Submitting 1099 for your accountant is an essential task to ensure compliance with tax laws and accurate financial reporting. The 1099 form, which reports various types of income other than wages, salaries, and tips, should ideally be submitted to your accountant as soon as you receive it. The IRS typically requires these forms to be issued to recipients by January 31st of the year following the tax year. By providing these forms to your accountant promptly, you allow them sufficient time to incorporate this information into your tax planning and filing. The timely submission also helps avoid potential penalties from the IRS for late filing. It's recommended to start the process early, keep your financial records organized, and maintain open communication with your accountant. The need for 1099 arises when a business or individual pays another entity certain types of income. This is a crucial first step as businesses must identify transactions and payments that qualify for 1099 reporting. The timing of submitting 1099 to your accountant is a critical element in ensuring compliance with tax laws. The IRS specifies deadlines each year by which these forms must be sent to recipients and filed with the IRS. Typically, 1099 forms should be provided to your accountant as soon as possible after you receive them, ideally no later than January 31st. Once you have recognized the need for a 1099 and collected the necessary information, your accountant can begin the process of filing the forms. This typically involves recording the income in your financial records, preparing the necessary tax returns, and ensuring that all required forms are sent to the IRS and other relevant parties. The first and most obvious benefit is that timely submission ensures compliance with federal tax laws. Failure to report income properly can result in significant penalties and interest charges. Providing your accountant with your 1099 forms as early as possible aids in effective tax planning. Your accountant can make the most accurate predictions and strategies for your tax situation when they have all the relevant information. The IRS imposes strict penalties for late filing of 1099 forms. By submitting these forms to your accountant in a timely manner, you allow enough time for proper filing and can avoid these penalties. Submitting your 1099 forms to your accountant on time ensures that all income is accurately reported on your tax return. This not only ensures compliance with tax laws but also provides you with the most accurate picture of your financial situation. The most significant drawback to late or improper submission is the possibility of penalties from the IRS. These can include fines and interest charges that increase the longer your forms are overdue. Late or improper submission can lead to inaccurate financial reporting. This not only impacts your tax returns but could also affect financial planning and decision-making. Late submission can make effective tax planning difficult. If your accountant does not have all the necessary information, they may not be able to make the best decisions or recommendations for your tax situation. It's crucial to understand the deadlines for 1099 submission. The IRS sets these deadlines, and failure to meet them can result in penalties. Before submitting a 1099 to your accountant, you should ensure you have all the necessary information. This includes the payer's and recipient's information, the amount paid, and the type of income. In this digital age, you might have the option to submit your 1099 forms electronically or by paper. It's important to discuss this with your accountant to decide the best method for your situation. Common mistakes when submitting 1099 can include missing information, incorrect amounts, and submitting the wrong type of 1099. Your accountant can help you avoid these mistakes. Don’t wait until the last minute to start gathering your 1099 forms and other tax documents. Starting early gives you plenty of time to ensure you have all the necessary documents and to resolve any issues that may arise. Keeping your financial records organized throughout the year can make the process of submitting your 1099 forms much smoother. It's much easier to gather and review your documents when they are neatly organized and easily accessible. Maintain regular communication with your accountant throughout the year, not just at tax time. This allows your accountant to stay up-to-date on your financial situation and provide the best advice and services possible. If you use tax software to manage your financial records, make sure it's from a reputable company. Good tax software can make the process of gathering, organizing, and submitting your 1099 forms much easier. Timely and accurate submission of 1099 forms to your accountant is a crucial part of adhering to tax laws and maintaining precise financial reporting. This process begins with recognizing the need for a 1099 and continues with understanding deadlines and collecting necessary information. Your accountant's role is indispensable in filing these forms and aiding in effective tax planning. Early submission helps ensure legal compliance, avoids penalties, and contributes to accurate reporting. Conversely, late or improper submission can lead to penalties and compromised financial accuracy. Understanding these dynamics and the benefits of electronic submission, avoiding common mistakes, and practicing good communication with your accountant are all keys to smooth tax processes. By adopting these practices, businesses can significantly enhance their financial compliance and tax management strategiesWhen to Submit a 1099 for Your Accountant: Overview

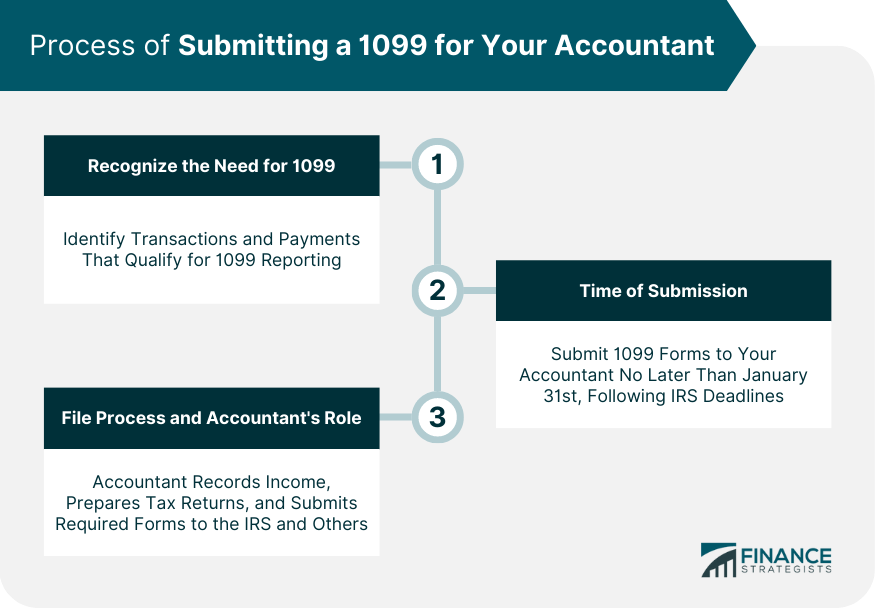

Process of Submitting a 1099 for Your Accountant

Recognize the Need for 1099

Time of Submission

File Process and Accountant's Role

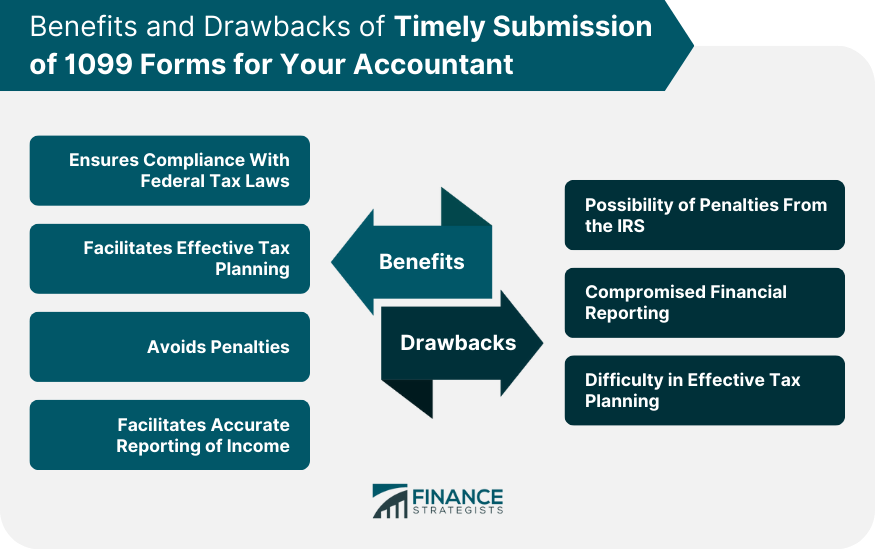

Benefits of Timely Submission of 1099 for Your Accountant

Ensures Compliance

Helps in Effective Tax Planning

Avoidance of Penalties

Facilitates Accurate Reporting

Drawbacks of Late or Improper Submission of 1099 for Your Accountant

Possibility of Penalties

Compromised Financial Reporting

Implications for Tax Planning

Crucial Considerations to Submit 1099 for Your Accountant

Understand Deadlines

Submit Information Required

Submit Electronically or by Paper

Avoid Common Mistakes

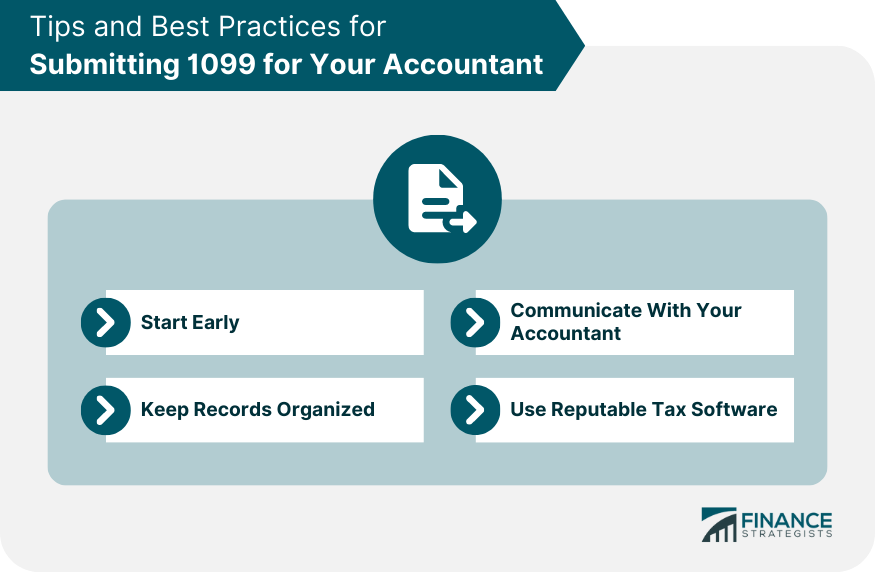

Tips and Best Practices for Submitting 1099 for Your Accountant

Start Early

Keep Records Organized

Communicate With Your Accountant

Use Reputable Tax Software

Final Thoughts

When to Submit a 1099 for Your Accountant FAQs

A 1099 form is used to report various types of income other than wages, salaries, and tips. This includes income from self-employment, interest, dividends, government payments, and more.

It's best to submit your 1099 form to your accountant as soon as you receive it. This typically means by January 31st of the year following the tax year.

The IRS imposes strict penalties for the late filing of 1099 forms. The exact amount varies, but penalties can increase the longer your forms are overdue.

Your accountant plays a crucial role in filing your 1099 forms. They record the income in your financial records, prepare the necessary tax returns, and ensure that all required forms are sent to the IRS and other relevant parties.

Some best practices include starting the process early, keeping your financial records organized, maintaining regular communication with your accountant, and using reputable tax software.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.