Forensic accounting represents the exciting convergence of number-crunching acuity, investigative skills, and a deep understanding of legal processes. Forensic accountants are financial detectives, unraveling intricate monetary puzzles, and probing for inaccuracies, fraud, and deceit within the realm of financial records. As a profession, forensic accounting is an exceptional blend of detail-oriented number work and stimulating investigative challenges. It's an essential practice in upholding transparency and integrity within financial systems. A forensic accountant is a trusted authority that utilizes their financial and accounting expertise to investigate and interpret complex monetary information. These financial specialists delve deep into financial statements, audits, and transactions to unravel irregularities, discrepancies, and fraudulent activities. Their work often makes a significant difference in legal cases, business operations, and regulatory compliance. Forensic accounting is pivotal in uncovering deceptive activities lurking within an organization's financial records. When financial anomalies arise, forensic accountants step in, their detective hats donned, scrutinizing transactions and ledgers for signs of fraudulent activities. Their specialized training and sharp analytical skills aid them in deciphering inconsistencies that may hint at a variety of fraudulent activities like embezzlement, tax evasion, or payroll fraud. Fraud investigations often demand a forensic accountant's meticulous eye, combing through layers of financial data to trace any deceitful trails. Armed with sophisticated data analytics tools and a profound understanding of financial systems, these experts deftly identify red flags, follow the money trails, and unearth potential fraudulent schemes. Their investigations may lead to significant revelations, lending strength to fraud prevention efforts and contributing to the overall financial health of the organization. Forensic accountants offer a lifeline, providing the clarity needed to solve contentious financial issues. These professionals may be called upon during business disagreements, matrimonial disputes involving financial settlements, or legal cases requiring detailed financial analysis. Their role entails dissecting financial records, assessing the value of assets, and providing an unbiased analysis of financial positions. Forensic accountants bring their expertise to the fore during dispute resolution, presenting a clear, unbiased financial perspective. This helps parties understand the financial ramifications of their dispute, promoting informed decision-making. With their involvement, convoluted financial disputes can be resolved more accurately and equitably, preventing further escalation and fostering amicable resolutions. The complexity of financial reporting can often shroud inconsistencies, inaccuracies, or even deliberate manipulation. Here, forensic accountants become invaluable. They bring their razor-sharp analytical skills and deep understanding of accounting standards to identify and investigate any irregularities in financial reports. Such anomalies could range from revenue recognition issues to inaccurately reported assets or liabilities. Beyond merely identifying these irregularities, forensic accountants take it a step further. They probe into the root cause of these inconsistencies, seeking out whether they stem from honest errors, systemic issues, or intentional manipulation. Their insights can help organizations rectify inaccuracies, adhere to financial standards, and enhance the credibility of their financial reporting. Forensic accountants play a crucial role in business valuations - a critical activity during mergers and acquisitions, dispute resolution, or strategic planning. Their expert eyes scrutinize the company's financial records, assess its assets and liabilities, project future earnings, and consider market conditions to arrive at a fair and accurate valuation. The prowess of a forensic accountant extends beyond mere number-crunching. They adopt a holistic approach, taking into account both tangible and intangible factors that could affect the company's value. Through this comprehensive analysis, they help paint a realistic picture of the business's financial worth, driving informed decision-making in business transactions. Following an incident such as a natural disaster, accident, or theft, businesses often file insurance claims for losses incurred. Forensic accountants are called upon to calculate these losses accurately, considering various financial aspects like lost income, expenses, and other relevant financial metrics. Forensic accountants navigate the intricate maze of financial data, evaluating the economic impact of the incident. They ensure the calculated losses are comprehensive, accurate, and substantiated by financial evidence. Their expertise aids in fair settlement of insurance claims, guarding against over or under-compensation and fostering trust between insurers and policyholders. At the heart of forensic accounting lies the meticulous analysis of financial statements. Forensic accountants apply various analytical techniques to dissect balance sheets, income statements, and cash flow statements. They scrutinize these financial documents for anomalies, inconsistencies, and trends that may signal fraudulent activities or financial misrepresentation. Financial statement analysis is not a cursory glance at numbers. It's an in-depth exploration of financial data involving ratio analysis, trend analysis, and horizontal and vertical analysis. Through their trained eyes, revenue manipulations, inflated assets, hidden liabilities, or suspicious transactions come to light. This analysis forms the cornerstone of their investigations, guiding them toward the truth behind the figures. Forensic accountants leverage the power of technology to streamline and enhance their investigations. They harness data analytics software to parse through extensive financial data, automating tedious tasks and revealing trends or anomalies that might escape the human eye. Tools such as Microsoft Excel, ACL, and Tableau are staples in their technological arsenal. Beyond conventional data analytics, forensic accountants also tap into the realm of artificial intelligence and machine learning. These cutting-edge technologies aid in pattern recognition, anomaly detection, and predictive analysis, contributing to more efficient and thorough investigations. Such advanced tools not only facilitate in-depth analysis but also significantly reduce the time and effort involved in examining voluminous financial data. Amidst all the numbers and data, people play a critical role in forensic accounting. Interviewing and interrogation form an integral part of a forensic accountant's toolkit. They often need to interact with employees, management, and other stakeholders to gather information related to a case. Effective interviewing techniques enable forensic accountants to extract crucial information that may not be evident in financial documents. Non-verbal cues, inconsistencies in statements, and reluctant admissions can all provide valuable insights into potential fraud or financial misrepresentation. This human aspect of forensic accounting adds a layer of depth to their investigations, complementing their financial analysis and guiding them towards the truth. Forensic accounting plays a pivotal role in combatting one of the most serious financial crimes – fraudulent financial reporting. This involves intentional misstatement or omission of financial information, leading to distorted financial statements that misrepresent the company's true financial position. It could include activities such as earnings management, fictitious transactions, or improper asset valuation. Forensic accountants act as gatekeepers against this form of financial deceit. They meticulously comb through financial statements, investigate suspicious activities, and trace irregularities to their source. Their findings not only help unveil existing fraud but can also deter potential fraudsters, reinforcing the integrity of financial reporting. Asset misappropriation is another common financial crime that falls under the purview of forensic accounting. This includes any unauthorized use or theft of a company's assets by its employees. From pilfering office supplies to siphoning off funds through complex billing schemes, asset misappropriation can take various forms. Forensic accountants employ their skills to identify and investigate signs of asset misappropriation. They examine transaction records, scrutinize internal controls, and track asset movements to detect any irregularities. Their efforts can lead to the identification of loopholes in the system, the prevention of future theft, and recovery of stolen assets. Money laundering, the process of making illegally-gained money appear legitimate, poses significant challenges to economies and societies. Forensic accountants often find themselves on the frontlines in the battle against this sophisticated financial crime. Their expertise in financial systems, coupled with their investigative skills, makes them a formidable adversary against money launderers. Forensic accountants detect suspicious transactions, trace funds, and unravel complex money trails. Their investigative efforts can lead to the identification of money-laundering schemes and, potentially, the perpetrators behind them. With their help, illicit money can be seized, illegal activities can be curtailed, and economic stability can be maintained. Bribery and corruption are insidious crimes that can infiltrate organizations and destabilize economies. Forensic accountants stand as sentinels against these unethical practices, utilizing their financial acumen and investigative skills to detect, investigate, and prove instances of bribery or corruption. Through their scrupulous examination of financial records, forensic accountants can identify red flags such as unusual payments, discrepancies in accounting records, or inexplicable wealth accumulation. Their investigations not only help prosecute offenders but also contribute to establishing more robust systems that discourage bribery and corruption. Forensic accountants often deal with sensitive financial information, and they must ensure this data remains secure and confidential. They are also expected to respect privilege, a legal concept that protects certain communications from disclosure. Confidentiality and privilege are not mere ethical guidelines but fundamental tenets of the forensic accounting profession. Adherence to these principles is crucial to maintain trust, uphold professional standards, and avoid legal complications. Forensic accountants, like all professionals, must guard against conflicts of interest that could compromise their objectivity and professional judgment. A conflict of interest occurs when a personal or financial relationship could influence the forensic accountant's professional duties. Forensic accountants must identify and disclose any potential conflicts of interest promptly. They should ensure that their professional judgment is not clouded by personal gain or relationships. Upholding this ethical principle is crucial to maintain the credibility of their work and the integrity of the profession. Professional skepticism is an essential trait for forensic accountants. It involves having a questioning mind and a critical assessment of evidence. Forensic accountants must not take things at face value but should always dig deeper, seeking corroborative evidence and challenging assumptions. Adopting an attitude of professional skepticism helps forensic accountants detect hidden discrepancies, uncover deceit, and question dubious financial practices. It's an indispensable tool in their ethical toolkit, enabling them to conduct thorough and unbiased investigations. Independence is a critical ethical consideration in forensic accounting. Forensic accountants must avoid any situation that could compromise their ability to perform their duties objectively and impartially. This includes steering clear of any undue influence, bias, or personal interests that could cloud their professional judgment. Independence is not just about actual conflicts but also about perceived conflicts. Forensic accountants must ensure that their actions do not raise doubts about their impartiality. Upholding independence enhances the credibility of their findings and fosters trust in their professional judgment. Forensic accounting is a dynamic and multidisciplinary field that combines financial expertise with investigative skills and legal knowledge. Forensic accountants play a crucial role in uncovering fraudulent activities, resolving financial disputes, identifying financial reporting irregularities, conducting business valuations, and calculating insurance claims. Through techniques like financial statement analysis, data analytics, and interviewing, they navigate complex financial data and bring clarity to intricate financial matters. Their work covers a wide range of financial crimes, including fraudulent financial reporting, asset misappropriation, money laundering, and bribery. In carrying out their responsibilities, forensic accountants must uphold ethical considerations such as confidentiality, avoiding conflicts of interest, maintaining professional skepticism, and ensuring independence. By upholding these ethical principles, forensic accountants contribute to the integrity of financial systems and the pursuit of justice.What Is Forensic Accounting?

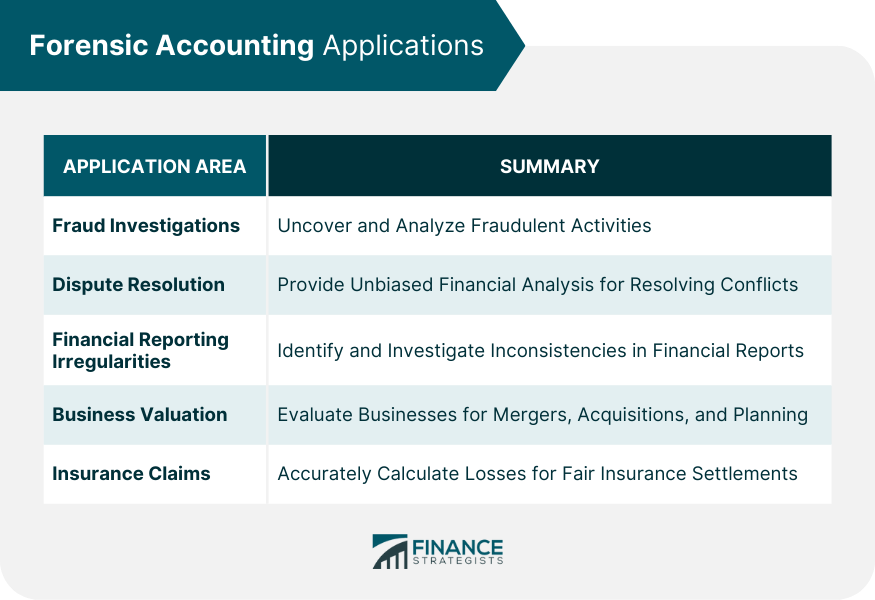

Application Areas of Forensic Accounting

Fraud Investigations

Dispute Resolution

Financial Reporting Irregularities

Business Valuation

Insurance Claims

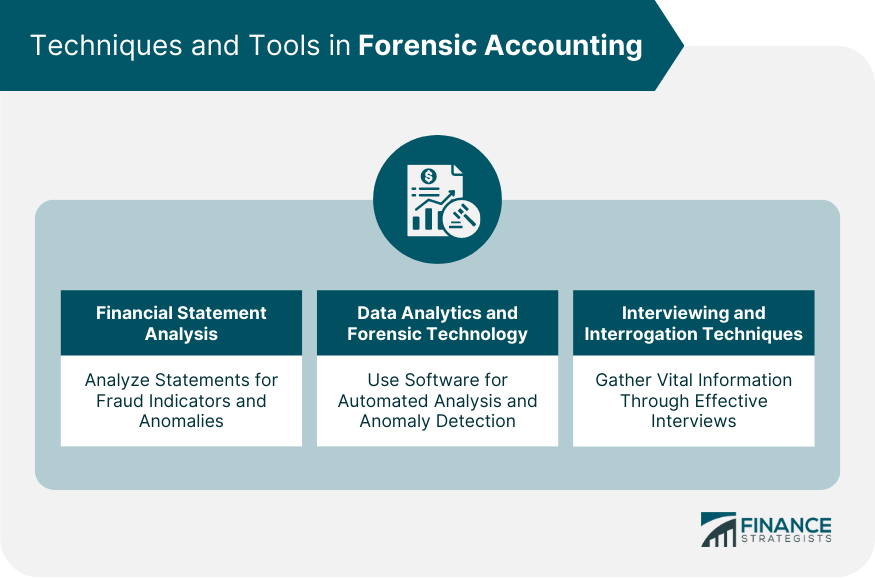

Techniques and Tools in Forensic Accounting

Financial Statement Analysis

Data Analytics and Forensic Technology

Interviewing and Interrogation Techniques

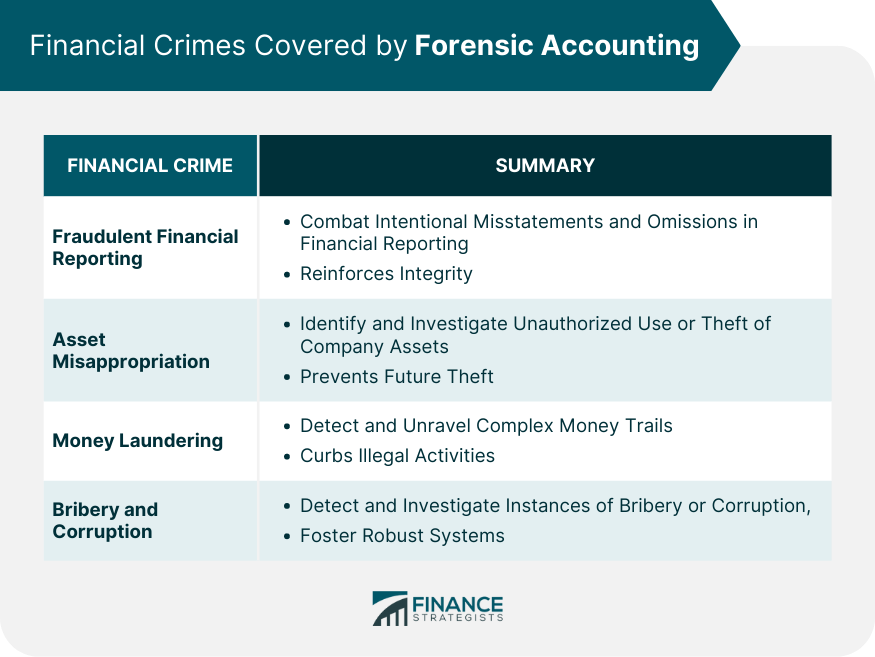

Financial Crimes Covered by Forensic Accounting

Fraudulent Financial Reporting

Asset Misappropriation

Money Laundering

Bribery and Corruption

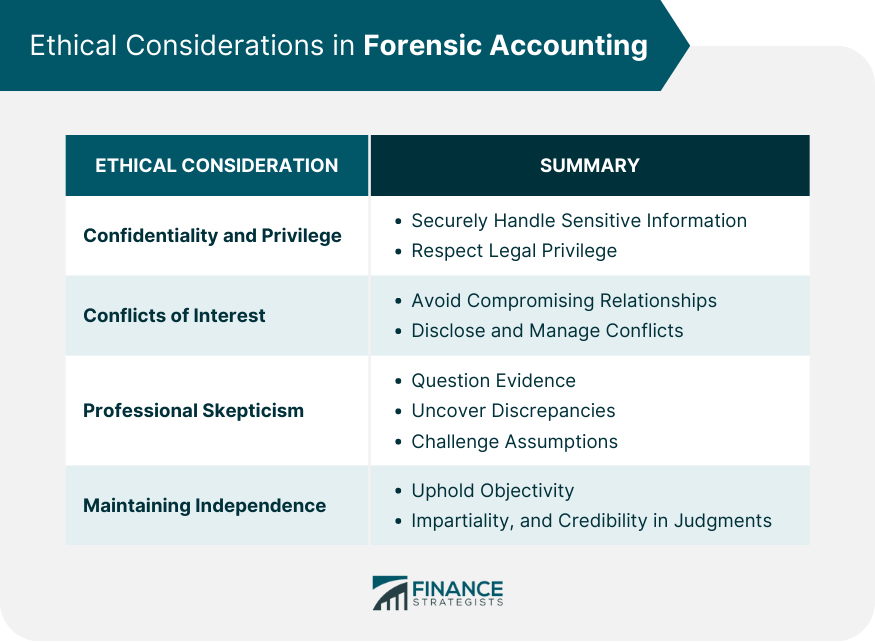

Ethical Considerations in Forensic Accounting

Confidentiality and Privilege

Conflicts of Interest

Professional Skepticism

Maintaining Independence

Conclusion

Forensic Accounting FAQs

Forensic accountants leverage their accounting and investigative skills to examine financial records, identify discrepancies, and detect fraudulent activities. They often testify as expert witnesses in court and provide crucial insights during legal disputes, fraud investigations, and insurance claims.

A successful forensic accountant requires a strong understanding of accounting principles, meticulous attention to detail, and sharp analytical skills. Additionally, they must have a solid grasp of legal issues, effective communication skills, and an innate sense of curiosity.

Forensic accountants can find employment in a range of sectors, including government agencies, law enforcement, financial institutions, insurance companies, and accounting firms. They may also work as independent consultants or experts in legal cases.

Forensic accountants investigate a variety of financial crimes, such as fraudulent financial reporting, asset misappropriation, money laundering, and bribery. Their investigations help uncover illegal activities, support legal proceedings, and contribute to fraud prevention efforts.

Ethical considerations in forensic accounting include maintaining confidentiality and privilege, avoiding conflicts of interest, exercising professional skepticism, and ensuring independence. These principles guide the work of forensic accountants, ensuring their investigations are thorough, unbiased, and credible.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.