A forensic accountant is a financial expert proficient in carrying out investigations into financial discrepancies, fraudulent activities, and complex transactions. Their expertise is often sought after in legal proceedings and disputes that involve financial issues, contributing an additional layer of scrutiny to our financial systems. These financial sleuths apply their analytical abilities to uncover details that might go unnoticed by a regular accountant. They meticulously examine financial records, seeking evidence of white-collar crimes such as embezzlement, money laundering, or securities fraud. The range of the forensic accountant thus spans beyond mere numbers, immersing them in the intriguing world of financial detective work. The forensic accountant is not only an expert in accounting but also an accomplished investigator. Their primary function is to thoroughly scrutinize financial records in search of anomalies or irregularities. By conducting detailed audits, they piece together a complete, accurate financial picture, effectively sifting through layers of financial data to uncover potential fraud or misrepresentation. They use their findings to establish patterns of behavior that may indicate fraudulent activity, following leads and investigating suspicious transactions. Beyond just the numbers, they're able to interpret the financial data in the broader context, identifying hidden relationships and unearthing clues which can unveil the truth behind a potentially deceptive financial façade. They critically review balance sheets, income statements, and cash flow statements, meticulously hunting for any discrepancies or signs of fraudulent activities. Through their trained eyes, anomalies in revenue reporting, abnormal expense claims, and inconsistencies in inventory valuation may surface. In addition, their astute financial analysis skills enable them to assess business valuation, calculate economic damages, and determine bankruptcy risk. Their expertise empowers businesses to understand their financial status better, identify areas for improvement, and take action to avert any potential financial catastrophe. Unmasking fraud and preventing it from reoccurring stands as one of the cornerstone responsibilities of forensic accountants. Using their accounting knowledge and investigative skills, they identify and analyze indicators of fraud, such as suspicious transactions, unusually high expenses, and sudden changes in financial behavior. These experts not only detect fraud but also design and implement measures to prevent future instances. They work closely with organizations to strengthen internal controls, conduct regular audits, and educate employees about potential fraud schemes. In this role, forensic accountants serve as the vanguards against financial malfeasance, contributing significantly to business longevity and integrity. In the arena of litigation, forensic accountants shine as invaluable assets. They assist lawyers by providing a clear, concise interpretation of complex financial data, which can often tip the balance in a court case. Their work often involves creating financial profiles of individuals or businesses involved in a case, calculating economic damages, and analyzing relevant financial evidence. Their insights can greatly influence the direction and outcome of a legal proceeding. They can either solidify a case's foundation or dismantle an adversary's claims. Their nuanced understanding of financial matters, combined with their investigative prowess, makes them indispensable in the contentious world of litigation. As expert witnesses, they present their findings in court, explaining complex financial concepts in a manner that judges, juries, and attorneys can comprehend. Their ability to communicate effectively and maintain credibility under cross-examination can significantly influence a case's outcome. Serving as an expert witness requires a forensic accountant to exhibit a high level of professionalism, impartiality, and confidence. They are expected to deliver their testimony clearly, objectively, and succinctly, ensuring the facts are understood and appreciated for their full impact. Forensic accountants usually begin their educational journey with a Bachelor’s degree in accounting or a related field. This provides them with a strong foundation in core accounting principles, auditing, business law, and taxation. An advanced degree, such as a Master's in Accounting or Business Administration, can further deepen their understanding of financial intricacies and give them a competitive edge in the job market. Many institutions now offer specialized programs or coursework in forensic accounting, giving students the opportunity to learn about fraud detection, computer forensics, professional ethics, and criminal law. Through this blend of academic rigor and specialized training, aspiring forensic accountants are well-equipped to embark on their investigative careers. Beyond academic qualifications, professional certifications further testify to a forensic accountant's expertise. Certifications like the Certified Public Accountant (CPA), Certified Fraud Examiner (CFE), and Certified Forensic Accountant (Cr.FA) are some of the most sought-after designations in this field. These certifications validate the holder's knowledge and skills, and often, certain levels of experience are required before one can sit for these examinations. By pursuing these certifications, professionals demonstrate their commitment to excellence in their field. These credentials serve as a testament to their competence and ethical standards, reinforcing their reputation as reliable and trusted specialists in the world of forensic accounting. In a field as dynamic as forensic accounting, continuing education and professional development play crucial roles. Staying abreast of the latest industry trends, technological advancements, and regulatory changes is essential for these professionals. This often involves attending industry conferences, workshops, seminars, or webinars. Professional associations, like the Association of Certified Fraud Examiners (ACFE) and the American Institute of Certified Public Accountants (AICPA), provide numerous resources for ongoing learning. They also foster a professional community that enables knowledge sharing, networking, and collaborative problem solving, further enhancing the forensic accountant's arsenal of skills and knowledge. At the heart of a forensic accountant's skillset lies a profound understanding of accounting principles and practices. They must be adept at interpreting financial statements, conducting audits, and navigating tax laws. Their extensive knowledge of accounting enables them to identify inconsistencies or irregularities in financial records, facilitating effective fraud detection. Moreover, they need to stay updated on the latest accounting standards, regulatory changes, and financial trends. This continuous learning enables them to adapt and apply their skills in the ever-evolving landscape of business finance, ensuring their investigations remain comprehensive, accurate, and relevant. Given their significant role in legal proceedings and their duty to uphold financial laws and standards, they must be well-versed in pertinent laws relating to financial fraud, white-collar crime, and litigation. This knowledge extends to rules regarding evidence collection and preservation, as well as the legal processes surrounding trial and testimony. Being attuned to these legal dimensions helps forensic accountants ensure their findings are both accurate and admissible in court, thus enhancing their effectiveness in the legal arena. Their work often involves sorting through complex, voluminous financial data to identify patterns, inconsistencies, and indicators of potential fraud. To do this effectively, they need to employ logical reasoning, problem-solving, and data analysis skills. These professionals are often confronted with ambiguous and incomplete information, requiring them to make informed assumptions and judgments. Their ability to think critically allows them to discern the significant from the irrelevant, formulate sound hypotheses, and draw valid conclusions based on their analysis. Given the precise nature of their work, forensic accountants must exhibit exceptional attention to detail. Every transaction, every entry, and every discrepancy could potentially hold the key to uncovering fraud or misrepresentation. Missed details could mean overlooked evidence, leading to inaccurate conclusions and potentially major legal and financial implications. By meticulously scrutinizing every piece of financial data, they ensure no stone is left unturned in their pursuit of truth. This diligent attention to detail, combined with their accounting acumen, allows them to provide a thorough and accurate analysis of the financial records they examine. Despite their technical expertise, forensic accountants’ work is not confined to the walls of numbers and data. They frequently need to communicate their findings to non-accounting professionals, including lawyers, judges, and juries. As such, excellent communication and presentation skills are indispensable. The ability to simplify complex financial information and present it in an understandable and engaging manner is crucial, particularly when serving as an expert witness in court. In addition, strong written communication skills are essential for preparing detailed reports, summaries, and documentation of their findings. As financial detectives, forensic accountants leverage advanced data analysis software to sift through vast amounts of financial data. Tools such as Microsoft Excel, ACL, IDEA, and various business intelligence platforms help streamline their work, automate repetitive tasks, and facilitate deeper analysis. These tools can identify trends, highlight anomalies, and produce visualizations that can simplify complex data sets. With the aid of these software platforms, forensic accountants can efficiently and effectively dissect financial records, making their investigations more accurate, comprehensive, and efficient. Forensic accountants employ a host of specialized techniques in their investigations. These include, but are not limited to, ratio analysis, horizontal and vertical analysis, Benford’s Law, and regression analysis. They also use investigative methods such as interviews, surveillance, and public record searches to gather information related to the case. These techniques allow them to detect unusual transactions, identify hidden assets, and uncover fraudulent schemes. By adeptly wielding these tools, forensic accountants can deliver an in-depth, incisive analysis that stands up to scrutiny in both the boardroom and the courtroom. They often work with electronic data and must be familiar with various IT systems and software used in financial management. This includes knowledge of databases, network security, and digital forensics tools that aid in data recovery and analysis. The ability to handle and analyze digital data can significantly enhance the scope and accuracy of their investigations. As cybercrime and electronic fraud become increasingly prevalent, these skills are becoming more crucial than ever. They follow strict protocols when collecting, preserving, and presenting evidence to ensure its admissibility in court. This involves maintaining a clear audit trail, securing evidence properly, and documenting their procedures meticulously. These rigorous methodologies ensure the integrity and credibility of their findings. Their adherence to these procedures not only makes their work more systematic and comprehensive but also enhances its acceptance in the legal sphere, where procedural correctness is paramount. A forensic accountant is a financial expert proficient in carrying out investigations into financial discrepancies, fraudulent activities, and complex transactions. Their expertise in accounting, coupled with their investigative skills, allows them to uncover financial discrepancies, detect fraud, and provide litigation support. They analyze financial statements, meticulously scrutinize data and employ specialized techniques to identify irregularities and patterns of fraudulent activity. With a deep understanding of legal frameworks, they ensure their findings are admissible in court. Strong attention to detail, analytical thinking, and communication skills are essential in their work. Moreover, forensic accountants utilize data analysis software, employ accounting techniques, leverage information technology, and follow strict auditing procedures to enhance the accuracy and efficiency of their investigations. By upholding the integrity of financial systems and safeguarding against fraud, forensic accountants contribute significantly to the financial well-being and trust in organizations and society as a whole.What Is a Forensic Accountant?

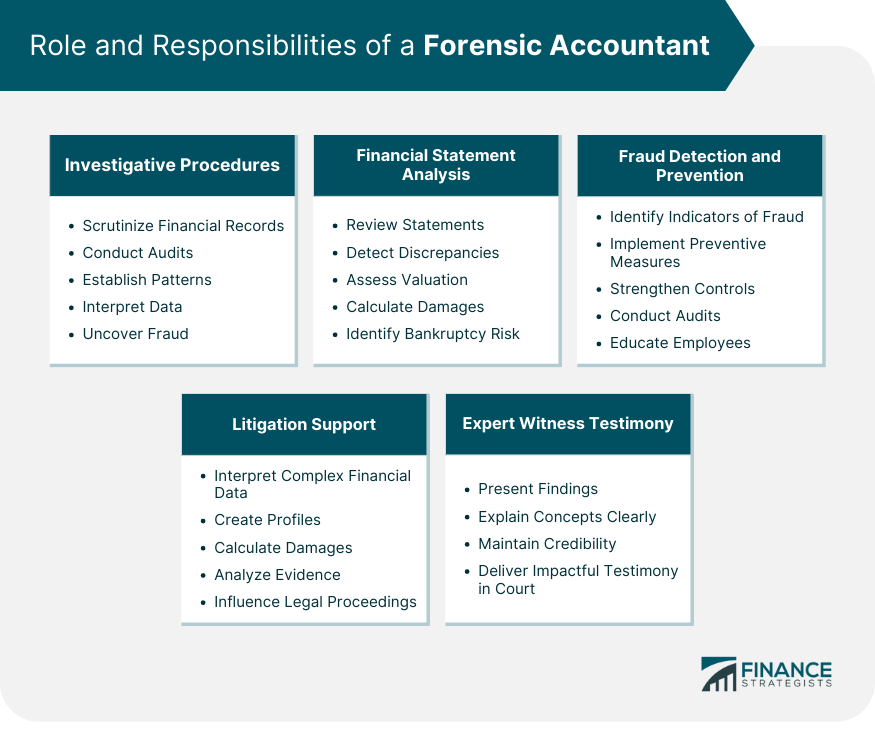

Role and Responsibilities of a Forensic Accountant

Investigative Procedures

Financial Statement Analysis

Fraud Detection and Prevention

Litigation Support

Expert Witness Testimony

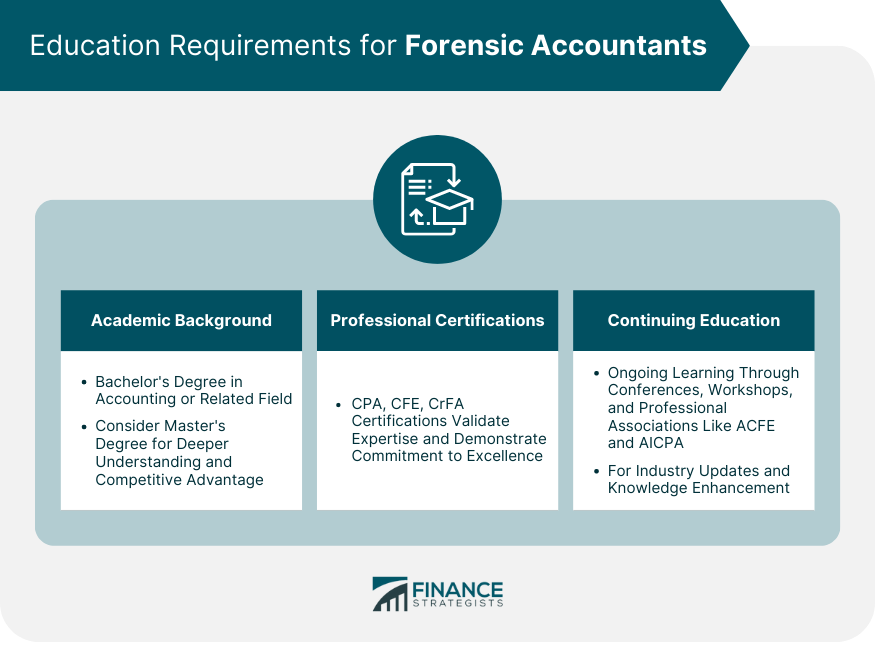

Education Requirements for Forensic Accountants

Academic Background

Professional Certifications

Continuing Education and Professional Development

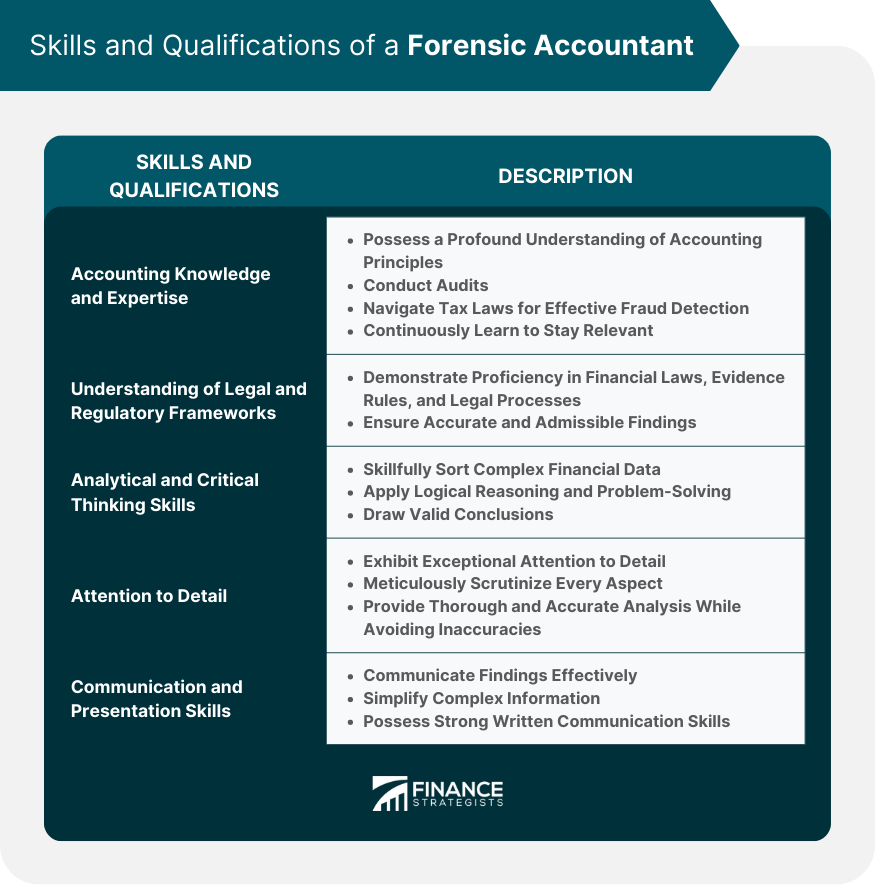

Skills and Qualifications of a Forensic Accountant

Accounting Knowledge and Expertise

Understanding of Legal and Regulatory Frameworks

Analytical and Critical Thinking Skills

Attention to Detail

Communication and Presentation Skills

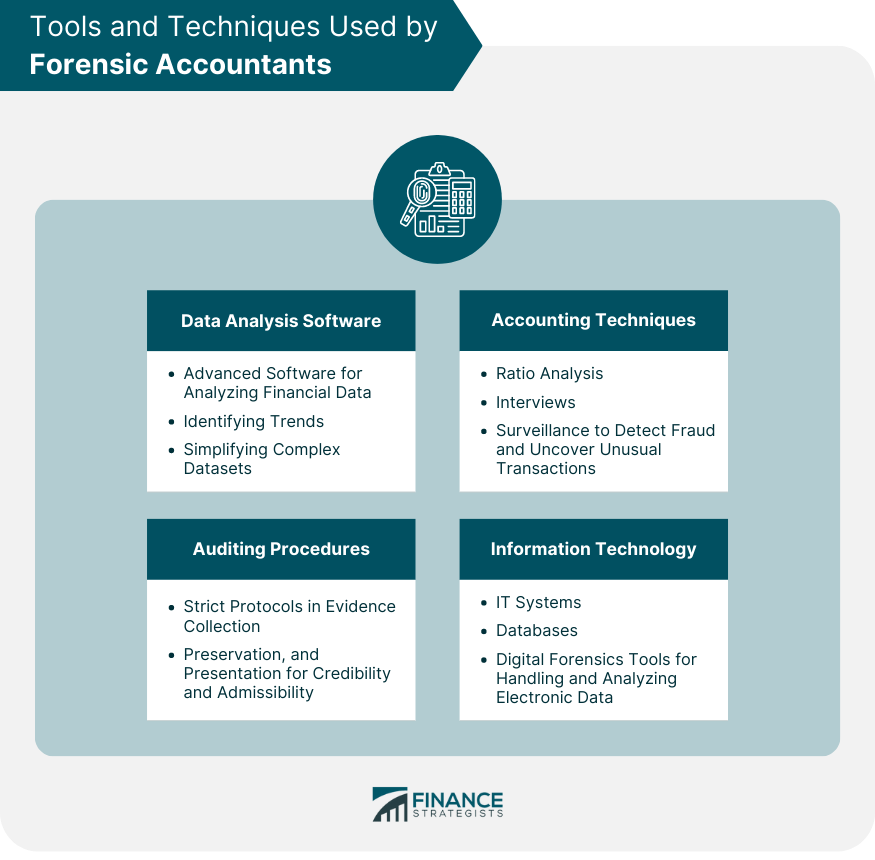

Tools and Techniques Used by Forensic Accountants

Data Analysis Software

Accounting Techniques

Information Technology

Auditing Procedures

Conclusion

Forensic Accountant FAQs

A forensic accountant is a specialist who combines accounting knowledge with investigative skills to detect fraud and other financial irregularities. They are often involved in legal proceedings related to financial disputes.

A forensic accountant typically needs a bachelor's degree in accounting or a related field. Some pursue advanced degrees or specialized coursework in forensic accounting. Professional certifications, like the CPA or CFE, are also common among these specialists.

Forensic accountants need a solid understanding of accounting principles, strong analytical and critical thinking skills, meticulous attention to detail, and excellent communication skills. They should also be familiar with legal and regulatory frameworks related to financial fraud and litigation.

Forensic accountants use data analysis software and specialized forensic accounting techniques in their investigations. They also need IT skills to work with electronic data and must adhere to rigorous forensic auditing procedures.

While both handle financial data, forensic accountant uses their skills to investigate possible fraud or financial misrepresentation. Their work often involves legal proceedings, and they need additional skills in investigation, legal understanding, and communication.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.