A lottery annuity refers to the long-term payout option that lottery winners can choose. Instead of a lump-sum payment, the winner receives the total prize in increments over an extended period, typically 20-30 years. Choosing between a lump-sum payment and annuity payments depends on the winner's financial goals, tax situation, and risk tolerance. The lump-sum option gives the winner the total prize amount upfront, but less than the advertised prize due to the discounting process. Annuity payments are paid out over time, potentially providing stable income but introducing risks related to inflation, longevity, state laws, and the financial instability of the annuity provider.

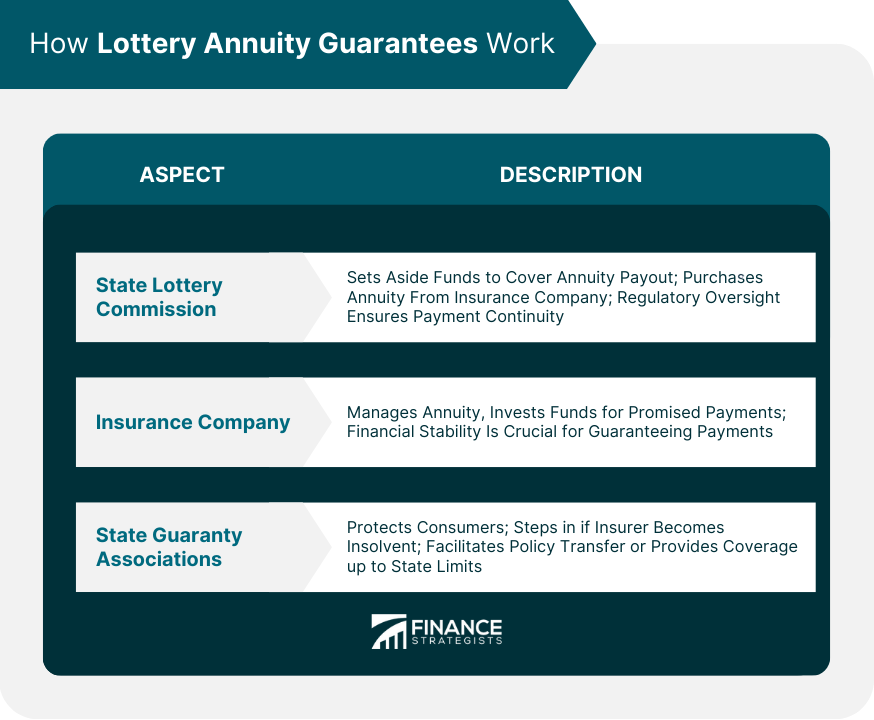

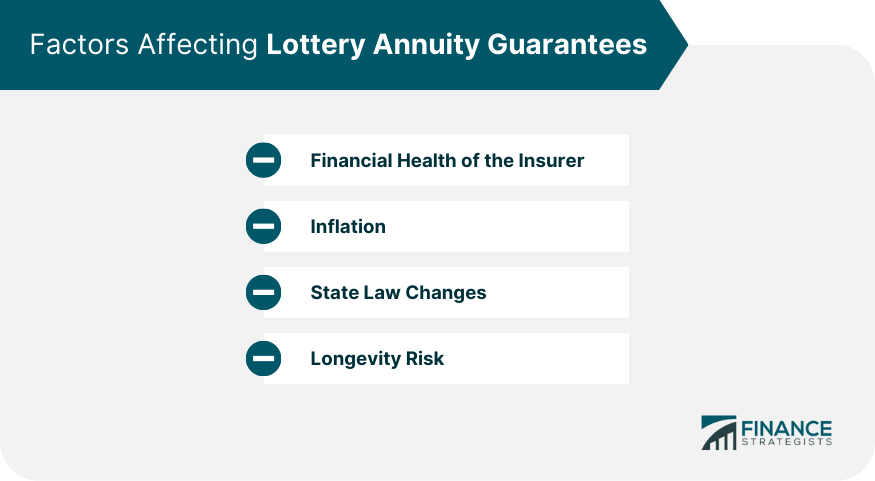

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. It is true that lottery annuities are generally guaranteed, backed by the state or insurance companies that issue them. They offer a steady income over a period, typically 20-30 years, reducing the risk of spending all winnings at once. However, consider inflation and your financial goals before choosing an annuity. Align your choices with your long-term financial aspirations. If you are looking to plan out your lottery winnings, I'm here to help you navigate through several options. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation When a lottery winner opts for an annuity payment, the state lottery commission sets aside the funds to cover the annuity's total payout. The commission doesn't pay the winnings directly to the winner. Instead, it uses the prize money to purchase an annuity from an insurance company. The funds set aside by the commission are intended to cover the entire cost of the annuity, ensuring the promised payments are fulfilled. Moreover, most states have laws and regulations in place that help ensure the lottery annuity payments continue, even if the state lottery commission runs into financial difficulties. This regulatory oversight adds an extra layer of security for the annuity payments. The insurance company plays a critical role in the guarantee of lottery annuity payments. After the lottery commission purchases the annuity using the prize money, the insurance company takes over management. This involves investing the initial funds in a manner that ensures both the principal and interest can cover the promised payments for the duration of the annuity. The insurance company is obligated to make the annual payments to the lottery winner, even if the investments do not perform as expected. The financial stability and creditworthiness of the insurance company are essential to maintaining this guarantee. Each state, including the District of Columbia and Puerto Rico, has a Guaranty Association, and all insurance companies authorized to sell life insurance, health insurance, or annuities in the state are required to be members. The coverage limits provided by the associations vary by state but are designed to offer protection to consumers. In the context of a lottery annuity, if the insurance company providing the annuity faces insolvency, the State Guaranty Association steps in. It can either facilitate the transfer of the policy to another insurer or provide coverage for the policy directly, up to the state's statutory limits. However, this limit might be less than the total remaining lottery annuity, which introduces a level of risk. The National Organization of Life and Health Insurance Guaranty Associations (NOLHGA) assists the state associations in coordinating their efforts to provide protection to policyholders when a multi-state insurance company fails. Often an insurance company, the insurer is responsible for managing the annuity, investing the initial funds, and disbursing the annual payments to the lottery winners. It is important to understand that the capacity of the insurer to honor these obligations largely depends on its financial health. Should the insurer face financial difficulties or, in a worst-case scenario, become insolvent, it could significantly disrupt the payout schedule. It's advisable that lottery winners review the financial stability and creditworthiness of the insurer before making a decision. Reputable insurers usually have strong ratings from major rating agencies, which can serve as a reference. Annuity payments are typically fixed and do not adjust with inflation. If the inflation rate rises significantly during the annuity payout period, it could substantially erode the real value or purchasing power of the annuity payments. For example, an annual payment of $100,000 might seem significant now. However, if inflation averages 2% per year, after 25 years, the same $100,000 would have a purchasing power of approximately $61,000 in today's dollars. Each state in the U.S. has its own set of laws and regulations governing lottery operations, and these laws can directly impact the guarantees provided to lottery annuities. If a state decides to amend its laws regarding the operation of lotteries or the provision of annuities, these changes could potentially affect the annuity's guarantees. It is essential for lottery winners to stay updated with their state's lottery laws and regulations. Lastly, longevity risk, or the risk associated with the life expectancy of the winner, can affect the guarantees of lottery annuities. Some lotteries might allow the remaining payments to be passed to the winner's estate or a designated beneficiary, while others might not. Winners considering the lottery annuities should understand how their payments would be handled in the event of their death and plan accordingly. Since the annuity payments are managed by an insurance company chosen by the lottery commission, the financial stability of the insurer is crucial. Researching the insurer, their financial standing, and reputation in the industry can provide insight into their ability to fulfill the annuity obligations over the long term. Consider checking their ratings with major credit rating agencies as a measure of their financial health. For annuity recipients, diversification can help hedge against inflation and longevity risk. It's generally not prudent to rely solely on the annuity payments for financial stability. Investing in a range of assets such as stocks, bonds, and real estate, can provide additional income streams and growth potential, contributing to overall financial health. An often overlooked aspect of winning a lottery is estate planning. Lottery winners should consider how their newfound wealth fits into their broader estate plan, particularly if they have dependents or wish to leave a legacy. Should the winner pass away before all annuity payments are made, the remaining funds could potentially be passed to the winner's estate, depending on the lottery rules and the estate plan. Consulting with an estate planning attorney can help navigate these considerations, ensuring the winner's wishes are met and their loved ones are provided for. Taxation can significantly impact the real value of a lottery win. Depending on the amount, lottery winnings can push the recipient into a higher tax bracket, potentially leading to a substantial tax liability. Annuity payments, spread out over years, might also result in a different tax scenario compared to receiving a lump sum. It's essential to consult with a tax advisor or accountant to fully understand these implications. They can assist in determining the most tax-efficient way to receive the winnings and how to plan for future tax liabilities. A financial advisor can provide a personalized assessment of the winner's financial situation, help understand the pros and cons of lottery annuities, and guide the winner in making a decision that aligns with their long-term financial goals. They can also provide insight into investment strategies that can help maximize the benefits of the win. Lottery annuities offer winners a long-term payout option, providing a stable income stream over an extended period. The guarantees associated with lottery annuities rely on the involvement of the state lottery commission and the insurance company. The commission sets aside funds to buy an annuity from the insurance company, which invests them to ensure the promised payments are fulfilled. Additionally, state guaranty associations provide another layer of security by assisting policyholders if the insurance company becomes insolvent. However, factors such as the financial health of the insurer, inflation, state law changes, and longevity risk can affect the guarantees of lottery annuities. It is crucial for lottery winners to thoroughly evaluate these factors before opting for the annuity payout option. Employing strategies like diversifying investments, considering estate planning, understanding tax implications, and consulting with a financial advisor can enhance the guarantees and maximize the benefits of lottery annuities, aligning the decision with long-term financial goalsLottery Annuity: Overview

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

How Lottery Annuity Guarantees Work

State Lottery Commission

Insurance Company

State Guaranty Associations

Factors Affecting Lottery Annuity Guarantees

Financial Health of the Insurer

Inflation

State Law Changes

Longevity Risk

Strategies to Enhance Lottery Annuity Guarantees

Evaluate the Insurer

Diversify Investments

Consider Estate Planning

Understand the Tax Implications

Consult With a Financial Advisor

Final Thoughts

Is Lottery Annuity Guaranteed? FAQs

Yes, lottery annuities are generally considered reliable. They are backed by both the state lottery commission and the insurance company providing the annuity. The lottery commission guarantees the initial funds, while the insurance company guarantees the payout structure.

The insurance company's financial stability is crucial for guaranteeing lottery annuity payments. Winners should research the insurer's reputation and financial standing, including checking their ratings with major credit rating agencies. This assessment provides insight into the insurer's ability to fulfill annuity obligations over the long term.

Yes, inflation can impact the real value or purchasing power of annuity payments over time. Since annuity payments are typically fixed, if the inflation rate rises significantly during the payout period, it could erode the value of the payments. Winners should consider the potential impact of inflation when choosing between a lump sum and an annuity.

Yes, changes in state laws related to lottery operations can directly impact the guarantees provided to lottery annuities. Each state in the U.S. has its own set of laws and regulations governing lotteries and annuities. If a state decides to amend these laws, it could potentially affect the guarantees associated with the annuity. It is important for lottery winners to stay updated with their state's lottery laws and regulations to understand any potential impact on their annuity guarantees.

In the event of the insurance company becoming insolvent, state guaranty associations step in to protect policyholders. Each state has its own Guaranty Association, which can facilitate the transfer of the policy to another insurer or provide coverage for the policy directly, up to the state's statutory limits. However, it's important to note that the coverage limit provided by the association might be less than the total remaining lottery annuity, which introduces a level of risk.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.