Longevity insurance is a financial product designed to provide individuals with a guaranteed income stream during their retirement years. As life expectancies continue to rise, longevity insurance is becoming an increasingly important aspect of comprehensive retirement planning. This article will explore the concept of longevity risk, the key features of longevity insurance, factors to consider when choosing a policy, taxation and regulatory aspects, and the role of financial advisors. Longevity risk refers to the uncertainty surrounding an individual's lifespan and the possibility that they may outlive their retirement savings. As life expectancies increase, the risk of outliving one's savings becomes a significant concern for retirees. Longevity risk refers to the risk that an individual or an organization faces due to the increasing life expectancy of people. Factors that contribute to longevity risk include: Modern medicine has made significant progress in treating and preventing diseases, leading to increased life expectancy. While this is good news for individuals, it makes it difficult to predict how long someone will live. Healthy lifestyle choices, such as regular exercise, healthy eating habits, and avoiding harmful habits such as smoking and excessive alcohol consumption, can also contribute to a longer life expectancy. As people become more health-conscious, the risk of living longer increases. Some individuals may have genetic traits that make them more likely to live longer than others. These factors can include genetics related to longevity, such as telomere length or the presence of certain genes associated with longevity. Longevity risk also affects retirement planning. As people live longer, they may need to save more to ensure they have enough money to last throughout their retirement years. This can be challenging, as the length of retirement is uncertain, and an individual may live much longer than anticipated. Longevity risk also affects society as a whole. As life expectancies increase, the number of older adults increases, which can strain social security systems and healthcare resources. The increasing number of older adults can also have an impact on the economy, as older adults may work longer, retire later, or require additional financial assistance. Longevity risk can significantly impact an individual's retirement planning by necessitating the need for additional savings and income sources to cover a potentially extended retirement period. This makes it crucial for individuals to consider longevity insurance as part of their retirement strategy. Deferred annuities: These policies allow individuals to invest a lump sum or make regular premium payments during their working years, with payouts commencing at a predetermined retirement age. Longevity annuities: These products provide guaranteed income for life, with payouts beginning at a specified age, typically later in retirement. Lifetime income guarantees: These guarantees can be added to investment products like mutual funds or retirement accounts, providing a guaranteed income stream during retirement. Single-life vs. joint-life: Single-life policies provide income for the policyholder's life, while joint-life policies provide income for the lives of both the policyholder and their spouse. Fixed vs. inflation-adjusted: Fixed payouts provide a consistent income throughout retirement, while inflation-adjusted payouts increase annually to account for inflation. Immediate: Immediate policies provide payouts immediately upon purchase, making them suitable for individuals already in retirement. Deferred: Deferred policies delay payouts until a specified age, allowing individuals to accumulate savings and invest during their working years. Death benefit: This optional feature provides a lump sum payment to beneficiaries upon the policyholder's death. Cost of living adjustments: These adjustments can be added to policies to account for inflation, ensuring the income stream maintains its purchasing power. Long-term care coverage: This optional coverage provides additional benefits for long-term care expenses, such as nursing home care or home health services. Individuals should assess their financial goals for retirement, such as desired lifestyle, travel plans, and potential healthcare expenses, when determining the appropriate amount of longevity insurance coverage. Risk tolerance plays a significant role in choosing a longevity insurance product. Conservative investors may prefer products with guaranteed income streams, while more aggressive investors may opt for products with potential for higher returns. An individual's health status and family medical history can provide insight into their potential lifespan, influencing the type of longevity insurance product that may be most suitable for them. Considering the impact of inflation and economic conditions on retirement savings is essential when selecting a longevity insurance policy. Inflation-adjusted policies can help protect against the erosion of purchasing power over time. Incorporating longevity insurance into a diversified retirement portfolio can help reduce reliance on a single income source and provide financial stability during retirement. Understanding the fees and charges associated with various longevity insurance products is crucial for making informed decisions. These may include administrative fees, surrender charges, and management fees. The tax treatment of longevity insurance payouts varies depending on the type of product and the individual's tax situation. In some cases, a portion of the payout may be tax-free, while other portions may be subject to income tax. It is essential to consult a tax professional to understand the specific tax implications of a chosen product. Longevity insurance products are regulated by various government agencies and industry organizations to ensure consumer protection and product standardization. In the United States, for example, the National Association of Insurance Commissioners (NAIC) and state insurance departments play a crucial role in overseeing the industry. Insurance companies are required to provide clear and transparent information about the features, fees, and risks associated with their longevity insurance products. This helps consumers make informed decisions and compare different products to find the best fit for their needs. Financial advisors can help individuals evaluate their financial needs, risk tolerance, and retirement goals to determine the most appropriate longevity insurance product for their situation. By understanding an individual's unique circumstances, financial advisors can recommend suitable longevity insurance products that align with their client's retirement objectives and risk tolerance. Financial advisors can periodically review a client's longevity insurance policy to ensure it remains aligned with their retirement goals and adjust the policy as necessary. Addressing longevity risk is a critical aspect of retirement planning. Incorporating longevity insurance into a diversified retirement portfolio can help mitigate this risk and provide financial stability during one's retirement years. By understanding the features of different longevity insurance products, assessing personal financial goals and risk tolerance, and consulting with a financial advisor, individuals can proactively plan for a secure and fulfilling retirement.What Is Longevity Insurance?

Understanding Longevity Risk

What Is Longevity Risk?

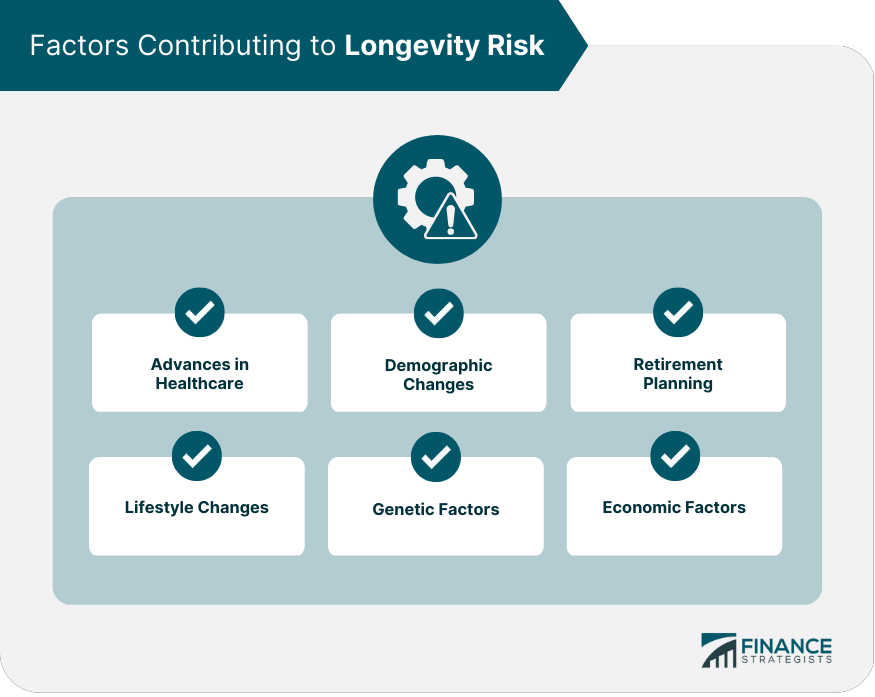

Factors Contributing to Longevity Risk

Advances in Healthcare

Lifestyle Changes

Genetic Factors

Retirement Planning

Demographic Changes

Economic Factors

The Impact of Longevity Risk on Retirement Planning

Key Features of Longevity Insurance

Types of Longevity Insurance Products

Payout Structures

Age of Commencement

Riders and Options

Factors to Consider When Choosing Longevity Insurance

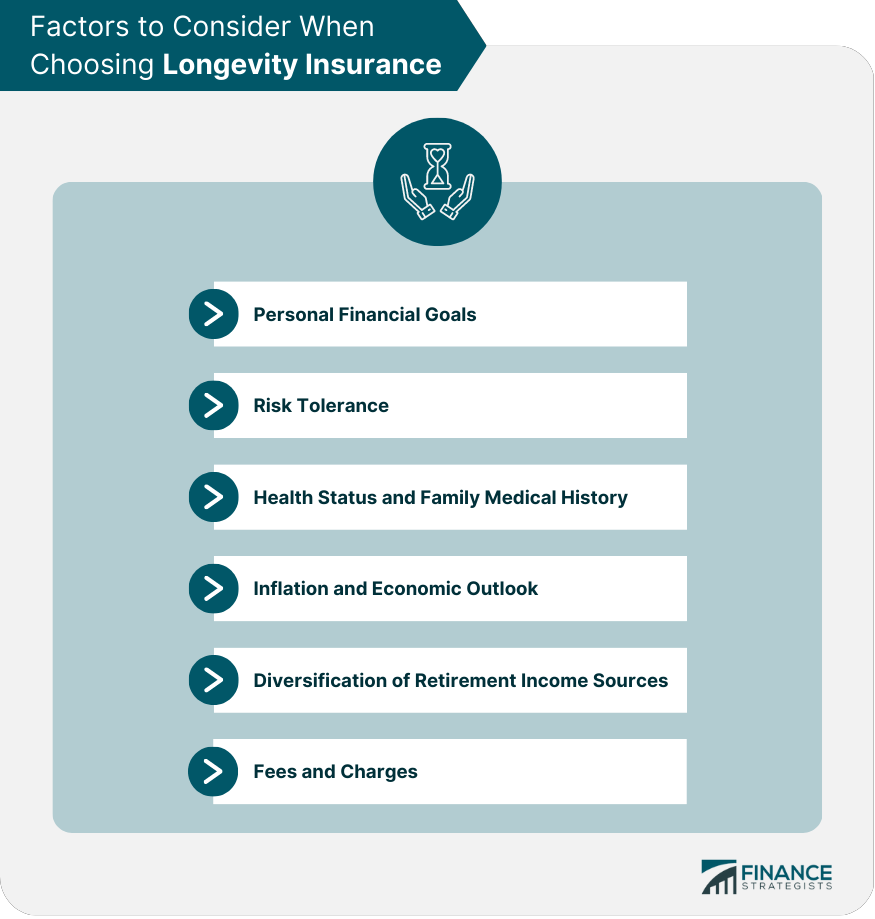

Personal Financial Goals

Risk Tolerance

Health Status and Family Medical History

Inflation and Economic Outlook

Diversification of Retirement Income Sources

Fees and Charges

Taxation and Regulatory Aspects

Tax Implications of Longevity Insurance Payouts

Regulatory Bodies Governing Longevity Insurance

Disclosure Requirements for Insurers

Role of Financial Advisors

Assessing Individual Needs and Risk Tolerance

Recommending Suitable Longevity Insurance Products

Monitoring and Reviewing Insurance Policies

Conclusion

Longevity Insurance FAQs

Longevity insurance is a type of insurance that provides a guaranteed income to an individual in their later years to protect against the risk of outliving their retirement savings.

With longevity insurance, an individual pays a premium to an insurance company in exchange for a guaranteed income stream that starts at a specific age, typically age 80 or older. This income stream can be paid out for the rest of the individual's life.

Longevity insurance is typically designed for individuals who have a significant amount of retirement savings and are concerned about the risk of outliving their savings. It may be a good option for those who are not eligible for a pension or who want to supplement their retirement income.

The main benefit of longevity insurance is that it provides a guaranteed income stream in later life, which can help individuals feel more financially secure and protect against the risk of running out of money in retirement. It can also provide peace of mind for those who are concerned about their longevity risk.

One potential drawback of longevity insurance is that it can be expensive, and premiums may be higher for those who have health issues or who purchase coverage at a younger age. Additionally, if the individual dies before the income stream starts, the premiums paid for the policy may not be returned.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.