A small business accountant is a professional who specializes in managing the financial matters of small enterprises. Their scope of work ranges from bookkeeping, tax planning, and preparation of financial statements, to providing strategic financial advice. As the financial backbone of a business, they are key to ensuring financial compliance, operational efficiency, and sustainable growth. Small business accountants wear many hats. They may act as a bookkeeper, tax consultant, or financial advisor, among other roles. While they focus on financial tasks, their influence extends into the strategic planning realm, helping businesses to capitalize on opportunities, mitigate risks, and navigate through diverse economic landscapes. The pathway to becoming a small business accountant often begins with a bachelor's degree in accounting or a related field. However, it's not just about acquiring a degree; professional certification is equally important. Certified Public Accountant (CPA) status or other similar certifications significantly enhance an accountant's credibility, indicating a high level of competence and commitment to ethical practices. Beyond formal education, continuous professional development is crucial in this ever-evolving field. Accountants need to stay updated with the latest financial regulations, accounting standards, and tax laws. Additionally, familiarity with emerging financial technologies and tools can give small business accountants an edge in today's digital age. Their understanding of concepts like accrual and cash accounting, debits and credits, and financial statement analysis is foundational to their role. These principles guide their work and enable them to provide accurate, relevant financial information. Additionally, an understanding of industry-specific accounting practices is also valuable. Every industry has unique financial nuances, and being able to navigate these can make an accountant an invaluable asset. From recognizing industry-specific tax deductions to interpreting sector-related financial data, knowledge of specialized practices can significantly enhance an accountant's effectiveness. For a small business accountant, a deep understanding of business taxation is essential. They must navigate the complex world of federal, state, and local taxes, ensuring that the business remains compliant while maximizing available deductions and credits. This includes income tax, sales tax, payroll tax, and other industry-specific taxes. Not only should small business accountants understand current tax laws, but they should also stay abreast of changes and new legislation. Tax laws can change from year to year, and keeping up-to-date is essential for effective tax planning and compliance. A good small business accountant can translate complex tax laws into actionable strategies for small businesses. They need to be comfortable with a range of software for tasks such as bookkeeping, payroll management, invoicing, and financial reporting. Familiarity with cloud-based accounting platforms like QuickBooks, Xero, or FreshBooks is a common requirement. Moreover, they should be able to leverage these tools to streamline financial processes and provide real-time financial insights. Today's accounting software offers far more than just bookkeeping functionalities—they provide valuable data that can drive strategic decision-making. The ability to extract, interpret, and utilize this data is a key skill for modern accountants. It involves maintaining accurate records of all financial transactions, including sales, expenses, and payroll. Good bookkeeping ensures that businesses have a clear view of their financial health and are well-prepared for tax season. In addition to recording daily transactions, small business accountants are also responsible for reconciling bank statements, managing accounts payable and receivable, and maintaining a general ledger. These tasks form the backbone of a company's financial infrastructure, providing the raw data that informs all other financial activities. They generate income statements, balance sheets, and cash flow statements, which provide a comprehensive view of a business's financial performance. These statements are essential for making informed business decisions, securing loans, attracting investors, and complying with legal requirements. In creating these statements, small business accountants don't just compile numbers—they also interpret them. They help business owners understand what the numbers mean for their business, highlighting trends, identifying potential issues, and suggesting strategic actions. This ability to translate financial data into actionable insights is what makes an accountant truly valuable to a small business. They help businesses understand their tax obligations, plan for tax liabilities, and ensure timely and accurate tax filing. By doing so, they prevent costly penalties and ensure that businesses take full advantage of tax deductions and credits. Additionally, small business accountants can provide strategic tax planning advice. This can involve optimizing business structures for tax efficiency, planning for capital gains and losses, or advising on tax implications of business decisions. In this role, an accountant doesn't just maintain compliance—they also contribute to a business's financial strategy. They help businesses plan their financial future by projecting revenues, anticipating expenses, and setting financial targets. A well-prepared budget serves as a roadmap, guiding businesses towards their financial goals. Beyond preparing budgets, small business accountants also monitor and analyze financial performance. They compare actual results with budgeted figures, identify variances, and suggest corrective actions. They also conduct financial analysis to evaluate profitability, liquidity, and efficiency, providing valuable insights for business improvement. By monitoring incoming and outgoing cash, they ensure that businesses have enough liquidity to meet their short-term obligations. Effective cash flow management can prevent financial distress and provide businesses with the stability they need to grow. This involves not just tracking daily cash flows, but also forecasting future cash needs. Accountants help businesses anticipate cash crunches, plan for large expenses, and optimize cash reserves. They can also advise on strategies to improve cash flow, such as accelerating receivables, delaying payables, or managing inventory. They compile financial reports that summarize a company's financial position, performance, and cash flows. These reports are essential for informing stakeholders, meeting legal requirements, and supporting strategic decision-making. But creating financial reports is just half the job—the other half involves interpreting them. Accountants analyze financial reports to identify trends, evaluate performance, and uncover insights. They translate complex financial data into understandable terms, helping business owners make informed, data-driven decisions. Small business accountants ensure that a company's financial records are accurate, complete, and in compliance with accounting standards. This not only prepares businesses for potential audits but also builds credibility with stakeholders. In the event of an audit, small business accountants act as a liaison between the business and the auditors. They provide necessary documents, answer queries, and help resolve any issues that arise. By managing the audit process, they can alleviate stress for business owners and ensure a smooth, efficient audit. Accountants have a deep understanding of tax rules and are updated with any changes that occur. Their expertise helps businesses avoid legal trouble and costly penalties associated with non-compliance. Having an accountant oversee your taxes also means less stress during tax season. They handle all the calculations, paperwork, and filing, freeing you from the time-consuming and often confusing task of doing your own taxes. With an accountant, you can be confident that your tax obligations are being handled professionally and efficiently. They know where to look for savings that you might not be aware of. From home office deductions to industry-specific incentives, an accountant can help you take full advantage of tax benefits available to your business. Besides identifying deductions, accountants can also strategize for tax savings. They can guide you on timing purchases, structuring transactions, or making other business decisions that could reduce your tax burden. They don't just crunch numbers—they analyze them and translate them into meaningful insights. From spotting financial trends to identifying cost-saving opportunities, an accountant can provide you with information that informs strategic decision-making. Additionally, having an accountant means having a financial advisor on your team. They can provide guidance on financial planning, budgeting, and investing, helping you make sound financial decisions that support your business goals. Managing financial tasks can be time-consuming and complex, especially for those without a strong financial background. An accountant takes care of these tasks, freeing up your time to focus on other aspects of running your business. Having an accountant also brings peace of mind. You don't have to worry about errors in your bookkeeping, missed tax deadlines, or financial decisions made in the dark. With an accountant, you have a trusted professional managing your finances, providing you with accurate, timely information and reliable financial advice. Choosing a small business accountant starts with a clear understanding of your accounting needs. Are you looking for basic bookkeeping services, or do you need comprehensive financial management? Do you need help with tax preparation, or are you seeking strategic financial advice? Your specific needs will guide your choice of accountant. Take time to define your accounting needs before starting your search. Consider your business size, industry, growth plans, and complexity of your financial transactions. Once you have a clear picture of what you need, you can look for an accountant who meets those needs. Qualifications and experience are critical considerations when choosing a small business accountant. Check their educational background, certifications, and professional memberships. Ensure they have relevant experience in managing small business finances and are updated with current financial regulations and technologies. Don't just look at their resume—ask about their work. How have they helped small businesses improve their finances? What strategies do they use to manage taxes? What kind of results have they achieved? An accountant's past performance can give you an idea of their competence and effectiveness. Industry knowledge and expertise can make a significant difference in accounting services. Every industry has unique financial nuances, and an accountant who understands these can provide more accurate, relevant services. From recognizing industry-specific tax deductions to interpreting sector-related financial data, industry knowledge can enhance an accountant's effectiveness. So when choosing an accountant, consider their experience in your industry. Do they understand the financial challenges and opportunities unique to your sector? Do they have proven experience in handling industry-specific accounting issues? An accountant who knows your industry can be a valuable asset to your business. Good communication and interpersonal skills are often overlooked when choosing an accountant but are equally important. An accountant should be able to explain complex financial concepts in simple terms and keep you informed about your financial status. They should be approachable, responsive, and respectful, fostering a good working relationship. Remember, you'll be working closely with your accountant, so it's important to choose someone you're comfortable with. Do you feel at ease discussing your finances with them? Are they able to understand your concerns and provide clear, helpful responses? A good accountant is not just a numbers person—they're a people person, too. Referrals and reviews can provide valuable insights when choosing a small business accountant. Ask for recommendations from your business network or professional associations. People who have used an accountant's services can give you firsthand feedback on their performance. Online reviews can also be helpful. Check review sites or social media for comments about the accountant's services. Keep in mind, though, that reviews should be taken with a grain of salt—positive reviews can be biased, and negative reviews may not reflect the accountant's overall performance. Use reviews as just one of many factors in your decision-making process. When it comes to pricing, small business accounting services can either charge hourly rates or fixed fees. Hourly rates can be a good option if your accounting needs are unpredictable or infrequent. Fixed fees, on the other hand, can provide more certainty and can be more cost-effective for ongoing, predictable services. It's important to understand what's included in the fee. Does it cover all your accounting tasks, or are there extra charges for additional services? Make sure to clarify this upfront to avoid unexpected costs down the line. Different accountants may use different pricing models, so it's essential to understand these before making a decision. Some may charge a flat monthly fee for a package of services, while others may charge on a per-task basis. Some may offer a hybrid model, combining fixed fees with hourly rates for additional services. Ask potential accountants to explain their pricing structure and provide a detailed quote. This will help you compare costs and choose a service that offers good value for money. Cost comparison is a useful tool when choosing a small business accountant. Get quotes from multiple accountants and compare their prices. However, don't make your decision based solely on cost. Remember, you get what you pay for—cheap services may not offer the quality and reliability you need. Look for an accountant who offers a balance of cost and quality. They may not be the cheapest, but they should provide excellent value for money. Consider their qualifications, experience, and performance, not just their price tag. When considering the cost of accounting services, remember to balance it with the quality of services. Low-cost services may seem appealing, but they may not offer the level of service your business needs. At the same time, high-priced services may not necessarily guarantee superior quality. The best approach is to consider cost as one factor among many. Evaluate the overall value the accountant offers—their expertise, the range and quality of their services, their customer service,and their proven results. By weighing cost against quality, you can choose a service that offers the best return on your investment. A small business accountant is a professional who specializes in managing the financial matters of small enterprises. They ensure compliance with tax laws and regulations, maximizing tax deductions and credits while providing valuable financial insights for business growth. With their expertise in financial analysis, cash flow management, and budgeting, they help businesses make informed decisions that drive success. Hiring a small business accountant brings peace of mind as they handle financial tasks accurately and provide reliable advice. When choosing an accountant, it's important to assess specific needs, evaluate qualifications, consider industry knowledge, and ensure good communication skills. Referrals and reviews provide valuable insights. While cost is a factor, it should be balanced with the quality of services. Ultimately, a small business accountant plays a crucial role in ensuring financial stability, maximizing tax benefits, and supporting the growth of small businesses.What Is a Small Business Accountant?

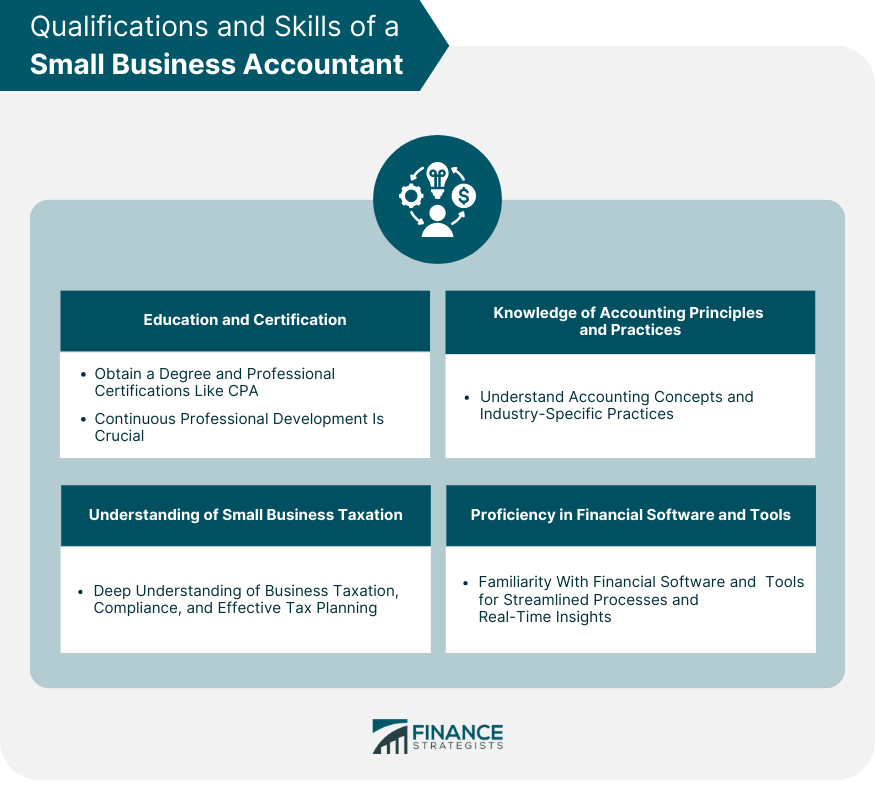

Qualifications and Skills of a Small Business Accountant

Education and Certification

Knowledge of Accounting Principles and Practices

Understanding of Small Business Taxation

Proficiency in Financial Software and Tools

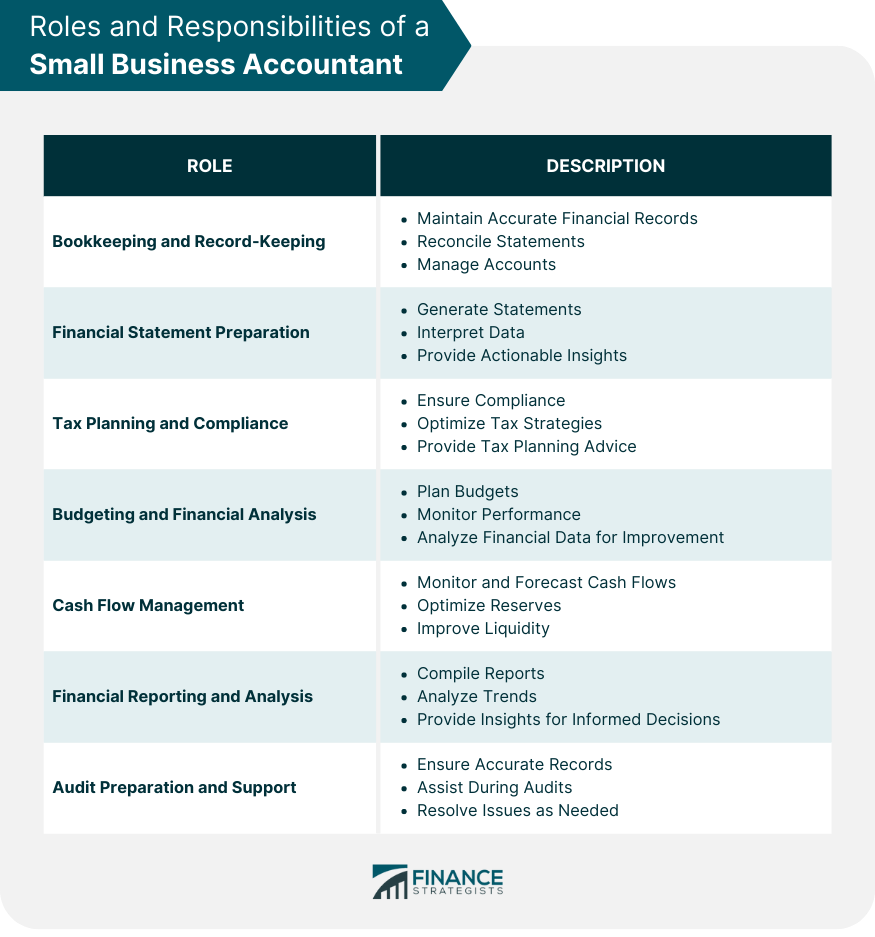

Roles and Responsibilities of a Small Business Accountant

Bookkeeping and Financial Record-Keeping

Preparation of Financial Statements

Tax Planning and Compliance

Budgeting and Financial Analysis

Cash Flow Management

Financial Reporting and Analysis

Audit Preparation and Support

Benefits of Hiring a Small Business Accountant

Ensures Compliance With Tax Laws and Regulations

Maximizes Tax Deductions and Credits

Provides Financial Insights for Business Growth

Saves Time and Reduces Stress for Small Business Owners

How to Choose a Small Business Accountant

Assess Specific Accounting Needs

Evaluate Qualifications and Experience

Consider Industry Knowledge and Expertise

Check for Good Communication and Interpersonal Skills

Obtain Referrals and Reading Reviews

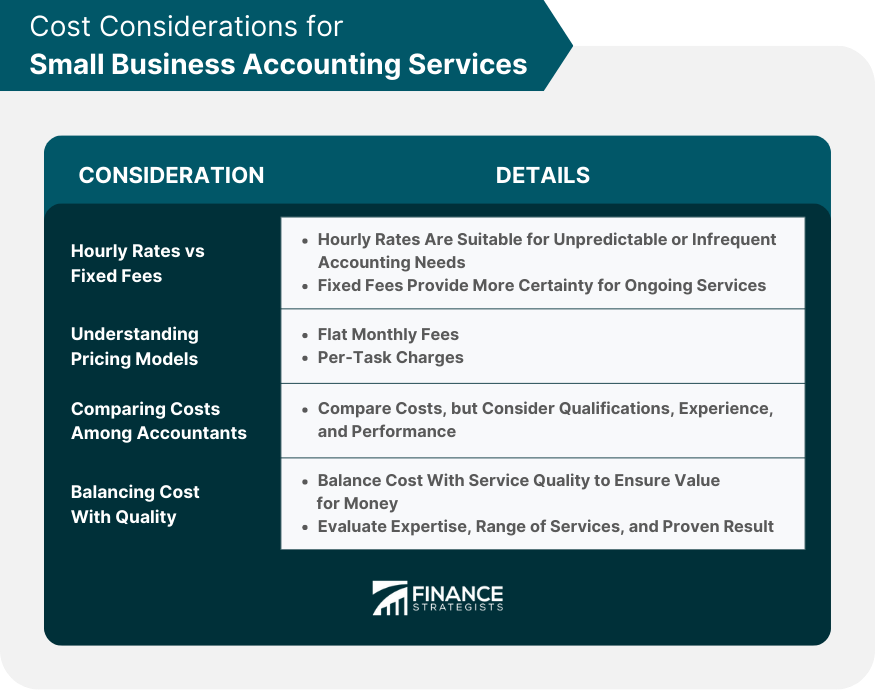

Cost Considerations for Small Business Accounting Services

Hourly Rates vs Fixed Fees

Understanding Pricing Models

Comparing Costs Among Accountants

Balancing Cost With Quality of Services

Conclusion

Small Business Accountant FAQs

A small business accountant manages all aspects of a business's finances, including bookkeeping, financial analysis, tax planning, budget preparation, cash flow management, financial reporting, and audit preparation. They ensure compliance with financial regulations, help maximize tax savings, provide financial insights, and save time for business owners.

A small business accountant should have a solid educational background in accounting or finance, relevant certifications (like a CPA), and experience in small business accounting. They should also have a deep understanding of accounting principles and practices, small business taxation, and financial software and tools.

A small business accountant can provide valuable financial insights that inform strategic decision-making, helping to drive your business growth. They can identify financial trends, spot cost-saving opportunities, and provide guidance on financial planning, budgeting, and investing. With their help, you can make sound financial decisions that support your business goals.

Choosing the right small business accountant involves assessing your specific accounting needs, evaluating the accountant's qualifications and experience, considering their industry knowledge, checking their communication and interpersonal skills, and reading reviews or obtaining referrals. It's also important to understand their pricing structure and balance the cost with the quality of services.

Hiring a small business accountant is a valuable investment for most businesses. They can save you time, reduce stress, ensure compliance with tax laws, maximize tax savings, and provide crucial financial insights. By handling your financial tasks professionally and efficiently, an accountant can help you focus more on running and growing your business.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.