Accounting is a crucial aspect of every business, and different roles within the field carry out unique functions. Two of these roles, the General Accountant and the Staff Accountant, are pivotal in maintaining the financial health of an organization. However, their responsibilities, qualifications, and paths differ significantly, providing unique contributions to the overall financial operations. A General Accountant typically oversees a broad range of accounting activities, from financial statement preparation to tax filing, making strategic decisions based on their analysis of the financial data. They often have a comprehensive understanding of the business's overall financial health and are involved in key decision-making processes. On the other hand, a Staff Accountant often has a more focused role, working on specific tasks such as accounts payable, receivables, and payroll, providing vital support to the accounting department. A General Accountant, often referred to as a full-charge accountant, bears a broader range of responsibilities compared to other types of accountants. They handle all the financial matters of a company, which can include preparing financial statements, managing accounts payable and receivable, processing payroll, and ensuring compliance with regulatory requirements. General Accountants are also expected to participate in budgeting processes, perform financial forecasting, and analyze the organization's financial performance. They're typically the go-to personnel for matters involving the company's overall financial condition and strategy. A successful General Accountant needs a robust set of skills. They must have excellent numerical and analytical abilities, a comprehensive understanding of financial regulations and principles, and a keen eye for detail. Proficiency in using accounting software is also a must. In addition to these technical skills, a General Accountant must also demonstrate strong interpersonal and communication skills, given their frequent interactions with various business departments and stakeholders. The path to becoming a General Accountant usually starts with earning a bachelor's degree in accounting, finance, or a related field. This education is followed by gaining relevant work experience, often in entry-level roles such as a Junior Accountant or an Accounts Assistant. Aspiring General Accountants also often pursue professional certifications, like the Certified Public Accountant (CPA) designation, to boost their career prospects. From there, they may gradually advance to more senior positions, such as a Financial Controller or even Chief Financial Officer (CFO). A Staff Accountant, on the other hand, has a more specialized role. While their responsibilities can vary depending on the organization, their primary duty usually involves maintaining financial reports, records, and general ledgers, as well as preparing and analyzing budgets. Staff Accountants also perform general bookkeeping, process payroll, and manage accounts payable and receivable. They're often responsible for reconciling accounts, assisting with year-end closings, and supporting the auditing process. Similar to a General Accountant, a Staff Accountant needs strong numerical and analytical skills, attention to detail, and proficiency in accounting software. They must also understand basic accounting principles and be able to adhere to accounting procedures and controls. Good communication and organizational skills are vital as well, as they often work closely with other departments and need to manage multiple tasks concurrently. Becoming a Staff Accountant typically requires a bachelor's degree in accounting or a related field. Entry-level positions or internships provide the initial experience that's often a prerequisite for Staff Accountant roles. Over time, with experience and potentially further education or certifications, a Staff Accountant may advance to roles such as a Senior Staff Accountant, Accounting Manager, or even a General Accountant. While both General and Staff Accountants handle financial reporting and account management, their scope of work varies significantly. A General Accountant has a more comprehensive role, dealing with the company's overall financial health. They are often a part of strategic planning and decision-making processes. In contrast, a Staff Accountant's work is more specialized and usually revolves around maintaining financial records, processing transactions, and supporting audit processes. They may focus on particular areas, such as accounts receivable, accounts payable, or payroll, providing in-depth expertise in these areas. The education and qualification requirements for these two roles can also differ. While both roles typically require a bachelor's degree in accounting or a related field, a General Accountant often needs additional qualifications or certifications, such as a CPA designation, due to the complexity and responsibility of their role. On the other hand, a Staff Accountant's position might not always require such advanced qualifications. However, further education or certifications can help with career progression and open up opportunities for higher responsibilities within the organization. Given the broader responsibilities and higher qualifications, General Accountants often command a higher salary compared to Staff Accountants. According to the latest available data from the U.S. Bureau of Labor Statistics, the median salary for accountants was $77,250 per year. However, salaries can vary significantly depending on the specific role, the individual's qualifications, the industry, and the geographic location. It's essential to note that these figures can increase with experience, advanced education, and professional certifications. Despite their differences, General and Staff Accountants share a number of essential skills and areas of knowledge. Both roles require strong analytical and numerical skills, proficiency in accounting software, and an in-depth understanding of accounting principles and financial regulations. In addition, both General and Staff Accountants must demonstrate attention to detail and excellent organizational skills, given the critical nature of their tasks. Good communication skills are also crucial, as both roles require effective interaction with various departments within a company. General and Staff Accountants play critical roles in business operations. Both positions contribute significantly to maintaining the financial health of an organization. They ensure the accuracy of financial records and compliance with regulations and assist in strategic decision-making processes. Without the skills and expertise of both General and Staff Accountants, a company could face serious financial mismanagement issues. In a corporate setting, a General Accountant may oversee all financial activities, including financial planning, budgeting, and forecasting. They might also prepare detailed financial reports for top management and stakeholders, highlighting the company's financial performance and providing insights for strategic decision-making. In addition, they might liaise with external auditors and ensure the company's compliance with financial regulations and tax obligations. Conversely, a Staff Accountant in a corporation might focus on specific areas like processing accounts payable and receivable, payroll, or maintaining the general ledger. They may also assist in preparing budgets and contribute to financial audits. Their role is more operational, ensuring the smooth running of daily financial activities within the company. Although their roles differ, a General Accountant and a Staff Accountant often need to collaborate closely in a corporate environment. For instance, a Staff Accountant might prepare preliminary financial reports or records, which a General Accountant then reviews and uses to develop comprehensive financial statements or strategic recommendations. Choosing between a General Accountant and a Staff Accountant for your business involves several considerations. These include the size and nature of your business, the complexity of your financial operations, and your specific accounting needs. For example, a small business with straightforward financial activities might only need a Staff Accountant, while a large corporation with complex operations might require the skills of a General Accountant. Consider hiring a General Accountant if your business requires a professional who can handle a wide range of financial tasks, participate in strategic planning, and provide financial insights for decision-making. General Accountants are also preferable if you need someone to oversee other accounting staff or if you need to ensure compliance with complex financial regulations. On the other hand, a Staff Accountant may be the better choice if your business needs are more specific, such as managing payables and receivables, processing payroll, or maintaining financial records. They're ideal for businesses that require operational support for daily financial tasks and basic financial reporting. A General Accountant and a Staff Accountant, while sharing common skill sets and knowledge areas, play distinct roles within an organization. The former has a broader scope of work, covering the entire financial health of a company, while the latter focuses on operational accounting tasks. Despite these differences, both are pivotal for the smooth functioning of a business's financial operations. Comprehending the nuances between different accounting roles is paramount for any business. It empowers businesses to make informed hiring decisions based on their specific needs, thereby leading to more efficient financial management. Understanding whether a General Accountant's strategic oversight or a Staff Accountant's operational support suits a business's requirements is an essential step toward achieving financial stability and success.General Accountant vs Staff Accountant: Overview

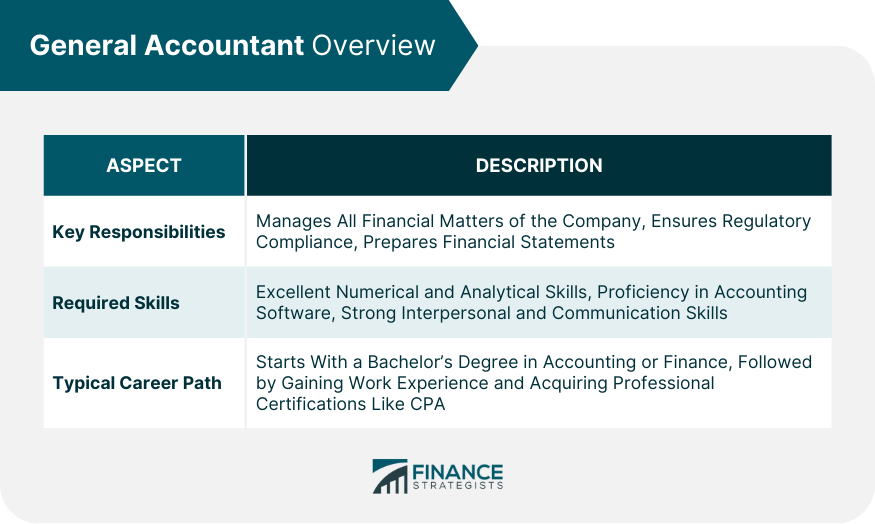

Understanding the Role of a General Accountant

Key Responsibilities

Required Skills

Typical Career Path

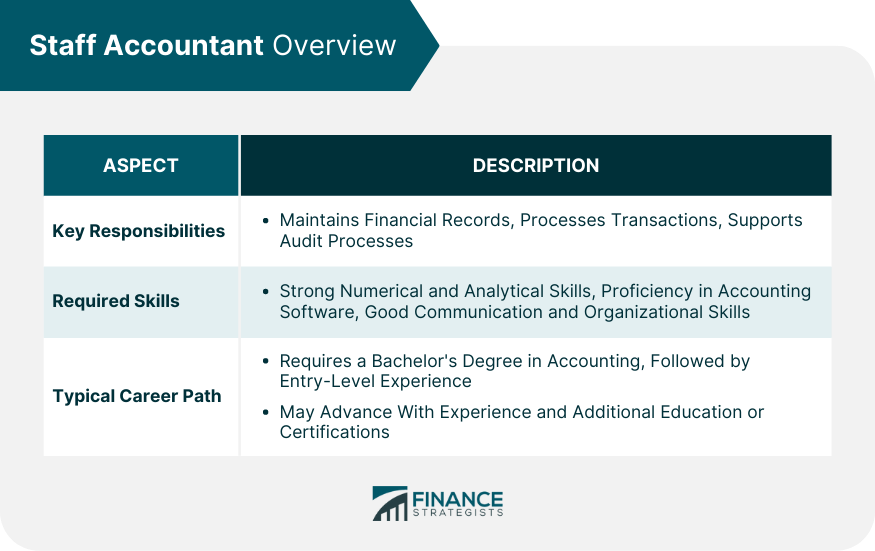

Understanding the Role of a Staff Accountant

Key Responsibilities

Required Skills

Typical Career Path

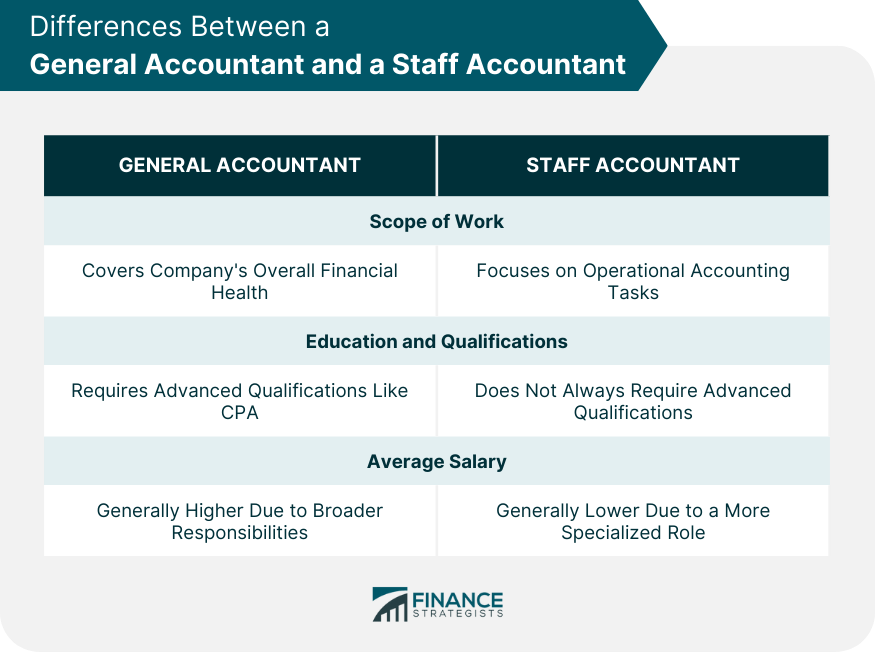

Differences Between a General Accountant and a Staff Accountant

Scope of Work

Education and Qualification Requirements

Average Salary Differences

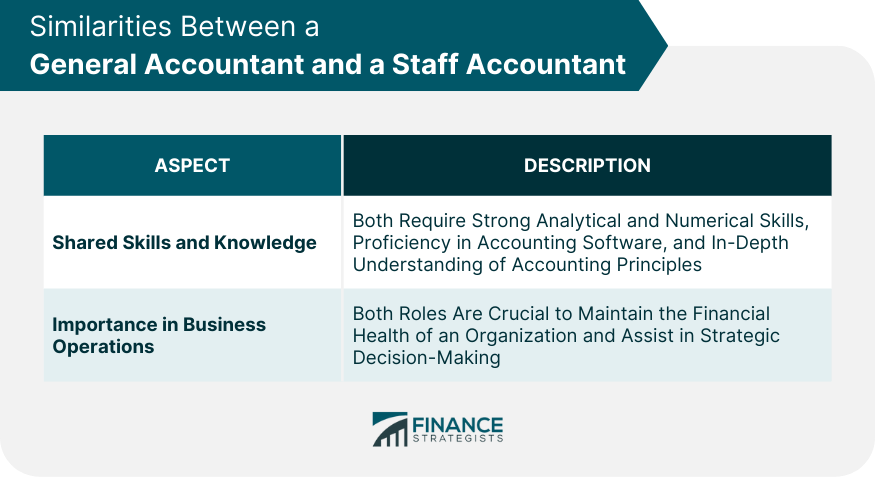

Similarities Between a General Accountant and a Staff Accountant

Shared Skills and Knowledge

Importance in Business Operations

General Accountant vs Staff Accountant in a Corporate Setting

Role of a General Accountant in a Corporation

Role of a Staff Accountant in a Corporation

Interactions and Collaborations

Choosing the Right Accountant for Your Business

Factors to Consider

When to Choose a General Accountant

When to Choose a Staff Accountant

Bottom Line

General Accountant vs Staff Accountant FAQs

A General Accountant manages all of a company's financial matters, from preparing financial statements to ensuring regulatory compliance.

A Staff Accountant's tasks often include maintaining financial records, processing transactions, and supporting audit processes within a company.

Yes, with experience, additional education, and potentially professional certifications, a Staff Accountant can progress to roles such as a General Accountant.

Generally, due to their broader responsibilities and qualifications, General Accountants tend to command a higher salary than Staff Accountants.

If a business requires comprehensive financial management, strategic planning, and compliance with complex financial regulations, a General Accountant would typically be the preferred choice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.