Yes, it is possible to buy a house after bankruptcy. Although bankruptcy can have an impact on your creditworthiness and mortgage options, there are processes and strategies to help you achieve homeownership. Rebuilding credit, saving for a down payment, exploring alternative mortgage options, and working with professionals such as credit repair agencies, mortgage brokers, and real estate agents are crucial steps in this journey. Bankruptcy can have profound implications on your financial situation, especially your creditworthiness. By taking proactive measures and seeking expert guidance, individuals can overcome the challenges posed by bankruptcy and realize their goal of purchasing a house. Bankruptcy significantly impacts a person's credit score, and a lower credit score often means higher interest rates when borrowing money. It's worth noting that the impact of bankruptcy on a person's credit score lessens over time, particularly if they demonstrate responsible credit behavior. Lenders view bankrupt individuals as high-risk borrowers, thus making it harder to qualify for a mortgage loan. However, not all hope is lost. There are loan programs designed specifically for people with a bankruptcy in their credit history. For conventional loans, the standard waiting period after bankruptcy is typically four years. This period starts from the discharge or dismissal date of the bankruptcy. However, this duration can vary based on the type of bankruptcy filed and the individual lender's policies. FHA loans, backed by the Federal Housing Administration, are popular among first-time homebuyers and those with less-than-perfect credit. Following a bankruptcy, applicants generally must wait at least two years before they can be eligible for an FHA loan. For veterans and active-duty military personnel, U.S. Department of Veterans Affairs (VA) loans present an opportunity for homeownership even after bankruptcy. The standard waiting period for a VA loan is two years from the discharge or dismissal date of the bankruptcy. After bankruptcy, preparing for homeownership should be a deliberate and methodical process. The first step is to evaluate your finances and set a realistic budget that factors in all homeownership costs, including mortgage payments, property taxes, insurance, and maintenance expenses. Establishing a history of on-time payments, opening a new credit account, and keeping balances low on credit cards can help rebuild credit over time. Remember, patience is key - credit recovery is a process that takes time. A larger down payment can increase your chances of mortgage approval and possibly help you secure a lower interest rate. Start saving early and regularly to accumulate a substantial down payment. Different lenders have different policies, so it's worthwhile to shop around for the best terms. Government-backed loans, such as FHA or VA loans, may have more lenient qualification requirements. Paying all bills on time is a simple yet effective way to rebuild credit. Timely payment demonstrates to lenders that you are responsible and reliable in managing your debts, which can positively impact your credit score. Managing and reducing existing debt is equally important. A lower debt-to-income ratio can enhance your creditworthiness in the eyes of lenders. Aim to pay down debts and avoid taking on new debt as you work towards homeownership. Building a positive credit history requires consistent, responsible financial behavior over time. This includes maintaining low balances on credit cards, not applying for new credit frequently, and managing a diverse mix of credit types responsibly. Secured credit cards and loans can be beneficial in rebuilding credit. These credit products require collateral, typically a cash deposit, which reduces risk for the lender and makes it easier for individuals with a bankruptcy to qualify. Working with a credit repair agency can be another viable option. These agencies specialize in assisting individuals in improving their credit scores, often by disputing errors on credit reports and providing personalized advice. Choosing the right time to buy a house after bankruptcy requires careful consideration. While there are waiting periods after bankruptcy discharge for certain loan types, it's essential to assess one's overall financial stability and readiness for homeownership. It may be beneficial to spend some time rebuilding credit, saving for a down payment, and improving financial habits before taking on the responsibility of homeownership. Assessing affordability and budgeting for homeownership is crucial for homebuyers with a bankruptcy history. It's important to carefully evaluate one's income, expenses, and debt-to-income ratio to determine what is affordable in terms of monthly mortgage payments, property taxes, insurance, and maintenance costs. Creating a realistic budget and ensuring that homeownership fits comfortably within it helps prevent financial strain and potential setbacks in the future. Potential challenges may arise for homebuyers with a bankruptcy history, but they can be overcome with careful planning and perseverance. Some challenges might include higher interest rates, limited loan options, or stricter qualifying criteria. However, by continuing to rebuild credit, maintain stable employment, and demonstrate financial responsibility, homebuyers can improve their prospects and increase their options over time. It's important to stay patient, seek guidance from professionals, and remain proactive in addressing any challenges that may arise along the path to homeownership. Buying a house after bankruptcy is indeed possible, albeit with some considerations and strategic planning. Rebuilding credit, saving for a down payment, exploring alternative mortgage options, and establishing strong relationships with lenders and mortgage professionals are key steps in this process. Despite the impact of bankruptcy on credit scores and the potential challenges faced, individuals can overcome these obstacles through responsible financial behavior and seeking expert guidance. By carefully evaluating affordability, timing the purchase appropriately, and being aware of potential challenges, prospective homebuyers with a bankruptcy history can navigate the path to homeownership successfully. Patience and perseverance are vital, and with the right approach, individuals can achieve their goal of owning a house even after experiencing bankruptcy.Can You Buy a House After Bankruptcy?

Effects of Bankruptcy on Buying a House

Impact on Credit Score

Difficulty in Obtaining a Mortgage

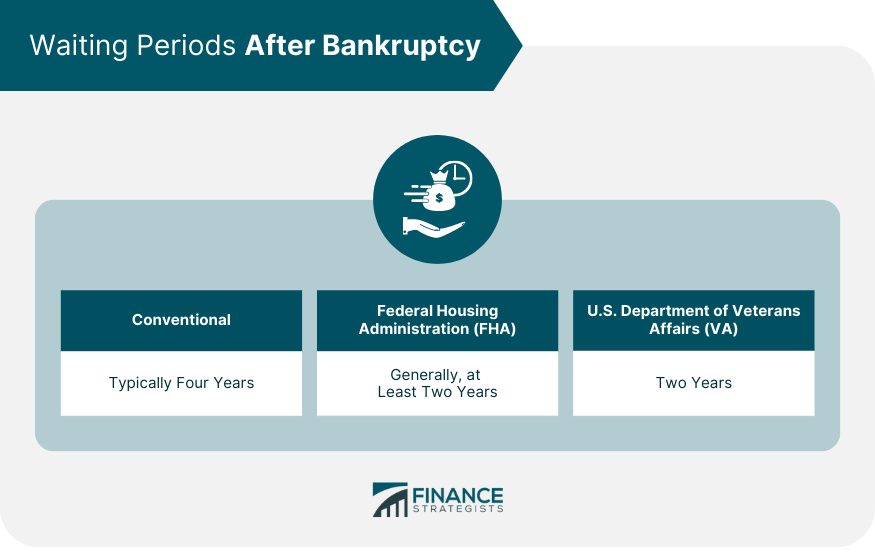

Waiting Periods After Bankruptcy

Conventional Loans

FHA Loans

VA Loans

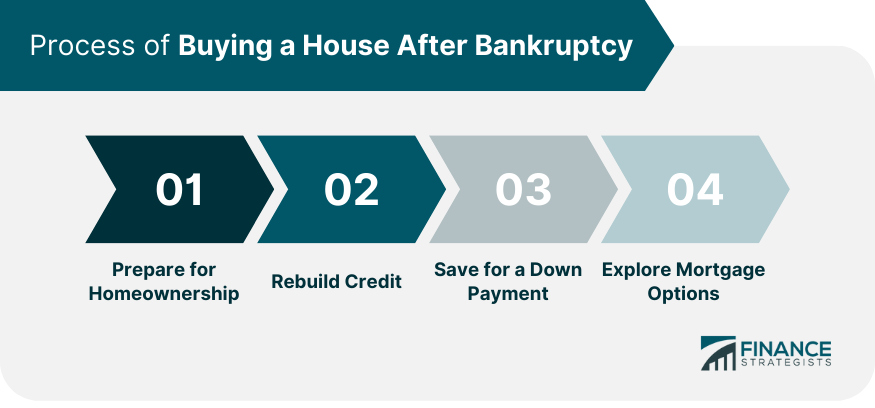

Process of Buying a House After Bankruptcy

Preparing for Homeownership

Rebuilding Credit

Saving for a Down Payment

Exploring Mortgage Options

Rebuilding Credit After Bankruptcy

Paying Bills on Time

Reducing Debt

Building a Positive Credit History

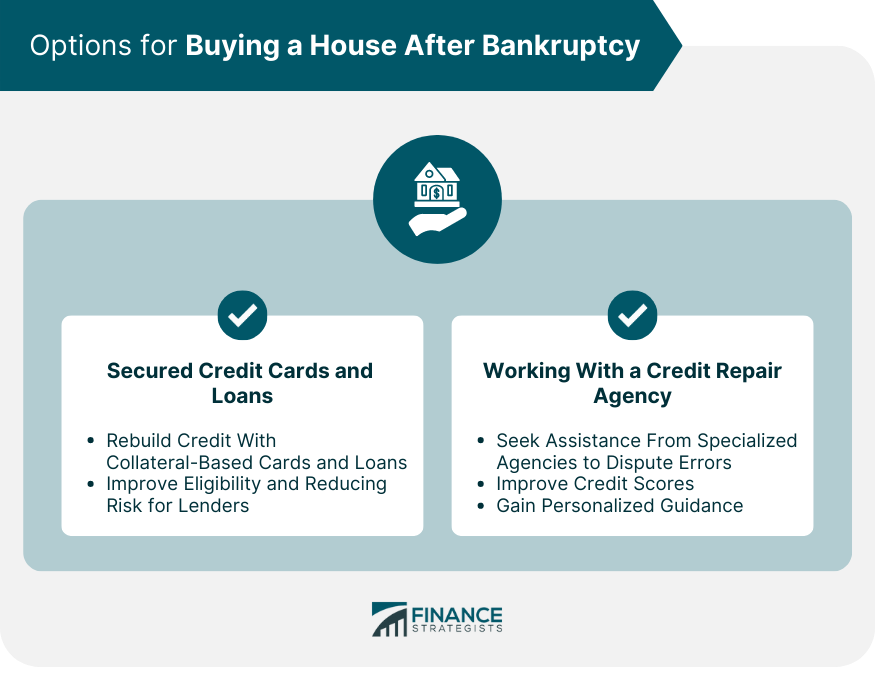

Options for Buying a House After Bankruptcy

Secured Credit Cards and Loans

Working With a Credit Repair Agency

Other Considerations for Homebuyers With Bankruptcy History

Choose the Right Time to Buy a House After Bankruptcy

Assess Affordability and Budget for Homeownership

Consider Potential Challenges

Conclusion

Can You Buy a House After Bankruptcy? FAQs

Yes, but it may be more complex and challenging due to the impact on your credit score and the potential difficulty of obtaining a mortgage.

Waiting periods vary by the type of loan. For conventional loans, it's typically four years. For FHA and VA loans, it's usually two years.

You can rebuild your credit by paying bills on time, reducing debt, and building a positive credit history over time.

Some options include using secured credit cards and loans to rebuild credit and working with a credit repair agency. FHA and VA loans might be more accessible options for obtaining a mortgage.

Yes, it can be more challenging to get a mortgage after bankruptcy due to lenders seeing you as a higher risk. However, with time and a concentrated effort to rebuild your credit, you can increase your chances of mortgage approval.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.