Navigating the intricate world of finance and taxes can be a daunting task for both individuals and businesses. To ensure accuracy, compliance, and peace of mind, many individuals and companies seek the expertise of professional accountants. These financial experts play a vital role in managing financial affairs, maintaining records, and providing crucial advice. However, what happens when an accountant's actions or advice lead to detrimental outcomes? In such unfortunate scenarios, the aggrieved parties may consider taking legal action and suing their accountant. While not all disputes with accountants result in lawsuits, it is essential to understand the circumstances that may warrant this course of action, the steps involved in pursuing a legal case, and the potential outcomes. Accountants owe their clients a duty of care. If they fail to adhere to the accepted professional standards of practice, and this results in financial loss for the client, they may be sued for negligence. Common instances of negligence include errors in financial statements, tax filing mistakes, and poor financial advice. Accountants are sometimes in a fiduciary relationship with their clients. This means they must act in the best interests of the client, even over their own interests. A breach of this duty could involve a conflict of interest, misuse of client funds, or revealing confidential information, providing grounds for a lawsuit. In some cases, an accountant may intentionally deceive a client for personal gain or to benefit a third party. Examples include false representation, fraudulent financial reporting, and embezzlement of client funds. These acts of fraud can have severe financial implications for the client and constitute a significant legal violation. The first step in suing an accountant is to gather all necessary evidence that supports your claim. This includes financial records, contracts, email correspondence, and any other relevant documentation. A lawyer will typically help analyze this evidence to determine the strength of the case. After assembling all the necessary documents, the next step is to file a lawsuit. This typically involves drafting and filing a complaint with the court and serving it on the defendant (the accountant or accounting firm). The complaint will detail the allegations against the accountant, and the damages sought. If the case proceeds to trial, both sides will present their arguments and evidence to the judge or jury. If the plaintiff successfully proves their case, the court may award damages to compensate for the financial loss incurred. Alternatively, the case could end in a settlement agreement before reaching the trial phase. Before suing an accountant, it’s important to assess the scale of the financial damage. You need to evaluate whether the potential compensation is worth the cost and effort of litigation. Another key factor is the strength of your evidence. A strong case requires clear, convincing evidence of the accountant's wrongdoing and the resulting financial loss. Finally, consider alternative dispute resolution methods, such as mediation or arbitration. These methods can be less costly, less stressful, and quicker than going to court. One of the main benefits of suing an accountant is the potential for financial compensation. If the lawsuit is successful, the client can recover the losses incurred due to the accountant's professional misconduct. Suing an accountant also helps ensure accountability within the profession. It sends a message to other accountants about the consequences of violating professional and legal standards. Accountability also serves as a deterrent. Legal actions against accountants emphasize the importance of upholding professional standards, thus discouraging similar misconduct within the industry. One of the major challenges of suing an accountant is the legal and financial cost. Litigation can be expensive, with costs for legal advice, court fees, and other related expenses. It’s crucial to consider whether the potential recovery of losses outweighs these costs. Proving an accountant's professional negligence or misconduct can be challenging. It often requires expert testimony and detailed financial analysis, which can be time-consuming and complex. In addition to the financial costs, lawsuits can take a significant emotional toll and require a considerable time commitment. Parties involved may have to endure stress and disruption to their personal and professional lives during the litigation process. Having a competent lawyer is crucial when suing an accountant. Lawyers not only guide clients through the complex legal process but also help them understand their rights and options. Selecting an attorney who specializes in accountant malpractice or professional negligence cases can greatly influence the outcome. Look for lawyers with a strong track record in similar cases and who are familiar with the accounting industry. Suing an accountant is a complex process that requires careful consideration. It presents a chance for compensation and helps ensure professional accountability. However, it also involves significant financial, time, and emotional costs. Before proceeding, assess the financial damage and the strength of the evidence, and consider alternative dispute resolution methods. Always engage a competent lawyer to guide you through the process and make informed decisions.Suing an Accountant: Overview

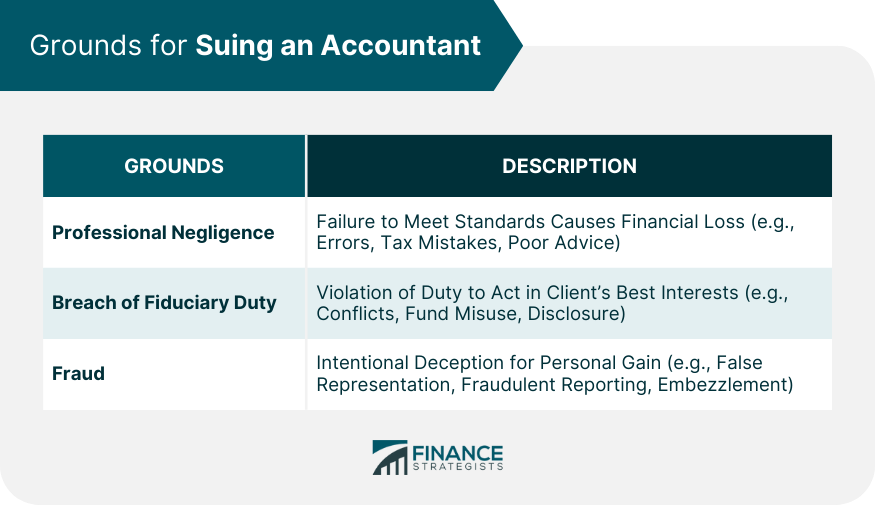

Grounds for Suing an Accountant

Professional Negligence

Breach of Fiduciary Duty

Fraud

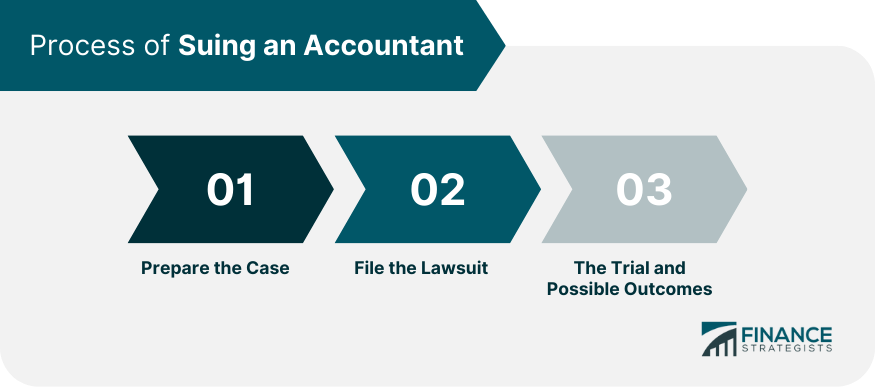

Process of Suing an Accountant

Prepare the Case

File the Lawsuit

Trial and Possible Outcomes

Evaluating the Feasibility of the Lawsuit

Assess the Financial Damage

Strength of Evidence and Likelihood of Success

Alternatives to Litigation

Benefits of Suing an Accountant

Compensation for Financial Loss

Ensure Accountability

Deterrence to Other Professionals

Challenges in Suing an Accountant

Legal and Financial Costs

Difficulties in Proving the Case

Emotional and Time Investment

Role of Legal Professionals in Suing an Accountant

Importance of Legal Counsel

Choose the Right Lawyer for the Financial Case

Conclusion

Suing an Accountant FAQs

Professional negligence in accounting occurs when an accountant fails to perform their duties to the standard expected of a reasonable accountant, resulting in financial loss to the client. Common instances include errors in financial statements, tax filing mistakes, and ill-informed financial advice.

A breach of fiduciary duty involves an accountant acting against the best interest of the client. This could involve a conflict of interest, misuse of client funds, or disclosing confidential information. In a fiduciary relationship, the accountant must prioritize the client's interests above their own.

The evidence needed to sue an accountant might include financial records, contracts, email correspondence, and any other relevant documents that demonstrate the accountant's negligence or misconduct and the subsequent financial damage suffered by the client.

Alternatives to suing an accountant include mediation and arbitration. These are often less costly and quicker dispute resolution methods that don't require court intervention. In some cases, a simple discussion or negotiation between parties may help resolve the issue.

When choosing a lawyer to sue an accountant, consider their experience and track record in similar cases. The lawyer should have a deep understanding of both legal and accounting principles and, ideally, be specialized in accountant malpractice or professional negligence cases.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.