The retirement income floor refers to the minimum amount of income that an individual needs to cover basic living expenses during their retirement years. It is often calculated based on the cost of living and is designed to ensure that retirees have a basic standard of living without the need to rely on government assistance or family support. To establish a retirement income floor, start by assessing your personal financial needs. This includes calculating the cost of living and anticipated expenses during retirement, such as housing, healthcare, travel, and leisure. Estimates the cost of living in your desired retirement location, taking into account factors like housing, utilities, transportation, groceries, and healthcare. This will help you determine the minimum income needed to maintain your standard of living during retirement. Consider other expenses that may arise during retirement, such as travel, hobbies, and supporting family members. By accounting for these additional expenses, you can ensure that your retirement income floor covers all your financial needs. Next, identify your guaranteed income sources, which are stable and reliable throughout your retirement years. These may include Social Security benefits, pension plans, and annuities. Understanding the amount of guaranteed income available to you will help you determine how much additional income you need from investments to reach your desired retirement income floor. To reach your retirement income floor, you may need to rely on investment returns. Adopt conservative investment strategies, and consider diversifying your portfolio through asset allocation. This approach will help reduce risk while aiming for steady, long-term growth. To create a secure income stream, consider various investment options, such as laddering bond investments, dividend-paying stocks, and real estate investments. These can provide regular income while helping to minimize risk. Laddering involves purchasing bonds with different maturity dates, creating a steady stream of income as each bond matures. This approach helps reduce interest rate risk and provides a stable source of income. Investing in dividend-paying stocks can provide a consistent stream of income while potentially offering capital appreciation. Dividends can be reinvested or used as part of your retirement income floor. Real estate investments, such as rental properties, can provide a stable source of income during retirement. Additionally, real estate investments can offer potential appreciation and tax advantages. Utilize retirement accounts, such as 401(k) plans and Individual Retirement Accounts (IRAs), to help reach your retirement income floor. These accounts offer tax advantages and can provide a significant source of income during retirement. Incorporate tax-advantaged strategies, such as Roth conversions and Required Minimum Distributions (RMDs), to help optimize your retirement income. These strategies can help minimize taxes and ensure that you make the most of your retirement savings. Monitor your investments regularly to ensure that they continue to align with your retirement income floor goals. Regular monitoring can help identify potential issues and provide opportunities to adjust your investment strategy. Rebalance your investment portfolio periodically to maintain your desired asset allocation. Rebalancing can help mitigate risk and ensure that your investments remain aligned with your retirement income floor goals. Adjust your retirement income floor as needed to account for changing circumstances and needs, such as inflation, healthcare expenses, and family or lifestyle changes. Regularly reassessing your retirement income floor can help you stay on track and maintain financial stability throughout your retirement years. Inflation can erode the purchasing power of your retirement income. To protect against inflation, consider incorporating inflation-protected investments, such as Treasury Inflation-Protected Securities (TIPS), into your portfolio. Adjust your retirement income floor periodically to account for changes in inflation rates. Healthcare costs can significantly impact your retirement income floor, as these expenses often increase as you age. Plan for potential long-term care needs and consider purchasing long-term care insurance or setting aside funds specifically for health care expenses. Family and lifestyle changes, such as marriage, divorce, or the arrival of grandchildren, can impact your retirement income floor. Periodically reassess your financial needs to ensure your retirement income floor remains sufficient to support your desired lifestyle. Establishing and maintaining a retirement income floor is crucial for ensuring financial stability during retirement. To build a secure income stream, retirees should consider various investment options, utilize retirement accounts, and incorporate tax-advantaged strategies. It is also important to regularly monitor and adjust investments to maintain alignment with retirement income goals. Inflation, healthcare expenses, and family or lifestyle changes can impact retirement income, so it's necessary to regularly reassess financial needs and adjust the income floor as needed. By following these steps, retirees can establish a retirement income floor that covers their basic living expenses and provides a comfortable lifestyle during their retirement years.What Is Retirement Income Floor?

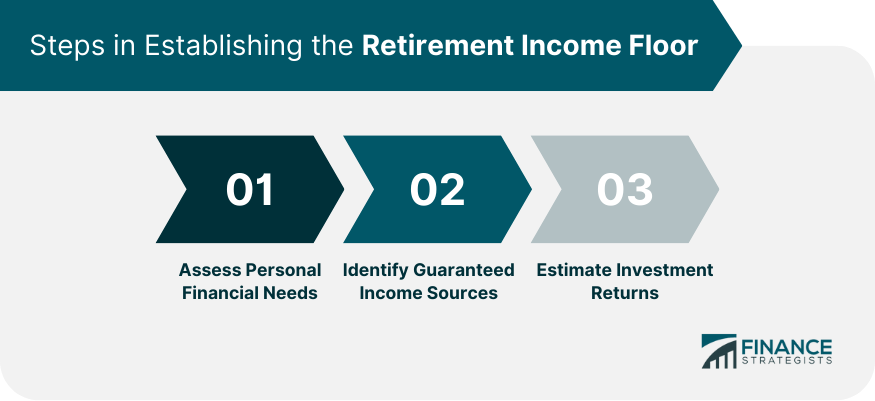

Establishing the Retirement Income Floor

Assessing Personal Financial Needs

Cost of Living Calculations

Anticipated Expenses During Retirement

Identifying Guaranteed Income Sources

Estimating Investment Returns

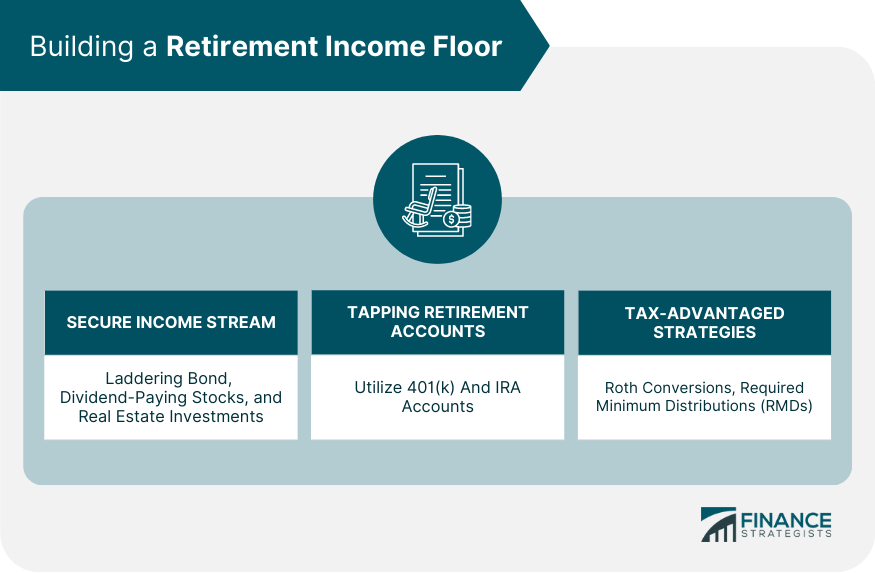

Building a Retirement Income Floor

Ensuring a Secure Income Stream

Laddering Bond Investments

Dividend-Paying Stocks

Real Estate Investments

Tapping Into Retirement Accounts

Utilizing Tax-Advantaged Strategies

Maintaining and Adjusting the Retirement Income Floor

Regular Monitoring of Investments

Rebalancing the Investment Portfolio

Adapting to Changing Circumstances and Needs

Inflation

Health Care Expenses

Family and Lifestyle Changes

Bottom Line

Retirement Income Floor FAQs

A retirement income floor is the minimum amount of income you need during retirement to cover your essential expenses and maintain your desired lifestyle. Establishing a retirement income floor is vital for retirement planning as it helps ensure financial stability and allows you to enjoy a comfortable retirement.

To determine your retirement income floor, start by assessing your personal financial needs, such as cost of living calculations and anticipated expenses during retirement. Then, identify guaranteed income sources, such as Social Security benefits, pension plans, and annuities, and estimate potential investment returns. This process will help you calculate the minimum income needed to maintain your desired lifestyle during retirement.

Investment strategies that can help you build a secure retirement income floor include laddering bond investments, investing in dividend-paying stocks, and exploring real estate investments. These strategies can provide a stable income stream while minimizing risk and helping you reach your retirement income goals.

To maintain and adjust your retirement income floor, regularly monitor your investments, rebalance your portfolio, and adapt to changing circumstances, such as inflation, healthcare expenses, and family or lifestyle changes. Periodic reassessments and adjustments will ensure that your retirement income floor remains sufficient to support your desired lifestyle.

Yes, tax-advantaged strategies, such as Roth conversions and required minimum distributions (RMDs), can help you optimize your retirement income floor. These strategies can minimize taxes and ensure that you make the most of your retirement savings, ultimately contributing to a more stable and secure retirement income floor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.