A Unit Linked Insurance Plan (ULIP) is a hybrid financial product that combines the benefits of insurance coverage and investment. It is offered by insurance companies and allows policyholders to invest a portion of their premium payments into various market-linked assets like stocks, bonds, or mutual funds, while the rest goes towards providing a life insurance cover. The invested portion is converted into units and its value, called the Net Asset Value (NAV), fluctuates with market conditions. ULIPs offer flexibility in terms of premium payments, fund selection, and switching between funds. They also provide potential returns based on market performance. ULIPs come with a lock-in period, typically of five years, and may have charges associated with them. ULIPs were first introduced in India in the late 1990s as a flexible and transparent alternative to traditional insurance products. Over the years, ULIPs have undergone several regulatory changes to protect investor interests and make them more investor-friendly. The Insurance Regulatory and Development Authority of India (IRDAI) has played a pivotal role in shaping the ULIP landscape by implementing guidelines and regulations to ensure transparency and better investor protection. ULIPs serve the dual purpose of providing life insurance coverage and allowing policyholders to invest in a range of market-linked funds. The key benefits of ULIPs include flexibility in fund allocation, switching options, tax benefits, and the potential for long-term wealth creation. ULIPs offer various types of life insurance coverage, including: 1. Term Life Coverage: Provides a lump sum amount, also known as the sum assured, to the nominee in case of the policyholder's demise during the policy term. 2. Whole Life Coverage: Offers coverage for the entire life of the policyholder, typically up to 100 years of age. The sum assured is paid to the nominee upon the policyholder's death. 3. Endowment Coverage: Combines insurance and investment benefits. In addition to the sum assured, the policyholder receives a maturity benefit upon surviving the policy term. The sum assured is the guaranteed amount payable to the nominee in case of the policyholder's demise during the policy term. The death benefit in a ULIP includes the sum assured, the fund value, or both, depending on the plan's terms and conditions. ULIPs offer a variety of funds to invest in, depending on the investor's risk appetite: 1. Equity Funds: These funds invest primarily in equity shares of companies and have the potential to generate high returns over the long term. However, they also come with a higher risk factor. 2. Debt Funds: These funds invest in fixed income instruments such as government bonds, corporate bonds, and money market instruments. Debt funds are considered less risky than equity funds but typically offer lower returns. 3. Balanced Funds: These funds invest in a mix of equity and debt instruments, offering a balance between risk and return. ULIPs provide policyholders with the flexibility to allocate their premiums between different funds. Policyholders can choose to invest in a single fund or distribute their investment across multiple funds, depending on their risk appetite and investment goals. ULIPs allow policyholders to switch between different funds during the policy term, enabling them to align their investments with changing market conditions and personal financial goals. Most ULIPs offer a limited number of free switches per year, with charges applicable for additional switches. This is a charge that is deducted upfront from the premium you pay. It is used to cover initial expenses incurred by the insurance company, such as agent commissions, underwriting, and issuing the policy. The Premium Allocation Charge typically decreases over the policy term. For instance, it could be 6% in the first year, reducing to 3% by the fifth year. The remainder of your premium after this charge is what actually gets invested in your chosen funds. This is a monthly charge for administrative tasks related to the maintenance of your policy. These tasks include premium intimation, policy documentation, and other customer service options. The charge could be a flat rate, like $1.50 per month, or a percentage of the premium. This charge is generally deducted by cancelling units from your policy. This is an annual fee, deducted daily, for managing your chosen investment funds. It is a percentage of the fund value and is typically around 1.35%. The charge is higher for equity funds due to the higher risk and management involved. The Fund Management Charge is accounted for while calculating the Net Asset Value (NAV) of the fund, so you don't see it explicitly deducted from your policy. This charge is for the life cover or insurance component of the ULIP. The insurer deducts this charge monthly. The amount depends on factors such as the policyholder's age, sum assured, and overall health status. For example, a 30-year-old non-smoker male might be charged $0.12 per $1000 of life cover. If you decide to surrender your ULIP policy before the end of the minimum lock-in period (usually 5 years), you'll incur a surrender charge. This charge can be a percentage of the fund value or a flat rate, and it decreases over time. For instance, it could be $50 in the third year, reducing to $0 in the fifth year. ULIPs allow you to make partial withdrawals from your fund after the lock-in period. While some withdrawals may be free, a charge could be applied for additional withdrawals. This charge is typically a flat rate, say $20 per withdrawal, after the first few free withdrawals. The net asset value of a ULIP fund is the price at which the units are bought or sold. It is calculated by dividing the total market value of the fund's assets by the number of units outstanding. NAV is an important indicator of a ULIP fund's performance, as it reflects the gains or losses made on the investments. ULIP fund performance is measured using various parameters such as returns, risk-adjusted performance, and consistency. These metrics help investors assess the fund's performance and make informed investment decisions. A fund manager's expertise plays a crucial role in the performance of a ULIP fund. An experienced fund manager can optimize the fund's portfolio by making timely investment decisions, managing risks, and delivering consistent returns over time. Before investing in a ULIP, it is essential to assess your risk appetite and investment horizon. This will help you choose the right type of fund to invest in and ensure that your investment aligns with your financial goals and risk tolerance. Analyzing the past performance of the ULIP funds can provide insights into their potential future performance. While past performance is not a guarantee of future returns, it can help you identify funds with a consistent track record of delivering returns over time. Understanding the charges and fees associated with a ULIP is crucial in assessing its overall cost-effectiveness. Comparing the charges of different ULIPs can help you select a plan that offers the best value for your investment. ULIPs offer various features and options, such as fund switching, premium redirection, and partial withdrawals. It is essential to choose a plan that offers the flexibility and features that meet your needs and preferences. The claim settlement ratio indicates the percentage of claims settled by the insurance company in a given financial year. A higher claim settlement ratio indicates that the insurance company has a better track record of settling claims, providing greater assurance to policyholders. ULIPs can be purchased online through the insurance company's website or offline through an agent or intermediary. Online purchases offer the advantage of convenience, lower costs, and easy comparison of different plans, while offline purchases can provide personalized guidance and support from an agent. Before purchasing a ULIP, it is essential to compare different plans based on factors such as coverage, investment options, charges, and flexibility. Online comparison tools and websites can help you make an informed decision by providing detailed information on various ULIPs. The application process for a ULIP involves filling out an application form and submitting the necessary documents, such as identity proof, address proof, and income proof. Once the application is approved, the policyholder will receive a policy document containing the plan's terms and conditions. Regularly reviewing the performance of your ULIP funds can help you identify trends and make informed decisions about fund allocation and switching. It is essential to monitor the performance of your funds against their benchmarks and peers. ULIPs offer the flexibility to switch between funds and redirect future premiums to different funds during the policy term. This allows you to align your investments with changing market conditions and personal financial goals. ULIPs allow policyholders to make top-up premiums and partial withdrawals after the completion of the lock-in period. These features provide greater flexibility in managing your investments and meeting unforeseen financial requirements. ULIPs require regular premium payments to maintain the policy and ensure continued life coverage and investment benefits. Policyholders can choose from various premium payment options, such as monthly, quarterly, half-yearly, or yearly, based on their convenience and financial situation. ULIPs offer a unique combination of insurance and investment benefits, making them an attractive financial tool for long-term wealth creation and financial security. By understanding the various components of a ULIP and considering factors such as risk appetite, fund performance, and charges, investors can make informed decisions to optimize their investments and achieve their financial goals. Regular monitoring and active management of ULIP investments are essential to ensure that they continue to align with the policyholder's changing needs and preferences.Definition of Unit Linked Insurance Plan (ULIP)

History and Evolution of ULIP

Purpose and Benefits of ULIP

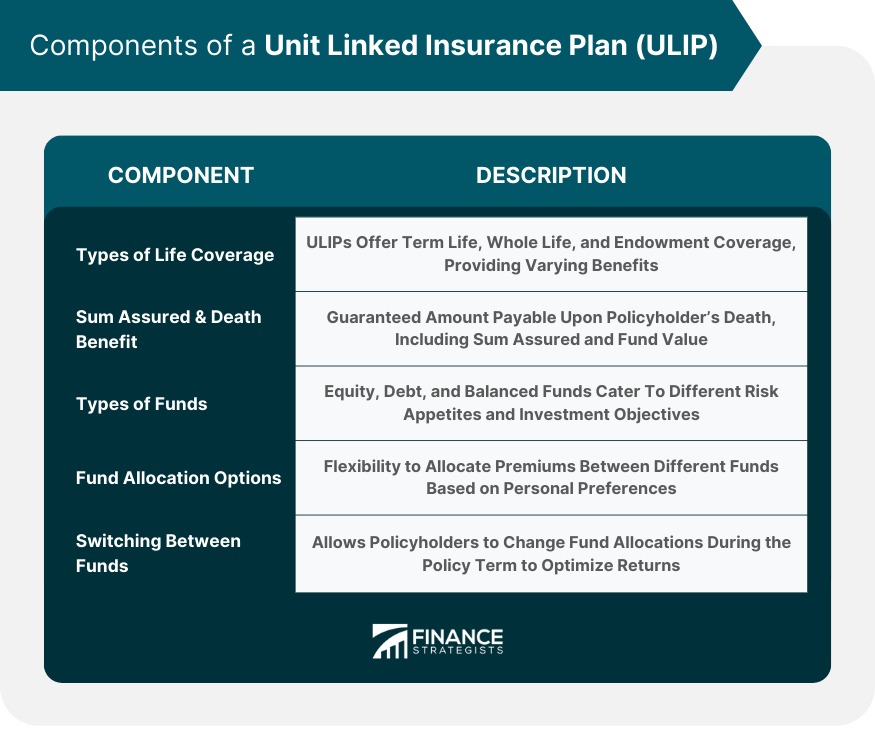

Components of a Unit Linked Insurance Plan

Types of Life Coverage in ULIPs

Sum Assured and Death Benefit

Types of Funds in ULIPs

Fund Allocation Options

Switching Between Funds

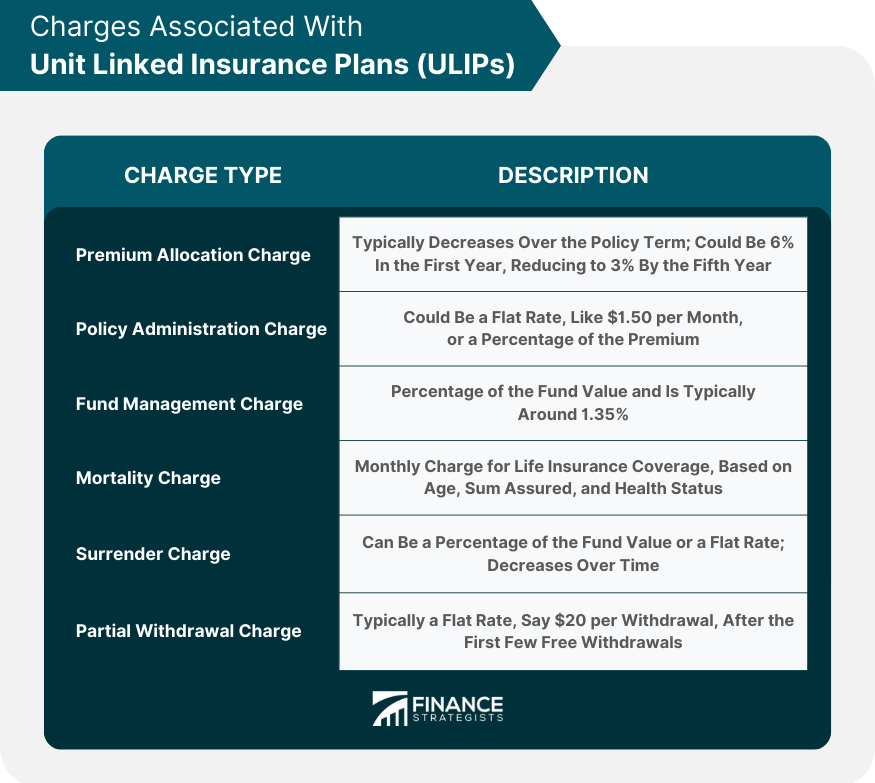

Charges Associated With Unit Linked Insurance Plans

Premium Allocation Charge

Policy Administration Charge

Fund Management Charge

Mortality Charge

Surrender Charge

Partial Withdrawal Charge

Understanding ULIP Performance

Net Asset Value (NAV)

Fund Performance Measurement

Importance of Fund Manager's Expertise

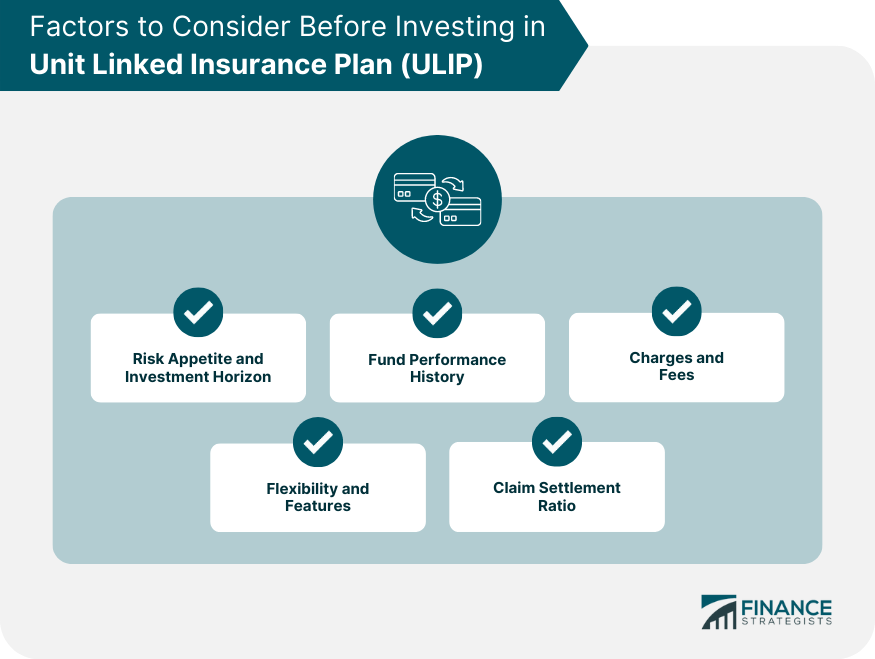

Factors to Consider Before Investing in Unit Linked Insurance Plan

Risk Appetite and Investment Horizon

Fund Performance History

Charges and Fees

Flexibility and Features of the Plan

Claim Settlement Ratio of the Insurance Company

How to Buy a Unit Linked Insurance Plan

Online vs. Offline Purchase

Comparing ULIPs

Application Process and Documentation

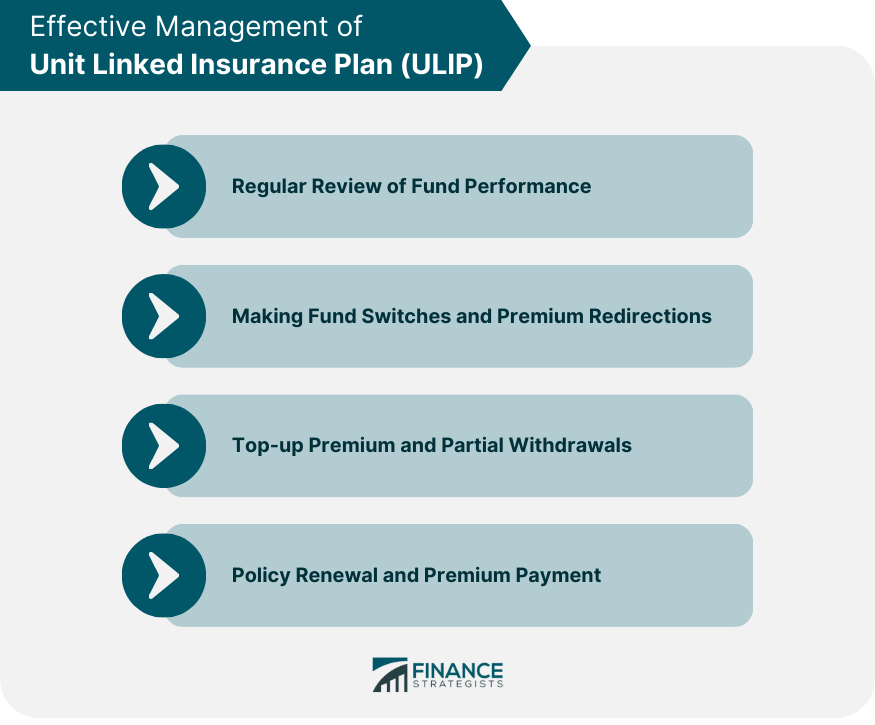

Managing and Monitoring Your Unit Linked Insurance Plan

Regular Review of Fund Performance

Making Fund Switches and Premium Redirections

Top-up Premium and Partial Withdrawals

Policy Renewal and Premium Payment

Conclusion

Unit Linked Insurance Plan (ULIP) FAQs

A Unit Linked Insurance Plan (ULIP) is a market-linked insurance product that combines life insurance coverage with investment in equity, debt, or a balanced fund. ULIPs allow policyholders to invest a portion of their premiums in various funds while providing life cover to secure their family's financial future.

The main components of a ULIP include the insurance component, which provides life coverage to the policyholder, and the investment component, which allows the policyholder to invest in a range of market-linked funds such as equity, debt, or balanced funds.

You can manage and monitor your ULIP by regularly reviewing the performance of your funds, making fund switches and premium redirections, utilizing top-up premium and partial withdrawal features, and ensuring timely policy renewal and premium payments.

ULIPs offer the flexibility to switch between different funds during the policy term, allowing policyholders to align their investments with changing market conditions and personal financial goals. Most ULIPs offer a limited number of free switches per year, with charges applicable for additional switches.

To monitor your ULIP investments, regularly review the performance of your ULIP funds, make fund switches and premium redirections as needed, utilize top-up premium and partial withdrawal options, and ensure timely policy renewal and premium payment. Monitoring the performance of your funds against their benchmarks and peers is crucial for making informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.