Asset decumulation refers to the process of converting accumulated savings and investments into income during retirement. This process typically involves withdrawing assets from various sources, such as retirement accounts, investment portfolios, and other savings vehicles, to cover living expenses and support financial goals during retirement. Effective asset decumulation is a critical component of retirement planning, as it helps ensure that retirees have a steady stream of income to cover their expenses and maintain their desired lifestyle throughout their retirement years. By developing a well-thought-out decumulation strategy, retirees can manage various risks, such as longevity risk, market risk, and inflation risk, while optimizing their financial resources. Several factors can influence an individual's asset decumulation strategy, including their retirement income needs, risk tolerance, investment preferences, tax considerations, and the types of financial accounts they hold. Understanding these factors can help retirees make informed decisions about their decumulation approach. The first step in developing an asset decumulation strategy is to estimate your retirement expenses. This involves creating a detailed budget that accounts for both essential and discretionary expenses, such as housing, healthcare, food, utilities, travel, and entertainment. It's essential to periodically review and update this budget to account for changes in your financial circumstances and goals. Next, identify all potential income sources during retirement, including: Social Security benefits typically represent a significant portion of retirees' income. Understanding the factors that determine your benefit amount and the optimal claiming strategy can help maximize your Social Security income. If you are entitled to a pension from your employer, it's crucial to understand the terms of your pension plan, including the benefit amount, payment options, and any survivor benefits available to your spouse or dependents. Personal savings and investments, such as individual retirement accounts (IRAs), 401(k) plans, and taxable brokerage accounts, can provide a flexible source of retirement income. Developing a withdrawal strategy that balances your income needs with tax considerations and risk management is critical to optimizing your savings. A key component of asset decumulation planning is determining a sustainable withdrawal rate – the percentage of your total assets that you can withdraw annually without depleting your savings prematurely. A commonly recommended withdrawal rate is the "4% rule," which suggests that retirees can withdraw 4% of their total assets in the first year of retirement and adjust that amount for inflation each subsequent year. However, individual circumstances and market conditions may necessitate a more conservative or aggressive withdrawal rate. A fixed dollar amount strategy involves withdrawing a predetermined dollar amount from your savings each year. This approach provides a consistent income stream but may not account for changes in market conditions, inflation, or your financial needs. A fixed percentage strategy involves withdrawing a set percentage of your total assets each year. This approach adjusts your income based on your portfolio's performance, which can help mitigate the impact of market fluctuations. However, this strategy may result in fluctuating income levels, making it more challenging to plan for expenses. Inflation-adjusted withdrawals involve increasing your withdrawal amount each year based on the rate of inflation. This approach helps maintain the purchasing power of your income but may require a more conservative initial withdrawal rate to account for the increasing withdrawals over time. Immediate annuities provide a guaranteed income stream for life or a specified period in exchange for a lump-sum payment. This approach can help manage longevity risk and provide a stable income source, but it may limit your flexibility and potential for investment growth. Deferred annuities involve investing a lump sum or series of payments with an insurance company, which then provides income payments at a later date, typically at retirement. These annuities can offer tax-deferred growth and a guaranteed income stream, but they may have higher fees and less flexibility than other investment options. The bucket strategy involves dividing your assets into multiple "buckets" based on their intended purpose and time horizon. The short-term bucket contains assets intended to cover expenses in the next few years, typically composed of cash and cash-equivalent investments. The intermediate-term bucket includes assets intended to cover expenses in the medium term (e.g., 5-10 years). This bucket may contain a mix of fixed income and conservative equity investments to balance income generation with the potential for growth. The long-term bucket holds assets intended to cover expenses beyond ten years, typically composed of growth-oriented investments such as stocks and higher-risk bonds. This bucket can help manage longevity risk and provide the potential for investment growth over time. A dynamic withdrawal strategy involves adjusting your withdrawal rate based on market conditions and your portfolio's performance. This approach can help mitigate the impact of market fluctuations on your retirement income and preserve your savings during periods of poor market performance. Incorporating guaranteed income sources, such as Social Security benefits, pensions, and annuities, into your dynamic withdrawal strategy can provide a stable income base to cover essential expenses and reduce the need to withdraw from your savings during market downturns. Hybrid strategies combine elements of multiple decumulation approaches to create a customized solution that meets your unique financial needs and goals. For example, you might use a systematic withdrawal strategy for a portion of your savings and purchase an annuity to provide guaranteed income for essential expenses. Developing a tax-efficient withdrawal order can help minimize the tax impact of your decumulation strategy. This may involve withdrawing from taxable accounts first, followed by tax-deferred accounts (e.g., traditional IRAs and 401(k)s), and finally tax-free accounts (e.g., Roth IRAs). RMDs are mandatory withdrawals from certain tax-deferred accounts, such as traditional IRAs and 401(k)s, beginning at age 72. Failing to take RMDs can result in significant tax penalties. Integrating RMDs into your decumulation strategy can help optimize your tax situation and ensure compliance with tax regulations. Converting assets from a traditional IRA to a Roth IRA can provide tax-free growth and withdrawals, potentially reducing your tax liability during retirement. However, it's essential to weigh the tax implications of the conversion against the potential benefits. Longevity risk refers to the possibility of outliving your savings. Strategies for managing longevity risk include purchasing annuities, maintaining a conservative withdrawal rate, and adjusting your withdrawal strategy based on market conditions and your financial needs. Market risk involves the potential for your investments to lose value due to market fluctuations. Diversifying your portfolio, using a dynamic withdrawal strategy, and incorporating guaranteed income sources can help mitigate market risk. Inflation risk refers to the potential for rising prices to erode the purchasing power of your retirement income. Strategies for managing inflation risk include adjusting your withdrawal rate for inflation, investing in assets with the potential for inflation-adjusted growth (e.g., stocks and inflation-protected securities), and incorporating annuities with inflation-adjusted benefits. Sequence of returns risk refers to the possibility that poor market performance early in your retirement could significantly impact your savings and future income. To mitigate this risk, consider maintaining a diverse portfolio, adjusting your withdrawal strategy based on market conditions, and utilizing a bucket strategy to cover short-term expenses with less volatile investments. Working with a financial advisor can provide valuable guidance and expertise in developing and implementing an effective asset decumulation strategy. Financial advisors can help you assess your retirement income needs, identify appropriate decumulation strategies, and manage the various risks associated with retirement income planning. A financial advisor can work with you to develop a customized decumulation strategy that reflects your unique financial needs, goals, and risk tolerance. This may involve selecting the most suitable withdrawal rate, incorporating guaranteed income sources, and developing a tax-efficient withdrawal plan. Financial advisors can provide ongoing monitoring of your decumulation plan, helping you adjust your strategy as needed in response to changing market conditions, tax regulations, and your financial circumstances. This can help ensure that your decumulation plan remains aligned with your evolving needs and goals throughout retirement. An effective asset decumulation strategy is essential for ensuring financial security and maintaining your desired lifestyle during retirement. By carefully considering your retirement income needs, potential income sources, and various risks, you can develop a comprehensive decumulation plan that optimizes your financial resources. Working with a financial advisor can provide valuable expertise and guidance in developing, implementing, and adjusting your decumulation strategy to adapt to changing financial circumstances and market conditions. By regularly reviewing and updating your decumulation plan, you can help ensure that you have a reliable and sustainable source of income throughout your retirement years.Definition of Asset Decumulation

Assessing Retirement Income Needs

Estimating Retirement Expenses

Identifying Income Sources

Social Security

Pensions

Personal Savings and Investments

Determining Withdrawal Rate

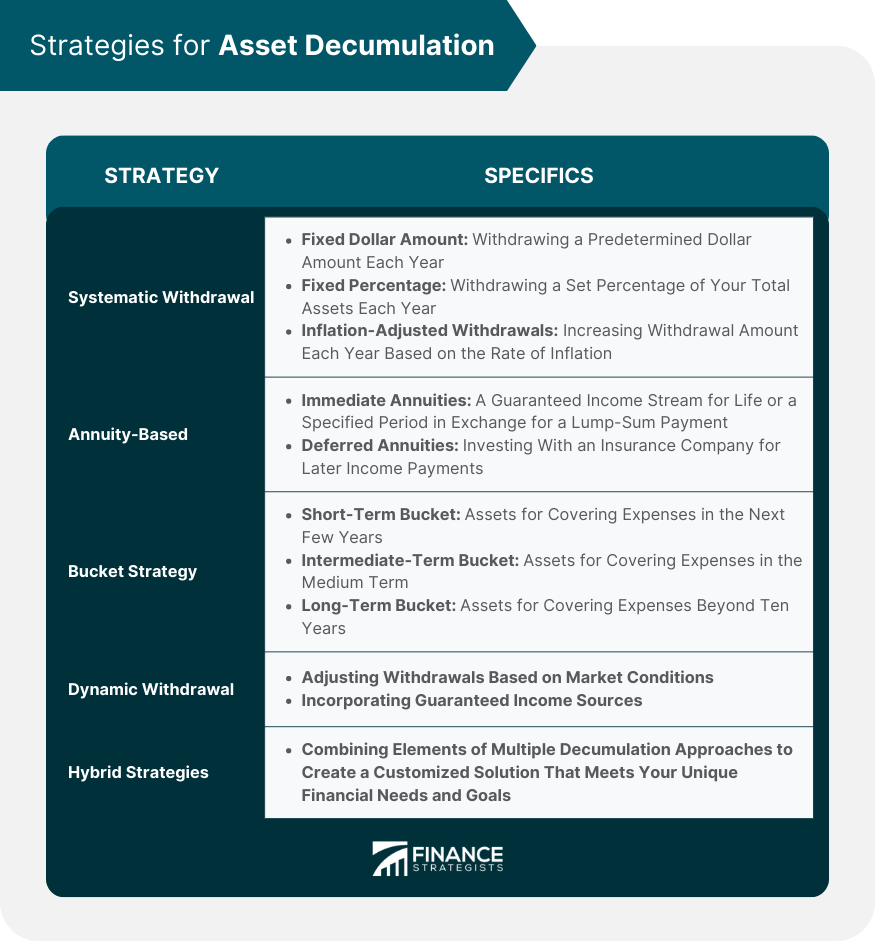

Strategies for Asset Decumulation

Systematic Withdrawal Strategy

Fixed Dollar Amount

Fixed Percentage

Inflation-adjusted Withdrawals

Annuity-Based Strategy

Immediate Annuities

Deferred Annuities

Bucket Strategy

Short-Term Bucket

Intermediate-Term Bucket

Long-Term Bucket

Dynamic Withdrawal Strategy

Adjusting Withdrawals Based on Market Conditions

Incorporating Guaranteed Income Sources

Hybrid Strategies

Tax Considerations in Asset Decumulation

Tax-Efficient Withdrawal Order

Required Minimum Distributions (RMDs)

Roth IRA Conversions

Managing Risks in Asset Decumulation

Longevity Risk

Market Risk

Inflation Risk

Sequence of Returns Risk

Working With a Financial Advisor

Benefits of Professional Guidance in Asset Decumulation Planning

Developing a Customized Decumulation Strategy

Ongoing Monitoring and Adjustments to Decumulation Plan

Conclusion

Asset Decumulation FAQs

Asset decumulation is the process of drawing down retirement savings and investment assets to provide income during retirement.

It's essential to start planning for asset decumulation well before you retire, ideally in your 50s or early 60s, to ensure you have enough savings and a plan for drawing down those assets in retirement.

Common strategies for asset decumulation include systematic withdrawals, bucketing, and annuitization. Each strategy has its pros and cons, and the best option will depend on your specific retirement goals and financial situation.

The amount you can safely withdraw during asset decumulation will depend on various factors, such as your age, retirement goals, investment returns, and inflation. A common rule of thumb is to withdraw no more than 4% of your portfolio in the first year and adjust for inflation in subsequent years.

Yes, seeking professional help from a financial advisor or retirement planner can be helpful in creating a comprehensive asset decumulation plan that considers your unique financial situation and retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.