A bank account levy by the IRS is a direct seizure of funds from your bank account to cover unpaid tax liabilities. It differs from a wage garnishment, another collection method where a certain percentage of your income is sent to the IRS. In the case of a bank account levy, the IRS can take the full amount or a substantial portion of your bank balance, leaving you in a precarious financial situation. The fundamental purpose of an IRS bank account levy is to enforce tax laws and collect outstanding tax debts. It represents a severe step taken when taxpayers have ignored several previous attempts to collect the debt, including mailed tax bills and notices. Although it can result in financial hardship for individuals, the existence of such a tool underlines the importance of tax compliance for the overall functioning of our tax system and societal infrastructure. Before placing a levy, the IRS must provide you with a written notice and a waiting period. The IRS usually sends several bills titled "Notice and Demand for Payment" before levying your bank account. If you don't pay the bill, eventually, you'll receive a "Final Notice of Intent to Levy" and a "Notice of Your Right to A Hearing" at least 30 days before the levy. This period allows you to explore potential solutions to your tax problem or to seek professional help. When the IRS imposes a levy on your bank account, the procedure is fairly straightforward. Your bank must hold funds you had in your account on the day of the levy for 21 days. This holding period allows time to resolve any disputes or issues with the IRS. After 21 days, unless the IRS or taxpayer has instructed otherwise, the bank must send the money plus interest, if applicable, to the IRS. A levy on your bank account is a one-time event, and its impact is based on the balance in your account at the time the levy is issued. The IRS only seizes the amount present in your account on that day. Future deposits are not affected unless the IRS issues another bank account levy. This allows you to continue using your bank account for future deposits and transactions, although you might still be dealing with the financial repercussions of the levy. Before an IRS bank account levy occurs, a federal tax lien is typically in place. This lien is the government's legal claim against your property when you neglect or fail to pay a tax debt. The lien comes into effect automatically when you don't fully pay a tax debt within ten days after the IRS makes a tax assessment. It serves as a preliminary step, paving the way for potential future enforcement actions, including levies. The IRS follows a stringent, lawful procedure before issuing a levy. They first assess the tax and send a tax bill to the taxpayer. If the taxpayer neglects or refuses to pay the tax, the IRS issues a Final Notice of Intent to Levy and Notice of Your Right to A Hearing. This notice is sent at least 30 days before the levy, providing the taxpayer with an opportunity to either pay the outstanding amount or arrange for an alternative resolution. Despite the potential severity of an IRS bank account levy, taxpayers retain a set of rights and protections under the Taxpayer Bill of Rights. These rights include the right to be informed, the right to quality service, and the right to challenge the IRS's position and be heard. If you believe the levy is unjust or incorrect, you can file an appeal to contest it, offering a potential avenue for the resolution or modification of your tax debt. When the IRS levies your bank account, you may face immediate financial hardship. Your bank is obligated to freeze the funds in your account, which may make it impossible for you to access your money. This situation can leave you unable to meet your basic living expenses or to pay other bills, creating a cascade of financial difficulties. While the IRS does not directly report your tax debt to credit bureaus, a levy by the IRS can still indirectly impact your credit score. For example, if a levy leaves you unable to pay your bills and those unpaid debts end up on your credit report, your credit score might take a significant hit. This could make it more challenging for you to secure loans or credit in the future. Upon receiving the final notice of intent to levy, you should act quickly. Contact the IRS immediately to discuss your situation and explore potential alternatives. These could include setting up an installment agreement, making an offer in compromise, or demonstrating that the levy creates an immediate economic hardship. Taking action during the 30-day window after receiving the final notice can potentially prevent the levy from going into effect. Dealing with an IRS bank account levy can be a complex and daunting task. For this reason, seeking help from tax professionals, like a tax attorney or a certified public accountant (CPA), can be beneficial. These experts can guide you through the intricacies of the levy process, help you understand your rights, and represent you in dealings with the IRS. They can also provide advice on the best course of action for your specific situation. If you disagree with the IRS's decision, you have the right to file an appeal. The appeal must be filed within 30 days of the final notice. A successful appeal could lead to the release of your levy and help you set up alternative payment methods. It can also provide an opportunity to reevaluate your tax debt, potentially uncovering errors or new information that might reduce the amount you owe. The most effective strategy to prevent an IRS bank account levy is to promptly pay your taxes in full and on time. If you're unable to do this, make sure to contact the IRS to discuss potential payment plans or other alternatives. Taking action as soon as you receive a notice from the IRS can help you avoid escalating enforcement measures like a bank account levy. If you're already facing a bank account levy, there are several resolution strategies. These can include setting up a payment plan with the IRS, applying for a compromise offer, or showing that the levy causes significant hardship. If you've been levied and the situation results in financial hardship, the IRS Taxpayer Advocate Service might be able to intervene on your behalf. An IRS bank account levy, used to enforce tax laws and recoup unpaid taxes, can have severe financial implications for individuals, making it vital to understand its mechanics and legal framework. Key protective measures include prompt payment of taxes and proactive engagement with IRS notices. Should a levy notice arrive, swift action, including contacting the IRS or a tax professional, can potentially avert the levy. Also, taxpayers retain the right to challenge levies and seek alternative resolutions, underpinning the importance of understanding your rights and available options. In the event of hardship, assistance programs exist to offer some relief. Therefore, while an IRS bank account levy is an extreme measure with substantial consequences, informed action and professional guidance can lead to manageable outcomes. Finally, don't overlook the importance of a reliable banking partner. Seek personalized banking services that support your financial stability and goals in both calm and challenging times.What Is an IRS Bank Account Levy?

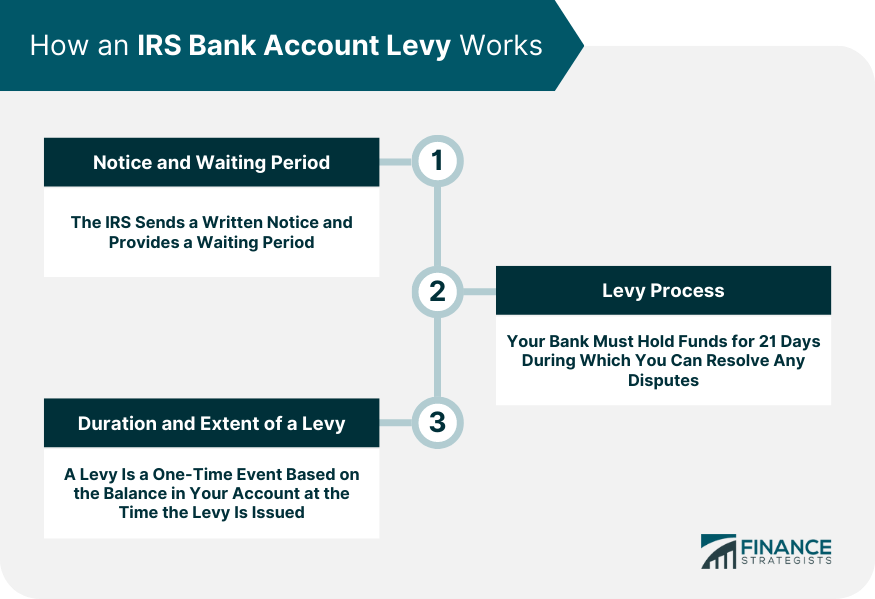

How an IRS Bank Account Levy Works

Notice and Waiting Period

Levy Process

Duration and Extent of a Levy

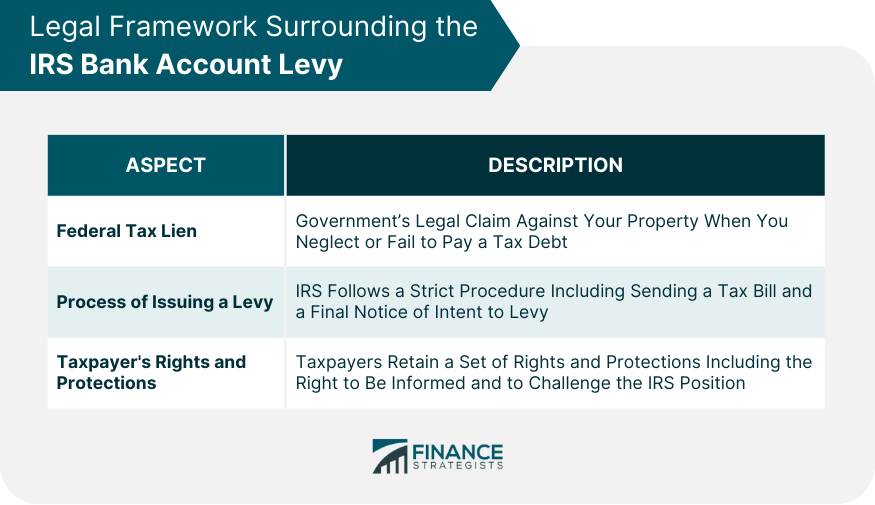

Legal Framework Surrounding the IRS Bank Account Levy

Federal Tax Lien

Process of Issuing a Levy

Taxpayer's Rights and Protections

Impact of an IRS Bank Account Levy on the Taxpayer

Financial Consequences

Credit Score Implications

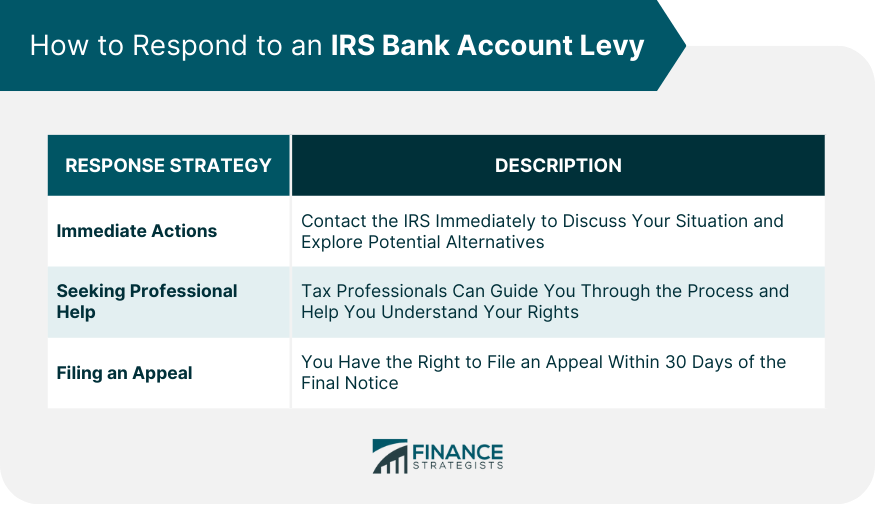

How to Respond to an IRS Bank Account Levy

Immediate Actions

Seeking Professional Help

Filing an Appeal

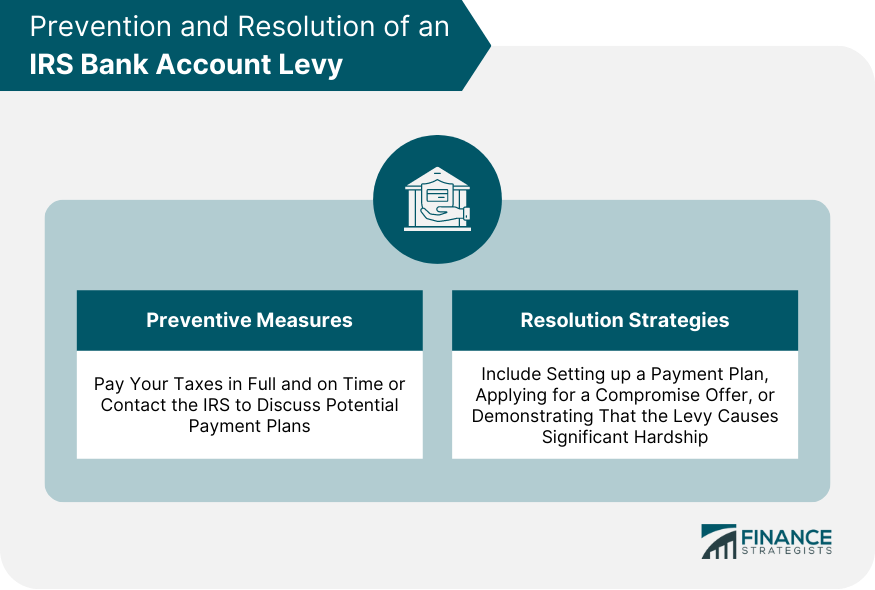

Prevention and Resolution of an IRS Bank Account Levy

Preventive Measures

Resolution Strategies

Final Thoughts

IRS Bank Account Levy FAQs

An IRS bank account levy is a legal seizure of your property, specifically bank accounts, by the IRS to cover unpaid tax liabilities.

The IRS sends multiple notices to the taxpayer. If unresolved, a Final Notice of Intent to Levy is issued. Post 30 days, if no action is taken, a levy is placed.

Although the IRS doesn't directly report your tax debt to credit bureaus, a levy can indirectly impact your credit score if it leads to unpaid bills.

Upon receiving a levy notice, immediately contact the IRS to discuss your situation. Consider seeking professional help or filing an appeal if you disagree.

To prevent a levy, promptly pay your taxes in full. If you're unable to do so, contact the IRS to discuss potential payment plans or other alternatives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.