A Chartered Accountant is a well-qualified financial professional, providing expertise in various areas of accounting and finance, essential for businesses, organizations, and individuals. Their training includes a strong base in accounting principles, financial analysis, taxation, and auditing, enabling them to conduct tasks like auditing financial statements, ensuring tax compliance, delivering strategic financial advice, and managing risks. To become Chartered Accountants, individuals typically obtain a bachelor's degree in accounting or a related field and pass professional examinations. They are governed by professional bodies that enforce ethical standards, professional conduct guidelines and promote continuous learning. Chartered Accountants are valued for their insights and contribution to business growth, financial planning, and decision-making, becoming trusted advisors who help clients navigate the complex financial landscape confidently. Becoming a Chartered Accountant is a challenging and demanding process, involving rigorous academic and professional training. The academic prerequisites often include a bachelor's degree in accounting, finance, or a related field. Prospective Chartered Accountants then sit for a series of professional examinations, which test their knowledge and skills in various areas, including auditing, financial reporting, taxation, and law. Many students commence their journey towards becoming a Chartered Accountant during their university years, majoring in relevant fields such as accounting or finance. However, it's also common for professionals from other fields to transition into accountancy, undergoing further studies to meet the necessary academic requirements. Chartered Accountant examinations are renowned for their difficulty, requiring a high level of technical knowledge and analytical thinking. These exams typically encompass subjects like financial management, corporate reporting, strategic business management, and taxation. Chartered Accountants are held accountable by professional bodies established to maintain the integrity of the profession. These bodies set standards, provide resources for ongoing professional development, and enforce a code of ethics. Regulation is crucial in ensuring that Chartered Accountants perform their duties to a high standard. It enhances public confidence in the profession, ensuring clients can trust the advice they receive. It also guarantees that the profession continually adapts to changing financial landscapes. Globally, several prominent organizations regulate Chartered Accountants, such as the Institute of Chartered Accountants in England and Wales (ICAEW), the American Institute of Certified Public Accountants (AICPA), and the Institute of Chartered Accountants of India (ICAI). These bodies not only set professional standards but also play an influential role in shaping policy and legislation. Chartered Accountants have a vast range of responsibilities, making them indispensable to businesses of all sizes. From auditing to consultation, their diverse skill set is in high demand across various industries. One of the primary roles of a Chartered Accountant is auditing. They provide an independent assessment of a company's financial statements, ensuring accuracy and compliance with regulations. This function is vital for maintaining transparency and trust between businesses and their stakeholders. Chartered Accountants are experts in navigating the complex world of taxation. They ensure that their clients adhere to tax laws and optimize their tax strategies, saving them money and avoiding potential legal complications. Consultation is another critical function of Chartered Accountants. They offer strategic advice to businesses, helping them plan their financial future, manage risks, and make informed decisions. Chartered Accountancy is a broad field with numerous specialties, allowing practitioners to focus on areas where they have specific expertise or interest. Some Chartered Accountants specialize in tax consulting, offering comprehensive tax planning and compliance services. They provide expert advice on various aspects of taxation, from individual income tax to corporate tax matters. Forensic Accounting is another area of specialization. Forensic accountants investigate financial irregularities, fraud, and disputes. They often play a pivotal role in legal proceedings, providing critical evidence and expert testimony. Chartered Accountants are bound by a set of ethical standards, which are typically set by the regulatory body that governs their practice. These standards aim to ensure integrity, professionalism, and trust in the field of accountancy. Chartered Accountants must demonstrate integrity in all professional and business dealings. This involves honesty, fairness, and truthfulness. They should not be involved in any actions that could discredit the profession. Accountants must remain objective, making professional decisions without influence from personal or external interests that could compromise their professional or business judgment. Information obtained during the course of their work must be treated as confidential and not disclosed without proper authority. This ensures trust between the accountant and the client. Chartered Accountants should maintain professional knowledge and skill at a level required to ensure a client or employer receives competent professional service. This includes continuous professional development to keep up-to-date with the latest standards and practices. Accountants should conduct themselves in a manner that is consistent with the good reputation of the profession. This includes compliance with relevant laws and regulations and avoidance of any action that may bring disrepute to the profession. These ethical standards are important to maintaining public trust in the profession, ensuring the accuracy and reliability of an accountant's work, and providing a framework for ethical decision-making in a variety of professional contexts. Chartered Accountants contribute significantly to business development. They bring a wealth of financial knowledge to the table, enabling them to play both consultative and strategic roles. In a consultative role, Chartered Accountants provide valuable insights into a company's financial health. They help business leaders understand financial complexities and make informed decisions, ultimately driving growth and profitability. In their strategic role, Chartered Accountants contribute to high-level decision-making. They help develop financial strategies, identify opportunities for growth, and manage risks. Chartered Accountants are highly trained, ethical, and regulated professionals with a vast range of responsibilities essential for the smooth financial operation and growth of businesses. Their extensive education and rigorous professional examination process ensure they are well-equipped to handle various financial tasks, from auditing to tax consulting and strategic financial advice. They operate under the guidance of professional bodies that maintain high ethical standards and continue to promote professional development. Their specialized knowledge can also be focused in areas such as forensic accounting or tax consulting. Chartered Accountants are not just number crunchers but key strategic advisors who significantly contribute to business development by providing critical insights, identifying growth opportunities, and managing risks. Their integrity, objectivity, and professional competence play a crucial role in maintaining public trust in the accounting profession.What Is a Chartered Accountant?

Education and Qualifications of a Chartered Accountant

Academic Requirements

Professional Exams

Professional Bodies Governing Chartered Accountants

Importance of Regulation

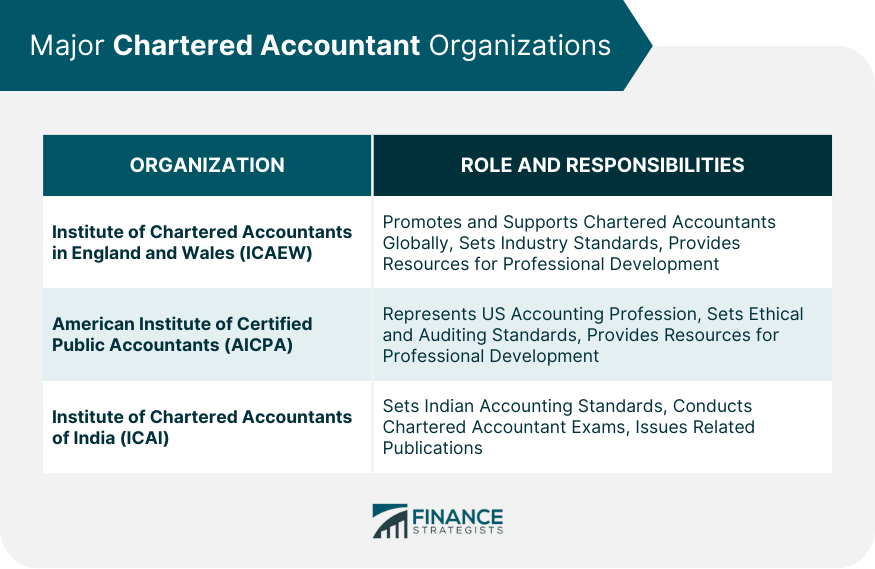

Major Chartered Accountant Organizations

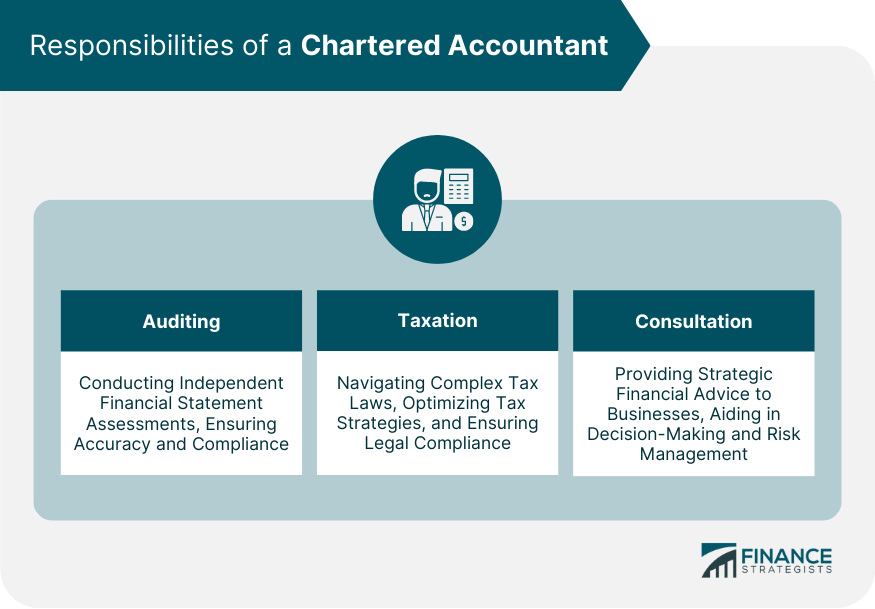

Responsibilities and Duties of a Chartered Accountant

Auditing

Taxation

Consultation

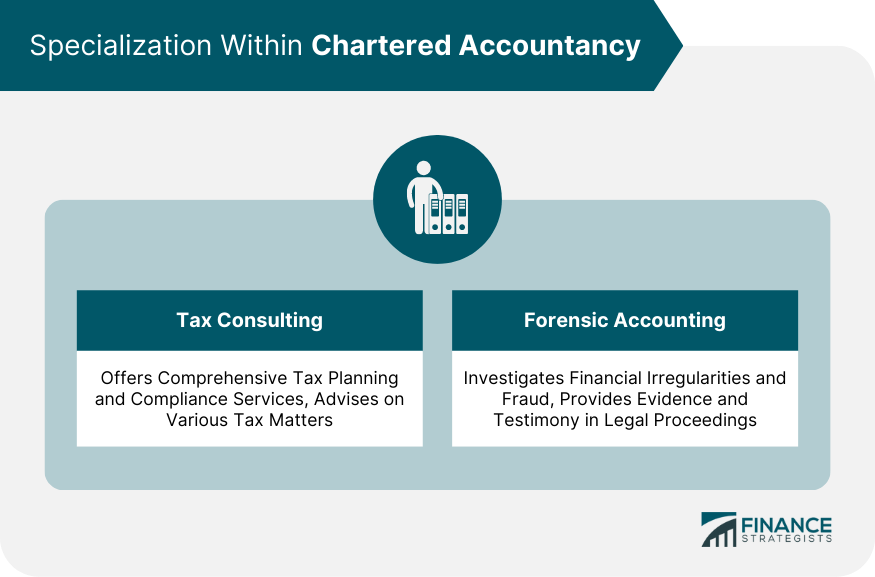

Specializations Within Chartered Accountancy

Tax Consulting

Forensic Accounting

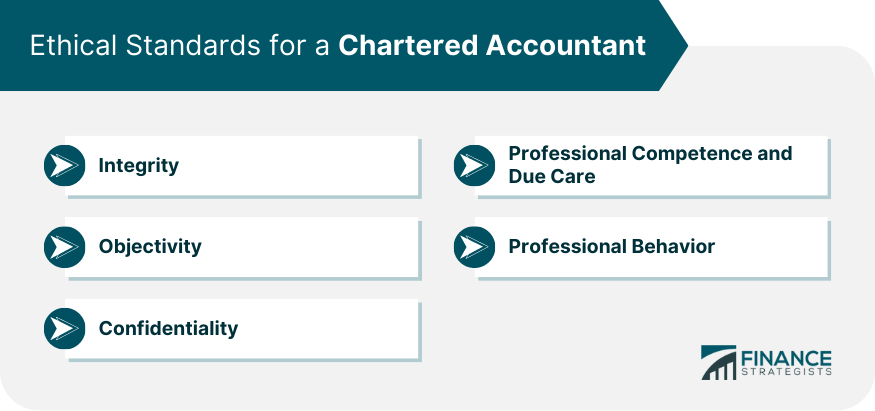

Ethical Standards for a Chartered Accountant

Integrity

Objectivity

Confidentiality

Professional Competence and Due Care

Professional Behavior

Chartered Accountant's Role in Business Development

Consultative Role

Strategic Role

Bottom Line

Chartered Accountant FAQs

Chartered Accountants typically need a relevant bachelor's degree and must pass professional exams.

Chartered Accountants are responsible for auditing financial statements, handling taxation matters, and providing financial consultation.

Chartered Accountants can specialize in tax consulting or forensic accounting, among other areas.

Professional bodies regulate the profession, set standards, and ensure ethical conduct among Chartered Accountants.

Chartered Accountants play consultative and strategic roles, providing financial insights, assisting in decision-making, and managing risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.