A longevity annuity is a financial product designed to provide a guaranteed income stream for life, beginning at a predetermined age, typically in the later years of retirement. These annuities are specifically designed to help retirees manage the risk of outliving their savings. With increased life expectancies and uncertainty surrounding retirement income sources, longevity annuities are becoming an essential part of retirement planning. They offer a level of financial security by providing a steady income stream, irrespective of market fluctuations. There are several type of longevity annuities, including the following: Deferred Income Annuities (DIAs) allow the investor to make a lump sum payment or a series of payments to an insurance company, with the promise of receiving guaranteed lifetime income at a later date, typically in retirement. Qualified Longevity Annuity Contracts (QLACs) are a specific type of DIA, designed for use within qualified retirement plans, such as IRAs or 401(k)s. They offer tax advantages by allowing the investor to defer a portion of their Required Minimum Distributions (RMDs) until the annuity payments begin. Variable annuities offer the potential for investment growth based on the performance of underlying investment options, such as stocks and bonds. The living benefit rider provides a guaranteed lifetime income stream, regardless of the investment performance. Fixed index annuities offer interest crediting based on the performance of a market index, such as the S&P 500. The lifetime income rider guarantees a lifetime income stream, regardless of market fluctuations. Longevity annuities have several advantages, such as: Longevity annuities offer a guaranteed income stream for life, providing financial security and peace of mind throughout retirement. By providing a stable income source, longevity annuities help retirees manage the risk of outliving their savings. Longevity annuities often provide higher payouts compared to other fixed-income investments, such as bonds or CDs, due to their lifetime income guarantees. Certain types of longevity annuities, like QLACs, offer tax advantages by allowing investors to defer RMDs and reduce their taxable income. Some longevity annuities offer optional riders to help protect against inflation, ensuring that the income stream maintains its purchasing power over time. There are several factors which one must consider before investing in a longevity annuity. It is crucial to evaluate your financial goals, retirement needs, and current savings before purchasing a longevity annuity. Consider your life expectancy and overall health when determining if a longevity annuity is suitable for your financial plan. Inflation and interest rate fluctuations can impact the purchasing power and value of annuity payments, so it is essential to understand these risks before investing. Annuities often come with various fees and expenses, which can impact the overall return on investment. Longevity annuities typically have limited liquidity and flexibility, making it crucial to understand the surrender charges and restrictions before purchasing. The following are the steps involved in choosing the right longevity annuity. Before choosing a longevity annuity, it is essential to assess your financial situation, retirement goals, and risk tolerance to ensure the annuity aligns with your overall plan. Research and compare various annuity products, features, and riders to determine which option best suits your needs. Choose an insurance company with a strong financial rating and a positive reputation to ensure the safety and stability of your investment. Consult with an insurance broker or retirement expert to help guide your decision-making process and ensure you choose the right longevity annuity for your situation. State insurance departments regulate the sale of annuities and enforce consumer protection laws to ensure fair practices within the industry. State guaranty associations provide coverage for annuity contracts in the event of an insurance company's insolvency, but coverage limits vary by state, making it essential to understand your protection level. Federal regulations, such as the Employee Retirement Income Security Act (ERISA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act, help protect consumers and provide guidelines for the annuity industry. Several case studies demonstrate the positive impact of longevity annuities on retirees' financial security and quality of life. Retirees who have not included a longevity annuity in their retirement plans may face financial challenges and stress due to uncertainty about their income sources. Real-life experiences offer valuable insights into the benefits and potential pitfalls of longevity annuities, helping future retirees make informed decisions. Longevity annuities are a vital component of retirement planning, offering guaranteed lifetime income, protection against outliving savings, and the potential for higher payouts compared to traditional investments. Various types of longevity annuities, such as DIAs, QLACs, and annuities with living benefits, cater to different needs and preferences. Before purchasing a longevity annuity, it is crucial to consider factors like financial goals, life expectancy, inflation and interest rate risks, fees and expenses, and liquidity concerns. Choosing the right longevity annuity involves analyzing one's financial situation, comparing products and features, evaluating insurance companies, and consulting with financial advisors or retirement experts. Given the complexity and long-term implications of purchasing a longevity annuity, it is highly recommended to seek the guidance of a professional insurance broker. Definition and Importance of Longevity Annuity

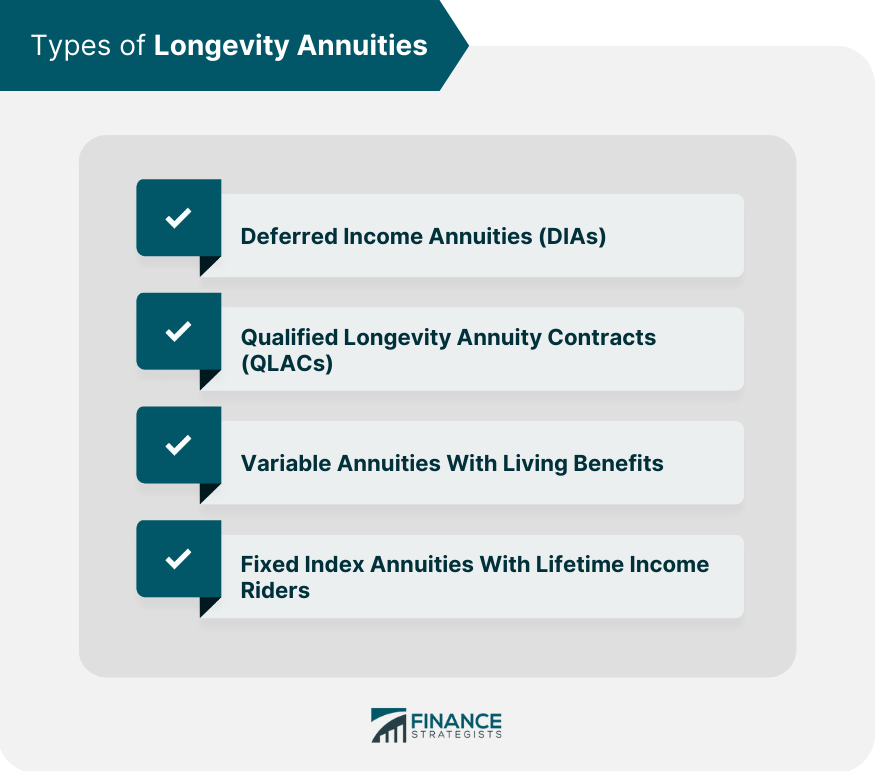

Types of Longevity Annuities

Deferred Income Annuities (DIAs)

Qualified Longevity Annuity Contracts (QLACs)

Variable Annuities With Living Benefits

Fixed Index Annuities With Lifetime Income Riders

Benefits of Longevity Annuities

Guaranteed Lifetime Income

Protection Against Outliving Savings

Potential for Higher Payouts Than Traditional Investments

Tax Advantages

Inflation Protection

Factors to Consider Before Purchasing a Longevity Annuity

Financial Goals and Retirement Needs

Life Expectancy and Health Status

Inflation and Interest Rate Risks

Annuity Fees and Expenses

Liquidity and Flexibility Concerns

How to Choose the Right Longevity Annuity

Analyzing Personal Financial Situation and Goals

Comparing Different Annuity Products and Features

Evaluating Insurance Companies and Their Financial Strength

Consulting With an Insurance Broker or Retirement Expert

Longevity Annuity Regulation and Consumer Protection

Role of State Insurance Departments

Guaranty Associations and Their Coverage Limits

Relevant Federal Regulations and Protections

Case Studies

Success Stories of Retirees Using Longevity Annuities

Challenges Faced by Those Without a Longevity Annuity in Retirement

Lessons Learned from Real-Life Experiences

The Bottom Line

Longevity Annuity FAQs

A longevity annuity is a financial product that provides a guaranteed income stream for life, starting at a predetermined age in retirement. By purchasing a longevity annuity, you can secure a stable income source to help manage the risk of outliving your savings during retirement.

There are several types of longevity annuities, including Deferred Income Annuities (DIAs), Qualified Longevity Annuity Contracts (QLACs), variable annuities with living benefits, and fixed index annuities with lifetime income riders. Each type offers unique features and benefits to suit different retirement needs and goals.

Investing in a longevity annuity offers several benefits, such as guaranteed lifetime income, protection against outliving savings, potential for higher payouts than traditional investments, tax advantages, and optional inflation protection.

To choose the right longevity annuity, start by analyzing your financial situation, retirement goals, and risk tolerance. Compare different annuity products and features, evaluate the financial strength of insurance companies, and consult with a financial advisor or retirement expert to make an informed decision.

Before purchasing a longevity annuity, it is essential to consider factors such as inflation and interest rate risks, annuity fees and expenses, and liquidity concerns. Additionally, it is crucial to understand the surrender charges and restrictions associated with the annuity product you are considering. Consult with an insurance broker or financial advisor to help you navigate these potential risks and make the best decision for your retirement needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.