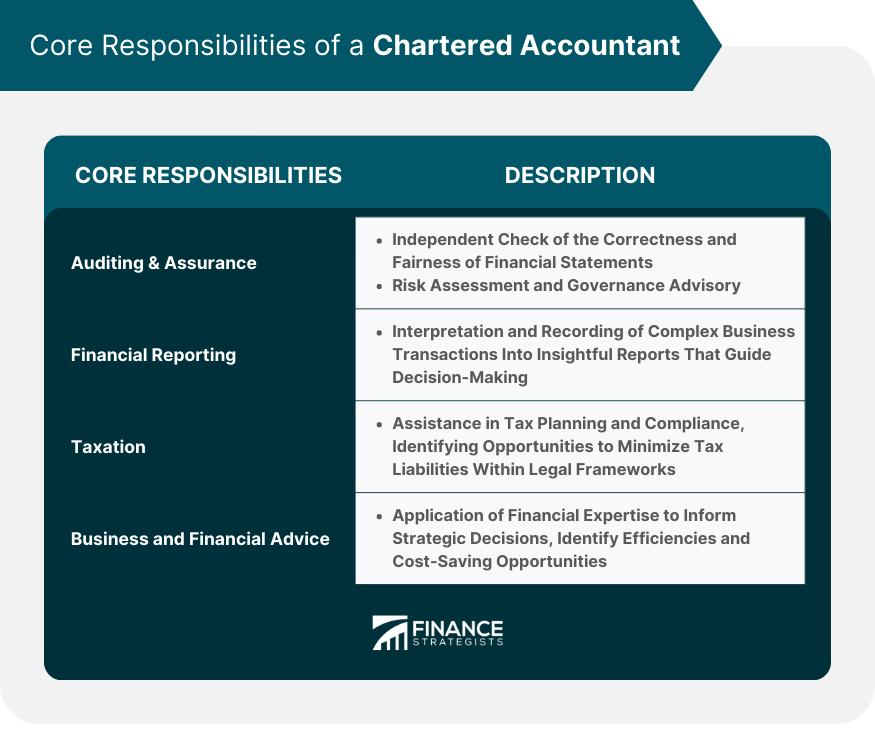

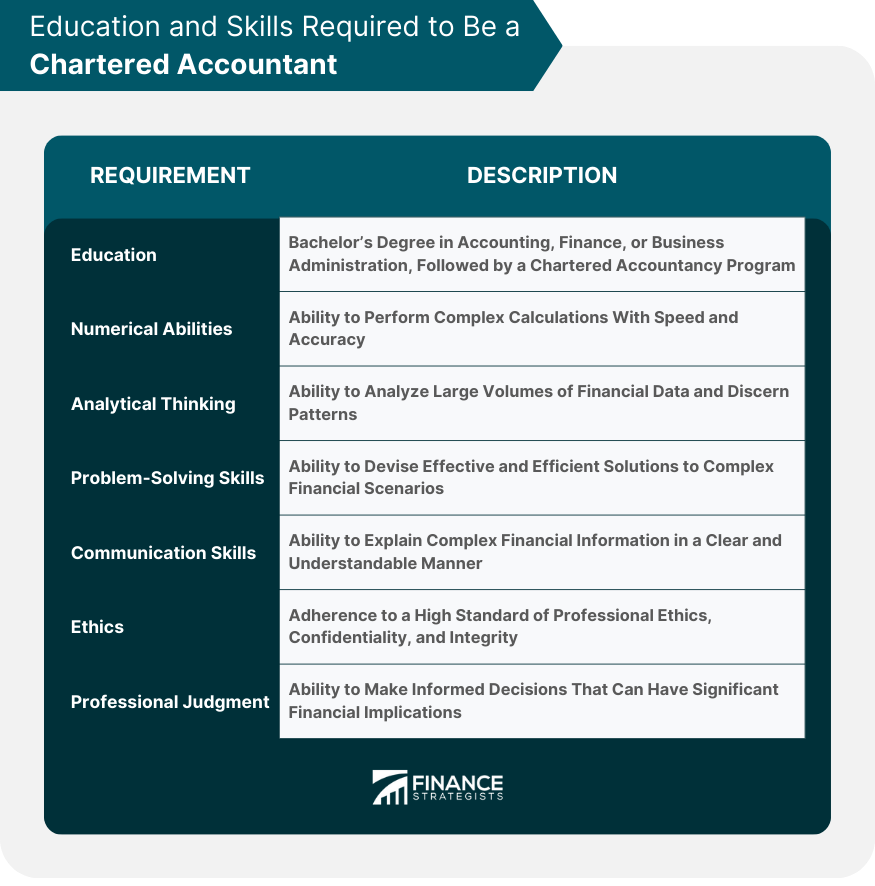

A Chartered Accountant (CA) is a high-ranking professional in the field of accountancy, highly esteemed and acknowledged for their comprehensive knowledge and practical experience. To earn the designation, a candidate must pass rigorous academic and professional examinations, acquire relevant experience, and commit to a code of professional ethics. The CA designation is globally recognized, highlighting the professional's expertise in areas such as auditing, taxation, financial reporting, and business advice. They are integral to the smooth functioning of organizations, offering strategic insights and ensuring compliance with financial regulations. CAs play a pivotal role in shaping business decisions and driving financial strategies. Their extensive training and practical understanding make them indispensable in corporate finance, business planning, and management. Chartered Accountants are trusted with the financial health of an organization. Their primary responsibilities revolve around auditing & assurance, financial reporting, taxation, and offering business and financial advice. An integral part of a Chartered Accountant's role is auditing – an independent check on the correctness and fairness of financial statements. The CA examines company records and operations, verifying their accuracy and compliance with laws and regulations. This due diligence builds confidence among stakeholders, particularly investors and regulators. Assurance services extend beyond traditional auditing. These may include risk assessment, governance advisory, and assurance on information systems. In providing these services, Chartered Accountants contribute to enhancing the transparency, reliability, and integrity of financial information. A fundamental duty of Chartered Accountants is financial reporting. They interpret and record complex business transactions, converting data into insightful reports. These financial reports provide a clear picture of a company's financial health, guiding management and stakeholders in decision-making. Financial reports prepared by Chartered Accountants have far-reaching impacts. They not only influence strategic decisions within the company but also affect investor perception, credit ratings, and even the company's stock price. Accurate and timely reporting is therefore vital, with Chartered Accountants playing a pivotal role. The ever-evolving landscape of taxation laws makes it challenging for businesses to ensure compliance and optimize their tax position. Chartered Accountants, with their extensive knowledge of tax legislation, bridge this gap. They assist in tax planning, identifying opportunities to minimize tax liabilities within the legal framework. Chartered Accountants also ensure that businesses fulfill their tax obligations timely, thereby avoiding penalties and legal repercussions. The value of their role in taxation cannot be overstated, as they help businesses navigate the complexities of tax laws, resulting in substantial monetary and time savings. As trusted advisers, Chartered Accountants play an essential role in the strategic planning process. They apply their financial expertise to forecast trends, analyze business performance, and provide insights that inform decision-making. Furthermore, Chartered Accountants contribute to profit growth by identifying efficiency improvements and cost-saving opportunities. They assess operational performance, recommend budget controls, and help businesses manage their finances effectively. Their role in business planning, profit growth, and cost management is indispensable to the sustained success of any organization. Being a Chartered Accountant requires more than just a knack for numbers; it's a profession that demands a robust educational foundation, exhaustive professional training, and a diverse set of skills. The journey to becoming a Chartered Accountant begins with a solid academic foundation. Most aspiring Chartered Accountants start by earning a bachelor's degree in fields such as Accounting, Finance, or Business Administration. This foundational education helps to develop basic accounting and business knowledge. After the completion of their undergraduate degree, aspiring Chartered Accountants enter into a Chartered Accountancy program, which is typically offered by professional accountancy bodies in each respective country. The Chartered Accountancy program is rigorous and comprehensive, encompassing advanced topics in accounting, auditing, taxation, and business law. These programs also include challenging examinations that are designed to test the in-depth knowledge and application skills of the candidates. Upon passing these examinations, the candidates are required to gain practical experience, typically ranging from three to five years, under the mentorship of a qualified Chartered Accountant. This professional experience is a critical component of the journey, as it offers real-world exposure to accounting practices and business environments. Becoming a Chartered Accountant is not solely about acquiring academic credentials; it's also about developing a diverse skill set. Numerical Abilities: Given the nature of their work, Chartered Accountants must have excellent numerical abilities. They must be able to perform complex calculations with speed and accuracy and have a good understanding of financial metrics and measures. Analytical Thinking: Chartered Accountants need to analyze large volumes of financial data and discern patterns, trends, and insights. This requires strong analytical thinking skills and attention to detail. Problem-Solving Skills: Chartered Accountants often encounter complex financial scenarios and must devise effective and efficient solutions. This requires excellent problem-solving skills. Communication Skills: Despite the technical nature of their work, Chartered Accountants must also have strong communication skills. They need to explain complex financial information to stakeholders in a clear and understandable manner. Ethics: Chartered Accountants are expected to adhere to a high standard of professional ethics. They deal with sensitive financial information and are expected to maintain confidentiality and act with integrity. Professional Judgment: Chartered Accountants need to make informed decisions that can have significant financial implications. This requires sound professional judgment, which is developed through education, training, and experience. In addition to these skills, a successful Chartered Accountant must continually update their knowledge and skills to stay abreast with the latest developments in finance, taxation laws, and corporate governance. This commitment to continuous learning and professional development is a hallmark of the profession. Both Chartered Accountants and Certified Public Accountants are trusted finance professionals, recognized for their high level of expertise in accounting and financial management. However, while there is a significant overlap in their roles, there are differences that stem from their training, geographical recognition, and specialization. Chartered Accountants often have a broader, more global perspective, which is mirrored in the nature of their work. They are trained extensively in all areas of business and finance, including corporate finance, audit and assurance, taxation, and financial reporting. This broad base of knowledge allows them to take on various roles within a business or consultancy environment, from auditing to strategic advisory. In addition, CAs often play a significant role in strategic decision-making processes, providing valuable input on matters such as tax planning, business forecasting, and risk assessment. Because of their international recognition, CAs are also often engaged in cross-border financial transactions and business operations, providing a global viewpoint to financial management. While CPAs are also highly skilled professionals, their training and recognition are primarily focused on American GAAP (Generally Accepted Accounting Principles) and U.S. taxation laws. This means that CPAs are often more specialized in their knowledge, with a deeper understanding of specific areas of finance and accountancy as it pertains to the U.S. context. CPAs are heavily involved in compliance audits, ensuring that businesses adhere to the financial reporting standards as stipulated by U.S. regulatory bodies. They also have a key role in U.S. tax planning and filing, assisting businesses and individuals with navigating the complex American tax system. CPAs can also provide consulting and advisory services, although these may often be more U.S.-centric due to their focused training. CAs are critical pillars in the realm of accountancy, tasked with responsibilities ranging from auditing to strategic business advice. Their role is underpinned by rigorous academic and professional training, fostering a diverse skill set including strong numerical abilities, analytical thinking, and sound professional judgment. The role of CAs is ever-evolving, demanding a commitment to lifelong learning to keep pace with updates in finance, taxation laws, and corporate governance. A comparative understanding of Certified Public Accountants illustrates the variations in roles and practices within the field of accountancy. Ultimately, Chartered Accountants serve a pivotal function in shaping financial strategies, ensuring fiscal integrity, and steering businesses towards success. Their expertise extends beyond mere numbers, making them strategic advisors, ethical watchdogs, and indispensable contributors to the business and financial world.What Is a Chartered Accountant?

Core Responsibilities of a Chartered Accountant

Auditing & Assurance

Financial Reporting

Taxation

Business and Financial Advice

Education and Skills Required to Be a Chartered Accountant

Educational Path

Essential Skills

Chartered Accountant (CA) vs Certified Public Accountant (CPA)

Role of Chartered Accountants (CAs)

Role of Certified Public Accountants (CPAs)

The Bottom Line

What Does a Chartered Accountant Do? FAQs

A Chartered Accountant is responsible for auditing & assurance, financial reporting, taxation, and offering strategic business and financial advice.

A Chartered Accountant undergoes rigorous academic and professional training, including a bachelor's degree and a specialized Chartered Accountancy program.

Skills for a Chartered Accountant range from numerical abilities, analytical thinking, problem-solving, communication, ethics, to professional judgment.

Both are finance professionals, but their roles differ due to their training, with CAs having a broader, global perspective, and CPAs focusing on American GAAP and U.S. taxation laws.

Chartered Accountants provide strategic business and financial advice, contribute to profit growth, and help businesses make sound financial decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.