Medicaid planning for long-term care refers to the legal and financial strategies used by individuals to become eligible for Medicaid coverage of long-term care expenses. This planning typically involves transferring assets to others, spending down assets, and taking advantage of exemptions and allowances provided by Medicaid laws. Medicaid planning is the process of strategically managing assets and income to meet Medicaid eligibility requirements while preserving financial resources for long-term care needs. Medicaid planning is a proactive strategy that can help individuals and families prepare for the potential need for long-term care and minimize the financial burden of care. The purpose of Medicaid planning is to help individuals and families qualify for Medicaid benefits while preserving assets and resources for future use. Medicaid planning can help ensure that an individual has access to quality long-term care services, whether in a nursing home, assisted living facility, or at home, without depleting their financial resources. Medicaid planning is essential for individuals and families who want to protect their assets and resources and ensure that they can access necessary long-term care services. Without proper planning, the high cost of long-term care can quickly deplete an individual's financial resources, leaving them with limited options for care and potentially impacting their quality of life. Medicaid eligibility is based on income and asset requirements. Income requirements vary by state but typically limit an individual's monthly income to a set amount, often around $2,700, with additional allowances for certain medical expenses. To qualify for Medicaid, individuals must meet the income requirements for their state and demonstrate that they require long-term care services. Medicaid also has strict asset requirements for eligibility. In most states, an individual cannot have more than $2,000 in countable assets, which include cash, investments, and property. Medicaid planning strategies, such as asset transfers and trusts, can help individuals meet asset requirements while still preserving assets for future use. Medicaid has a look-back period, which is a period of time during which the government examines an individual's financial transactions to ensure compliance with Medicaid rules and regulations. The look-back period is five years in most states, meaning that any asset transfers or other financial transactions made within the past five years may be subject to penalties or disqualification from Medicaid benefits. Asset transfers are a common Medicaid planning strategy used to reduce an individual's countable assets and meet Medicaid asset requirements. Asset transfers can include gifting assets to family members, creating joint ownership arrangements, or purchasing exempt assets like a primary residence or a car. It is important to work with a knowledgeable professional when considering asset transfers to ensure compliance with Medicaid rules and regulations. Trusts are legal arrangements that allow individuals to transfer assets to a trustee to manage on behalf of beneficiaries. Irrevocable trusts can be used in Medicaid planning to remove assets from an individual's countable assets, making them eligible for Medicaid benefits. Revocable trusts may also be used to manage assets in the event of incapacity or death. It is essential to work with an experienced professional when establishing trusts to ensure compliance with Medicaid and other legal requirements. Annuities are financial tools that can be used to convert non-exempt assets into income streams, making them eligible for Medicaid benefits while preserving assets for future use. Annuities can be complex financial instruments, and it is crucial to work with a professional when considering annuities in Medicaid planning to ensure compliance with Medicaid rules and regulations. Income-only trusts, also known as Miller trusts, are a type of trust designed to help individuals with high monthly incomes qualify for Medicaid benefits. Income-only trusts can be used to shelter excess income, allowing individuals to meet Medicaid income requirements while still having access to their income for personal use. It is essential to work with an experienced professional when establishing income-only trusts to ensure compliance with Medicaid and other legal requirements. Personal services contracts can be used in Medicaid planning to compensate family members or other individuals who provide care services to the Medicaid recipient. Personal services contracts can help reduce countable income for Medicaid eligibility and provide compensation for caregivers who may otherwise provide care services for free. It is essential to work with a knowledgeable professional when establishing personal services contracts to ensure compliance with Medicaid and other legal requirements. Spousal protections are Medicaid planning strategies that can help protect the assets and resources of a non-applicant spouse when one spouse requires long-term care services. Spousal protections can include asset transfers, the use of special trusts, and other planning strategies to ensure that the non-applicant spouse can maintain financial stability while still accessing necessary long-term care services. It is essential to work with a knowledgeable professional when considering spousal protections in Medicaid planning to ensure compliance with Medicaid and other legal requirements. Medicaid estate recovery is a process by which states may seek reimbursement from the estates of deceased Medicaid recipients for certain long-term care expenses. Estate recovery can result in significant financial impact on an individual's heirs and beneficiaries. Understanding and incorporating strategies to minimize the effects of Medicaid estate recovery in Medicaid planning can help protect an individual's assets and preserve their legacy for future generations. The Medicaid look-back period can result in penalties or disqualification from Medicaid benefits for non-compliant asset transfers or other financial transactions made within the past five years. Working with a knowledgeable professional can help ensure compliance with Medicaid rules and regulations and minimize the risk of penalties or disqualification. An elder law attorney is a legal professional who specializes in the unique legal and financial issues affecting seniors and their families. Elder law attorneys can assist with Medicaid planning, estate planning, long-term care planning, and other related matters. Working with an experienced elder law attorney in Medicaid planning can help ensure that an individual's plan is comprehensive, compliant with state and federal regulations, and tailored to their unique needs and circumstances. An experienced attorney can also help individuals and families navigate the complex legal processes involved in Medicaid planning and long-term care. Medicaid planning is a proactive strategy that can help individuals and families protect their assets and resources while accessing necessary long-term care services. Eligibility for Medicaid is based on income and asset requirements, and there are several Medicaid planning strategies available to help meet these requirements while preserving financial resources. It is never too early or too late to start Medicaid planning. Planning early can help ensure that an individual's plan is comprehensive and maximizes available options and resources. However, even those who require long-term care services immediately can benefit from Medicaid planning strategies. Working with a knowledgeable professional and regularly reviewing and updating one's Medicaid plan can help ensure continued access to necessary long-term care services and protect assets and resources for future use. Medicaid planning is an essential part of comprehensive long-term care planning and can provide peace of mind for individuals and families facing the potential need for long-term care services.Overview of Medicaid Planning for Long-Term Care

Eligibility for Medicaid

Income Requirements

Asset Requirements

Medicaid Look-Back Period

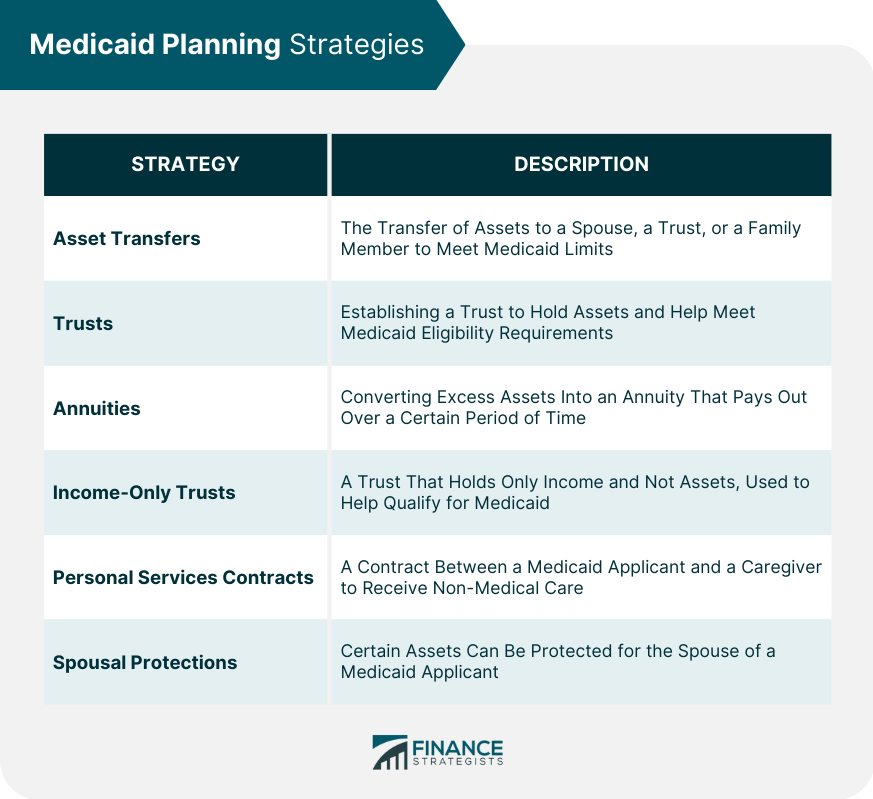

Medicaid Planning Strategies

Asset Transfers

Trusts

Annuities

Income-Only Trusts

Personal Services Contracts

Spousal Protections

Legal Considerations in Medicaid Planning

Estate Recovery

Look-Back Period and Penalties

The Role of an Elder Law Attorney

Conclusion

Medicaid Planning for Long-Term Care FAQs

Medicaid planning for long-term care involves creating a strategy to help you qualify for Medicaid benefits that can cover the cost of long-term care services.

To be eligible for Medicaid long-term care benefits, you must meet specific financial and medical requirements. Your income and assets must fall below a certain threshold, and you must have a medical need for long-term care services.

Some Medicaid planning strategies for long-term care include transferring assets, creating a trust, and purchasing long-term care insurance. It's best to consult with a professional to determine the best strategy for your unique situation.

Transferring assets for the purpose of qualifying for Medicaid long-term care benefits can be a complicated process. It's essential to consult with an attorney or financial planner to ensure you're following the legal guidelines.

To start Medicaid planning for long-term care, you can speak with an attorney or financial planner who specializes in elder law. They can help you determine the best strategy for your situation and guide you through the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.