Group carve-out plans are a type of employee benefit plan that allows employers to offer specific benefits to a select group of employees, rather than offering them to the entire workforce. These plans are typically designed to provide more comprehensive and tailored benefits to a high-performing group of employees. Benefits that can be offered through a group carve-out plan may include life insurance, disability insurance, long-term care insurance, and other specialized benefits. Eligibility for these plans is typically limited to a specific group of employees, such as executives or other key employees. These plans supplement the standard benefits package, offering enhanced coverage and perks to attract, retain, and reward top talent. Common industries that use group carve-out plans include finance, technology, and healthcare. Life insurance carve-out plans provide additional life insurance coverage for select employees, beyond what is offered in the standard group life insurance plan. These plans can be tailored to the unique needs of executives and key employees, ensuring their families are adequately protected in the event of their passing. Disability insurance carve-out plans offer enhanced short-term and long-term disability benefits to high-earning employees who may not receive adequate coverage under the standard group disability insurance policy. These plans help maintain financial stability for the employee and their family in case of injury or illness that results in a loss of income. Executive medical reimbursement plans, sometimes called executive health plans, provide additional health benefits and reimbursements for medical expenses not covered under the standard group health insurance plan. These plans may include access to specialized treatments, higher reimbursement rates, and other perks designed to appeal to top talent. Key person insurance plans, also known as key man insurance, provide financial protection for the business in the event of the death or disability of a key employee. The policy's payout can help the company cover expenses related to finding a replacement or managing the loss of the key employee's expertise and skills. Designing a group carve-out plan is an important process that involves identifying the target group, determining the plan objectives, selecting appropriate coverage options, and funding the plan. The first step in designing a group carve-out plan is to identify the target group. This could include key executives, top performers, and high-potential employees who are critical to the success of the organization. These employees are typically highly valued and sought after by other companies, making it important to develop a plan that helps to retain, attract, and reward them. Once the target group has been identified, the next step is to determine the plan objectives. This could include retention objectives to keep the key employees with the company, attraction objectives to entice new talent to join the organization, or reward objectives to incentivize employees to continue to perform at a high level. After determining the plan objectives, the next step is to select appropriate coverage options. This could include choosing the right benefit levels, coverage period, and portability and conversion options. The benefit levels should be competitive and in line with industry standards, while the coverage period should be sufficient to provide long-term protection. Portability and conversion options are also important, as they allow employees to take the coverage with them if they leave the organization. Finally, the plan needs to be funded. This can be done in several ways, including employer-paid, employee-paid, or a combination of both. Employer-paid plans are fully funded by the company, while employee-paid plans require employees to contribute a portion of the cost. A combination of both allows for cost sharing between the company and employees. Ensure the plan complies with non-discrimination rules, which require that benefits be provided fairly and equitably among employees. Review ERISA implications for the plan, as this federal law regulates the administration of employee benefit plans and imposes certain requirements on employers. Consider IRC regulations, which govern the tax treatment of various employee benefits and may affect plan design. Adhere to HIPAA requirements, which protect the privacy and security of individuals' health information. Partnering with insurance carriers and brokers is important to ensure that the plan is well-designed and that the right coverage options are selected. Insurance carriers and brokers can provide valuable expertise and guidance on selecting the appropriate benefit levels, coverage period, and other plan details. Developing a communication strategy is important to ensure that employees are aware of the plan and understand the benefits they are entitled to. This strategy should include a plan introduction, enrollment process, and ongoing communication and updates to keep employees informed. The plan introduction should be clear and concise, explaining the key features of the plan, such as benefit levels, coverage period, and any portability or conversion options. The enrollment process should be easy to follow, with clear instructions on how to enroll and what information is required. It is important to ensure that all eligible employees are enrolled in the plan. Ongoing communication and updates are important to keep employees informed of any changes to the plan, such as benefit levels, coverage period, or other details. This communication should be regular and easily accessible to all employees. Plan administration is important to ensure that the plan is running smoothly and that claims are processed and payouts are made in a timely manner. Enrolling eligible employees is an important part of plan administration. It is important to ensure that all eligible employees are enrolled in the plan and that they have the necessary information to make informed decisions about their coverage. Tracking and monitoring coverage is important to ensure that all employees are covered and that there are no gaps in coverage. This can be done through regular audits and reviews of the plan. Managing claims and payouts is important to ensure that employees receive the benefits they are entitled to in a timely and efficient manner. This involves working closely with the insurance carrier to process claims and make payouts. Assess the success of the plan by tracking relevant KPIs, such as: Employee retention rates are an important KPI to measure the effectiveness of group carve-out plans. High retention rates indicate that the plan is successful in retaining key employees and providing them with the benefits they need. Employee satisfaction levels are also an important KPI to measure the effectiveness of group carve-out plans. High satisfaction levels indicate that the plan is meeting the needs of employees and providing them with the necessary benefits to support their health and well-being. Cost effectiveness is another important KPI to measure the effectiveness of group carve-out plans. The cost of the plan should be balanced against the benefits it provides to ensure that it is cost-effective for the organization. Regularly review the plan and make adjustments as needed: Periodic plan reviews are important to ensure that the plan is meeting the needs of employees and the organization. These reviews should be conducted regularly to identify areas of improvement and make necessary changes to the plan design. Incorporating employee feedback is important to ensure that the plan is meeting the needs of employees. Employee feedback can provide valuable insight into what is working well and what needs improvement. Updating coverage options and benefit levels is important to ensure that the plan remains competitive and meets the needs of employees. This could include adding new coverage options or adjusting benefit levels to better align with industry standards and employee needs. Group carve-out plans are a powerful tool for organizations to attract, retain, and reward top talent. These specialized insurance and benefit programs offer enhanced coverage and perks to a select group of employees, typically executives or key personnel within the company. By designing and implementing a well-crafted group carve-out plan, employers can differentiate themselves in a competitive market and provide valuable benefits that appeal to high-performing employees. However, it is important to note that designing and administering a group carve-out plan requires careful consideration of legal and compliance requirements, as well as regular evaluation and adjustments to ensure its effectiveness. Partnering with insurance carriers and brokers, developing a comprehensive communication strategy, and tracking relevant KPIs are all crucial elements of implementing a successful group carve-out plan. With the right approach, group carve-out plans can be a powerful tool for organizations to achieve their talent management goals and drive business success.What Are Group Carve-Out Plans?

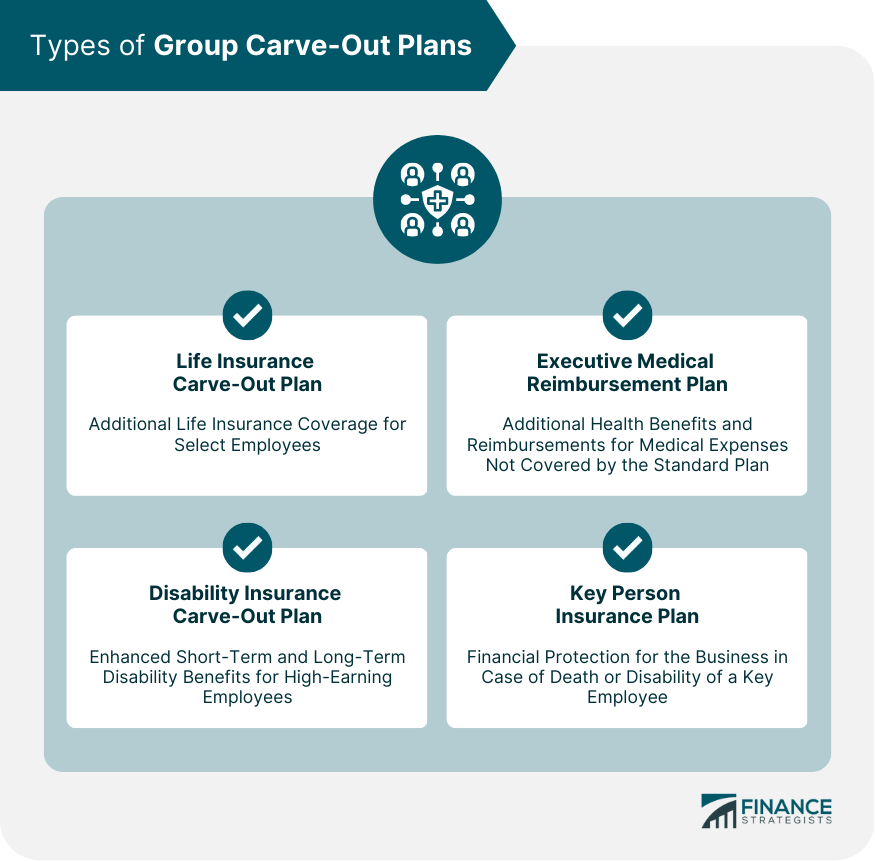

Types of Group Carve-Out Plans

Life Insurance Carve-Out Plans

Disability Insurance Carve-Out Plans

Executive Medical Reimbursement Plans

Key Person Insurance Plans

Designing a Group Carve-Out Plan

Identifying the Target Group

Determining Plan Objectives

Selecting Appropriate Coverage Options

Funding the Plan

Legal and Compliance Considerations

Non-discrimination Rules

Employee Retirement Income Security Act (ERISA) Implications

Internal Revenue Code (IRC) Regulations

Health Insurance Portability and Accountability Act (HIPAA) Considerations

Implementing and Communicating Group Carve-Out Plans

Partnering With Insurance Carriers and Brokers

Developing a Communication Strategy

Plan Introduction

Enrollment Process

Ongoing Communication and Updates

Plan Administration

Enrolling Eligible Employees

Tracking and Monitoring Coverage

Managing Claims and Payouts

Evaluating the Effectiveness of Group Carve-out Plans

Measuring Key Performance Indicators (KPIs)

Employee Retention Rates

Employee Satisfaction Levels

Cost Effectiveness

Adjusting Plan Design as Needed

Periodic Plan Reviews

Incorporating Employee Feedback

Updating Coverage Options and Benefit Levels

Conclusion

Group Carve-Out Plans FAQs

A group carve-out plan is a type of employee benefit plan that allows employers to provide certain benefits to a select group of employees, rather than offering them to the entire workforce. This select group of employees is typically made up of high-performing or executive-level employees.

Common benefits that can be offered through a group carve-out plan include life insurance, disability insurance, and long-term care insurance. These benefits are often more comprehensive and may offer higher coverage amounts than what is typically available through a standard employee benefit plan.

Eligibility for a group carve-out plan is typically limited to a select group of employees. This group may include executives, key employees, or other high-performing employees who have been identified as critical to the organization's success. Eligibility requirements may vary depending on the specific plan.

Group carve-out plans are typically funded through employer contributions. Employers may pay the entire cost of the plan or may require employees to contribute a portion of the premium. In some cases, employees may have the option to purchase additional coverage beyond what is provided through the plan.

Group carve-out plans can offer a number of advantages for both employers and employees. For employers, these plans can help attract and retain top talent by offering comprehensive benefits that are tailored to the needs of a select group of employees. For employees, group carve-out plans can provide access to higher coverage amounts and more comprehensive benefits than what is typically available through a standard employee benefit plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.