Retirement represents a significant life transition where individuals transition from active employment to a period of financial reliance on their accumulated savings. It is crucial to recognize that retirement can span several decades, allowing individuals to enjoy their well-deserved leisure time while maintaining a comfortable standard of living. To achieve this, it is vital to understand the importance of retirement savings and the role it plays in ensuring financial stability during this phase of life. Planning for retirement is a crucial aspect of personal finance. A key question that arises during this planning phase is: how much of my annual income should I save for retirement? While the answer largely depends on personal factors, there are general guidelines to follow. Most financial advisors recommend saving between 10% to 15% of your pre-tax income for retirement, starting in your 20s. This percentage can provide a solid savings foundation, especially if you start early, due to the power of compound interest. However, this percentage might not be enough for everyone. Several factors can affect how much you need to save, including your desired retirement lifestyle, the age at which you plan to retire, and your current age. If you plan to travel extensively during retirement or retire early, you might need to save more. Similarly, if you're starting late, you'll need to set aside a larger portion of your income. Personal lifestyle largely affects how much one should save. For instance, if you plan to travel extensively in your retirement years, you'll need to set aside more savings than someone content with a more sedate lifestyle. Consider your current expenses, adjust them for inflation, and determine what your future needs might be. If you anticipate higher healthcare expenses or plan to relocate, factor these into your savings plan. Depending on your jurisdiction, government benefits can supplement your retirement savings. In the U.S., for example, Social Security forms a significant portion of retirement income for many. Pensions, rental income, dividends, and other income sources can contribute to your retirement nest egg, reducing the amount you need to save. Medical expenses often rise as we age. To cushion yourself, a portion of your retirement savings should cater to these potential costs. Inflation erodes the purchasing power of money. When planning your savings, consider the potential impact of long-term inflation. The earlier you start saving, the less you'll need to set aside each year, thanks to the power of compounding. Similarly, if you plan to retire early, you'll need to save more aggressively. The common rule of thumb advises saving 10-15% of your income for retirement. This percentage is a starting point but may need to be adjusted based on the factors mentioned above. It's simple, flexible, and applicable to most income levels. However, it might not be sufficient for late-starters or those with high retirement lifestyle expectations. Start saving as soon as you start earning. Take advantage of compounding and invest aggressively, as you have time to recover from potential market downturns. Your 30s are a great time to increase your savings rate. It's also the time to consider balancing your portfolio with a mix of aggressive and conservative investments. If you haven't started saving yet, it's not too late. However, you'll need to save a significantly higher percentage of your income. Maximize your contributions to retirement accounts. If possible, take advantage of "catch-up" contributions that are available to those over 50 in the U.S. Offered by many U.S. employers, these plans offer tax advantages and sometimes, employer-matching contributions. IRAs are a viable option for self-employed individuals or those whose employers do not offer a retirement plan. There are various types of IRAs, each with its unique benefits and restrictions. Unlike traditional IRAs, Roth IRAs are funded with post-tax income, which means qualified withdrawals are tax-free. Given their tax advantage, they are an excellent savings tool, especially for younger individuals who are likely in a lower tax bracket. An HSA is a tax-advantaged savings account for those with a high-deductible health plan. It allows individuals to save for medical expenses and unused funds can be used for retirement after age 65. There are other savings options like 403(b) plans for nonprofit employees, the Thrift Savings Plan for federal employees, and self-employed pension plans for business owners. Investments can earn significantly more than traditional savings accounts over the long term, making them an essential tool for retirement savings. Investments come with risks. Diversifying your investment portfolio - spreading your money across various investment types - can help manage this risk. Based on your risk tolerance and time horizon, choose investments that best meet your retirement savings goals. Increasing your income can be accomplished in several ways, from negotiating a salary raise to starting a side hustle or investing in income-generating assets. By managing your debt effectively, you can free up more money for retirement savings. Prioritize high-interest debt and avoid unnecessary borrowing. Simple lifestyle changes, like cooking at home more often or using public transportation, can result in significant savings over time. A habit of regular and consistent saving, no matter how small the amount, can have a substantial cumulative effect over time. Avoid these common retirement saving mistakes to ensure you're on the right path to a comfortable retirement. The sooner you start saving, the more time your money has to grow through compounding. If your employer offers to match your 401(k) contributions, make sure to contribute at least enough to get the full match. It's essentially free money. Many people assume they'll spend less in retirement, but often, expenses like healthcare can increase. As your income and lifestyle change, so should your savings goals. Regularly revisit your retirement plan to ensure it stays aligned with your current and future needs. Saving for retirement requires a proactive approach and an understanding of various personal and financial factors. The recommended savings rate is 10% to 15% of your pre-tax income, but it can vary depending on factors such as desired lifestyle, anticipated living expenses, potential income sources, health considerations, inflation, and age. Retirement savings can be significantly enhanced by making wise investment choices and utilizing retirement savings accounts. Moreover, increasing income, managing debt, reducing living expenses, and maintaining consistent saving habits can bolster your retirement fund. However, avoid pitfalls such as delaying savings, underestimating retirement expenses, and not adjusting goals over time. Remember, retirement planning is not a one-size-fits-all process but a customized strategy that should align with your individual circumstances and aspirations for a secure and comfortable retirement.Understanding the Importance of Retirement Savings

How Much Annual Income Should You Save for Retirement?

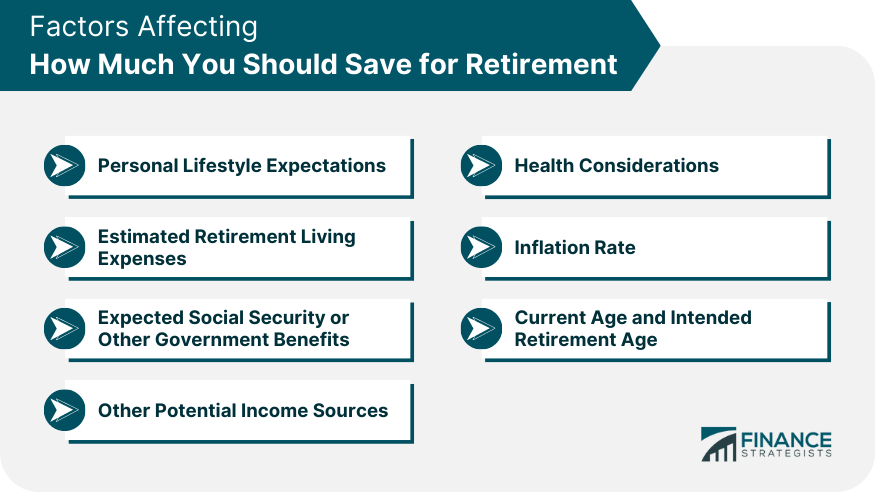

Factors Affecting How Much You Should Save for Retirement

Personal Lifestyle Expectations

Estimated Retirement Living Expenses

Expected Social Security or Other Government Benefits

Other Potential Income Sources

Health Considerations

Inflation Rate

Current Age and Intended Retirement Age

Rule of Thumb for Retirement Savings

Retirement Saving Strategies According to Age

Individuals in Their 20s

Individuals in Their 30s

Individuals in Their 40s

Individuals in Their 50s and Beyond

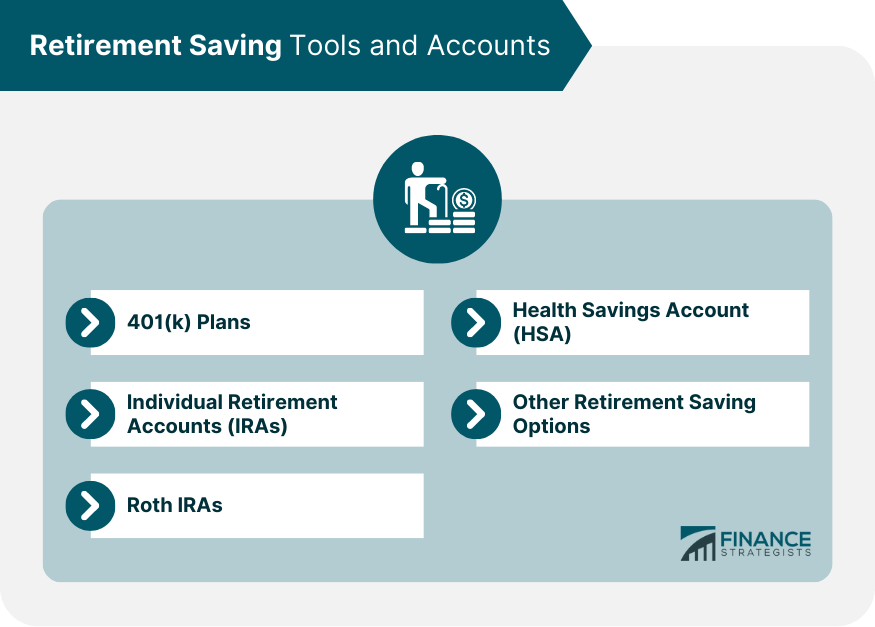

Retirement Saving Tools and Accounts

401(k) Plans

Individual Retirement Accounts (IRAs)

Roth IRAs

Health Savings Account (HSA)

Other Retirement Saving Options

Importance of Investment for Retirement Savings

Role of Investment in Growing Your Retirement Savings

Understanding Risk and Diversification

Choosing Suitable Investments

How to Increase Your Retirement Savings

Methods to Increase Income

Reducing and Managing Debt

Reducing Living Expenses

Consistent and Regular Saving

Common Mistakes to Avoid in Retirement Saving

Not Starting Early Enough

Not Taking Advantage of Employer Matching

Underestimating Living Expenses in Retirement

Not Adjusting Savings Goals Over Time

Conclusion

How Much Annual Income Should You Save for Retirement? FAQs

Financial advisors typically recommend saving between 10% to 15% of your pre-tax income for retirement. However, individual circumstances such as current age, intended retirement age, lifestyle expectations, and other factors may necessitate saving a larger portion of your income.

Yes, several factors can affect how much of your annual income you should save for retirement. These include your personal lifestyle expectations, estimated living expenses in retirement, expected social security or other government benefits, potential additional income sources, health considerations, the current inflation rate, and your current age and intended retirement age.

Investments can play a crucial role in your retirement savings. Effective investment strategies can increase the value of your savings over time, potentially reducing the percentage of your annual income that you need to save. However, investment comes with risks that need to be managed through diversification and choosing suitable investments.

Some common mistakes include not starting early enough, not taking full advantage of employer matching in retirement accounts, underestimating living expenses in retirement, and failing to adjust savings goals over time.

There are several strategies to increase retirement savings. These include methods to increase income such as negotiating a raise or starting a side hustle, effectively managing and reducing debt, decreasing living expenses through lifestyle changes, and maintaining a consistent and regular saving habit. It's also important to maximize contributions to retirement savings accounts and invest wisely.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.