Retirement income is the financial bedrock that supports individuals during their golden years, post-employment. This income usually comes from various sources such as social security, pensions, savings, and investments. The primary objective of these income streams is to provide a stable and reliable source of funds to maintain a comfortable standard of living after one has left the workforce. Retirement income plays a crucial role in sustaining individuals' financial well-being and ensuring a fulfilling retirement lifestyle. The IRS allows only taxable compensation (such as wages, salaries, commissions, self-employment income, etc.) as eligible contributions to a Traditional IRA. Some forms of retirement income, such as part-time employment income or self-employment income during retirement, can be counted as compensation. These can be used to contribute to a Traditional IRA. On the other hand, other forms of retirement income, such as Social Security benefits, pension income, or Required Minimum Distributions (RMDs) from existing retirement accounts, do not qualify as eligible compensation for Traditional IRA contributions. This nuanced understanding underscores the importance of planning and professional advice when considering contributions to a Traditional IRA during retirement. To contribute to a Traditional IRA, you must have eligible earned income. This includes income from wages, salaries, tips, commissions, and self-employment income. Earned income is typically generated through active participation in work or self-employment activities. If you receive alimony payments as part of a divorce or separation agreement, that income can be used to contribute to a Traditional IRA. However, child support payments do not qualify as eligible income for IRA contributions. If you own rental properties and receive income from rental payments, that income can be used to contribute to a Traditional IRA. Rental income is considered eligible earned income for IRA contribution purposes. If you earn royalties from intellectual property, such as copyrights, patents, or mineral rights, that income can be used for Traditional IRA contributions. If you are self-employed, income from your business activities can be used to contribute to a Traditional IRA. This includes income generated as a freelancer, independent contractor, or small business owner. Although Social Security is a significant component of retirement income for many retirees, the IRS does not consider it earned income. As such, it is not eligible for Traditional IRA contributions. This rule applies irrespective of the age or income status of the beneficiary. Much like Social Security, pension income is not classified as earned income by the IRS. Consequently, pension disbursements cannot be directly contributed to a Traditional IRA. The rules remain consistent for both private and public sector pension plans. 401(k) and 403(b) plans, typical of employer-sponsored retirement schemes, provide an income stream during retirement. However, these distributions are not categorized as earned income and therefore cannot be used to fund a Traditional IRA directly. Income generated from an existing IRA, whether Traditional or Roth, also falls under the unearned income category. It can't be used to fund a Traditional IRA. This rule is consistent with the overall IRS regulation that only earned income is eligible for Traditional IRA contributions. Annuities, much like the previously mentioned retirement income sources, are not counted as earned income. Therefore, they cannot be used for contributions to a Traditional IRA. The tax-deferred growth within an annuity, however, can provide significant retirement income benefits. Navigating the complex world of retirement income and investments can be challenging. Consulting with a financial advisor can provide you with personalized guidance and expert insights based on your unique circumstances. Following your consultation, you should have a clearer understanding of your eligible retirement income sources. With this knowledge, you can effectively strategize about funding your Traditional IRA. It's crucial to review IRS guidelines on Traditional IRAs to avoid potential tax penalties. By understanding these rules, you can optimize your retirement income and ensure compliance with tax laws. One must consider the potential tax implications of contributing to a Traditional IRA. This includes the possibility of future tax rates and the immediate tax deductions you might qualify for due to your contributions. After careful consideration and planning, you can begin to make contributions to your Traditional IRA. This step signifies the practical application of your retirement income strategy. Ensure all transactions and communications regarding your Traditional IRA are adequately documented and maintained. This practice not only aids in keeping track of your retirement income but also helps during tax season or in case of an audit. The utilization of retirement income for Traditional IRA contributions requires a nuanced understanding of the various sources of retirement income and their eligibility for such contributions. The IRS stipulates that only earned income can be used to contribute to a Traditional IRA. Certain sources of income like wages, alimony, royalties, rental income, and self-employment income can contribute to a Traditional IRA. Other retirement income streams like Social Security benefits, pension income, and Required Minimum Distributions from existing retirement accounts do not qualify. By consulting a financial advisor, reviewing IRS guidelines, evaluating tax implications, making contributions, and maintaining proper records, individuals can optimize their retirement income while ensuring compliance with tax laws. Overview of Retirement Income

Using Retirement Income for a Traditional IRA

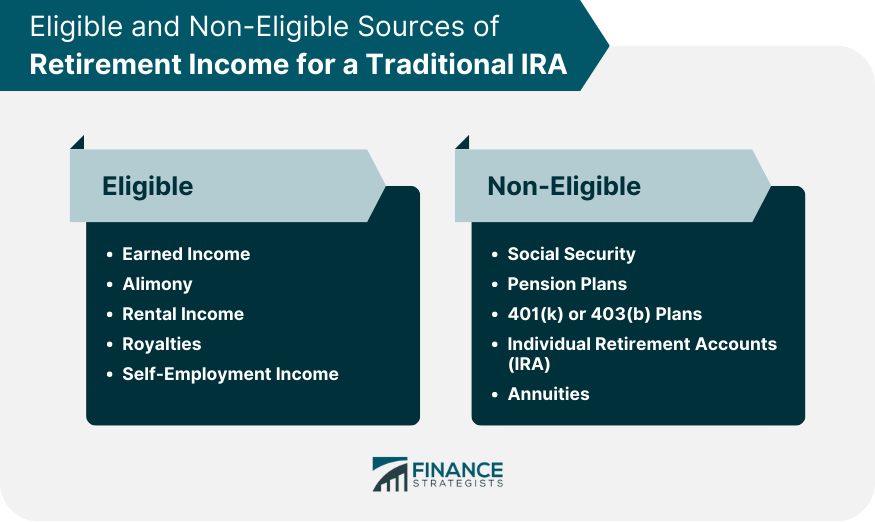

Eligible Sources of Retirement Income for a Traditional IRA

Earned Income

Alimony

Rental Income

Royalties

Self-Employment Income

Non-Eligible Sources of Retirement Income for a Traditional IRA

Social Security

Pension Plans

401(k) or 403(b) Plans

Individual Retirement Accounts (IRA)

Annuities

Steps to Use Retirement Income for a Traditional IRA

Consultation With a Financial Advisor

Determine Eligible Retirement Income Sources

Review IRS Guidelines

Evaluate Tax Implications

Make Contributions to a Traditional IRA

Document and Maintain Records

Conclusion

Can You Use Retirement Income for Traditional IRA? FAQs

No, the IRS does not categorize Social Security benefits as earned income. Therefore, these funds cannot be contributed to a Traditional IRA.

Unfortunately, no. Pension payouts, like many other sources of retirement income, are not classified as earned income by the IRS. Thus, they are ineligible for contribution to a Traditional IRA.

No, the IRS does not consider distributions from 401(k) or 403(b) plans as earned income. Consequently, these cannot be used for funding a Traditional IRA.

No, annuity payments are not recognized as earned income by the IRS. Hence, they cannot be used to make contributions to a Traditional IRA.

Eligible sources of funding for a Traditional IRA include earned income from wages, salaries, tips, commissions, and self-employment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.