A retirement income projection is a detailed estimate of an individual's expected income sources and cash flow during their retirement years. This projection takes into account various factors such as savings, investments, Social Security benefits, pension plans, and other income sources to provide a comprehensive understanding of one's financial preparedness for retirement. The projection helps individuals assess their current financial situation, identify potential income gaps, and make informed decisions to optimize their retirement income plan. Social Security is a government program designed to provide financial support to retirees. It is funded through payroll taxes and provides a steady income stream based on an individual's earnings history. To estimate your Social Security benefits, you can use the Social Security Administration's online calculator or review your annual Social Security statement. These estimates are crucial when projecting your retirement income. Pensions are employer-sponsored retirement plans that provide a fixed income during retirement. There are two main types: defined benefit plans and defined contribution plans. Your pension benefits depend on your plan type, years of service, and salary. To calculate your pension income, consult your employer's plan documents or speak with a human resources representative. Retirement savings accounts, such as 401(k)s, IRAs, and Roth IRAs, allow individuals to save and invest money for retirement. These accounts often have tax advantages and can significantly impact retirement income. Each retirement savings account has specific contribution limits and rules. It's essential to understand these limits and develop a strategy to maximize your contributions and retirement savings. Investment income, including stocks, bonds, and mutual funds, can provide an additional source of retirement income. These investments have varying levels of risk and return, so it's important to develop a diversified portfolio that aligns with your financial goals and risk tolerance. Real estate investments, such as rental properties or Real Estate Investment Trusts (REITs), can generate passive income during retirement. Consider the potential income and risks associated with these investments when planning your retirement income. Annuities are insurance products that provide a guaranteed income stream in exchange for a lump-sum payment or series of payments. There are several types of annuities, including immediate, deferred, fixed, and variable. Annuities offer various payout options, such as lifetime income, joint, and survivor income, or period-certain income. When considering an annuity, evaluate the fees, surrender charges, and potential income to determine if it's a suitable addition to your retirement income plan. Many retirees choose to work part-time or freelance to supplement their retirement income. This additional income can help cover expenses and provide financial security during retirement. Housing is a significant retirement expense. Consider whether you will have a mortgage or rent payment during retirement and how this will impact your income needs. Owning a home requires ongoing maintenance and repairs. Be sure to budget for these expenses when planning your retirement income. Medicare is a government health insurance program for individuals aged 65 and older. It covers various healthcare services but may not cover all expenses, so it's essential to understand the coverage and potential out-of-pocket costs. Many retirees purchase supplemental insurance or Medigap policies to cover additional healthcare expenses not covered by Medicare. Consider the cost of these policies and any out-of-pocket expenses when projecting your retirement healthcare costs. Retirement is an opportunity to enjoy travel and leisure activities. Be sure to factor in the cost of vacations, hobbies, and other leisure activities when planning your retirement income. Pursuing hobbies and interests during retirement can contribute to overall well-being and happiness. Make sure to account for the expenses associated with these activities in your retirement income projections. Different retirement income sources are taxed differently. For example, Social Security benefits may be partially taxable, while Roth IRA withdrawals are generally tax-free. Understand the tax implications of your income sources to ensure accurate income projections. Consult a tax professional or financial planner to develop tax-efficient strategies for withdrawing and managing your retirement income. Inflation erodes the purchasing power of money over time, so it's essential to factor in inflation when projecting your retirement income needs. Adjust your retirement income projections for inflation by using historical inflation rates or an estimated rate. This will help ensure your projected income maintains its purchasing power throughout retirement. The 4% Rule The 4% rule is a guideline suggesting that retirees withdraw 4% of their portfolio value in the first year of retirement and adjust this amount for inflation each subsequent year. This method is a simple way to estimate retirement income needs but may not be suitable for everyone. Multiply by 25 Rule The multiply by 25 rule suggests that you need 25 times your desired annual retirement income in savings before retiring. This rule provides a quick estimate of retirement savings needs but may not account for individual circumstances or goals. 80% of Pre-Retirement Income Another common rule of thumb is to plan for 80% of your pre-retirement income during retirement. This estimate may not accurately reflect your retirement expenses, but it can serve as a starting point for further analysis. Online Tools and Resources There are numerous online retirement calculators available that can help you estimate your retirement income needs based on factors such as age, savings, and desired retirement lifestyle. Financial Planner Assistance A professional financial planner can help you create a customized retirement income projection based on your specific goals and circumstances. Understanding Probability and Risk Monte Carlo simulations use computer algorithms to model various scenarios and estimate the probability of achieving your retirement income goals based on factors such as investment returns and inflation. Incorporating Investment Returns and Inflation These simulations can provide a more comprehensive view of potential retirement outcomes by accounting for the uncertainty of investment returns and inflation. If your retirement income projections show a shortfall, consider increasing your contributions to retirement savings accounts. Individuals aged 50 and older are eligible to make catch-up contributions to retirement accounts, which can help close the gap between current savings and retirement income needs. Delaying retirement allows you to continue earning income and accruing benefits, which can help you reach your retirement income goals. By delaying the start of your Social Security benefits, you can increase your monthly benefit amount. Evaluate your risk tolerance and consider adjusting your investment strategy to better align with your retirement income goals and risk preferences. Diversification and asset allocation are essential components of a successful investment strategy. Rebalance your portfolio regularly and ensure it is well-diversified to optimize returns and minimize risk. Consider downsizing your home or relocating to a more affordable area to reduce housing expenses during retirement. Implement budgeting and cost-cutting strategies to reduce your overall expenses, which can help you achieve your retirement income goals. Regularly reviewing and updating your retirement income projections is vital to ensure a financially creating a comprehensive retirement income projection is essential for ensuring a financially secure and comfortable retirement. By considering various income sources, such as Social Security, pensions, retirement savings accounts, investment income, annuities, and part-time work, you can develop a holistic view of your retirement income. It's equally important to account for expenses like housing, healthcare, lifestyle, taxes, and inflation when planning for your retirement years. Utilize different projection methods, including rule-of-thumb methods, retirement calculators, and Monte Carlo simulations, to accurately estimate your retirement income needs. Regularly review and update your projections, and seek professional guidance to help you make informed decisions. By being proactive and adjusting your retirement plan as needed, you can ensure a fulfilling and financially stable retirement.Definition of Retirement Income Projection

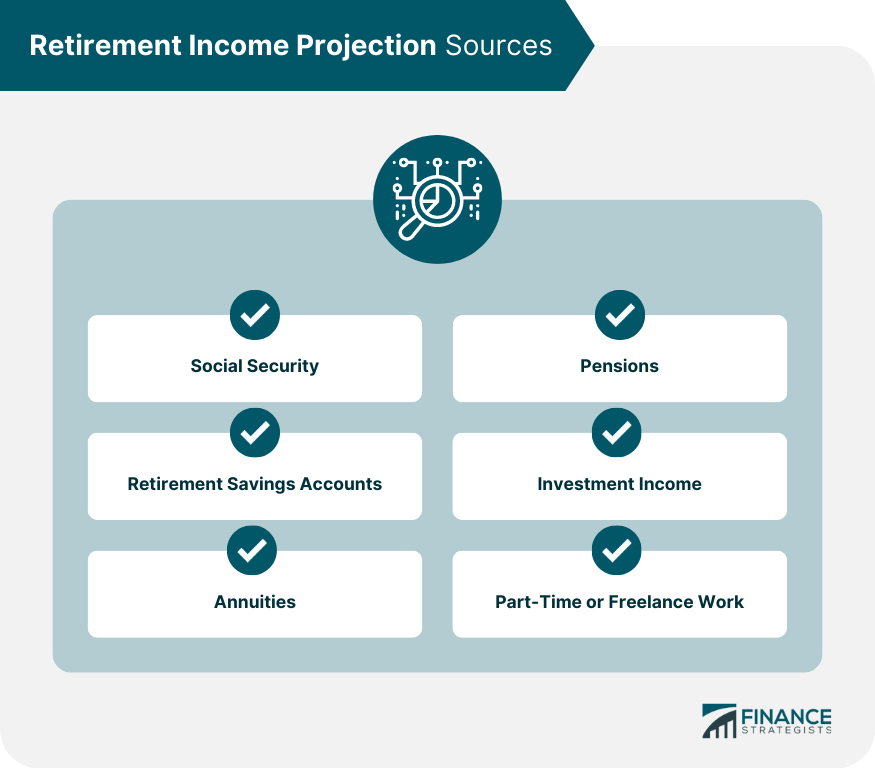

Retirement Income Projection Sources

Social Security

Pensions

Retirement Savings Accounts

Investment Income

Annuities

Part-Time or Freelance Work

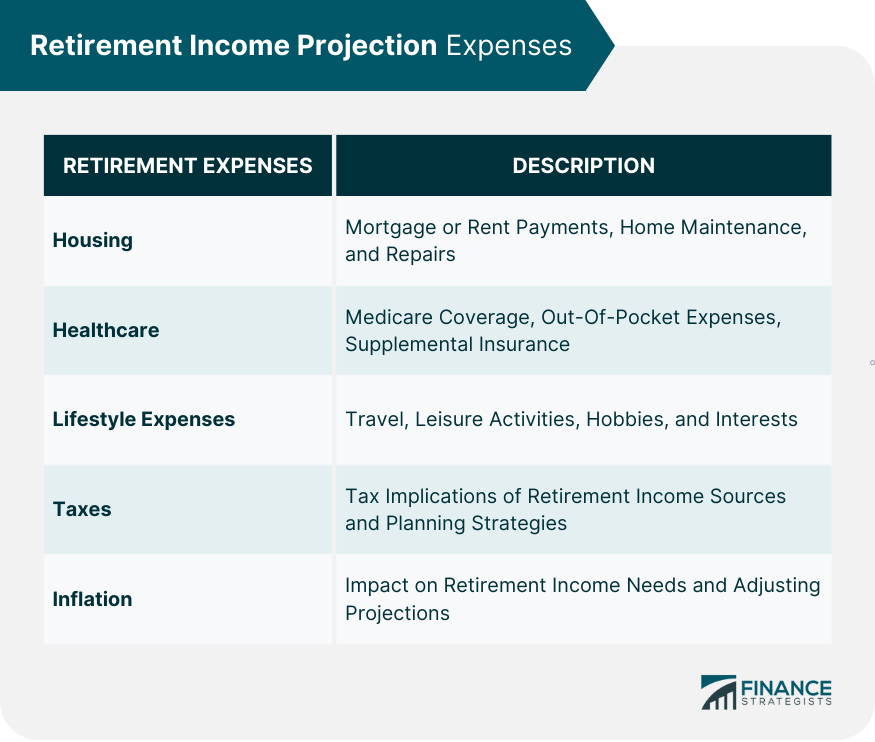

Retirement Income Projection Expenses

Housing

Healthcare

Lifestyle Expenses

Taxes

Inflation

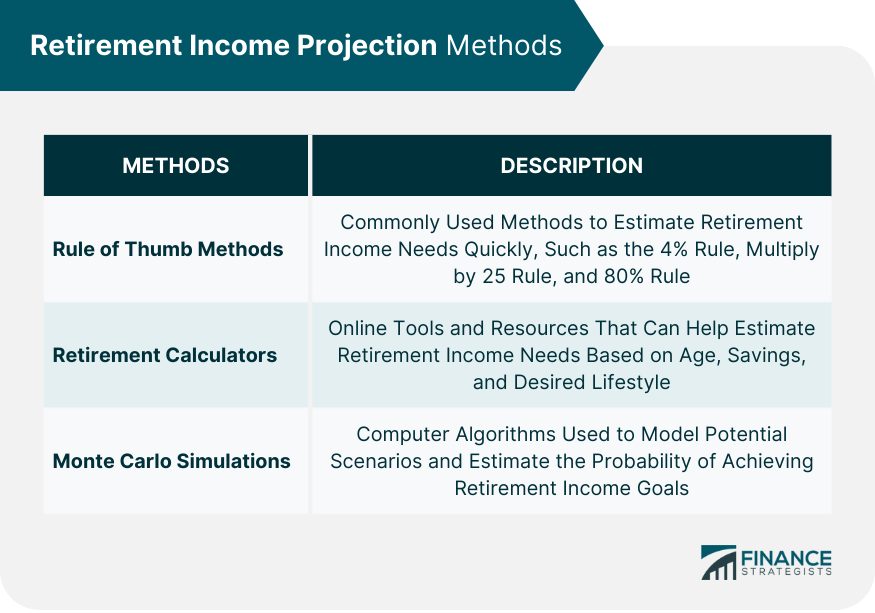

Retirement Income Projection Methods

Rule of Thumb Methods

Retirement Calculators

Monte Carlo Simulations

Adjusting Retirement Income Projection

Saving More

Delaying Retirement

Changing Investment Strategies

Reducing Expenses

Conclusion

Retirement Income Projection FAQs

A retirement income projection is an estimate of the income you will need during retirement to maintain your desired lifestyle. It is crucial because it helps you plan for various income sources, expenses, and potential economic changes, ensuring that you have enough financial resources to support your retirement years.

To include Social Security benefits in your retirement income projection, use the Social Security Administration's online calculator or review your annual Social Security statement to estimate your benefits. This information will help you understand how much income you can expect from Social Security during retirement.

When creating a retirement income projection, consider expenses such as housing (mortgage or rent payments, home maintenance, and repairs), healthcare (Medicare coverage, out-of-pocket expenses, and supplemental insurance), lifestyle expenses (travel, leisure, hobbies, and interests), taxes, and the impact of inflation on your income needs.

There are several methods to create a retirement income projection, such as the rule of thumb methods (4% rule, multiply by 25 rule, 80% of pre-retirement income), retirement calculators (online tools and resources or financial planner assistance), and Monte Carlo simulations (which take into account probability, risk, investment returns, and inflation).

If your retirement income projection shows a shortfall, you can adjust your retirement plan by saving more (increasing contributions to retirement accounts, making catch-up contributions), delaying retirement (continuing to earn income and accrue benefits, increasing Social Security benefits), changing your investment strategies (assessing risk tolerance, diversifying, and adjusting asset allocation), or reducing expenses (downsizing or relocating, implementing budgeting and cost-cutting strategies).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.