The professions of an accountant and a financial planner, while both rooted in finance, cater to distinct needs and require unique skill sets. An accountant excels in tasks like bookkeeping, tax preparation and planning, auditing, and generating financial reports. They are well-versed in tax laws and financial regulations, making them invaluable to individuals and businesses alike. On the other hand, a financial planner is skilled at providing strategic advice for managing and growing wealth. They guide individuals on investment management, retirement planning, estate planning, and insurance decisions. Financial planners are often engaged in long-term financial goal setting and implementation, offering guidance through major life changes. In essence, while there's an overlap, the accountant ensures financial accuracy and compliance, whereas a financial planner aids in wealth maximization and security. Understanding the difference between the two is crucial in making informed decisions about your financial needs. An accountant typically holds a bachelor's degree in accounting or a related field. Many also hold additional certifications, such as the Certified Public Accountant (CPA) designation. An accountant needs a strong understanding of financial concepts, excellent analytical skills, and a keen eye for detail. They must also be proficient in using various accounting software and have a strong understanding of tax laws and regulations. Accountants provide a broad array of services, including bookkeeping, tax preparation and planning, auditing, and financial reporting. They may also assist with budget planning and financial forecasting. Accountants often work with both businesses and individuals, helping them navigate financial decisions and obligations. Accountants typically work with a diverse range of clients. They may work with individuals looking to file their taxes, small business owners in need of bookkeeping services, or large corporations requiring complex financial reporting. They may also provide services to nonprofits, governmental agencies, or other organizations. Like accountants, financial planners often hold a bachelor's degree in a finance-related field. Many hold certifications such as the Certified Financial Planner (CFP) designation. Financial planners need a strong understanding of investment principles, estate planning, risk management, and retirement planning. They also need strong communication and interpersonal skills, as their role involves building relationships with clients and understanding their financial goals and concerns. Financial planners provide services related to investment management, retirement planning, estate planning, risk management, and insurance planning. They help clients create a comprehensive plan to reach their financial goals, which could range from buying a home to retiring comfortably. Financial planners often work with individuals and families, but they can also provide services to businesses. Financial planners often work with individuals and families looking to improve their financial health. They may also work with high-net-worth individuals who need assistance with estate planning or investment management. Some financial planners specialize in working with certain demographics, such as retirees or small business owners. While both accountants and financial planners work in the financial field, their scope of work differs significantly. Accountants focus on the accurate recording, reporting, and analysis of financial transactions. They can help individuals and businesses comply with tax laws, create budgets, and improve financial efficiency. On the other hand, financial planners focus on helping individuals and families plan for their financial future. This may involve investing, planning for retirement, managing risks through insurance, and organizing estate matters. Financial planners look at the big picture of a client's financial life and help create a roadmap to achieve their financial goals. Accountants often work behind the scenes, managing financial records, preparing taxes, and providing advice on financial efficiency and compliance. While they do interact with clients, the interaction is often transactional and based on specific tasks. Conversely, financial planners often have a more intimate relationship with their clients. They need to understand their client's financial goals, risk tolerance, and personal values. Therefore, they often engage in regular, in-depth discussions with their clients about their finances. Accountants can specialize in different areas, such as tax accounting, corporate accounting, or auditing. They can also specialize by industry, working only with clients in sectors like real estate, manufacturing, or nonprofit. Financial planners also have areas of specialization. Some focus on retirement planning, while others may specialize in insurance, investments, or estate planning. They might also specialize in serving certain types of clients, such as entrepreneurs, doctors, or professional athletes. If you run a business, an accountant can help you with bookkeeping and payroll, tax preparation, and financial forecasting. Individuals might need an accountant when they have a complex tax situation, such as owning a rental property, having substantial investments, or living and working in different states. Hiring an accountant can save you time and stress by ensuring that your financial records are accurate and your taxes are correctly filed. They can also provide valuable advice to help you or your business become more financially efficient and compliant. You might need a financial planner if you're not sure how to reach your financial goals, need help with investment decisions or are planning for retirement. A financial planner can also be beneficial if you've gone through a major life change, such as getting married, having a child, receiving an inheritance, or starting a business. A financial planner can provide the guidance you need to make confident financial decisions. They can help you create a comprehensive plan for your financial future, consider scenarios you may not have thought of, and adjust your plan as your life and financial situation change. There can be some overlap in the roles of an accountant and a financial planner, particularly in areas like tax planning and business planning. Some professionals might even choose to offer both services. However, this would typically require additional education and certifications. While an accountant could theoretically become a financial planner, and vice versa, they would need to obtain the necessary certifications and skills. For example, an accountant wanting to provide financial planning services would likely need to earn a CFP or similar certification. Similarly, a financial planner wishing to offer accounting services would need a solid understanding of accounting principles and may need to become a CPA. To decide whether you need an accountant, a financial planner, or both, you need to assess your financial situation and goals. If you need help with bookkeeping, taxes, or financial compliance, an accountant would be a suitable choice. If you need help planning your financial future and making investment decisions, a financial planner would be beneficial. When choosing a professional, consider their qualifications, experience, and areas of expertise. You should also consider how comfortable you feel with them, as a good professional relationship is crucial. Finally, ensure that the professional you choose is trustworthy and has a good reputation. While both are rooted in finance, accountants and financial planners offer distinct services. An accountant excels in tasks like bookkeeping, tax preparation, and ensuring financial compliance. In contrast, a financial planner specializes in strategic advice on wealth management and long-term financial planning. The choice between these professionals depends on your unique financial needs and goals. Accountants often work transactionally, focusing on immediate needs and compliance, while financial planners maintain a long-term perspective on your financial future. When choosing, consider their qualifications, experience, and reputation, your comfort level with them, and your financial objectives. In some instances, engaging both professionals may be beneficial for a comprehensive approach to financial health and wealth maximization. The ultimate goal is to make informed financial decisions aligned with your life goals.Accountant vs Financial Planner: Overview

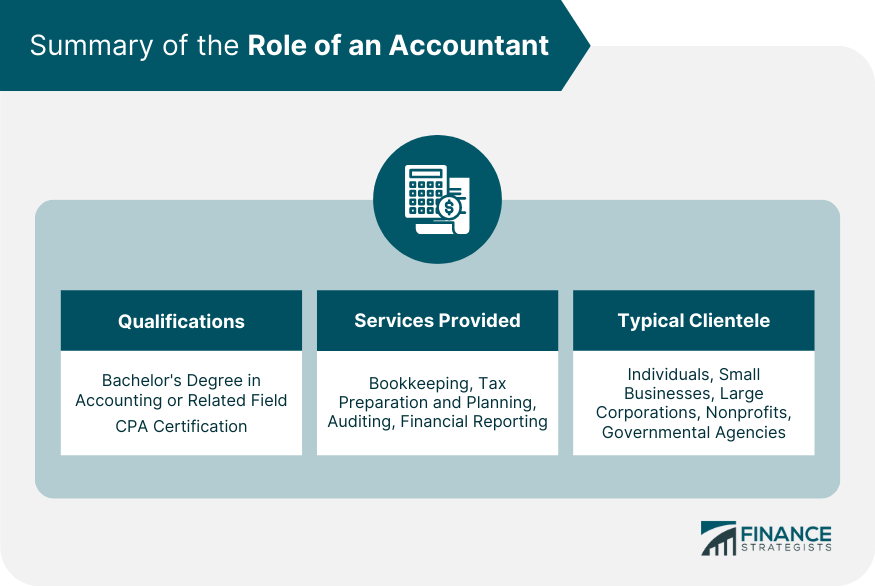

Understanding the Role of an Accountant

Qualifications and Skills Required

Range of Services Provided

Typical Clientele

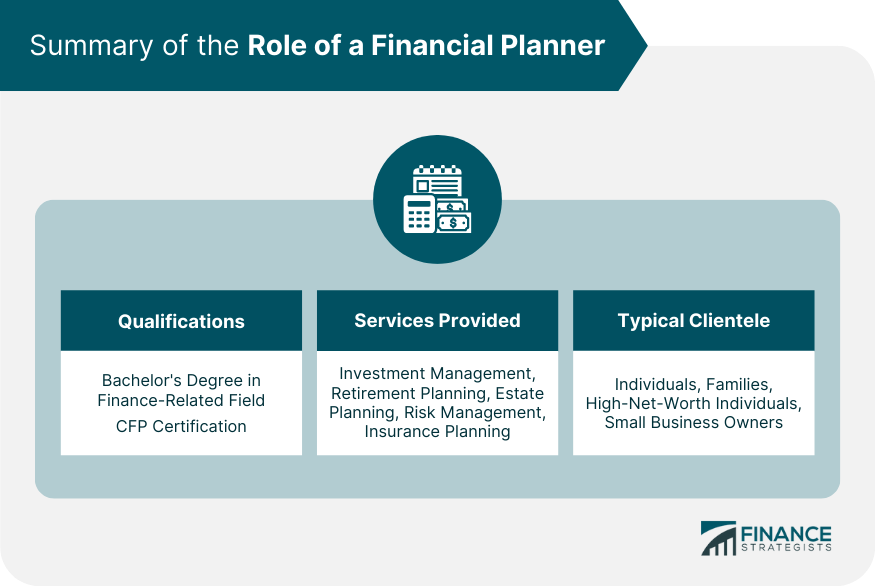

Understanding the Role of a Financial Planner

Qualifications and Skills Required

Range of Services Provided

Typical Clientele

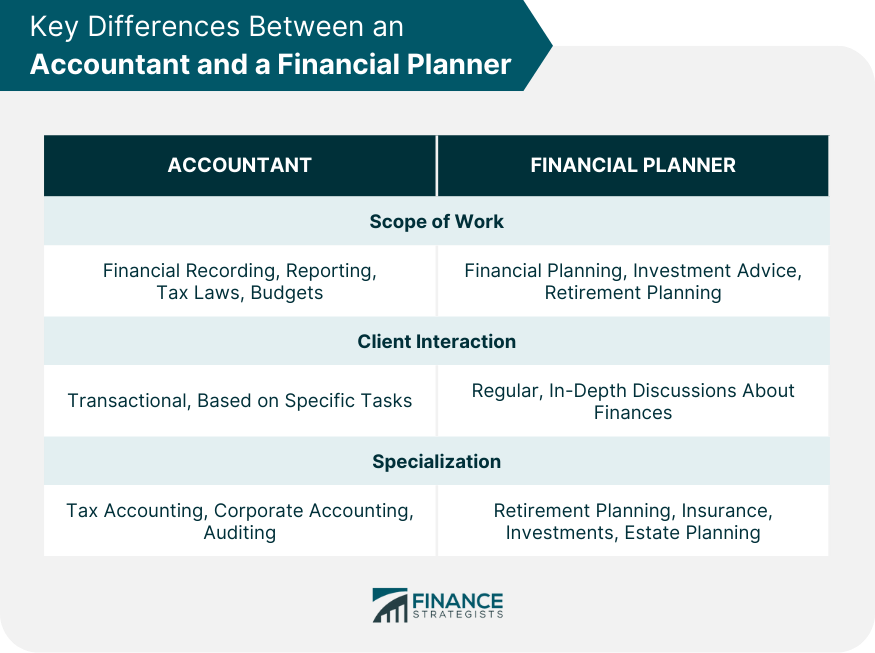

Accountant vs Financial Planner: Key Differences

Scope of Work

Client Interaction and Relationship Building

Areas of Specialization

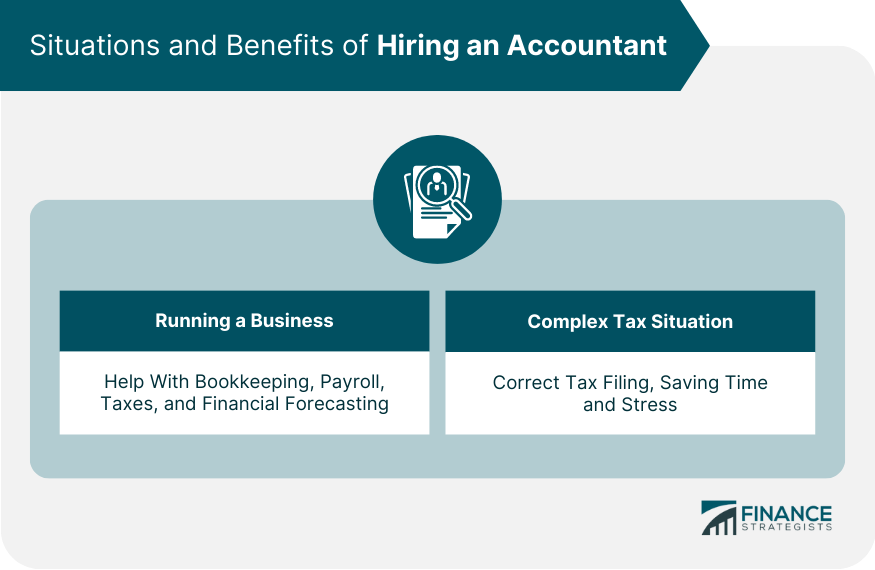

Situations Where You Might Need an Accountant

Specific Cases

Benefits of Hiring an Accountant

Situations Where You Might Need a Financial Planner

Specific Cases

Benefits of Hiring a Financial Planner

Can an Accountant be a Financial Planner or Vice Versa?

Potential Overlaps in Roles

Necessary Certifications and Skills

Choosing the Right Professional for Your Needs

Assessing Your Financial Situation

Tips on Making the Right Choice

The Bottom Line

Accountant vs Financial Planner FAQs

An accountant provides services like bookkeeping, tax preparation and planning, auditing, and financial reporting.

A financial planner usually has a bachelor's degree in a finance-related field and a Certified Financial Planner (CFP) certification.

An accountant focuses on financial recording, reporting, and tax laws, while a financial planner helps with investment and retirement planning.

You might need an accountant if you're running a business or if you have a complex tax situation.

Consider hiring a financial planner if you're unclear about your financial goals or undergoing a major life change like retirement or receiving an inheritance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.