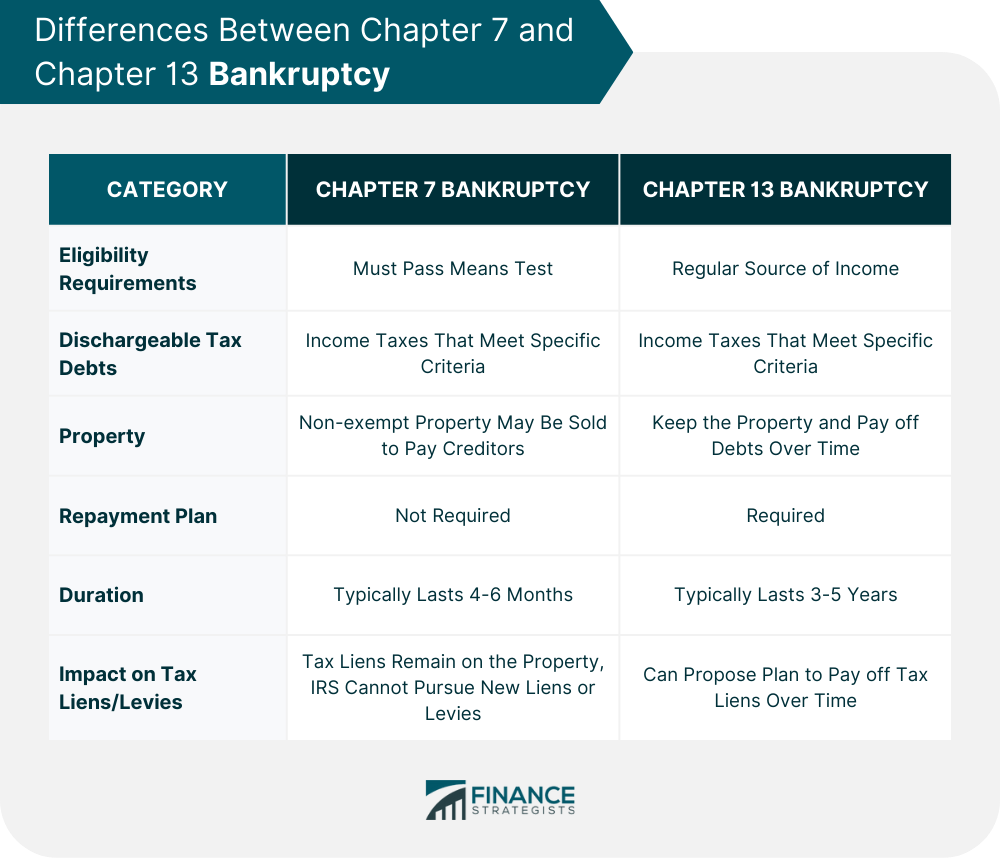

Bankruptcy is a legal process that allows individuals and businesses to discharge their debts and start anew. There are different types of bankruptcy, including Chapter 7 and Chapter 13. Chapter 7 bankruptcy is a liquidation process, while Chapter 13 bankruptcy is a reorganization process. Tax debt, on the other hand, is the amount of money that an individual or business owes to the government in unpaid taxes. There are different types of tax debts, including income taxes, payroll taxes, and sales taxes. Income taxes are the most common type of tax debt that individuals and businesses owe to the IRS. Yes, it is possible to file for bankruptcy on tax debts owed to the IRS. Bankruptcy can provide individuals or businesses with relief from their tax debts by either discharging the debts or creating a payment plan to pay off the debts over time. However, not all tax debts can be discharged in bankruptcy, and there are certain requirements that must be met in order to file for bankruptcy on the IRS. Not everyone is eligible for bankruptcy. To be eligible for bankruptcy, you must meet certain requirements. For Chapter 7 bankruptcy, you must pass the means test, which is a calculation that determines whether your income is below the median income in your state. If your income is above the median income, you may still be eligible for Chapter 7 bankruptcy if you pass the second part of the means test. For Chapter 13 bankruptcy, there is no means test, but you must have a regular source of income to be eligible. Chapter 7 bankruptcy is a liquidation process that allows individuals and businesses to discharge their debts and start anew. In Chapter 7 bankruptcy, a trustee is appointed to liquidate the debtor's assets and distribute the proceeds to the creditors. The debtor's debts are then discharged, and the debtor can start anew. In Chapter 7 bankruptcy, the income tax debt can be discharged if it meets the criteria that has been previously mentioned. However, if the IRS has placed a tax lien on the debtor's property, the lien will remain after the bankruptcy. The lien will attach to any property that the debtor acquires after the bankruptcy. Chapter 7 bankruptcy also does not stop the IRS from pursuing any tax liens or levies that were in place before the bankruptcy. The IRS can still garnish the debtor's wages or levy the debtor's bank account after the bankruptcy. Chapter 13 bankruptcy is a reorganization process that allows individuals to keep their property and pay off their debts over a three to five-year period. In Chapter 13 bankruptcy, the debtor proposes a repayment plan to the court, which outlines how they will pay off their debts. The debtor makes payments to a trustee, who then distributes the payments to the creditors. In Chapter 13 bankruptcy, the income tax debt can also be discharged if it meets the criteria mentioned earlier. However, the debtor must include the tax debt in their repayment plan and make payments on it. The repayment plan can last for three to five years, depending on the debtor's income and expenses. Chapter 13 bankruptcy can be a good option for individuals who want to keep their property and pay off their debts over time. It can also help individuals who have fallen behind on their mortgage payments or car payments. In Chapter 13 bankruptcy, the debtor can propose a plan to catch up on their missed payments and keep their property. Tax liens and levies are two tools that the IRS can use to collect unpaid tax debts. A tax lien is a legal claim against the debtor's property, while a tax levy is a legal seizure of the debtor's property to satisfy the tax debt. The IRS can place a tax lien or levy on the debtor's property if they have unpaid tax debts. Bankruptcy can have an impact on tax liens and levies. In Chapter 7 bankruptcy, tax liens will remain on the debtor's property, but the IRS cannot pursue any new liens or levies. In Chapter 13 bankruptcy, the debtor can propose a plan to pay off the tax liens over time. Bankruptcy is not the only option for individuals who have tax debt. There are other alternatives that individuals can explore, such as: Offers in Compromise - An offer in compromise is an agreement between the taxpayer and the IRS to settle the tax debt for less than the full amount owed. Installment Agreements - An installment agreement is a payment plan that allows the taxpayer to pay off the tax debt over time. Currently Not Collectible Status - Currently not collectible status is a temporary relief for taxpayers who are experiencing financial hardship. The IRS will stop collection activity on the tax debt, but the debt will still accrue interest and penalties. It is possible to file bankruptcy on a tax debt, but it depends on the type of tax debt and how old it is. Income tax debts that are more than three years old can be discharged in bankruptcy if they meet certain criteria. Chapter 7 bankruptcy and Chapter 13 bankruptcy are two options for individuals who have tax debt, but there are also alternatives that individuals can explore. It is important to seek professional advice before making any decisions about bankruptcy or tax debt. A qualified bankruptcy attorney or tax professional can help individuals understand their options and make informed decisions about their financial future.Understanding Bankruptcy and Tax Debt

Can You File Bankruptcy on the IRS?

Eligibility for Bankruptcy

Chapter 7 Bankruptcy on the IRS

Chapter 13 Bankruptcy on the IRS

Tax Liens and Levies

Alternatives to Bankruptcy

Final Thoughts

Can You File Bankruptcy on the IRS? FAQs

No, not all tax debt can be discharged in bankruptcy. Income tax debts that are more than three years old can be discharged if they meet certain criteria, but payroll taxes and sales taxes cannot be discharged in bankruptcy.

Filing bankruptcy can stop the IRS from pursuing any new tax liens or levies, but it may not stop them from pursuing liens or levies that were in place before the bankruptcy.

Not necessarily. In Chapter 7 bankruptcy, the trustee may liquidate some of the debtor's property to pay off their debts, but there are exemptions that protect certain types of property. In Chapter 13 bankruptcy, the debtor can keep their property and pay off their debts over time.

No, you cannot file bankruptcy on a tax debt if you haven't filed your tax returns. It is important to file your tax returns, even if you cannot pay the full amount owed.

Bankruptcy can stay on your credit report for up to ten years. However, the impact of bankruptcy on your credit score will decrease over time, and you may be able to rebuild your credit with responsible financial behavior.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.