A non-qualified plan is a type of retirement plan that does not meet the requirements established by the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code for tax-favored treatment. These plans are typically offered by employers as a way to provide additional retirement benefits to key employees, executives, or highly compensated individuals. Non-qualified plans can be customized according to the employer's specific needs and are not subject to the same regulatory requirements as qualified plans. Non-qualified plans are important because they allow employers to design retirement plans that cater to the needs of their key employees. By offering attractive benefits to these individuals, employers can retain and motivate their most valuable talent. Additionally, non-qualified plans can supplement the benefits provided by qualified plans, enabling key employees to save more for retirement and achieve their long-term financial goals. Deferred compensation plans allow employees to defer a portion of their income into the plan, which will then be paid out at a later date, typically upon retirement or separation from the company. This enables employees to postpone the taxation on the deferred income until it is received. There are two main types of deferred compensation plans: non-qualified deferred compensation (NQDC) plans and 457 plans. Supplemental Executive Retirement Plans (SERPs) are a type of non-qualified plan specifically designed to provide additional retirement benefits to executives and other key employees. SERPs are usually funded by the employer and can be structured as a defined benefit plan, a defined contribution plan, or a combination of both. These plans often include benefits such as early retirement options, enhanced pension benefits, and survivor benefits. Executive bonus plans, also known as Section 162 executive bonus plans, are non-qualified plans that allow employers to provide additional compensation to key employees in the form of bonuses. These bonuses can be used by the employee to purchase life insurance policies or other financial products, which can help build wealth and provide financial security for the employee and their family. Executive bonus plans are flexible and can be easily tailored to the specific needs of each employee. Split-dollar life insurance plans are arrangements where the employer and employee share the costs and benefits of a permanent life insurance policy. The employer typically pays the premiums, and the death benefit is divided between the employer and the employee's designated beneficiary. These plans can offer both tax and financial benefits to the participating employee. One of the key features of non-qualified plans is that there are no limitations on the amount of contributions that can be made by the employer or the employee. This allows for greater flexibility in designing the plan and enables key employees to save more for retirement than they would be able to with a qualified plan. Non-qualified plans are not subject to the same regulations under ERISA as qualified plans. This means that they are not required to meet certain minimum standards, such as funding requirements, fiduciary responsibilities, and reporting and disclosure requirements. This allows employers more flexibility in designing and administering non-qualified plans. Qualified plans are subject to non-discrimination testing, which ensures that the plan does not unfairly favor highly compensated employees over other employees. Non-qualified plans, on the other hand, are not subject to these tests, allowing employers to provide more generous benefits to key employees without having to increase benefits for all employees. Non-qualified plans do not have to adhere to the same vesting requirements as qualified plans. This allows employers to determine their own vesting schedules or even make benefits immediately available to key employees. One of the main advantages of non-qualified plans is their flexibility in design. Employers have the freedom to customize these plans according to their specific needs and the needs of their key employees. This allows for the creation of plans that are more closely aligned with the company's objectives and the financial goals of the employees. Non-qualified plans enable employers to offer attractive benefits to their key employees, such as higher contribution limits, immediate vesting, and more generous retirement benefits. These additional incentives can help employers retain and motivate their most valuable talent, ensuring the company's continued success. Unlike qualified plans, non-qualified plans do not have any contribution limits imposed by the IRS. This allows key employees to save more for their retirement, helping them achieve their long-term financial goals. Non-qualified plans are generally less expensive for employers to establish and maintain than qualified plans. This is because non-qualified plans are not subject to the same regulatory requirements as qualified plans, which can result in lower administrative and compliance costs. One of the main disadvantages of non-qualified plans for employers is that they do not receive tax deductions for their contributions until the benefits are actually paid out to the employee. This means that employers cannot take advantage of immediate tax savings, as they would with a qualified plan. Non-qualified plans do not offer the same level of creditor protection as qualified plans. This means that the assets held within a non-qualified plan may be subject to claims by creditors in the event of bankruptcy or other financial difficulties. Non-qualified plans are generally only offered to a select group of key employees, which can create feelings of inequality and dissatisfaction among other employees. This limited availability may also make it more difficult for companies to attract and retain top talent across all levels of the organization. A nonqualified plan is an employer-sponsored retirement or executive compensation plan that does not meet the criteria for qualification under the Internal Revenue Code (IRC) and is therefore not eligible for the same tax benefits as qualified plans. Non-qualified plans offer several advantages and disadvantages for both employers and employees. Key features of these plans include their flexibility in design, no limitations on contributions, exemption from ERISA regulations, and no discrimination testing or vesting requirements. Non-qualified plans play a significant role in retirement planning for key employees and executives. These plans allow for more customization and flexibility in designing retirement benefits, which can help attract and retain top talent. However, employers must also consider the potential disadvantages, such as delayed tax deductions and limited creditor protection. By carefully weighing the pros and cons, employers can create non-qualified plans that best meet the needs of their organization and key employees.What Is a Non-Qualified Plan?

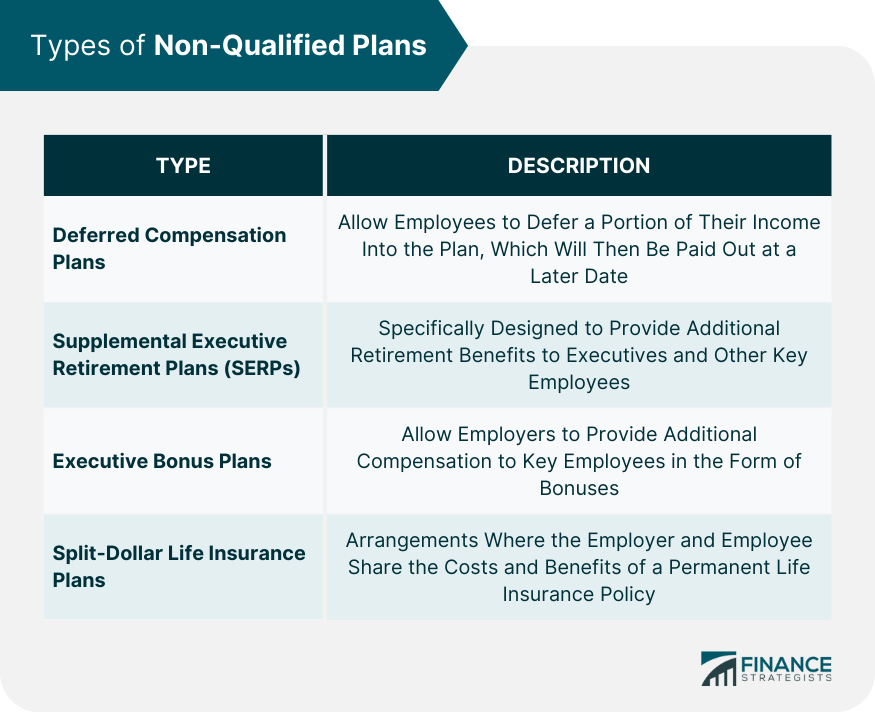

Types of Non-Qualified Plans

Deferred Compensation Plans

Supplemental Executive Retirement Plans (SERPs)

Executive Bonus Plans

Split-Dollar Life Insurance Plans

Features of Non-Qualified Plans

No Limitations on Contributions

Not Subject to ERISA Regulations

No Discrimination Testing Required

No Vesting Requirements

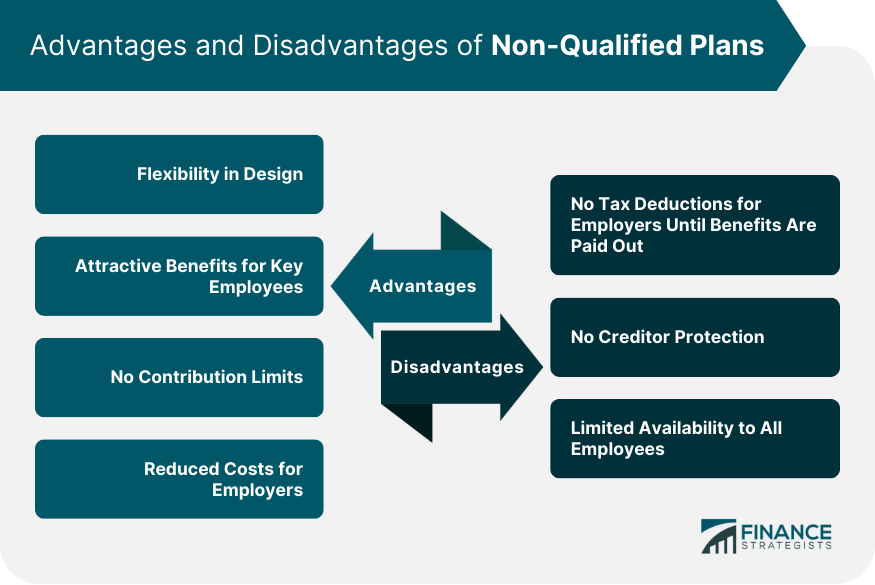

Advantages of Non-Qualified Plans

Flexibility in Design

Attractive Benefits for Key Employees

No Contribution Limits

Reduced Costs for Employers

Disadvantages of Non-Qualified Plans

No Tax Deductions for Employers until Benefits are Paid Out

No Creditor Protection

Limited Availability to All Employees

Final Thoughts

Non-Qualified Plan FAQs

Non-qualified plans are employer-sponsored retirement plans that do not meet the criteria for tax-favored status.

There are several types, including deferred compensation plans, supplemental executive retirement plans (SERPs), and executive bonus plans.

They have no contribution limits, are not subject to ERISA regulations, and do not require discrimination testing or vesting requirements.

They offer flexibility in design, attractive benefits for key employees, no contribution limits, and reduced costs for employers.

There are no tax deductions for employers until benefits are paid out, no creditor protection, and limited availability to all employees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.