differences Between SSI and SSDI

Similarities:

Differences:

SSI vs SSDI FAQs

Social Security Income (SSI) is a federal income supplement program that provides monetary support to disabled or blind individuals whose incomes fall below a certain level.

SSI pays benefits to disabled adults and children who have limited income and resources. Children under 18 years old must have a documented disability, but the disability doesn't need to be work-related.

To qualify for Social Security Disability Insurance (SSDI), an applicant must be able to prove that he or she has worked long enough and paid into the system. There are two main elements of SSDI eligibility: work history and medical disability.

SSI is need-based while SSDI is a contributory program. If you are not disabled, you can't get SSDI.

If you have a disability and have worked long enough to qualify, applying for SSDI is fairly simple. You can complete the applications online or in-person at a local Social Security office. You will need your social security card, proof of work history, and information about your current medical condition.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.