A 401(k) plan sequence number is simply the number that the employer assigns to the plan. It is often referred to as a participant ID or account number, is a unique identifier assigned to each participant in a 401(k) plan. For example, if the 401(k) plan is the second type of qualified plan that is or has been sponsored by the employer, then its number will be 002. This number is then combined with the employer's tax ID number to make up the whole sequence number. It's a specific number that helps plan administrators, employers, and service providers identify and track individual participants within a retirement plan. Retirement plans such as SEP or SIMPLE IRAs should not be included in this numbering sequence, nor should non-qualified plans such as deferred compensation plans , split dollar plans, executive bonus plans or group carve-out plans. Only qualified plans that fall under ERISA guidelines should be included in this sequence. Sequence numbers act as unique identifiers that help in identifying and tracking individual plan participants. They play a pivotal role in managing the diverse array of transactions and activities related to a participant’s 401(k) account. Sequence numbers are integral to efficient recordkeeping and account management. They help in maintaining accurate records of participant contributions, distributions, loans, and other account activities. Sequence numbers also play a crucial role in tracking and allocating contributions. They ensure that participant contributions, employer matches, and investment returns are accurately allocated to the correct accounts. Different strategies can be employed to generate sequence numbers for 401(k) plans. In many plans, sequence numbers are generated sequentially, based on the order in which participants enroll in the plan. This is a simple and straightforward method, ensuring each participant receives a unique identifier. Some plans might use more complex methods for generating sequence numbers, such as algorithms that incorporate unique identifiers like social security numbers or employee IDs. This approach adds an extra layer of security and uniqueness to each number. In other instances, sequence numbers may be generated using a combination of participant-specific and plan-specific identifiers. This method helps to distinguish participants across multiple plans within the same organization. Several factors might influence the assignment of sequence numbers within a 401(k) plan. Sequence numbers can be assigned based on the order in which participants enroll in the plan, with the earliest enrollees typically receiving the lowest numbers. Plan entry date or specific eligibility criteria could also influence the assignment of sequence numbers. For instance, participants who become eligible for the plan at the same time might receive sequential numbers. In some plans, employment status or tenure might affect sequence number assignment. For example, full-time employees might receive lower numbers, or long-tenured employees might receive sequence numbers before newer hires. In certain cases, contribution levels or allocation preferences could influence sequence number assignment. This can aid in distinguishing between different categories of participants, such as high contributors or those with specific investment preferences. Implementing best practices for sequence number management can ensure efficient and secure plan administration. Effective sequence number management begins with proper documentation and record-keeping. This includes maintaining a comprehensive and up-to-date list of all sequence numbers assigned and ensuring all plan transactions and activities are accurately recorded. To protect sensitive participant data and prevent unauthorized access, internal controls and safeguards should be implemented. This can include measures like secure storage of sequence number records and regular audits of sequence number use. Conducting regular audits and reviews can help identify potential issues or discrepancies in sequence number processes. This ongoing oversight can enhance accuracy, security, and efficiency. A 401(k) plan sequence number is a unique identifier assigned to participants in a retirement plan. It plays a vital role in identifying and tracking individual participants, facilitating recordkeeping, managing accounts, and ensuring proper contribution tracking and allocation. Sequence numbers streamline the administration of 401(k) plans, enabling efficient management of transactions and activities. Various methods, such as sequential numbering, algorithmic generation, and participant-specific identifiers, can be used to generate sequence numbers. Factors like participant enrollment order, plan entry date, employment status, and contribution level may influence sequence number assignment. To effectively manage sequence numbers, best practices include proper documentation, internal controls, safeguards, and regular audits. Understanding the importance of sequence numbers can contribute to the smooth operation of 401(k) plans and support participants' retirement savings goalsWhat Is a 401(k) Plan Sequence Number?

Have questions about 401(k) plan sequence numbers? Click here.Role of Sequence Numbers in 401(k) Plans

Identifying and Tracking Individual Plan Participants

Facilitating Recordkeeping and Account Management

Enabling Contribution Tracking and Allocation

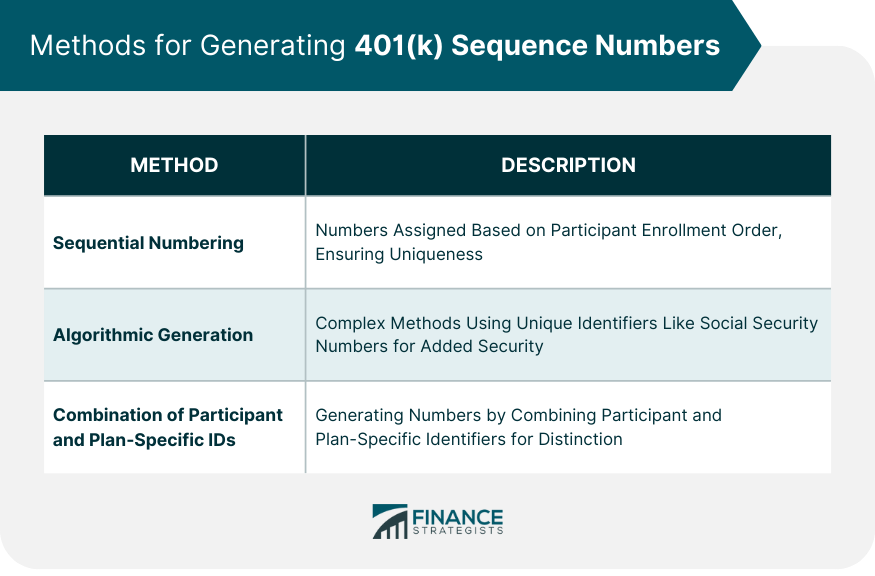

Methods for Generating 401(k) Sequence Numbers

Sequential Numbering Based on Participant Enrollment

Algorithmic Generation Using Unique Identifiers

Combination of Participant and Plan-Specific Identifiers

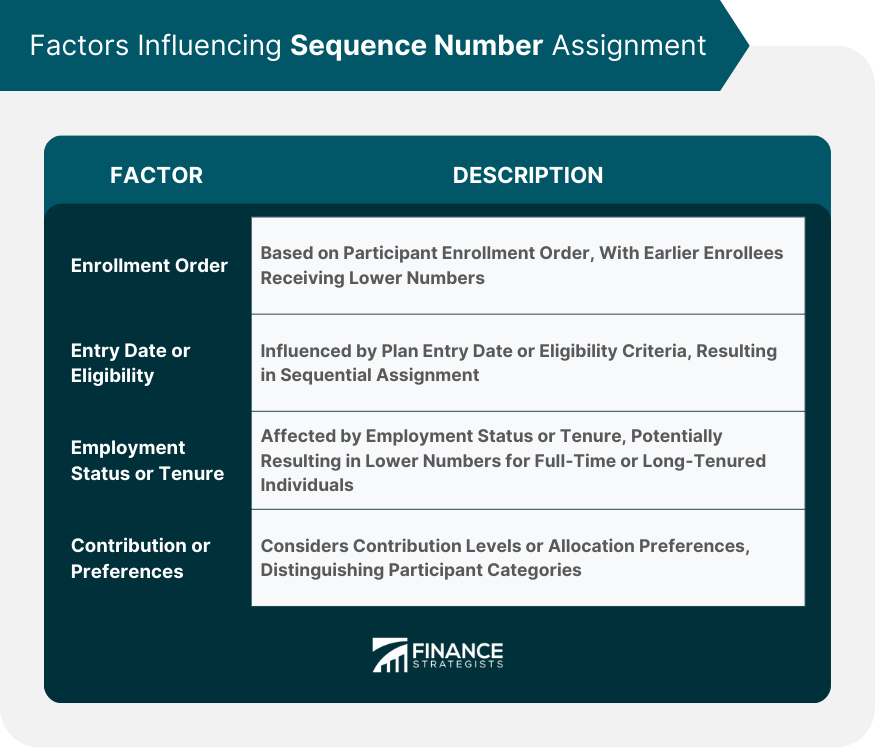

Factors Influencing Sequence Number Assignment

Participant Enrollment Order

Plan Entry Date or Eligibility Criteria

Employment Status or Tenure

Contribution Level or Allocation Preferences

Best Practices for Sequence Number Management

Establishing Proper Documentation and Record-Keeping

Implementing Internal Controls and Safeguards

Regular Audits and Reviews of Sequence Number Processes

Conclusion

401(k) Plan Sequence Number FAQs

A 401(k) plan is a retirement plan offered by an employer designed to help employees save for retirement.

A 401(k) Plan Sequence Number (PSN) is an Internal Revenue Service-issued identifier used to identify specific retirement plans. It enables the IRS to accurately track and audit the plan.

Your employer should provide you with your PSN when you enroll in their 401(k) plan. You can also request it directly from the IRS by completing Form 5300, Application for Determination of Employee Benefit Plan.

Yes, all employers offering a qualified 401(k) plan must provide the IRS with the PSN of their plan.

You will need to provide basic information about your employer and their qualified retirement plan when applying for a PSN from the IRS. This includes the name and address of the employer, as well as details about how the plan works and who participates in it. You may also need to provide additional documents or evidence of compliance to satisfy certain requirements before being approved by the IRS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.