In business and finance, an accountant consultant is a pillar of strategic guidance and financial wisdom. These individuals hold an in-depth understanding of accounting principles and how to apply them in various business scenarios. Their role is more than just number crunching; they provide meaningful and actionable insights from financial data that drive essential business decisions. Accountant consultants can be seen in many settings. They might be independent professionals, members of an accounting firm, or key players in the finance departments of large corporations. Their expertise in analyzing financial data, developing strategic plans, and managing financial risks is highly valued across industries. Becoming an accountant consultant is only achieved after a period of time. It involves a purposeful journey that combines rigorous academic studies, professional certifications, hands-on experience, and the development of a diverse skill set. Starting this journey requires a solid educational foundation. For most, this begins with earning a bachelor's degree in accounting or a related field, such as finance or business administration. This fundamental training imparts an understanding of the basic principles and techniques of accounting. In a fiercely competitive landscape, an additional degree can add significant weight to one's credentials. A Master's in Business Administration (MBA) or Accounting (MAcc) can set individuals apart. These degrees often delve deeper into specialized areas of business and accounting, equipping graduates with refined skills and knowledge. Professional certifications endorse expertise, proficiency, and commitment to the profession. Some highly sought-after certifications include the Certified Public Accountant (CPA) and the Certified Management Accountant (CMA). These designations boost one's credentials and open doors to greater job opportunities and career advancement. While formal education and certifications provide the theoretical foundation and professional legitimacy, practical skills, and experience make an accountant consultant genuinely effective. Mastering technical competencies such as financial analysis, tax planning, auditing, and risk management is crucial. Each of these areas requires unique methodologies and tools, the adept handling of which is a testament to a consultant's capabilities. Business advisory skills are another pivotal aspect of an accountant consultant's portfolio. Practical experience advising businesses on financial decisions, operational efficiency, and strategic planning can significantly enhance an accountant's consultancy potential. Spending time in various accounting roles—be it in a small firm, a large corporation, or independent practice—provides the valuable practical experience needed to understand the intricacies of the job. These roles often serve as stepping stones, preparing aspiring accountant consultants for the complex challenges they will later face in consultancy. The path to becoming an accountant consultant involves an interplay of formal education, professional certifications, and substantial hands-on experience. It's a journey that demands a continuous commitment to learning and skill enhancement, ultimately leading to a fulfilling and dynamic career in accounting consultancy. An accountant consultant's role varies depending on their area of specialization and their clients' specific needs. However, certain responsibilities are typical to the profession. Accountant consultants are well-versed in deciphering financial data to assess a company's financial health. They compile detailed financial reports and explain their findings to executives and key stakeholders. Their insights can influence business decisions, strategies, and growth plans. An accountant consultant doesn't just analyze numbers; they also guide businesses in financial planning, budgeting, and investments. They offer strategic advice to ensure optimal utilization of financial resources, helping businesses meet both short-term and long-term objectives. The landscape of tax laws is ever-changing and complex. Accountant consultants help businesses navigate this landscape, ensuring they remain compliant with laws while minimizing tax liabilities through strategic planning. Some accountant consultants specialize in auditing. They meticulously review financial records for accuracy, adherence to accounting standards, and compliance with relevant regulations. Assurance services are another critical area where these professionals provide unbiased opinions on the credibility of financial statements. Becoming an accountant consultant brings its share of rewards. Businesses across various industries seek the expertise of accountant consultants. Their unique skill set makes them valuable assets to any organization, keeping their services in high demand. Accountant consultants bring a high level of expertise, often reflected in their income. Independent consultants and those who establish their consultancy businesses have the potential to earn even more. Accountant consultants are exposed to various projects and clientele, which keeps their work exciting and diverse. They encounter complex situations that require innovative solutions, ensuring their work is far from mundane. Like any profession, being an accountant consultant comes with challenges. Clients often have high expectations, and deadlines can be tight. These pressures can result in an intense work environment. Specific periods, like the end of the fiscal year or tax season, can require extended working hours to meet clients' needs. With regulations, standards, and technology constantly evolving, accountant consultants must stay updated. This necessity for lifelong learning can be challenging but crucial for continued field success. Certain skills are vital for anyone seeking success in accountant consultancy. Deciphering complex financial data and identifying potential issues or opportunities is critical to the job. Being able to communicate complex financial concepts in simple language is crucial. Building and maintaining strong client relationships is also a key part of the job. Given the nature of their work, accountant consultants need to be precise and thorough. There is little room for error. Being adaptable and flexible is necessary with ever-changing client needs, industry trends, and regulatory environments. Successful accountant consultants have strategies to navigate these hurdles despite the inherent challenges. They can handle work pressure effectively by adopting effective time management strategies, delegating tasks where possible, and employing stress management techniques. Embracing new technologies can streamline tasks, making them more efficient. Staying current with digital advancements is vital to remain relevant in an increasingly digitized world. Providing strategic advice while ensuring compliance with rules and regulations is a delicate balance. This balancing act is a key part of minimizing risk for clients. Even with the job's demands, it's crucial to maintain a healthy work-life balance to prevent burnout and ensure sustained productivity. Building a rewarding career as an accountant consultant demands strategic planning, continuous learning, and a commitment to excellence. Networking is a powerful tool for career growth. Joining professional associations can provide valuable opportunities for networking, mentoring, and ongoing professional development. Finding a specific industry or service to specialize in can help set you apart in the market. Specializations can make your services more appealing to certain clients, often allowing you to command higher fees. The field of accountant consultancy is ever-evolving. Regularly updating your knowledge and skills through courses, seminars, and further certifications is essential. Ethics and professionalism form the bedrock of success in this profession. Upholding these principles wins clients' trust and respect from peers, forming the foundation of a successful career. Becoming an accountant consultant requires a combination of formal education, professional certifications, and practical experience. A bachelor's degree in accounting or a related field serves as the foundational education, while higher degrees like an MBA or MAcc can provide specialized knowledge. Professional certifications such as CPA and CMA showcase expertise and commitment. Essential skills for success include technical proficiency, business advisory experience, and hands-on accounting experience. Accountant consultants have key responsibilities like financial analysis and reporting, advising on financial strategy, tax planning and compliance, and auditing and assurance services. The pros of being an accountant consultant include high demand in the market, the potential for a high income, and challenging and diverse work. However, the cons include intense work pressure, long working hours, and the need for constant skill upgrading. To succeed in accountant consultancy, one must possess analytical and problem-solving skills, communication and interpersonal skills, attention to detail and accuracy, and adaptability in a fast-paced environment.What Is an Accountant Consultant?

Path to Becoming an Accountant Consultant

Required Education and Certifications

Bachelor's Degree

Higher Degrees and Specializations

Professional Certifications

Essential Skills and Experience

Technical Proficiency

Business Advisory Experience

Hands-on Accounting Experience

Key Responsibilities of an Accountant Consultant

Financial Analysis and Reporting

Advising on Financial Strategy

Tax Planning and Compliance

Auditing and Assurance Services

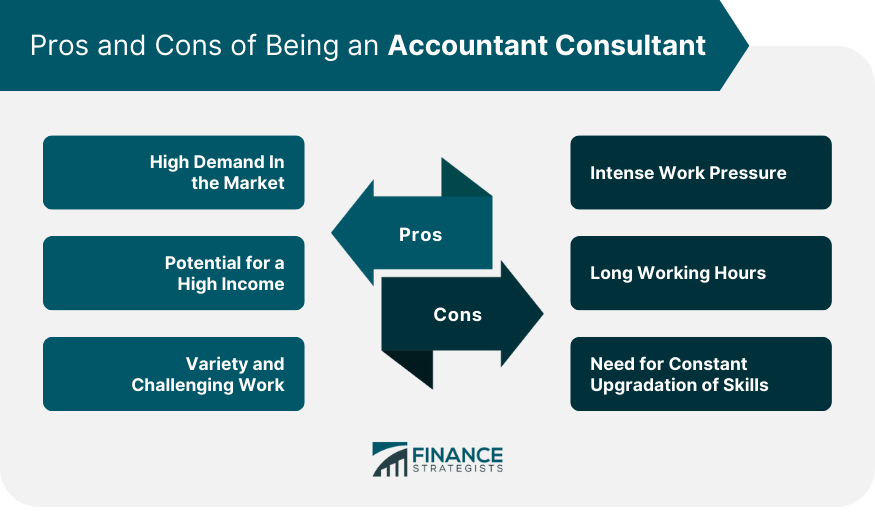

Pros of Being an Accountant Consultant

High Demand in the Market

Potential for a High Income

Variety and Challenging Work

Cons of Being an Accountant Consultant

Intense Work Pressure

Long Working Hours

Need for Constant Upgradation of Skills

Essential Skills for Success in Accountant Consultancy

Analytical and Problem-Solving Skills

Communication and Interpersonal Skills

Attention to Detail and Accuracy

Adaptability in a Fast-Paced Environment

Navigating the Challenges in Accountant Consultancy

Coping With Work Pressure

Keeping Up With Technological Changes

Balancing Risk and Compliance

Maintaining Work-Life Balance

Building Your Career as an Accountant Consultant

Networking and Professional Associations

Pursuing Specializations and Niches

Continuous Learning and Development

Ethics and Professionalism in Practice

Conclusion

How to Become an Accountant Consultant FAQs

An accountant consultant is a professional who provides strategic guidance and financial expertise to businesses, leveraging their knowledge of accounting principles.

To become an accountant consultant, you need a solid educational foundation in accounting, professional certifications, practical experience, and a diverse skill set.

The key responsibilities of an accountant consultant include financial analysis and reporting, advising on financial strategy, tax planning and compliance, and auditing and assurance services.

Being an accountant consultant offers advantages such as high demand in the market, the potential for a high income, and exposure to varied and challenging work.

Challenges of being an accountant consultant include intense work pressure, long working hours during busy periods, and the need for constant skill upgradation to keep up with changes in regulations and technology.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.