An agricultural accountant is a professional who specializes in accounting practices for the farming and agribusiness industry. They navigate the complex financial landscape unique to agriculture, which includes managing cash flows and production costs and balancing these against the uncertainties of crop yields and market prices. Their role goes beyond traditional accounting functions; they also take into account factors like seasonality, biological assets, inventory management, and government subsidies that are specific to agriculture. Their insights are crucial in guiding strategic decisions, risk analysis, and ensuring regulatory compliance. By understanding both the accounting and agricultural worlds, they serve as indispensable partners in maintaining the profitability and sustainability of farms and other agricultural businesses. Agricultural accountants are specialists within the accounting field who focus on agribusiness, providing expertise in financial management unique to the farming industry. They wear many hats, from tax experts to financial consultants, all tailored to the nuanced world of agriculture. Agricultural accountants deal with the complex financial landscape of the farming industry. They handle daily transactions, analyze financial data, and prepare financial reports. The importance of understanding the timing of cash flows, the cost of production, and farm profitability cannot be overstated. This understanding is crucial for farmers who need to manage their cash flow effectively during different farming seasons. Risk management is an inherent part of farming. An agricultural accountant's role is to identify these risks and help the farmers make informed decisions. They employ various financial models and tools to analyze different risk scenarios, such as changes in commodity prices, climate conditions, and interest rates. While the fundamental principles of accounting apply to all industries, certain characteristics set agricultural accounting apart from general accounting. Seasonality is a unique factor in agriculture that significantly affects accounting processes. Farming cycles often stretch over more than a fiscal year, causing income and expenses to be recognized in different accounting periods. Moreover, biological assets, such as crops and livestock, can vary greatly in value based on growth, diseases, and market fluctuations. The management of inventory in agriculture differs substantially from other industries. This is because agricultural produce undergoes different stages of transformation, each with different values. Inventory value can change due to biological factors like growth or disease, market conditions, or even weather events. In many countries, agriculture is heavily subsidized. Agricultural accountants need to account for these subsidies, ensuring they are accurately represented in financial statements. Moreover, there are specific tax laws and regulations related to agriculture, making tax planning and compliance a vital part of an agricultural accountant's job. To navigate the intricate landscape of agricultural accounting, several key skills are needed. A deep understanding of agricultural processes is vital. This includes knowing about crop cycles, livestock rearing, equipment usage, and more. This knowledge helps accountants make accurate financial forecasts and advise farmers appropriately. Technology plays a significant role in modern agriculture, and this extends to accounting. Agricultural accountants need to be proficient in specialized accounting software designed for the farming industry. These programs help manage and analyze the complex financial data associated with farming. As many agricultural products are commodities traded on global markets, an understanding of these markets is essential. Agricultural accountants need to be aware of local and international price trends, trade policies, and economic factors that can impact a farm's bottom line. Agricultural accountants are crucial players in the success of agribusiness. Agricultural accountants develop financial strategies that boost a farm's profitability. They advise on the optimal allocation of resources, efficient tax planning, and investment opportunities. Through thorough financial analysis, they can highlight areas of the business that are underperforming and suggest corrective measures. With evolving regulations in the agricultural industry, compliance has become increasingly complex. Agricultural accountants ensure farms adhere to industry and regulatory standards. They monitor changes in laws, analyze their implications, and implement necessary adjustments to business practices. Like all accountants, agricultural accountants require formal education and training. However, there are certain steps specific to this specialty. A bachelor's degree in accounting or a related field is generally required. However, a deep understanding of agriculture, either through additional coursework or hands-on experience, is equally crucial. Further, certifications like Certified Public Accountant (CPA) or Chartered Accountant (CA) can be beneficial. Continuing education is key in this evolving field. Regularly updating one's knowledge through professional courses, seminars, or workshops is advisable. Topics can include changes in agricultural laws and regulations, advances in accounting software, and shifts in the global agricultural market. Agricultural accountants serve as crucial pillars in the farming industry, navigating the complex and unique financial landscape of agribusiness. From managing the intricacies of seasonality and inventory to guiding risk analysis and maintaining profitability, they wield a specialized skillset tailored to agriculture. Moreover, they ensure compliance with changing regulations and serve as strategic advisors for farmers and agribusinesses. As the world moves toward increased sustainability and food security, the role of agricultural accountants will only become more vital, providing the financial insights and guidance necessary for the agricultural industry to flourish.Who Is an Agricultural Accountant?

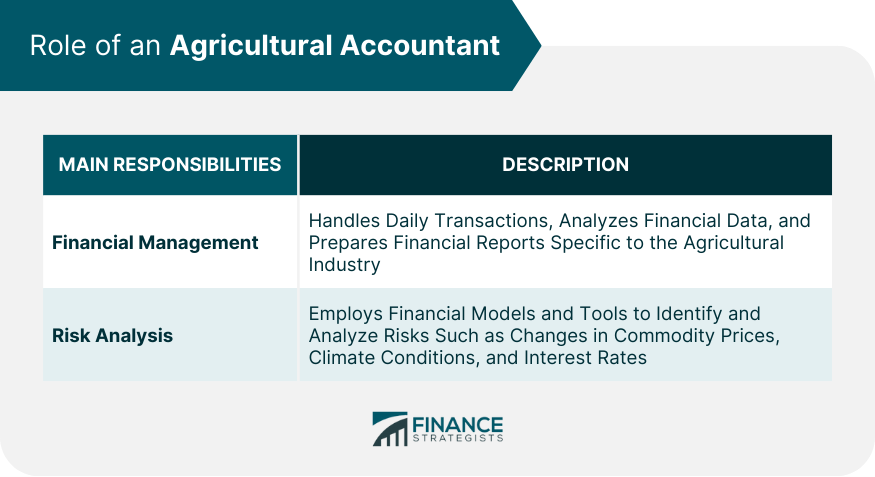

Role of an Agricultural Accountant

Managing Financial Aspects in Agriculture

Guiding Decisions Through Risk Analysis

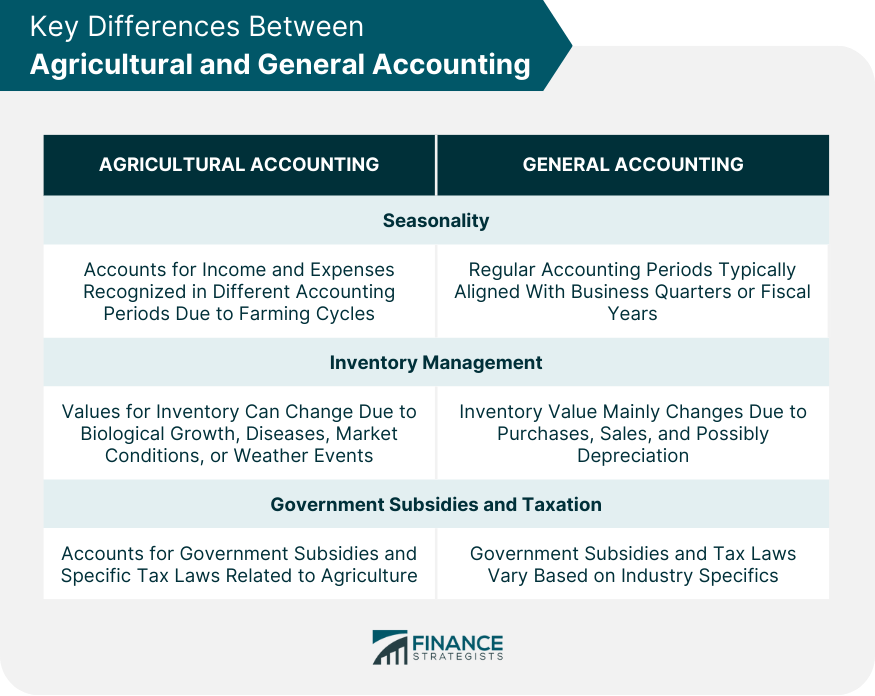

Key Differences Between Agricultural and General Accounting

Impact of Seasonality and Biological Assets

Unique Aspects of Inventory Management in Agriculture

Accounting for Government Subsidies and Tax Considerations

Essential Skills for an Agricultural Accountant

Understanding Agricultural Processes

Mastery of Specialized Accounting Software

Knowledge of Local and Global Agricultural Markets

Importance of Agricultural Accountants in Agribusiness

Strategies for Maintaining Profitability

Role in Ensuring Compliance With Industry and Regulatory Standards

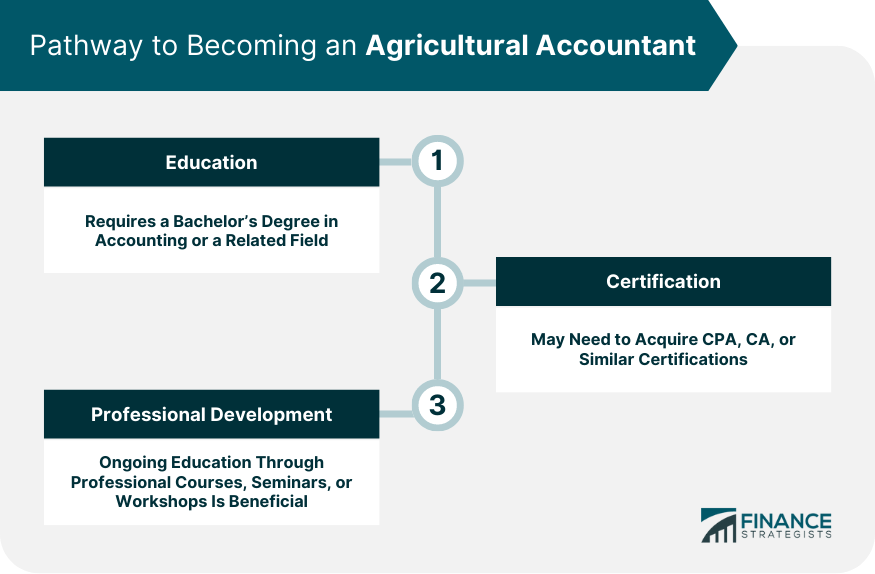

Pathway to Becoming an Agricultural Accountant

Required Education and Qualifications

Opportunities for Ongoing Professional Development

Final Thoughts

Agricultural Accountant FAQs

An agricultural accountant manages the financial aspects of agriculture and guides decisions through risk analysis.

Agricultural accounting deals with unique aspects like seasonality, biological assets, inventory management in agriculture, and specific government subsidies and tax regulations.

They need a deep understanding of agricultural processes, proficiency in specialized accounting software, and knowledge of local and global agricultural markets.

They develop strategies for maintaining profitability and play a critical role in ensuring compliance with industry and regulatory standards.

A formal education in accounting or a related field, an understanding of agriculture, relevant certifications, and ongoing professional development are required.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.