An accountant is a critical cog in the financial machinery of any business, small or large. Their primary responsibility includes maintaining accurate financial records, preparing and filing taxes, ensuring compliance with regulations, and providing strategic financial advice. Accountants handle everything from payroll processing and bookkeeping to financial forecasting and auditing. They analyze financial data to identify trends and make future predictions, assisting in strategic business decisions. Furthermore, with their expert knowledge of tax law, accountants are adept at minimizing tax liability and identifying potential tax deductions. As trusted advisors, they provide financial clarity, facilitate regulatory compliance, and support informed decision-making, playing a pivotal role in business growth and profitability. Accountants handle large volumes of financial data daily. From sales revenue, expenses, and payroll to investments, accountants are proficient in collecting, organizing, and interpreting this information. They ensure that financial transactions are correctly recorded and classified in the company's books, providing a clear financial picture for stakeholders. Internal and external audits are another significant aspect of an accountant's work. They are experts in examining a company's financial statements to ascertain their accuracy and compliance with regulations. Additionally, audits carried out by accountants can highlight potential areas of improvement in the company's financial management. Beyond the day-to-day operations, accountants also assist in strategic financial planning. They analyze financial data to forecast trends, identify opportunities for increased profitability, and recommend measures to reduce costs. Tax preparation and filing is a critical duty for accountants. They use their expert knowledge of tax law to ensure accurate tax filings, identify deductions, and provide advice on tax-related decisions. By doing so, accountants help individuals and companies minimize their tax liability. A bachelor's degree in accounting or a related field is typically the minimum requirement for an accountant. Some positions may require a master's degree or specific certification. Accountants need a range of skills, including attention to detail, analytical skills, proficiency with financial software, and strong communication skills. Certifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA) are valuable in advancing an accountant's career. Public accountants provide a variety of accounting services to individuals, businesses, and government agencies. Management accountants, or corporate accountants, work within a company and focus on internal financial documents. Government accountants maintain and examine records of government agencies and audit private businesses or individuals for compliance with government regulations. Forensic accountants investigate financial crimes such as embezzlement, fraud, and other complex financial disputes. Auditors can be internal or external, and they review financial statements for accuracy and regulatory compliance. Having an accountant ensures a business stays compliant with the various regulations, saving the company from penalties and maintaining its reputation. Accountants provide financial clarity to business owners and managers by keeping accurate records and presenting them in an understandable manner. Accountants aid in decision-making by providing well-analyzed financial data, helping to formulate strategic business plans. Accountants offer strategic tax planning, helping businesses leverage tax laws for their benefit, thereby saving money. Accountants manage risk by conducting internal audits, identifying areas of weakness, and suggesting improvements. Hiring an accountant can be expensive, especially for small businesses or startups operating on a tight budget. Companies heavily rely on their accountant's expertise and integrity. A less skilled or unethical accountant can harm the business. Despite their expertise, accountants are humans and can make errors, leading to financial losses or regulatory issues. Accountants play a pivotal role in the financial management of businesses, offering indispensable services that contribute to growth and profitability. Their responsibilities encompass maintaining accurate financial records, preparing taxes, ensuring compliance, and providing strategic financial advice. Accountants possess essential skills, such as attention to detail, analytical acumen, proficiency with financial software, and effective communication. Professional certifications like CPA or CMA enhance their career prospects. There are various types of accountants, including public accountants, management accountants, government accountants, forensic accountants, and auditors, each serving different needs. The benefits of having an accountant are numerous, ranging from ensuring regulatory compliance and providing financial clarity to aiding in decision-making and offering strategic tax planning. However, there are drawbacks as well, such as the cost of services, dependence on the accountant's expertise and integrity, and the potential for human errors. Despite these drawbacks, the expertise and insights provided by accountants make them indispensable assets for any business seeking financial success and stability.What Does an Accountant Do?

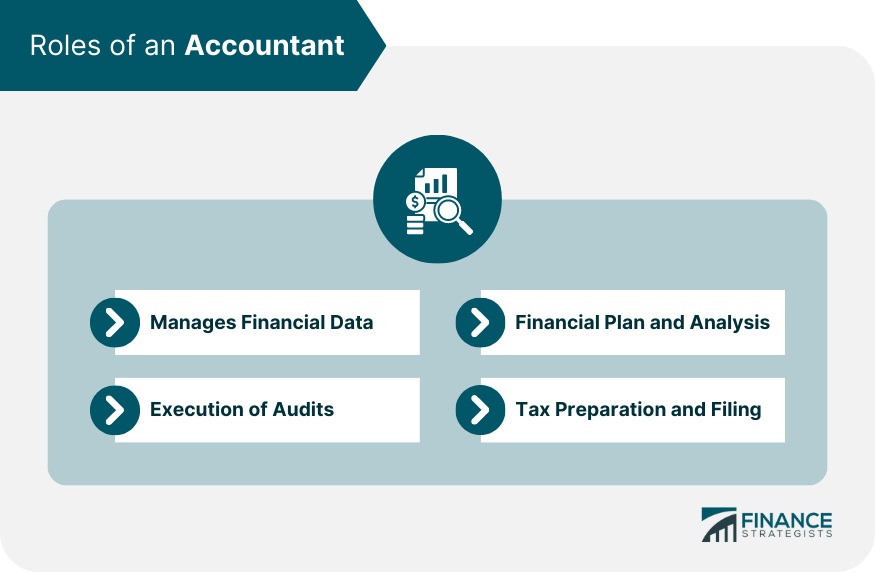

Roles of an Accountant

Manages Financial Data

Execution of Audits

Financial Plan and Analysis

Tax Preparation and Filing

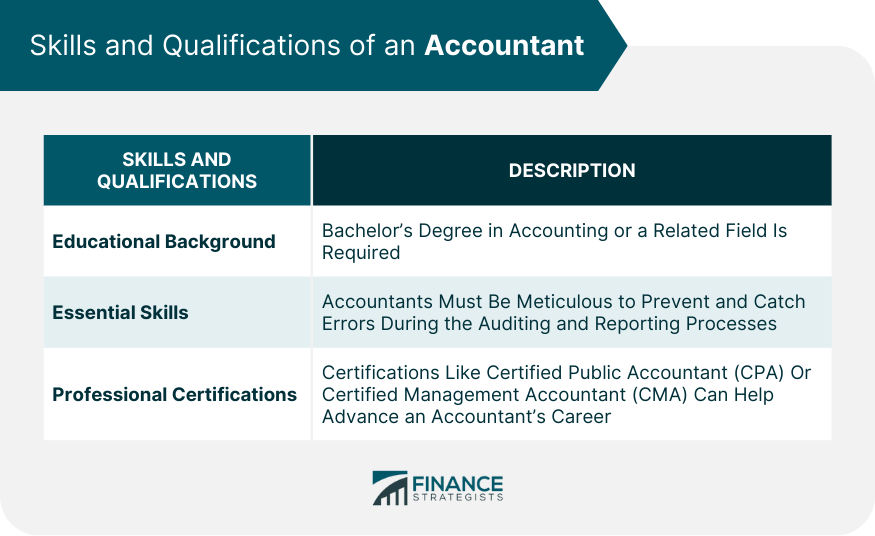

Skills and Qualifications of an Accountant

Educational Background

Essential Skills

Professional Certifications

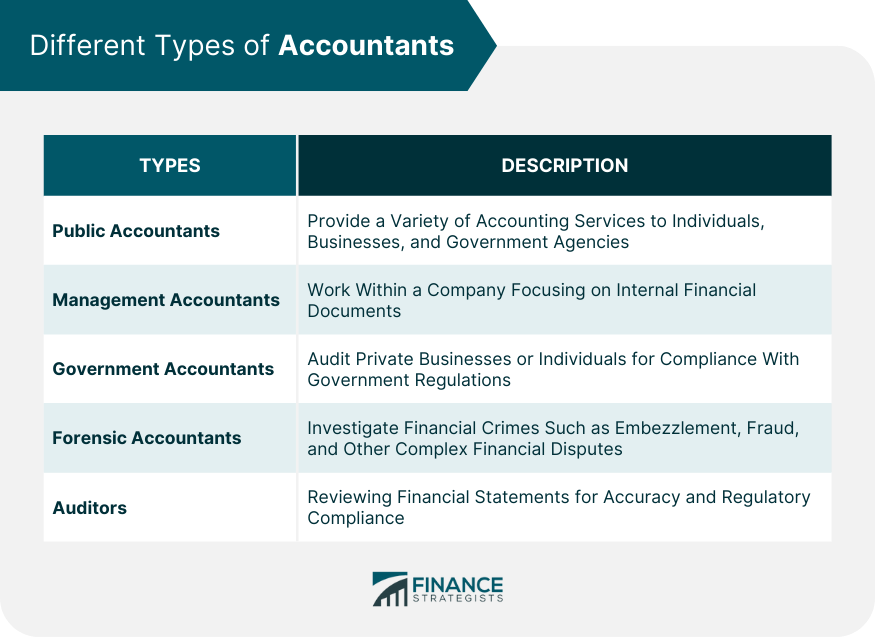

Different Types of Accountants

Public Accountants

Management Accountants

Government Accountants

Forensic Accountants

Auditors

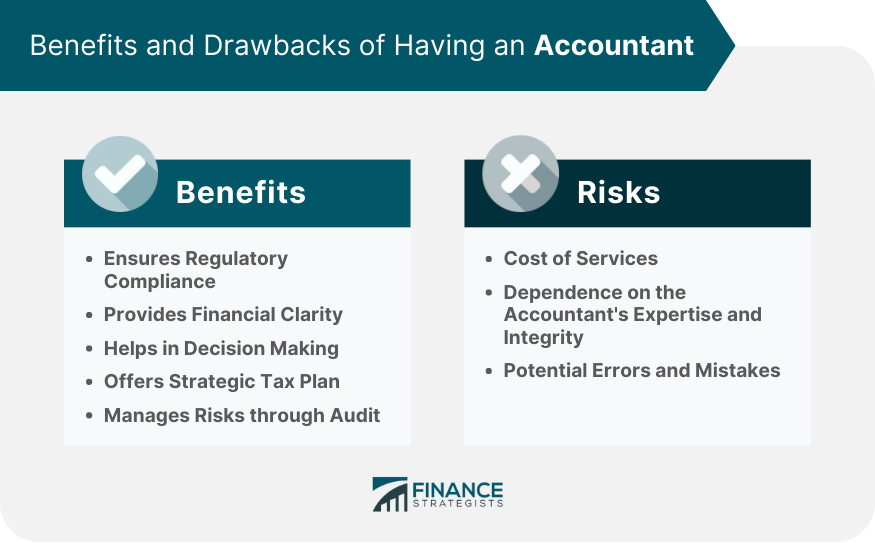

Benefits of Having an Accountant

Ensures Regulatory Compliance

Provides Financial Clarity

Helps in Decision Making

Offers Strategic Tax Plan

Manages Risks through Audit

Drawbacks of Having an Accountant

Cost of Services

Dependence on the Accountant's Expertise and Integrity

Potential Errors and Mistakes

Conclusion

What Does an Accountant Do? FAQs

An accountant in a small business manages a wide range of financial tasks, including bookkeeping, payroll processing, tax preparation and filing, regulatory compliance, and financial reporting. They also provide strategic financial advice to help the business grow and become more profitable.

While managing and interpreting numerical financial data is a significant part of an accountant's role, they do much more than that. An accountant also ensures regulatory compliance, assists in strategic financial planning, conducts audits, and offers expert advice on tax-related matters.

A bachelor's degree in accounting or a related field is typically the minimum requirement. However, for career advancement or to specialize in a particular area, further qualifications may be necessary, such as a master's degree in accounting or certifications like Certified Public Accountant (CPA) or Certified Management Accountant (CMA).

An accountant assists with decision-making by providing well-analyzed financial data, identifying trends, and forecasting future financial scenarios. This information is invaluable when making strategic business decisions such as expansion, investment, or cost-cutting.

The rise of technology and automation is changing the landscape of accounting. While some basic tasks can be automated, this shift allows accountants to focus more on strategic roles, such as analysis, advisory services, and decision-making support. As a result, accountants will need to adapt, enhancing their technical skills and focusing more on value-added services.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.