Automatic re-enrollment is a feature of employer-sponsored retirement savings plans, such as 401(k) plans that aim to increase participation rates and improve the retirement savings outcomes of employees. Under automatic re-enrollment, employees who have not made an election are automatically enrolled in the plan at a default contribution rate and investment option. Employees can opt out or change their contribution rate or investment option anytime. These contributions are invested in various investment options, with the aim of growing the savings over time. Employers can also make matching contributions to encourage employees to save more. 401(k) plans were introduced in the United States in 1978 as a tax-deferred savings plan for employees. Initially, the plans were designed to supplement defined-benefit pension plans, but they have become the primary retirement savings vehicle for many workers. Automatic enrollment features were first introduced in the early 2000s to increase worker participation rates. The Pension Protection Act of 2006 made it easier for employers to implement automatic enrollment features by providing safe harbor provisions that protect employers from fiduciary liability. Automatic re-enrollment is a newer feature of 401(k) plans that build on the success of automatic enrollment. Under automatic re-enrollment, employees who have previously opted out or changed their contribution rate or investment option are automatically re-enrolled at the default contribution rate and investment option. Employees who meet the eligibility criteria for the 401(k) plan are automatically enrolled in the plan under automatic re-enrollment. The eligibility criteria may include factors such as length of service, age, or job status. Under automatic re-enrollment, employees are enrolled in the plan at a default contribution rate. The default contribution rate is typically set at a level that is designed to provide sufficient retirement savings over time. The default contribution rate may vary based on factors such as age or salary level. Employees who are automatically enrolled under automatic re-enrollment are invested in default investment options. These options are typically designed to provide a diversified portfolio that balances risk and return. The default investment options may vary based on factors such as age or risk tolerance. Automatic re-enrollment typically occurs on an annual basis, but the timing and frequency may vary based on the plan design. Employers may choose to re-enroll employees at different times based on factors such as the plan year or the anniversary of the employee's enrollment. Employers are required to provide clear and timely communication to employees about the automatic re-enrollment process. This communication must include information about the default contribution rate and investment options, as well as opt-out procedures and the right to change contribution rates or investment options. Automatic re-enrollment helps overcome the inertia that prevents many workers from enrolling in a 401(k) plan. By automatically enrolling employees, employers remove the need for employees to take action to participate in the plan. Automatic re-enrollment also helps reduce procrastination among workers. Many workers intend to enroll in a 401(k) plan but have yet to get around to it. Automatic re-enrollment ensures that these workers are enrolled in the plan without having to take any action. Default investment options are typically designed to provide a diversified portfolio that balances risk and return. By defaulting employees into these options, employers ensure that employees' retirement savings are well-diversified. Automatic re-enrollment can also help ensure that employees' retirement savings remain well-diversified over time. Default investment options typically include periodic rebalancing to ensure the portfolio remains aligned with the target asset allocation. Automatic re-enrollment can help enhance the retirement savings of employees over time. By defaulting employees into the plan, employers ensure that employees' retirement savings benefit from the compounding effect over time. By encouraging employees to save more for retirement, automatic re-enrollment helps ensure that employees have sufficient savings to support themselves in retirement. This can help reduce the risk of poverty and financial insecurity in old age. Some employees may object to the loss of autonomy that comes with automatic re-enrollment. These employees may feel that they are being forced to participate in the plan against their will, or that they are not able to make informed decisions about their retirement savings. The default contribution rate under automatic re-enrollment may not be sufficient to provide adequate retirement savings over time. Employees who are automatically enrolled at the default contribution rate may need to save more to meet their retirement goals. The default investment options under automatic re-enrollment may not be appropriate for all employees. Employees who are automatically enrolled in investment options that do not match their risk tolerance or investment goals may experience lower returns or higher risk than they would like. Automatic re-enrollment may result in short-term financial strain on employees who are automatically enrolled at the default contribution rate. These employees may need to adjust their budget or spending habits to accommodate the contribution. Employers must comply with legal and regulatory requirements related to automatic re-enrollment. Failure to comply with these requirements can result in fiduciary liability or legal penalties. Employers can customize default contribution rates based on employee age. Younger employees may be defaulted into a higher contribution rate to take advantage of the compounding effect, while older employees may be defaulted into a lower contribution rate to avoid over-saving. Employers can customize default investment options based on employee age or stage of life. Lifecycle investment strategies automatically adjust the portfolio's asset allocation based on the employee's age, gradually reducing risk over time. Employers should provide clear and easy-to-follow opt-out procedures for employees who wish to refrain from participating in the plan. This can help ensure that employees are not enrolled against their will and have the ability to make informed decisions about their retirement savings. Employers should provide investment education to employees to help them make informed decisions about their retirement savings. This education should include information about the default investment options, as well as information about other investment options that may be available. Employers should regularly monitor the performance of the default investment options to ensure that they meet employees' needs. If the performance is not satisfactory, employers may need to consider adjusting the default investment options. Employers should stay up-to-date on regulatory changes related to automatic re-enrollment and make adjustments to the plan as needed to ensure compliance. Automatic re-enrollment is a feature of 401(k) plans that aims to increase participation rates and improve employee retirement savings outcomes. By defaulting employees into the plan, employers remove barriers to participation and encourage employees to save more for retirement. However, there are potential drawbacks and concerns associated with automatic re-enrollment, including loss of autonomy, inadequate default settings, short-term financial strain on employees, and legal and regulatory considerations. Despite the potential drawbacks and concerns, automatic re-enrollment is likely to become more widespread in 401(k) plans in the future. As employers continue to focus on improving employee retirement savings outcomes, automatic re-enrollment will remain a key tool in achieving this goal. By customizing default settings, providing clear and timely communication, and regularly reviewing and adjusting the plan, employers can ensure that automatic re-enrollment is a successful and effective feature of their 401(k) plan. Overall, automatic re-enrollment is a valuable feature that can help employees save more for retirement and achieve long-term financial security. Employers can customize default settings to meet the needs of their employees better, provide clear and easy-to-follow communication and education, and regularly monitor and adjust the plan to ensure compliance and effectiveness. With these best practices in place, automatic re-enrollment can be a powerful tool to improve employee retirement savings outcomes and promote financial security in old age.What Is Automatic Re-Enrollment?

Background of Automatic Re-Enrollment

History of 401(k) Plans

Development of Automatic Enrollment Features

Evolution of Automatic Re-Enrollment

Automatic Re-Enrollment Process

Eligibility Criteria

Default Contribution Rates

Default Investment Options

Timing and Frequency of Re-Enrollment

Communication and Disclosure Requirements

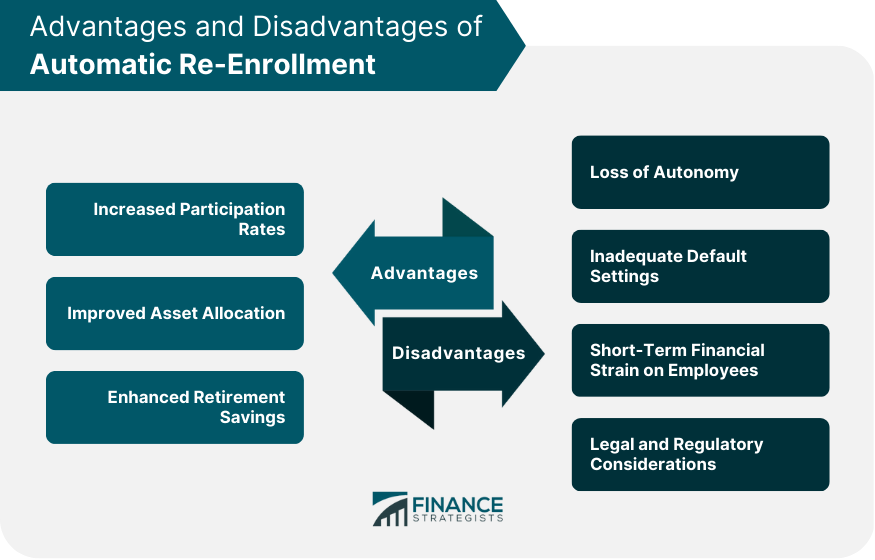

Advantages of Automatic Re-Enrollment

Increased Participation Rates

Overcoming Inertia

Reducing Procrastination

Improved Asset Allocation

Diversification Benefits

Periodic Rebalancing

Enhanced Retirement Savings

Compounding Effect

Long-Term Financial Security

Potential Drawbacks and Concerns of Automatic Re-Enrollment

Loss of Autonomy

Inadequate Default Settings

Contribution Rates

Investment Options

Short-Term Financial Strain on Employees

Legal and Regulatory Considerations

Best Practices for Implementing Automatic Re-Enrollment

Customizing Default Settings

Age-Based Contribution Rates

Lifecycle Investment Strategies

Clear and Timely Communication

Opt-Out Procedures

Investment Education

Regular Plan Review and Adjustment

Monitoring Investment Performance

Adapting to Regulatory Changes

Conclusion

Automatic Re-Enrollment FAQs

Automatic re-enrollment is a feature that automatically re-enrolls employees who previously opted out or changed their contribution rate or investment option into the plan at a default contribution rate and investment option.

Automatic re-enrollment can increase participation rates, improve asset allocation, and enhance retirement savings through the compounding effect over time.

Yes, employees have the right to opt-out of automatic re-enrollment or change their contribution rate or investment option at any time.

Automatic re-enrollment typically occurs on an annual basis, but the timing and frequency may vary based on the plan design.

Potential drawbacks include loss of autonomy, inadequate default settings, short-term financial strain on employees, and legal and regulatory considerations. Employers should customize default settings, provide clear communication and education, and regularly monitor and adjust the plan to mitigate these concerns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.