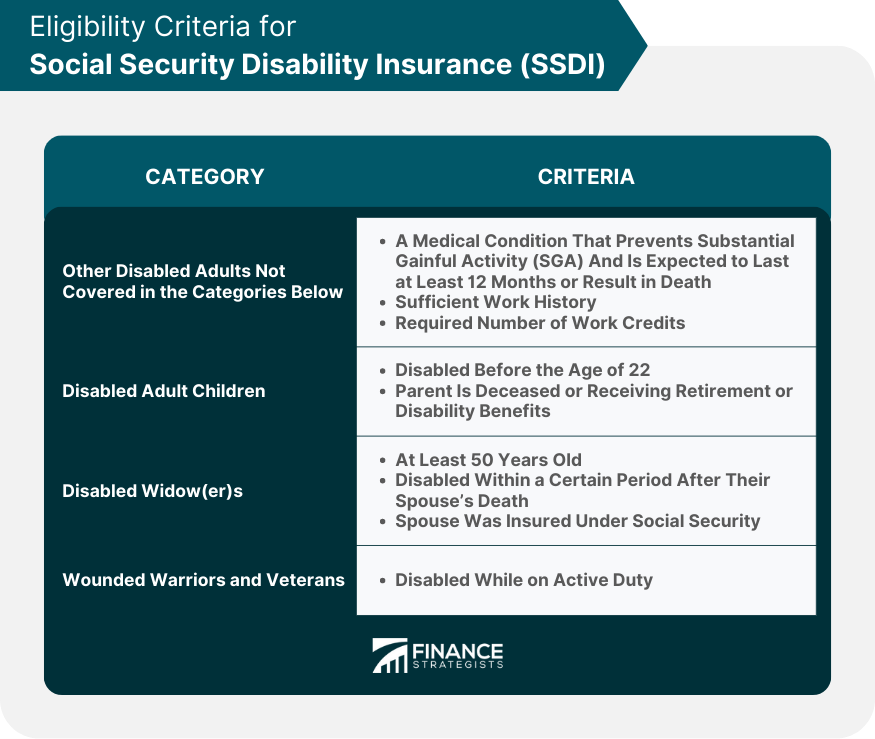

Social Security Disability Insurance (SSDI) is a federal insurance program in the United States that provides financial support to individuals who are unable to work due to a disability. To be eligible for SSDI, an individual must have a severe impairment that is expected to last at least 12 months or result in death and have a work history that includes paying into the Social Security system. If approved for SSDI, an individual will receive a monthly cash benefit to help cover their living expenses. The benefit amount is based on the individual's average earnings before becoming disabled. To qualify for SSDI benefits, an individual must meet both disability and work history requirements. According to the SSA, a disability is a medical condition that prevents an individual from engaging in substantial gainful activity (SGA) and is expected to last at least 12 months or result in death. Determine if the applicant is currently working. Assess the severity of the applicant's medical condition. Compare the applicant's condition to the SSA's Listing of Impairments. Determine if the applicant can perform their past work. Assess the applicant's ability to perform other work. In some cases, the SSA may also use medical-vocational guidelines (grid rules) to make a disability determination. To qualify for SSDI, an individual must have a sufficient work history and earn the required number of work credits. Work credits are based on the applicant's total yearly wages or self-employment income. Some individuals may qualify for SSDI benefits under special circumstances, including: Disabled Adult Children: Individuals who become disabled before the age of 22 and have a parent who is deceased or receiving retirement or disability benefits. Disabled Widow(er)s: Individuals who are at least 50 years old, have become disabled within a certain period after their spouse's death, and whose spouse was insured under Social Security. Wounded Warriors and Veterans: Military service members who become disabled while on active duty. SSDI provides various benefits, including monetary, health care, and additional support. The monthly benefit amount for SSDI recipients is calculated based on the individual's average lifetime earnings covered by Social Security. The SSA also applies a Cost of Living Adjustment (COLA) each year to help benefits keep pace with inflation. SSDI recipients become eligible for Medicare after a 24-month waiting period. Medicare coverage includes hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). In addition to financial and health care support, SSDI recipients may also have access to: Vocational rehabilitation services to help them return to work. Employment support programs, such as the Ticket to Work program. Protection from discrimination under the Americans with Disabilities Act (ADA). Applying for SSDI involves gathering documentation, submitting an application, and navigating the review process. Before applying for SSDI, individuals should gather necessary documentation, including: Personal information (e.g., Social Security number, birth certificate) Employment history Medical records and documentation of their disability SSDI applications can be submitted online, by phone, or in person at a local Social Security office. The SSDI application review process consists of several stages: Initial Determination: The SSA reviews the application and makes a decision on eligibility. Reconsideration: If the initial application is denied, the applicant can request a reconsideration of their case. Administrative Law Judge Hearing: If reconsideration is denied, the applicant can request a hearing before an administrative law judge. Appeals Council Review: If the applicant disagrees with the hearing decision, they can request a review by the Social Security Appeals Council. Federal Court Review: In some cases, applicants may choose to pursue their case in a federal court. SSDI is not the only federal disability program available to individuals with disabilities. Supplemental Security Income (SSI) is a needs-based program that provides financial assistance to individuals who are aged, blind, or disabled and have limited income and resources. SSDI is based on work history and is funded through payroll taxes, while SSI is based on financial needs and is funded by general tax revenues. SSDI provides Medicare coverage, while SSI recipients are generally eligible for Medicaid. Individuals may sometimes be eligible for concurrent benefits, meaning they receive both SSDI and SSI. Workers' compensation and other public disability benefits may also be available to individuals with disabilities. The SSA offers work incentives and support programs to help SSDI recipients return to work. Some of the work incentives and support programs available to SSDI recipients include: Trial Work Period (TWP): During which SSDI recipients can test their ability to work without losing their benefits. Extended Period of Eligibility (EPE): A 36-month period following the TWP during which SSDI benefits may be reinstated if the recipient's earnings fall below the SGA level. Ticket to Work Program: A voluntary program that provides SSDI recipients with access to employment services, vocational rehabilitation, and job training. SSDI recipients must report any changes in their work activity, including changes in employment, hours worked, and earnings. Timely reporting ensures that recipients continue to receive the correct benefit amount and maintain their eligibility for SSDI and Medicare. The SSA takes SSDI fraud seriously and has measures in place to detect and prevent it. Some examples of SSDI fraud include: Falsifying medical records or work history Concealing work activity or income Misrepresenting the severity of a disability Individuals found to be committing SSDI fraud may face penalties, including repayment of benefits, fines, and criminal prosecution. To report suspected SSDI fraud, individuals can contact the SSA's Office of the Inspector General (OIG) via phone, mail, or online. Social Security Disability Insurance is a federal insurance program that provides financial support to individuals who are unable to work due to a qualifying disability. To be eligible for SSDI, applicants must have a severe impairment expected to last at least 12 months or result in death and a work history with contributions to the Social Security system. The SSDI application process involves gathering documentation, submitting an application online, by phone, or in person, and navigating the review stages. If approved for SSDI, recipients receive a monthly cash benefit based on their average earnings before becoming disabled. They may also become eligible for Medicare coverage after a 24-month waiting period. In addition to monetary and healthcare benefits, SSDI recipients may have access to vocational rehabilitation services, employment support programs, and protection against discrimination. Lastly, the Social Security Administration actively combats SSDI fraud, including falsifying medical records or work history, concealing work activity or income, and misrepresenting the severity of a disability. Committing SSDI fraud can lead to penalties, repayment of benefits, fines, and criminal prosecution, and individuals should report suspected fraud to the SSA's Office of the Inspector General.What Is Social Security Disability Insurance (SSDI)?

The program is designed to provide financial assistance to individuals who have a qualifying disability and have worked and paid into the Social Security system through payroll taxes.

The Social Security Administration (SSA) evaluates the applicant's work history, medical records, and other evidence to determine if they are eligible for benefits.

Additionally, individuals who receive SSDI may also be eligible for Medicare coverage after two years of receiving benefits.Eligibility Criteria for Social Security Disability Insurance (SSDI)

Disability Criteria

To determine if an applicant meets the disability criteria, the SSA uses a five-step sequential evaluation process:Work History and Credits

The number of credits needed to qualify for SSDI varies depending on the applicant's age at the time of disability onset.Special Eligibility Cases

Benefits of Social Security Disability Insurance (SSDI)

Monetary Benefits

Health Care Benefits

Recipients may also choose to enroll in a Medicare Advantage plan (Part C) for additional coverage options.Other Benefits

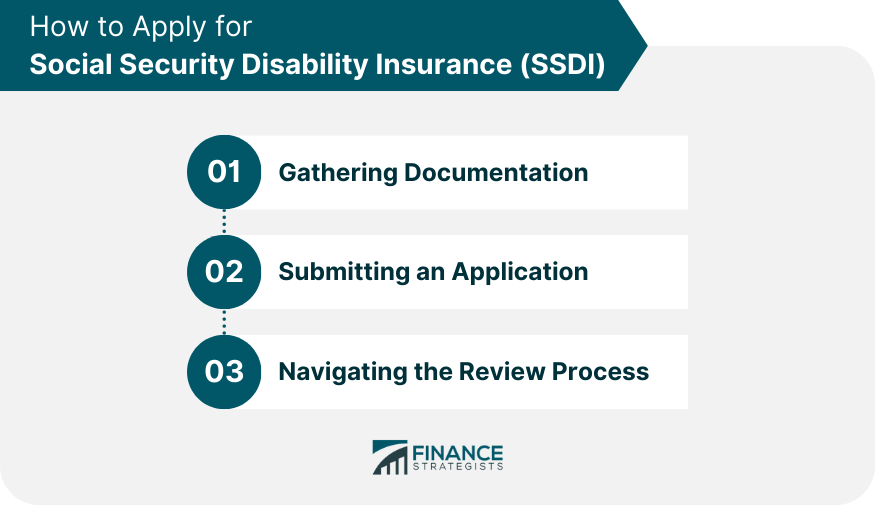

Application Process for Social Security Disability Insurance (SSDI)

Preparing to Apply

Application Methods

Application Review Process

Social Security Disability Insurance (SSDI) and Other Disability Benefits

Supplemental Security Income (SSI)

While both SSDI and SSI provide support to disabled individuals, there are important differences between the two programs:Workers' Compensation and Other Public Disability Benefits

These benefits can impact SSDI eligibility and benefit amounts. Coordination between SSDI and other public disability benefits is essential to ensure proper benefit distribution.When SSDI Recipients Return to Work

Work Incentives and Support Programs

Reporting Work Activity and Changes

Fraud Prevention for Social Security Disability Insurance (SSDI)

Types of SSDI Fraud

Consequences of SSDI Fraud

Reporting Suspected Fraud

Conclusion

Social Security Disability Insurance (SSDI) FAQs

Social Security Disability Insurance (SSDI) is a federal insurance program in the United States that provides financial support to individuals who cannot work due to a disability.

To be eligible for SSDI, an individual must have a severe impairment that is expected to last at least 12 months or result in death and have a work history that includes paying into the Social Security system.

The SSA evaluates an individual's work history, medical records, and other evidence to determine if they are eligible for SSDI benefits.

The benefit amount for SSDI is based on the individual's average earnings before becoming disabled.

Individuals receiving SSDI may also be eligible for Medicare coverage after two years of benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.