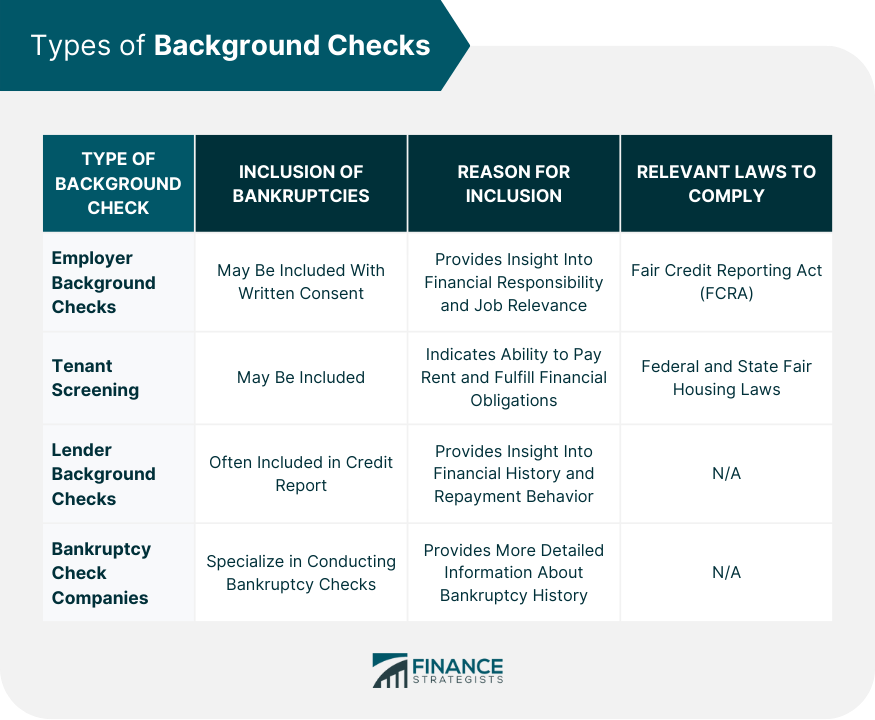

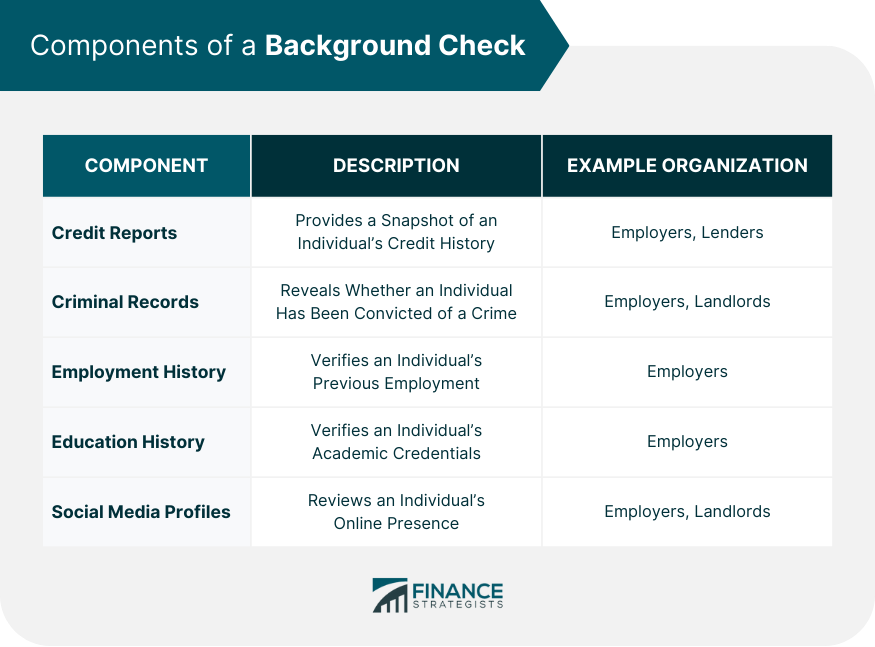

The answer is not straightforward and depends on the type of background check being conducted. Employers may conduct background checks on potential employees to ensure that they are a good fit for the job and the company. While employers are not permitted to discriminate against applicants based on their bankruptcy status, they may still include bankruptcies in their background checks. This is because bankruptcies can provide insight into an individual's financial responsibility and may be relevant to the job in question. However, employers must obtain the applicant's written consent before conducting a credit check, which would reveal the bankruptcy. Landlords may conduct background checks on potential tenants to verify their income, rental history, and creditworthiness. Bankruptcies may be included in a tenant screening report, as they can indicate an individual's ability to pay rent and fulfill their financial obligations. However, landlords must comply with federal and state fair housing laws, which prohibit discrimination based on bankruptcy status. Lenders may conduct background checks on potential borrowers to evaluate their creditworthiness and ability to repay a loan. Bankruptcies are often included in a lender's credit report, as they can provide insight into an individual's financial history and repayment behavior. There are also companies that specialize in conducting bankruptcy checks, which can provide more detailed information about an individual's bankruptcy history. These companies may be used by lenders, employers, or landlords to obtain a more comprehensive picture of an individual's financial history. When conducting a background check, organizations may look at various aspects of an individual's past to evaluate their suitability for a position or agreement. Some common components of a background check include: A credit report provides a snapshot of an individual's credit history, including their payment history, outstanding debts, and credit utilization. Employers and lenders may look at an applicant's credit report to assess their financial responsibility and determine whether they are high-risk borrowers. A criminal record check can reveal whether an individual has been convicted of a crime. Employers and landlords may conduct criminal record checks to ensure that the applicant does not pose a risk to the company or other tenants. An employment history check can verify an individual's work history, including their previous employers, job titles, and dates of employment. Employers may conduct employment history checks to confirm that an applicant has the necessary experience for a job and has not falsified their resume. An education history check can verify an individual's academic credentials, including their degrees, certifications, and coursework. Employers may conduct education history checks to ensure that an applicant has the necessary qualifications for a job. Social media checks involve reviewing an individual's online presence, including their social media profiles, blogs, and online activity. Employers and landlords may conduct social media checks to assess an applicant's character and suitability for a job or housing. While bankruptcy status may not always be relevant to a background check, there are several reasons why employers and lenders may include bankruptcies in their screening process. Bankruptcy can indicate an individual's financial responsibility, as it shows that they have struggled to manage their debt and may have defaulted on payments. Employers and lenders may view bankruptcy as a red flag and may be hesitant to hire or lend money to individuals who have filed for bankruptcy. Bankruptcy fraud is a serious offense and involves intentionally concealing or falsifying information in a bankruptcy filing. Employers and lenders may include bankruptcies in their background checks to protect against fraud and ensure that the applicant is honest and trustworthy. Bankruptcy status can also be used to assess an individual's risk, particularly in lending or housing situations. Lenders and landlords may view bankruptcy as a higher risk factor, as it indicates a history of financial difficulties and may increase the likelihood of default or eviction. The length of time that a bankruptcy stays on record depends on the type of bankruptcy filed. A Chapter 7 bankruptcy remains on an individual's credit report for up to ten years from the date of filing. This type of bankruptcy involves liquidating assets to pay off creditors and may result in the discharge of most unsecured debts. A Chapter 13 bankruptcy remains on an individual's credit report for up to seven years from the date of filing. This type of bankruptcy involves creating a repayment plan to pay off creditors over a period of three to five years. Bankruptcy filings are public records and can be accessed by anyone who conducts a public records search. However, some background check companies may only report bankruptcies that are within a certain timeframe, such as the past seven years. In summary, bankruptcy can have a significant impact on an individual's financial reputation and may be included in a background check conducted by employers, lenders, or landlords. While bankruptcy status may not always be relevant to a background check, it can provide insight into an individual's financial responsibility, potential risk, and history of repayment behavior. It is important to understand the type of background check being conducted and the rights and protections afforded to individuals under federal and state law. Ultimately, bankruptcy is a complex legal process that should be carefully considered and should not be taken lightly.Do Bankruptcies Show Up on a Background Check?

Employer Background Checks

Tenant Screening

Lender Background Checks

Bankruptcy Check Companies

What Shows up on a Background Check?

Credit Reports

Criminal Records

Employment History

Education History

Social Media Profiles

Why Do Background Checks Include Bankruptcies?

Evaluating Financial Responsibility

Protecting Against Fraud

Assessing Risk

How Long Do Bankruptcies Stay on Record?

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Public Records

Conclusion

Do Bankruptcies Show Up on Background Checks? FAQs

Bankruptcies may be included in background checks conducted by employers, lenders, or landlords. However, the inclusion of bankruptcies depends on the type of background check being conducted and the specific requirements of the organization.

A Chapter 7 bankruptcy remains on an individual's credit report for up to ten years from the date of filing, while a Chapter 13 bankruptcy remains on the report for up to seven years from the date of filing.

No, employers are not allowed to discriminate against applicants based on their bankruptcy status. However, employers may use bankruptcy status as a factor in their hiring decisions if it is relevant to the job.

Landlords may include bankruptcies in their tenant screening process, but they must comply with federal and state fair housing laws, which prohibit discrimination based on bankruptcy status.

Lenders may view bankruptcy as a risk factor and may be hesitant to lend money to individuals who have filed for bankruptcy in the past. However, each lender has its own policies and criteria for evaluating loan applications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.