A third party accountant is a certified professional or a firm providing accounting services on an outsourcing basis. Unlike an in-house accountant or accounting department, a third party accountant is not directly employed by the company seeking the service. They operate independently, providing their expertise to manage a variety of accounting functions for the company. The purpose and importance of a third party accountant are multifaceted. Companies opt for third-party accountancy for several reasons, but the most notable are accessing specialized accounting expertise, improving cost efficiency, and focusing more on core business operations. Third party accountants offer a comprehensive suite of accounting services, from tax planning and preparation to audit support, financial reporting, payroll management, and more. The scope of services offered by a third party accountant typically encompasses all areas of business accounting. These professionals cater to businesses of all sizes, from startups and small enterprises to large corporations, providing tailored services based on specific client needs. Their services often include bookkeeping, tax preparation, financial statement preparation, budgeting and forecasting, payroll services, and business advisory. Essentially, they function as an entire accounting department, capable of fulfilling a comprehensive suite of financial tasks. The engagement model of a third party accountant varies depending on the specific needs of the business. They may be hired to manage specific aspects of the company’s finances, such as tax preparation, or they could handle all of the company's financial operations. In some cases, a third party accountant operates on a retainer basis, offering services for a set number of hours each month. In other instances, they might work on a project basis, managing a specific financial task or project. Regardless of the model, clear communication and detailed service agreements ensure both parties understand the expectations and deliverables. One of the significant roles of a third party accountant in business is to assist in strategic financial decision-making. By analyzing financial data, they can provide insight into a company's financial health, helping to guide decisions around investments, cost-cutting, growth strategies, and more. Regulatory compliance is an essential aspect of business operations. A third party accountant helps ensure a business meets all tax obligations and complies with any relevant financial regulations. This function is crucial, as non-compliance can result in penalties and can harm a business's reputation. Risk management and internal controls are critical to maintaining the financial integrity of a company. A third party accountant can help set up and enforce these controls, which can range from checks and balances within the accounting system to strategies for managing financial risk. Third party accountants bring a level of expertise and specialization that may not exist within the business. They are up-to-date with the latest regulations, best practices, and tools in the accounting field. This level of expertise can lead to more accurate financial reporting and efficient accounting practices. Hiring a third party accountant can be more cost-effective than maintaining an in-house accounting department, especially for small businesses. By outsourcing accounting tasks, businesses can avoid the costs associated with full-time salaries, benefits, training, and software purchases. As businesses grow, their financial needs become more complex. A third party accountant can scale their services to match the growing needs of the business. This scalability allows for the flexibility businesses need as they evolve. One potential drawback of outsourcing accounting functions is the dependence on an external entity. If the third party accountant is unavailable or ends the business relationship abruptly, it could disrupt the company's financial operations. When hiring a third party accountant, businesses are entrusting sensitive financial information to an external entity. Therefore, there might be concerns about data privacy and security. Since the third party accountant operates externally, businesses may face challenges in controlling the quality of work. It's crucial to choose a reputable service provider and establish clear communication channels to mitigate this risk. Before engaging a third party accountant, businesses need to identify their specific needs. It's crucial to determine which accounting functions to outsource and the level of expertise required. Conducting due diligence is a vital step in choosing a third party accountant. This process includes checking the accountant's credentials, experience, reputation, and understanding their approach to work. Once a third party accountant is selected, a detailed service agreement should be defined. This agreement should outline the scope of services, terms of payment, confidentiality provisions, and the processes for dispute resolution and service termination. Third party accountants serve a critical role in the business landscape, providing comprehensive accounting services on an outsourced basis. Their expertise, cost-efficiency, and scalability make them a valuable asset to companies of all sizes. Their functions extend beyond basic accounting tasks to include strategic financial decision-making, compliance, and risk management. However, businesses must consider potential challenges such as dependence on an external entity, privacy concerns, and quality control. To mitigate these risks, it's essential to identify specific business needs, conduct thorough due diligence in the selection process, and define a detailed service agreement. In doing so, businesses can fully leverage the advantages of engaging with a third party accountant while ensuring their financial operations run smoothly.What Is a Third Party Accountant?

How a Third Party Accountant Operates

Scope of Services

Engagement Model

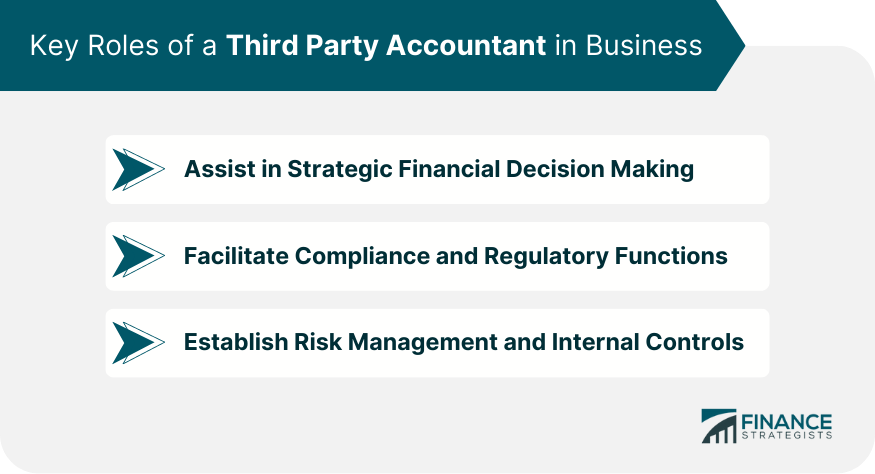

Key Roles of a Third Party Accountant in Business

Assist in Strategic Financial Decision Making

Facilitate Compliance and Regulatory Functions

Establish Risk Management and Internal Controls

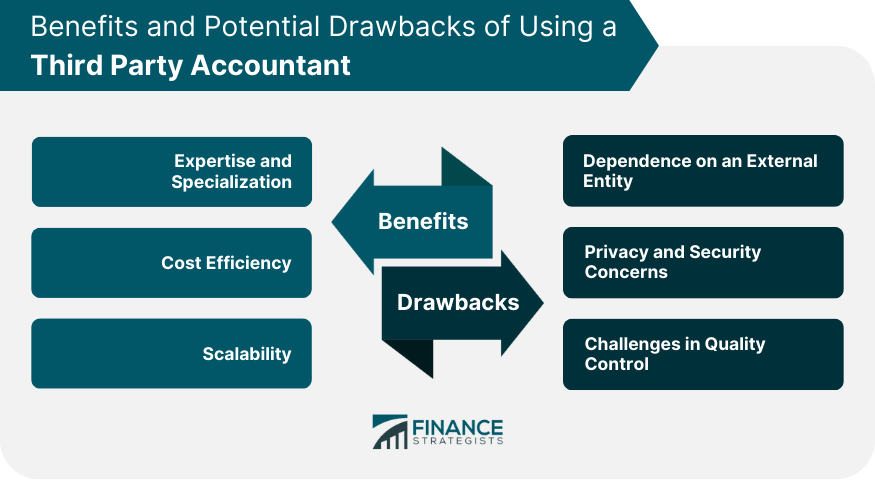

Benefits of Hiring a Third Party Accountant

Expertise and Specialization

Cost Efficiency

Scalability

Potential Drawbacks of Using a Third Party Accountant

Dependence on an External Entity

Privacy and Security Concerns

Challenges in Quality Control

Key Considerations When Engaging With a Third Party Accountant

Identify Business Needs

Due Diligence in the Selection Process

Define the Service Agreement

The Bottom Line

Third Party Accountant FAQs

A third party accountant is a professional or a firm that provides accounting services to companies on an outsourcing basis. They are independent entities, not directly employed by the businesses they serve.

A third party accountant assists in strategic financial decision-making, facilitates compliance with financial regulations and tax obligations, and establishes risk management strategies and internal controls for a business.

Hiring a third party accountant brings several benefits such as access to specialized expertise, cost savings, and scalability. They can provide a comprehensive range of accounting services, allowing businesses to focus on their core operations.

While beneficial, there can be drawbacks, such as dependence on an external entity, privacy and security concerns due to entrusting sensitive financial data to an outside party, and potential challenges in controlling the quality of work.

It's crucial to identify your specific business needs and conduct thorough due diligence during the selection process. Once you've chosen a third party accountant, a detailed service agreement outlining the scope of services, payment terms, and confidentiality provisions should be defined.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.