The financing landscape is replete with myriad terminologies and guidelines. Topping this intricate list for homeowners is the cash-out refinance process. Fannie Mae, as a vanguard in the mortgage industry, has been an instrumental force in sculpting these policies. Grasping the quintessence of cash-out refinancing is pivotal. It not only offers homeowners financial leverage but can also metamorphose their financial trajectory. The nuances of this instrument are manifold, and understanding them is paramount to leveraging its benefits. Through Fannie Mae's guidelines, potential pitfalls in the mortgage process can be circumvented, ensuring a smoother experience for homeowners. As the landscape of property financing evolves, staying attuned to these guiding principles can be the cornerstone of astute financial decisions. For homeowners, a mortgage is more than just a loan—it's an avenue to realize dreams. Fannie Mae sets the bar for cash-out refinance by emphasizing the age of the first mortgage. It's not just about having a mortgage; it's about its maturity. The seasoning or the period of your existing mortgage plays a pivotal role in determining your eligibility for cash-out refinance. In the labyrinth of financial guidelines, exceptions often emerge as glimmers of hope. While the age requirement of a mortgage is a cardinal rule, Fannie Mae has charted out specific exceptions. These carve-outs encompass scenarios where the borrower might have other subordinate liens or is looking to buy out a co-owner under a legal purview. Just as time seasons wine, the duration of property ownership seasons a mortgage. Ownership isn't merely about holding a title; it’s about how long you’ve held it. This tenure imparts a certain credibility and trustworthiness to the borrower in the eyes of lenders. Beyond the black and white of rules lie shades of grey—special cases that merit distinct attention. These scenarios can range from properties acquired via inheritance to those meeting certain delayed financing criteria. Real estate often finds its way into the narrative of inheritance and legal settlements. Fannie Mae delineates a clear path for those acquiring property through these channels, offering them an understanding of how this influences their refinancing journey. By accommodating properties obtained through inheritance or legal settlements, Fannie Mae ensures that beneficiaries or recipients aren't left grappling with ambiguity. This eases the refinancing process, allowing these homeowners to tap into the equity of their newly acquired properties without the usual waiting periods. The concept of delayed financing, while intricate, is an integral cog in the cash-out refinance machine. It’s an exception that gives homeowners flexibility, and understanding its intricacies can illuminate potential refinancing opportunities. Often, individuals might sell a property and wish to buy it back shortly after, and delayed financing becomes a beacon for such endeavors. With this exception, the wait time post the property's sale can be truncated, ensuring that homeowners can refinance the property soon after its acquisition. Real estate, in its vast expanse, often encounters the realm of corporate structures like LLCs. When a property transitions from such an entity to an individual owner, it carries with it certain implications and nuances in the cash-out refinance paradigm. The pivot from a corporate veil to individual ownership isn’t just a mere administrative change. It's a shift that can impact loan terms, rates, and even eligibility criteria, emphasizing the need for homeowners to be acutely aware of the requirements when navigating this transition. Melding the worlds of legal trusts and real estate, the inter vivos revocable trust introduces another layer to the cash-out refinance tapestry. With its unique blend of legal and real estate nuances, understanding its context can be a game-changer for potential refinancers. These trusts often serve as estate planning tools, allowing seamless transition of assets. However, when it comes to refinancing, properties held under such trusts present a distinctive set of challenges and opportunities, necessitating a tailored approach to cash-out refinancing options. Venturing beyond Fannie Mae, Freddie Mac emerges as another titan in the mortgage industry. Though they often sail in tandem, discerning the nuances that set them apart can empower borrowers to make informed choices. Despite both being government-sponsored entities, Freddie Mac has its own unique approach to mortgage refinancing, sometimes differing in requirements or benefits. By contrasting and comparing, homeowners can glean a comprehensive view, ensuring they select the path most suited to their circumstances. The FHA, with its distinct set of guidelines and ethos, offers a unique perspective on cash-out refinancing. Delving into its stance and comparing it with Fannie Mae can provide a kaleidoscope of insights for homeowners. Besides its signature loan programs which cater to a broader audience, especially those with lower credit scores, the FHA's cash-out refinancing thresholds and limits offer another dimension of options for borrowers. Weighing these against Fannie Mae’s offerings can sometimes reveal unexpected advantages or limitations. Honoring the valiant, the VA brings with it a distinct set of refinancing guidelines. Aligning these with Fannie Mae’s edicts presents a fascinating study, offering veterans a clear roadmap to navigate their refinancing voyage. With its foundation in supporting military members and their families, the VA’s guidelines inherently embed benefits catered specifically to this community. By juxtaposing this with Fannie Mae’s general policies, veterans can more effectively chart a course that maximizes their unique entitlements and opportunities. Conforming to seasoning requirements isn't just about compliance; it's a ticket to augmented financial security. It provides borrowers with a robust platform, reinforcing their financial decisions. By offering a structured framework, these requirements also act as a safeguard against potential market adversities, shielding borrowers from unforeseen financial downturns. Uniformity breeds stability. By adhering to these guidelines, the lending ecosystem achieves a consistent rhythm, ensuring the market remains robust and less susceptible to fluctuations. Furthermore, this consistency fosters trust among stakeholders, solidifying the foundational pillars of the real estate financing world. Temptations abound, especially in the world of refinancing. However, seasoning requirements act as a guardrail, ensuring borrowers don't venture into the realm of hasty or precarious refinancing decisions. By setting a clear timeline, these requirements discourage impulsive actions that may not be in the borrower's best long-term interest. Efficiency and clarity always stride hand in hand. For borrowers, adhering to Fannie Mae's seasoning guidelines means a smoother sail through the loan approval waters, minimizing potential hiccups. Moreover, lenders can expedite the processing time, knowing that the borrower's application aligns with established protocols, reducing the back-and-forth often seen in more ambiguous situations. Documentation is the backbone of refinancing. An oversight, however minute, can throw a spanner in the works. By ensuring thorough and meticulous paperwork, borrowers can sidestep potential setbacks. Adopting a systematic approach to documentation, replete with checklists and verifications, can bolster the refinancing process's robustness. The realm of refinancing is rife with complexities. To navigate its intricate corridors, regularly touching base with mortgage advisors can illuminate the path, keeping misconceptions at bay. Moreover, an informed dialogue with experts can often spotlight nuances that are easily overlooked, ensuring borrowers remain on solid ground. Value is dynamic, especially in real estate. Borrowers can sometimes overestimate their property's worth, leading to refinancing hiccups. Regular market assessments can keep such overestimations in check. Staying abreast with up-to-date property valuations not only informs refinancing decisions but also empowers borrowers with a realistic perspective on their assets. Time is of the essence, especially concerning property ownership duration. It's imperative for borrowers to be cognizant of these mandates, ensuring they align their refinancing aspirations accordingly. By marking critical ownership milestones and setting reminders, borrowers can ensure they are always in sync with seasoning requirements. Fannie Mae's cash-out refinance guidelines provide a structured roadmap for homeowners to leverage their properties, offering financial leverage and the potential to reshape their financial futures. Navigating through this maze, one encounters key seasoning requirements, emphasizing both the age and maturity of the mortgage and the duration of property ownership. Furthermore, Fannie Mae's accommodations for unique scenarios, such as properties acquired through inheritance, and their specific exceptions ensure clarity and flexibility. By comparing Fannie Mae's stance with other entities like Freddie Mac, FHA, and VA, homeowners gain a holistic view, enabling informed decision-making. While adhering to seasoning requirements brings benefits like enhanced financial security and market stability, pitfalls do exist. However, with the right countermeasures, such as meticulous documentation and regular consultations with experts, homeowners can sidestep potential setbacks, ensuring a seamless refinancing experience. Fannie Mae and the Importance of Cash-Out Refinance

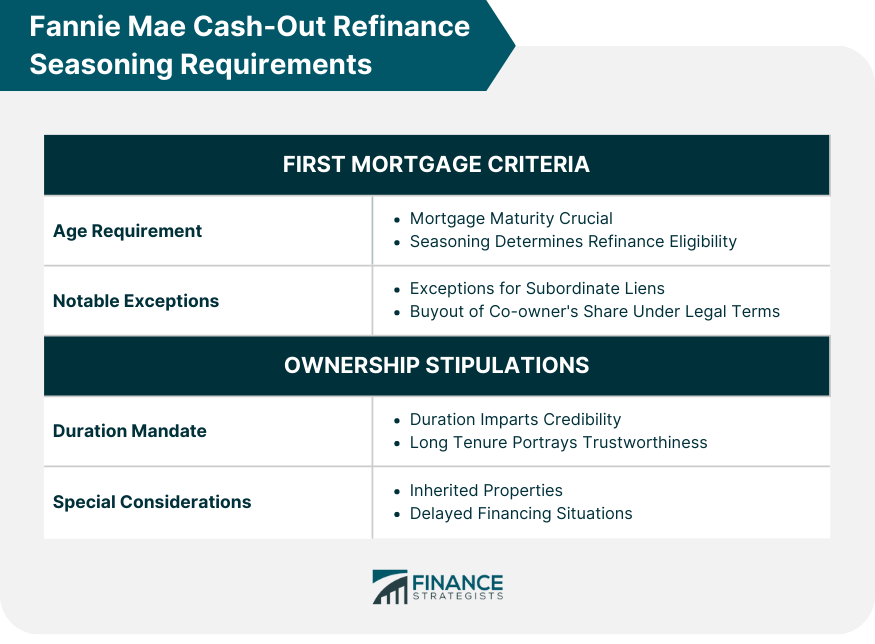

Fannie Mae Cash-Out Refinance Seasoning Requirements

First Mortgage Criteria

Age Requirement

Notable Exceptions

Ownership Stipulations

Duration Mandate

Special Considerations

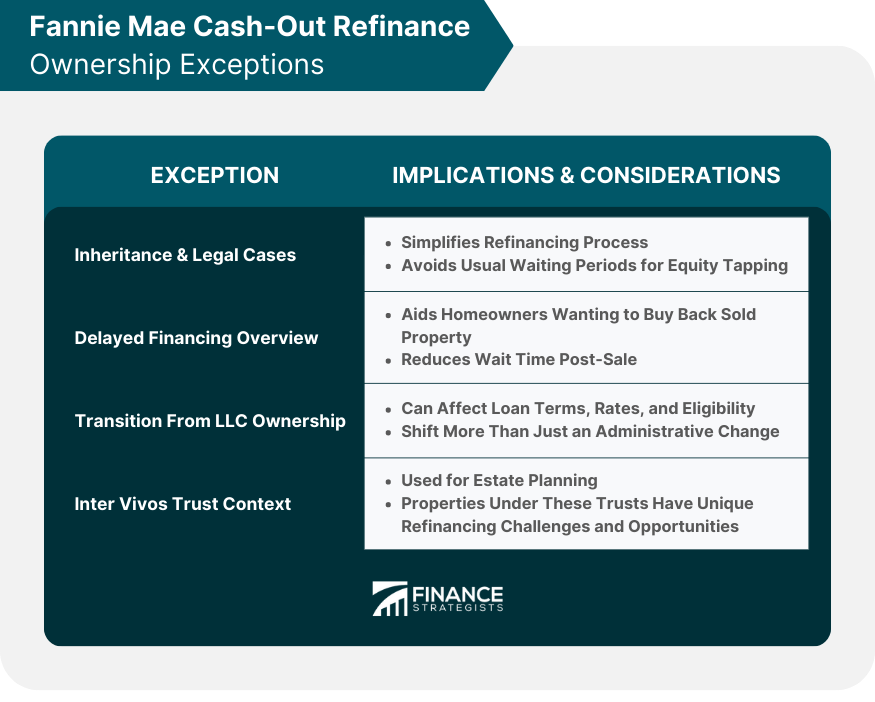

Fannie Mae Cash-Out Refinance Ownership Exceptions

Inheritance & Legal Cases

Delayed Financing Overview

Transition From LLC Ownership

Inter Vivos Trust Context

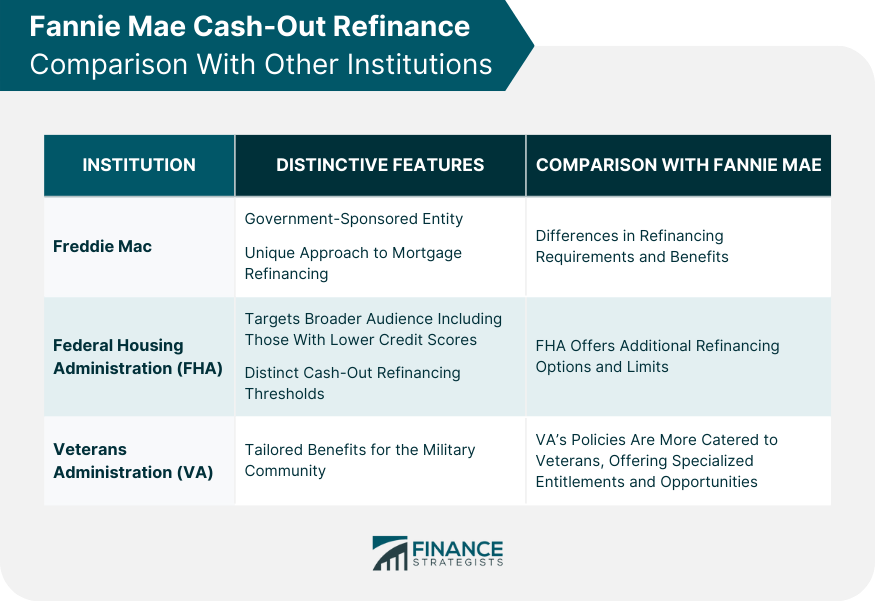

Fannie Mae Cash-Out Refinance Comparison With Other Institutions

Freddie Mac

Federal Housing Administration (FHA)

Veterans Administration (VA)

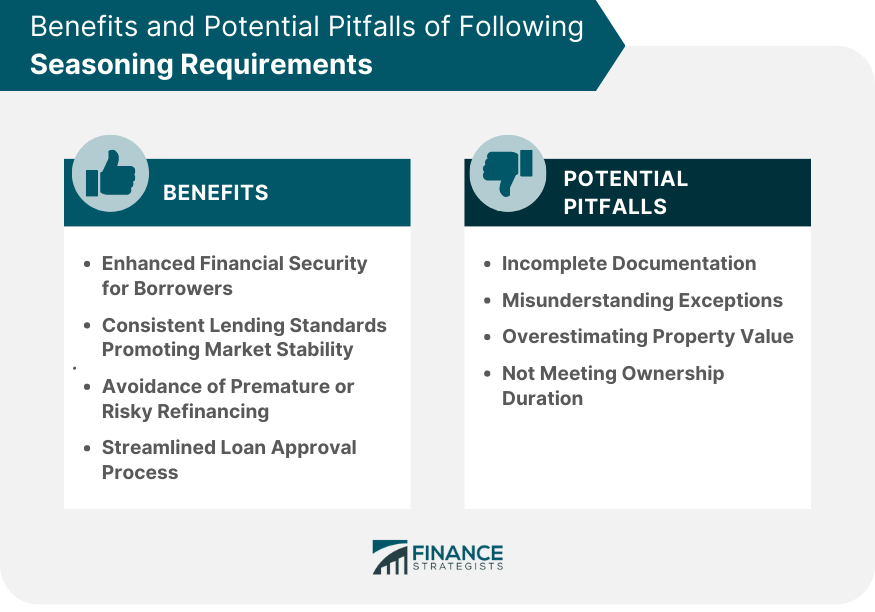

Benefits of Following Seasoning Requirements

Enhanced Financial Security for Borrowers

Consistent Lending Standards Promoting Market Stability

Avoidance of Premature or Risky Refinancing

Streamlined Loan Approval Process

Potential Pitfalls of Following Seasoning Requirements

Incomplete Documentation

Misunderstanding Exceptions

Overestimating Property Value

Not Meeting Ownership Duration

Bottom Line

Fannie Mae Cash-Out Refinance Seasoning Requirements FAQs

Fannie Mae emphasizes the age of the first mortgage and the duration of property ownership.

Fannie Mae offers clear guidelines for properties acquired through inheritance or legal settlements.

Yes, exceptions include inheritance, delayed financing, transitioning from LLC ownership, and properties under inter vivos trusts.

While Fannie Mae has its own set of guidelines, institutions like Freddie Mac and FHA offer unique perspectives on cash-out refinancing.

Benefits include enhanced borrower financial security, market stability, avoiding risky refinancing, and a streamlined loan approval process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.