Bankruptcy is a legal process designed to provide individuals or businesses with a fresh start when burdened by overwhelming debt. This process can have implications for car ownership, as it determines whether a person can keep their car or if it will be subject to liquidation to satisfy creditors. You may be able file bankruptcy and keep your car if you can protect the equity in it. If your state allows exemptions of an equity amount greater than that of your car, you may keep it. If the amount your creditors would receive from selling your car, after all associated sales costs, is too little to be worth the effort, they may decide to abandon your car and let you keep it anyway. Exemption laws allow debtors to keep property that the state determines is necessary for them to continue working, up to a certain amount of equity. The value of your car, minus the value of any outstanding loan payments, is its equity. If the equity amount does not cover the full value of your car, you will have to work with the trustee overseeing your case to try and keep it. If your car is worth more than what your state exempts, then when the creditors sell your car, they will give you back the equity that was exempt, and distribute the remaining funds to your creditors. A reaffirmation agreement is a legal contract between a debtor and a creditor that allows the debtor to retain ownership of a particular debt, such as a car loan, even after filing for bankruptcy. By signing a reaffirmation agreement, the debtor agrees to continue being legally obligated to repay the debt according to the original terms and conditions, effectively excluding it from the discharge granted in bankruptcy. Reaffirmation agreements are commonly used in Chapter 7 bankruptcy cases, where the debtor wishes to keep certain secured assets, such as a car, and continue making payments on the loan associated with that asset. The agreement must be voluntarily entered into, typically with the understanding that the debtor can afford the payments and considers it in their best interest to retain the property The automatic stay provision is a fundamental component of bankruptcy law that goes into effect immediately upon filing for bankruptcy. It serves as a powerful tool to protect debtors from creditor collection actions. The automatic stay puts a halt to various actions, such as wage garnishments, foreclosure proceedings, and, importantly, vehicle repossession. When an individual files for bankruptcy, the automatic stay provision prevents creditors from repossessing their vehicle without seeking permission from the bankruptcy court. If a debtor is behind on their car payments or faces the threat of repossession, the automatic stay will temporarily halt any attempts by the creditor to take possession of the vehicle. This provides the debtor with a breathing space and an opportunity to explore options for dealing with their debts, including the possibility of keeping their car through the bankruptcy process. One way to maximize exemptions for car ownership in bankruptcy is by understanding the specific exemption laws in your state. Some states offer higher exemptions for vehicles, allowing debtors to protect more equity in their cars. By consulting with a bankruptcy attorney, you can determine the applicable exemptions and ensure that you take full advantage of them to retain your car during the bankruptcy process. When considering reaffirmation agreements, it is essential to carefully review the terms and assess your financial situation. You should evaluate whether you can comfortably afford the monthly car loan payments after considering your other expenses and financial obligations. If reaffirming the car loan is feasible and aligns with your long-term goals, you can negotiate with the creditor to establish modified terms that may be more manageable during the bankruptcy period. Negotiating with creditors directly can be an effective strategy to retain car ownership. Open communication with your car loan lender is crucial, as they may be willing to work with you to find a solution that allows you to keep the vehicle. You can propose alternative repayment plans, loan modifications, or even negotiate a reduced payoff amount. By demonstrating your commitment to fulfilling your financial obligations, you may be able to reach a mutually beneficial agreement that allows you to retain ownership of your car. However, it's important to keep in mind that not all creditors may be open to negotiation, so exploring other strategies and consulting with a bankruptcy attorney can provide further guidance in such cases. TITLE: Strategies to Retain Car Ownership in Bankruptcy Maximize Exemptions for Car Ownership Reaffirmation Agreements and Car Loans Negotiate With Creditors to Retain Car Ownership The value of the car is determined by its fair market value, which can be obtained through appraisals or online valuation tools. Equity, on the other hand, refers to the difference between the car's value and any outstanding loans or liens against it. Each state has its own set of exemption limits that specify the maximum value of assets, including vehicles, that can be protected from liquidation. These laws vary widely, and it is essential to consult with a bankruptcy attorney or review the statutes of your specific state to determine the exemptions available for car ownership. Many states have specific vehicle exemptions that allow debtors to protect a certain value or equity in their cars during bankruptcy. These exemptions typically have monetary limits or restrictions on the type of vehicle that can be exempted. For example, a state may exempt up to a certain dollar amount of equity in one vehicle per debtor. Filing for bankruptcy does not necessarily mean you will lose your car. Maximizing exemptions is a key approach, as each state has specific exemption laws that determine the amount of equity you can protect in your car. Additionally, considering reaffirmation agreements with car loan creditors allows you to continue making payments on the loan and retain ownership. Negotiating directly with creditors is another valuable strategy, as it can lead to alternative repayment plans or modified terms that enable you to keep your car. Determining the exempt status of your car involves assessing its value and equity while being aware of state-specific exemption laws. By utilizing these strategies and seeking professional guidance, you can navigate bankruptcy while preserving car ownership.Overview of Cars and Bankruptcy

How to Declare Bankruptcy and Keep Your Car

Agreement and Provisions in Keeping a Car in Bankruptcy

Reaffirmation Agreement

The Automatic Stay Provision

Strategies to Retain Car Ownership in Bankruptcy

Maximizing Exemptions for Car Ownership

Reaffirmation Agreements and Car Loans

Negotiating With Creditors to Retain Car Ownership

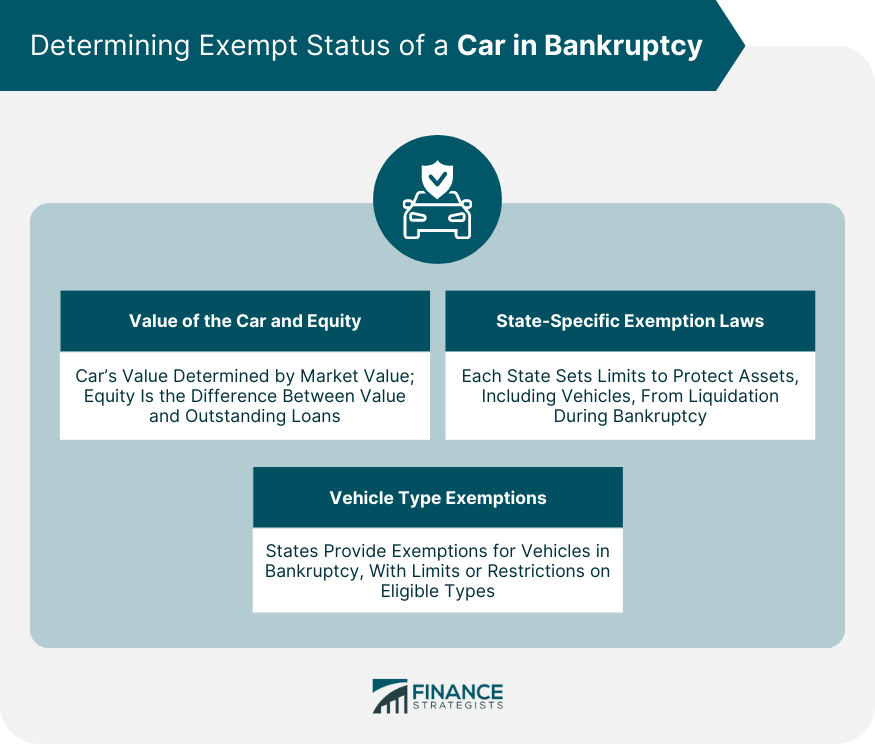

Determining the Exempt Status of a Car

Value of the Car and Equity

State-Specific Exemption Laws

Vehicle Type Exemptions

Conclusion

Can I Keep My Car if I File Bankruptcy? FAQs

Yes, it is usually possible to keep your car when filing bankruptcy as long as the value of the vehicle is within certain limits and you are current on your payments.

During the course of a bankruptcy case, creditors will be provided with a list of all assets owned by the debtor, which includes vehicles. This information is obtained from documents such as title registrations and loan records.

If the fair market value of your vehicle exceeds the state exemption limit, then you may have to surrender the vehicle. However, you may be able to use an exemption or pay the creditor additional funds to keep the car.

Yes, it is possible to purchase a new vehicle during bankruptcy proceedings. However, you will need to obtain permission from the court in order to do so and you will likely have to provide proof of income and other financial documents in order to receive authorization.

In order to protect your car when filing for bankruptcy, you should make sure that its value does not exceed any state exemption limits and that your payments are current at all times. Additionally, since creditors can access documents such as title registrations and loan records, you should keep these updated to ensure that your assets are accurately reflected in the bankruptcy case.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.