A replacement rate in the context of retirement planning refers to the percentage of an individual's pre-retirement income that is replaced by various sources of retirement income when they retire. These sources may include Social Security, private pensions, withdrawals from retirement accounts like 401(k)s, personal savings, and investments. This rate provides an important benchmark for evaluating the adequacy of retirement income. Understanding your replacement rate is key to planning for retirement. This rate offers a snapshot of your financial readiness for retirement, enabling you to make informed decisions about your savings strategy, investment choices, and retirement lifestyle. While replacement rates are often lower than 100%—reflecting the expectation that retirees will have lower living costs—these rates can vary significantly based on personal circumstances and preferences. Pre-retirement income is the primary determinant of your replacement rate. The higher your income, the greater the amount you will need to replace in retirement. However, higher earners typically have a lower replacement rate because a smaller proportion of their income is spent on necessities. Your chosen retirement age impacts your replacement rate. The earlier you retire, the longer your retirement savings must last. Additionally, retiring early can reduce the benefits you receive from Social Security and pensions, which often base their payouts on your final few years of work. Longer life expectancies mean that retirement savings must last longer, which may necessitate a lower replacement rate. Conversely, those with shorter life expectancies may aim for a higher replacement rate to maximize their lifestyle during their retirement years. Inflation erodes purchasing power over time. Consequently, a replacement rate that seems adequate today may fall short in the future. Including inflation in your retirement planning is critical to maintaining your desired standard of living. Investment returns can significantly impact your replacement rate. Higher returns allow for a higher replacement rate by growing your retirement savings more rapidly. However, investment returns can be unpredictable, and it's important to balance potential returns against the risk of loss. Your spending habits, both before and during retirement, will affect your replacement rate. Individuals who spend a large portion of their income may need a higher replacement rate to maintain their lifestyle in retirement, while those who live frugally may be comfortable with a lower rate. Social Security is a key component of most Americans' retirement income, and it's integral to the replacement rate calculation. The amount you receive from Social Security depends on your earnings record and the age at which you begin taking benefits. Private pensions can be a significant source of retirement income for those who have them, providing a steady income stream that contributes to your replacement rate. The amount you receive from a pension depends on factors like your final salary, years of service, and the terms of the pension plan. Qualified retirement accounts like 401(k)s and IRAs are a critical component of many individuals' retirement income. These tax-advantaged accounts allow you to contribute pre-tax dollars (or post-tax dollars, in the case of Roth accounts), which can grow tax-deferred until withdrawal. The amount these accounts contribute to your replacement rate depends on your contribution rate, investment returns, and withdrawal strategy. Personal savings and investments outside of retirement accounts can also contribute to your retirement income. This category might include savings accounts, CDs, stocks, bonds, real estate, and other investments. The contribution of these assets to your replacement rate will depend on their value and the income they generate. Annuities are insurance products that can provide a guaranteed income stream during retirement. By purchasing an annuity, you exchange a lump sum of money for regular income payments over a specified period or for the rest of your life. Annuities can contribute to your replacement rate by providing a predictable, stable source of retirement income. The amount of income an annuity generates depends on factors such as the type of annuity, the premium paid, the interest rate environment, and your age at the time of purchase. Determining an appropriate replacement rate requires a careful assessment of your living costs during retirement. Key factors to consider include: Mortgage payments, property taxes, and maintenance costs can all impact your housing expenses in retirement. You may find that downsizing or relocating to a more affordable area can help reduce these costs and lower your required replacement rate. Healthcare expenses often rise as you age, and they can be a significant portion of your retirement budget. Planning for these costs is crucial, as they can affect your required replacement rate. Your retirement lifestyle, including travel and leisure activities, will impact your replacement rate. If you plan to travel extensively or pursue expensive hobbies, you may need a higher replacement rate to support your desired lifestyle. Caring for aging parents or financially supporting adult children can affect your retirement expenses and, consequently, your replacement rate. Planning for these responsibilities is essential when determining an appropriate replacement rate. Your financial goals, both in retirement and leading up to it, play a significant role in determining your replacement rate. These may include paying off debts, funding a child's education, or leaving a legacy for your family. Understanding and prioritizing these goals will help you determine the appropriate replacement rate that aligns with your desired financial outcomes. It's important to consider potential changes in income sources during retirement when determining your replacement rate. For example, you may anticipate a decrease in income from employment but an increase in income from Social Security or pension payments. Adjusting your replacement rate to account for these changes will help ensure that your retirement income is sufficient. Tax considerations can significantly impact your replacement rate. Different types of retirement income are subject to varying tax treatments. For example, withdrawals from traditional 401(k) or IRA accounts are typically taxed as ordinary income, while withdrawals from Roth accounts may be tax-free. Factoring in potential taxes on retirement income will help you determine the after-tax replacement rate you need to maintain your desired lifestyle. Understanding the rules and options surrounding Social Security can help you maximize your benefits and increase your replacement rate. This may involve delaying your benefits to receive a higher monthly payout or coordinating spousal benefits to optimize your overall Social Security income. Consistently contributing to retirement accounts, such as 401(k)s and IRAs, can boost your replacement rate. Taking advantage of employer-matching contributions and maximizing your allowable contributions can accelerate the growth of your retirement savings. Diversifying your investment portfolio can help increase your replacement rate by potentially generating higher returns. By spreading your investments across different asset classes, sectors, and geographical regions, you can reduce the risk and increase the likelihood of achieving favorable investment outcomes. Extending your working years can have a significant impact on your replacement rate. By delaying retirement, you can continue to contribute to retirement accounts, increase your Social Security benefits, and allow your investments to grow. Delaying retirement by even a few years can result in a higher replacement rate and a more financially secure retirement. Lowering your pre-retirement expenses and paying off debt can positively impact your replacement rate. By minimizing financial obligations, you can allocate more funds towards retirement savings, increasing the amount available for generating retirement income. Engaging in part-time work or establishing passive income streams during retirement can supplement your retirement income and boost your replacement rate. This could involve consulting, freelancing, rental properties, or dividend-earning investments. These additional income sources can reduce the reliance on traditional retirement accounts and increase financial stability. The replacement rate is a fundamental concept in retirement planning that refers to the percentage of an individual's pre-retirement income that is replaced by various sources of retirement income. Factors such as pre-retirement income, retirement age, life expectancy, inflation, investment returns, and spending habits all play a role in establishing the desired replacement rate. Components of retirement income, including Social Security, private pensions, qualified retirement accounts, personal savings, investments, and annuities, contribute to the overall replacement rate calculation. Implement strategies like maximizing Social Security, contributing to retirement accounts, diversifying investments, delaying retirement, reducing pre-retirement expenses and debt, and exploring part-time work or passive income to increase the replacement rate. Financial advisors can provide personalized guidance, taking into account individual circumstances, goals, and risk tolerances. They can assist in optimizing retirement savings, investment strategies, tax planning, and other aspects critical to achieving a desirable replacement rate.What Is Replacement Rate?

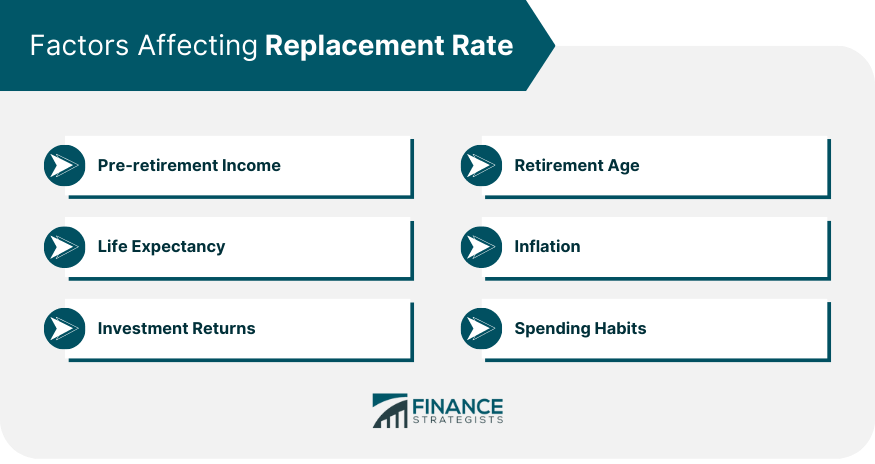

Factors Affecting Replacement Rate

Pre-retirement Income

Retirement Age

Life Expectancy

Inflation

Investment Returns

Spending Habits

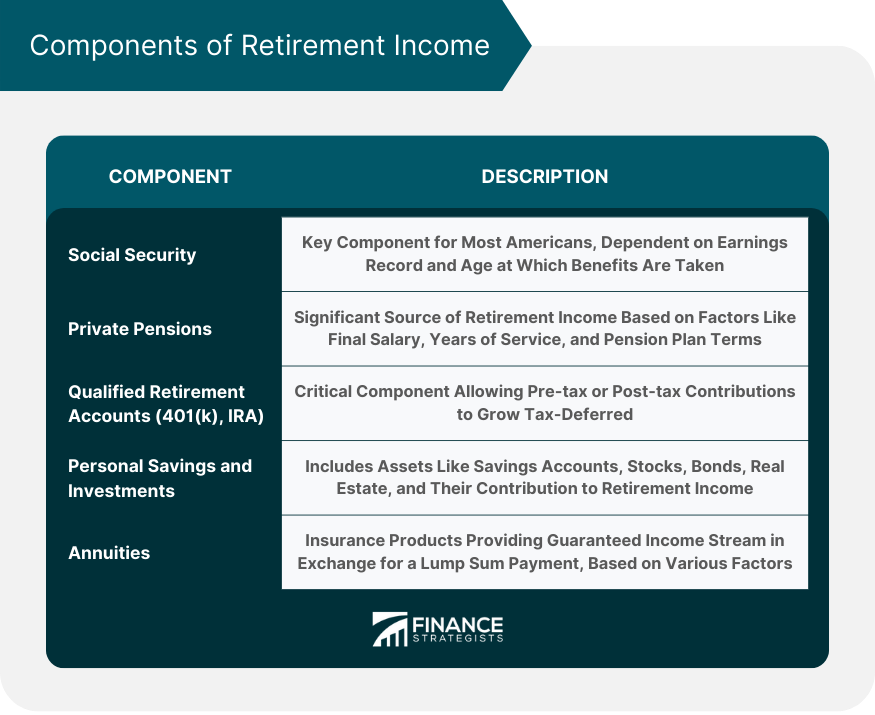

Components of Retirement Income

Social Security

Private Pensions

Qualified Retirement Accounts (401(k), IRA)

Personal Savings and Investments

Annuities

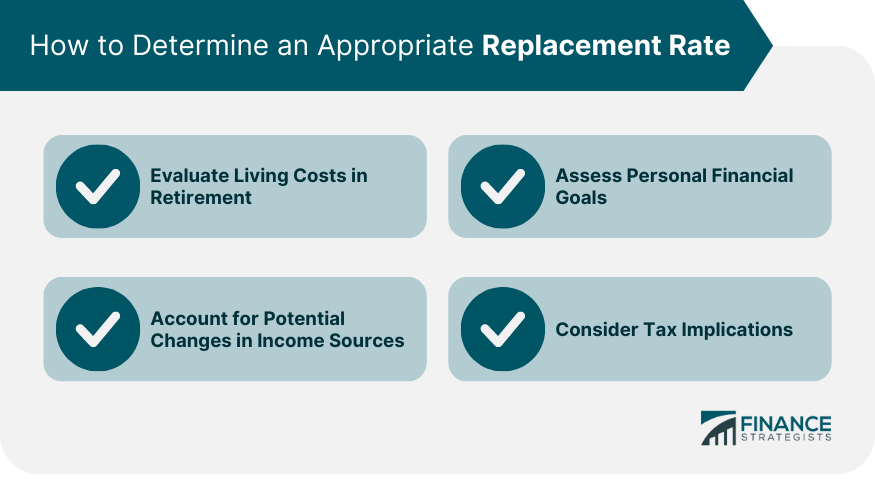

Determining an Appropriate Replacement Rate

Evaluating Living Costs in Retirement

Housing Expenses

Health Care Costs

Travel and Leisure

Family Responsibilities

Assessing Personal Financial Goals

Accounting for Potential Changes in Income Sources

Considering Tax Implications

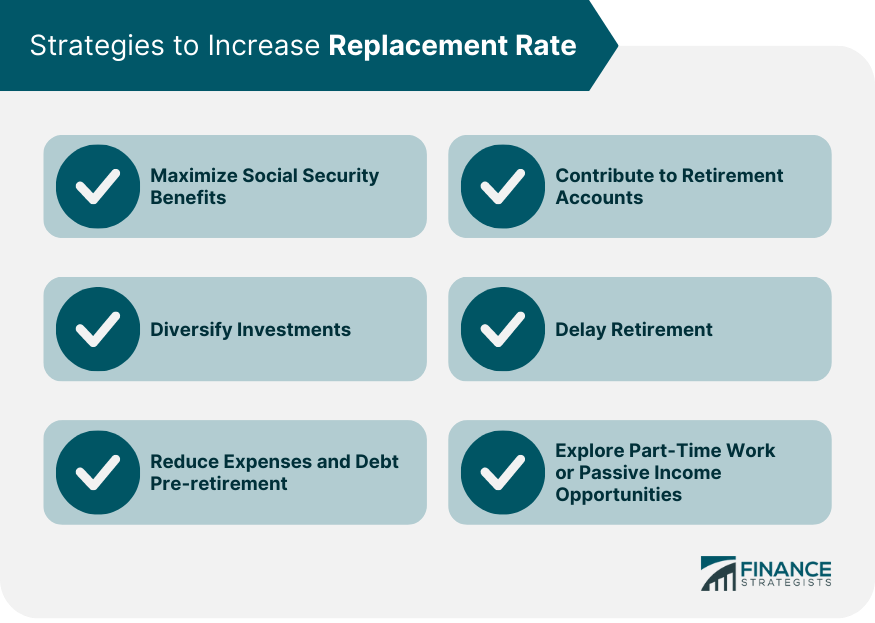

Strategies to Increase Replacement Rate

Maximizing Social Security Benefits

Contributing to Retirement Accounts

Diversifying Investments

Delaying Retirement

Reducing Expenses and Debt Pre-Retirement

Exploring Part-Time Work or Passive Income Opportunities

Final Thoughts

Replacement Rate FAQs

The replacement rate in retirement planning refers to the percentage of an individual's pre-retirement income that is replaced by various sources of retirement income when they retire.

The replacement rate is important because it helps individuals gauge their financial preparedness for retirement. It provides a benchmark to assess whether their retirement income will be sufficient to maintain their desired standard of living.

Several factors influence the replacement rate, including pre-retirement income, retirement age, life expectancy, inflation, investment returns, and spending habits. These factors collectively determine the income needed to support a comfortable retirement.

To increase your replacement rate, you can employ strategies such as maximizing Social Security benefits, contributing to retirement accounts, diversifying investments, delaying retirement, reducing pre-retirement expenses and debt, and exploring part-time work or passive income opportunities.

Seeking professional help, such as working with a financial advisor, can be highly beneficial in determining your replacement rate. Financial advisors can provide personalized guidance, tailor retirement plans to your specific needs, and help optimize your retirement savings and investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.