Plan audit support is an essential service in retirement planning because it helps individuals evaluate their retirement strategies and ensures they are on track to achieve their retirement goals. Plan audit support provides individuals with the necessary tools and guidance to address any issues identified during the audit, such as correcting administrative errors, updating plan documents, or adjusting investment strategies. A net worth analysis involves assessing an individual's assets and liabilities to determine their overall financial standing. This analysis helps identify areas of improvement and serves as a starting point for retirement planning. Estimating future income sources, including pensions, social security benefits, and investment income, is crucial in retirement planning. Accurate income projections enable individuals to make informed decisions regarding savings and investment strategies. Understanding projected expenses in retirement, such as housing, healthcare, and daily living expenses, is essential for developing a comprehensive financial plan. An expense analysis allows individuals to adjust their savings and investment goals accordingly. A well-balanced investment portfolio is crucial for meeting retirement objectives. Asset allocation involves diversifying investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and optimize returns. Evaluating an individual's risk tolerance is crucial for developing a suitable investment strategy. This assessment considers factors such as age, financial goals, and investment time horizon to determine an appropriate level of risk. Diversification involves spreading investments across various sectors, regions, and investment vehicles to reduce portfolio risk. A well-diversified portfolio can help protect against market fluctuations and improve overall returns. Implementing tax-efficient investment strategies can help minimize tax liabilities and increase overall returns. These strategies may include utilizing tax-advantaged accounts, such as IRAs and 401(k)s, and investing in tax-exempt bonds. Optimizing retirement accounts involves maximizing contributions, taking advantage of employer matches, and choosing the most appropriate investment options within the account to meet retirement goals. Understanding the tax implications of withdrawals from various retirement accounts is vital for minimizing tax liabilities and preserving retirement savings. Determining a target retirement age helps individuals develop a realistic savings and investment plan to achieve their goals. Identifying desired lifestyle preferences, such as travel, hobbies, and housing, helps individuals estimate future expenses and adjust their retirement planning strategies accordingly. Legacy planning involves developing strategies for wealth transfer, estate planning, and philanthropy to ensure a lasting financial legacy for future generations. Gathering information through client questionnaires helps financial advisors understand an individual's financial situation, goals, and risk tolerance to develop a personalized retirement plan. Reviewing financial statements, such as bank statements, investment account statements, and tax documents, provides a comprehensive picture of an individual's financial standing. Evaluating tax documents, such as W-2s, 1099s, and previous tax returns, helps identify potential tax-saving opportunities and inform retirement planning strategies. A thorough plan analysis involves assessing an individual's current retirement plan to identify areas of strength and opportunities for improvement. Monitoring progress toward retirement goals helps individuals make adjustments to their savings and investment strategies as needed to ensure they stay on track. Evaluating the risk exposure of an individual's investment portfolio helps identify areas where adjustments may be necessary to align with their risk tolerance and investment objectives. Based on the plan analysis, financial advisors can provide recommendations to address any gaps or weaknesses in the retirement plan, such as increasing savings or adjusting asset allocation. Regularly rebalancing the investment portfolio ensures that the asset allocation remains aligned with an individual's risk tolerance and investment goals. As life circumstances change, it's crucial to revisit and update retirement goals and objectives to ensure that the retirement plan remains relevant and effective. Conducting regular reviews of the retirement plan helps identify any changes in an individual's financial situation or goals and allows for timely adjustments to the plan. Significant life events, such as marriage, divorce, or job changes, may require a reassessment of the retirement plan to ensure it continues to align with the individual's evolving needs and goals. Tracking the performance of investments and comparing them to established benchmarks helps gauge the effectiveness of the retirement plan and informs any necessary adjustments. Comparing the performance of an individual's investments to relevant benchmarks provides valuable insights into the plan's effectiveness and the need for potential adjustments. Maintaining open communication with clients ensures they remain informed about their retirement plan's progress and can make informed decisions about adjustments or updates as needed. As market conditions change, it's crucial to adjust investment strategies to mitigate risks and capitalize on opportunities. Regularly revisiting and updating retirement goals and objectives ensures that the plan remains relevant and aligned with an individual's evolving needs and circumstances. As the retirement plan progresses, it may be necessary to adjust savings and investment strategies to ensure the plan remains on track to achieve its goals. Plan Audit Support is a vital component in ensuring a successful retirement planning process. It encompasses a thorough assessment of an individual's financial situation, investment strategies, tax planning, and progress toward their retirement objectives. By engaging in regular evaluations and adjustments, individuals can identify areas for improvement, optimize their investment portfolios, and adapt to changing market conditions. Additionally, ongoing Plan Audit Support provides essential monitoring, reporting, and communication to keep individuals informed about their plan's progress and enable them to make necessary updates. By utilizing professional Plan Audit Support services, individuals can effectively optimize their retirement plans and secure a financially comfortable future.What Is a Plan Audit Support?

Key Components of Plan Audit Support

Financial Assessment

Net Worth Analysis

Income Projections

Expense Analysis

Investment Strategy Evaluation

Asset Allocation

Risk Tolerance

Diversification

Tax Planning

Tax-Efficient Investment Strategies

Retirement Account Optimization

Tax Implications of Withdrawals

Retirement Goals and Objectives

Desired Retirement Age

Retirement Lifestyle Preferences

Legacy Planning

Plan Audit Process

Data Collection

Client Questionnaires

Financial Statements

Relevant Tax Documents

Plan Analysis

Identifying Strengths and Weaknesses

Evaluating Progress Towards Goals

Assessing Risk Exposure

Recommendations and Adjustments

Addressing Gaps in the Plan

Rebalancing Investment Portfolio

Updating Goals and Objectives as Needed

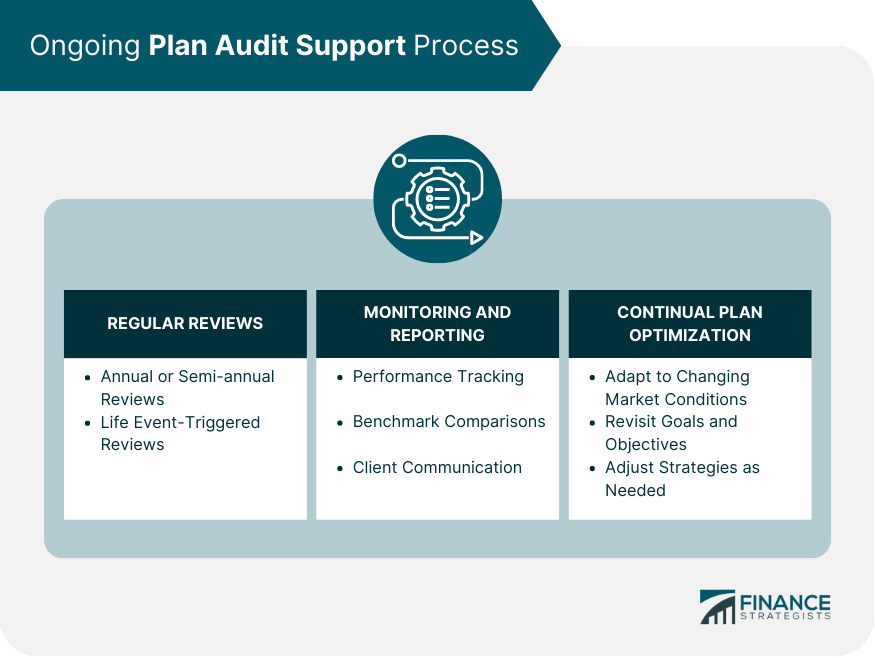

Ongoing Plan Audit Support Process

Regular Reviews

Annual or Semi-Annual Reviews

Life Event-Triggered Reviews

Monitoring and Reporting

Performance Tracking

Benchmark Comparisons

Client Communication

Continual Plan Optimization

Adapting to Changing Market Conditions

Revisiting Goals and Objectives

Adjusting Strategies as Needed

Bottom Line

Plan Audit Support FAQs

Plan Audit Support is a service that helps individuals evaluate their retirement strategies and ensure they are on track to achieve their retirement goals. It involves assessing financial situations, investment strategies, tax planning, and progress toward retirement objectives. Plan Audit Support is crucial in retirement planning to identify areas for improvement, optimize investment portfolios, and adjust strategies as needed to ensure long-term retirement success.

Plan Audit Support aids in evaluating investment strategies by assessing asset allocation, risk tolerance, and diversification. It helps individuals create a well-balanced investment portfolio that aligns with their risk tolerance and retirement goals. By optimizing investment strategies through Plan Audit Support, individuals can manage risk, improve returns, and ultimately achieve their retirement objectives.

Plan Audit Support plays a significant role in tax planning by identifying tax-efficient investment strategies, optimizing retirement accounts, and understanding the tax implications of withdrawals. It helps individuals minimize tax liabilities, maximize tax-advantaged account contributions, and choose the most appropriate investments within their retirement accounts, ensuring a more financially secure retirement.

Plan Audit Support helps individuals monitor their progress toward retirement goals by conducting regular plan analysis, tracking investment performance, and comparing results to established benchmarks. This ongoing support enables individuals to identify areas for improvement, make informed decisions about adjustments or updates to their retirement plan, and ensure that they stay on track to achieve their goals.

Ongoing Plan Audit Support involves regular reviews of an individual's retirement plan, performance tracking, benchmark comparisons, and client communication. It also includes continual plan optimization by adapting to changing market conditions, revisiting goals and objectives, and adjusting strategies as needed. Ongoing Plan Audit Support is essential for long-term retirement success as it ensures the retirement plan remains relevant, effective, and aligned with an individual's evolving needs and circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.