Accountants and bookkeepers are integral components of a functioning financial system within any business. A bookkeeper’s role is primarily transactional, dealing with the day-to-day recording of financial transactions, including purchases, sales, receipts, and payments. This meticulous recording forms the foundation of a business’s financial data. On the other hand, accountants provide a higher level of strategic financial oversight. They use the data provided by bookkeepers to generate financial models, perform risk analyses, create tax strategies, and offer recommendations to enhance financial performance and strategic growth. While their responsibilities differ, the roles of accountants and bookkeepers often overlap, and they work in tandem to ensure a business's financial health. The choice between a bookkeeper and an accountant largely depends on the size, complexity, and specific needs of the business, with many companies opting to utilize the distinct skills of both. In the world of finance, an accountant is a vital player. They are tasked with the responsibility of preparing, analyzing, and maintaining financial records. They ensure that an individual or business is paying taxes correctly and on time, and they offer advice on how to reduce costs, increase revenues, and improve profits. An accountant's primary role includes evaluating and summarizing an organization's financial activities. They scrutinize financial data to ensure that businesses run efficiently, public records are kept accurately, and taxes are paid timely and correctly. Accountants also perform overviews of the financial operations of a business to help it run efficiently. Typically, an accountant requires a bachelor’s degree in accounting or a related field. Some may even opt for a master's degree in business administration (MBA) with a concentration in accounting. Additionally, for progression in their career or for specific jobs, an accountant may need to become a Certified Public Accountant (CPA). This requires passing a national exam and meeting other state requirements. Accountants offer a wide range of services, including financial forecasting, risk analysis, budgeting, investment planning, auditing, and tax strategy. They may also oversee junior accounting staff and interface with other departments or executives in their organization. Contrasting with accountants, bookkeepers are professionals who focus more on the details of financial transactions. A bookkeeper is primarily responsible for recording the financial transactions of a business. They maintain complete and up-to-date detailed accounts, including purchases, sales, receipts, and payments. In many cases, a bookkeeper may not need a bachelor's degree, as skills can be learned on the job or through a basic course. However, a keen eye for detail, solid math skills, and a methodical approach to their work are essential traits for successful bookkeepers. Bookkeepers manage the daily financial records of a company, including tracking transactions, updating financial statements, checking financial records for accuracy, and producing financial records like balance sheets, income statements, and cash flow statements. While both accountants and bookkeepers work with financial data, the scope of their work and the responsibilities they carry are quite different. Bookkeepers record and classify financial transactions, while accountants interpret, analyze, report, and summarize financial data. The bookkeeper's role is transactional, laying the groundwork for the accountant's role, which is more advisory and analytical in nature. Typically, bookkeepers don't need to have a degree, while accountants are expected to have at least a bachelor’s degree. To enhance their career prospects, many accountants also pursue a CPA certification, which requires meeting additional education and experience requirements and passing a comprehensive exam. Accountants generally have a higher level of strategic involvement than bookkeepers. While bookkeepers manage day-to-day financial transactions, accountants use the data provided by bookkeepers to generate financial models. These models help business leaders make strategic decisions about growth, reductions, investments, and market expansion. When deciding between an accountant and a bookkeeper, a company should consider its size, industry, and specific needs. For small businesses with relatively uncomplicated financial transactions, a bookkeeper may suffice. However, larger businesses with more complex transactions, or businesses planning for growth, will likely need the skill set of an accountant. Additionally, any business that requires external financing or that is preparing for an audit would benefit from an accountant's expertise. In situations where financial strategy and analysis are critical, the skill set of an accountant would be most useful. However, for day-to-day financial management, such as accounts payable/receivable or payroll, a bookkeeper would be the most practical choice. In many situations, the roles of accountants and bookkeepers can overlap, and they often work in tandem, each playing their part in the broader financial function of a business. Accountants and bookkeepers can work together to ensure the financial health of a business. The bookkeeper's detailed recording of financial transactions provides a foundation for the accountant's high-level analysis. The collaboration between a bookkeeper and an accountant ensures the precision of financial data and allows for timely, informed business decisions. This dynamic relationship is a strategic asset in managing a business's financial health. Understanding the differences between an accountant and a bookkeeper is critical for business owners. Both roles are instrumental in maintaining the financial health of a company. However, they each serve different functions, with bookkeepers focusing on recording transactions and maintaining detailed accounts and accountants providing high-level analysis and strategic financial advice. This distinction is crucial when deciding the type of professional services a business needs to thrive. As a business evolves, so too might the need for more complex financial oversight, prompting a shift from relying on a bookkeeper to needing the services of an accountant. Nevertheless, many businesses find it beneficial to maintain both in a synergistic relationship, ensuring all aspects of the business's financial health are well taken care of.Accountant vs Bookkeeper: Overview

Who Is an Accountant?

Accountant's Role

Qualifications and Required Education

Services Provided

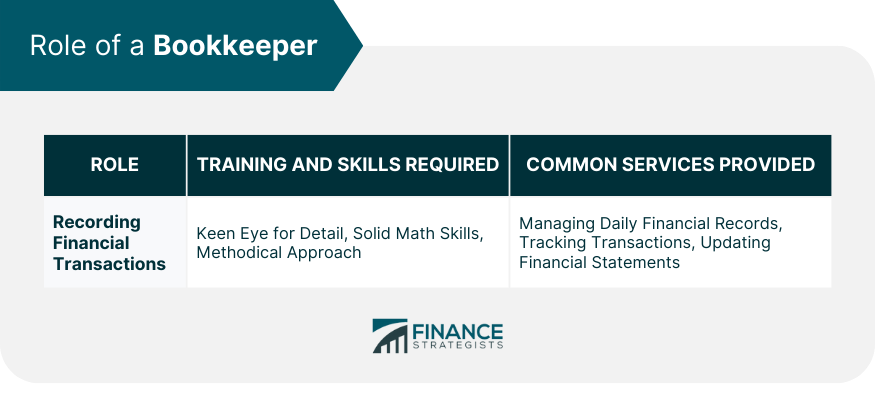

Who Is a Bookkeeper?

Bookkeeper's Job

Necessary Training and Skills

Common Services Offered

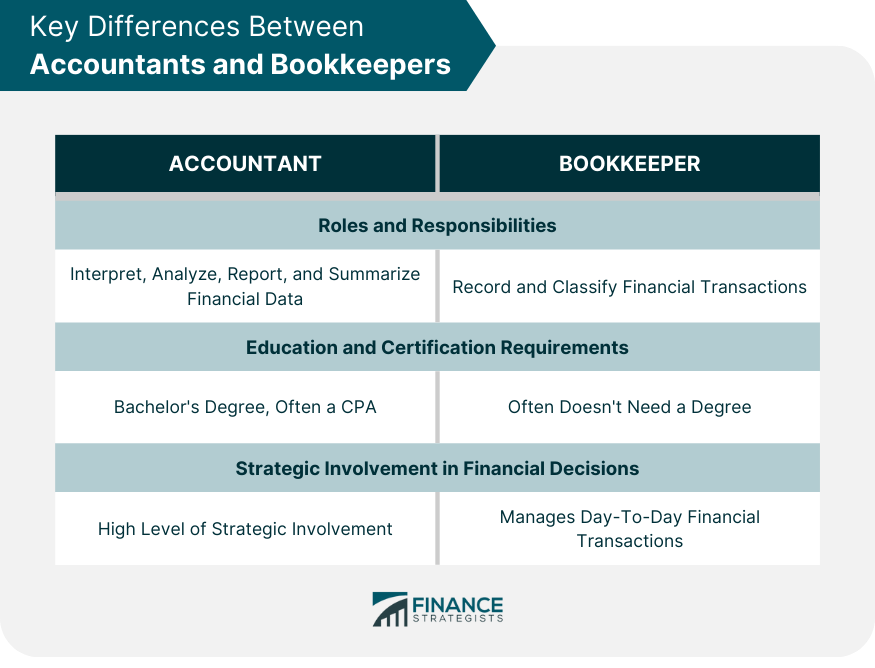

Key Differences Between Accountants and Bookkeepers

Distinct Roles and Responsibilities

Differences in Education and Certification Requirements

Different Levels of Strategic Involvement in Financial Decisions

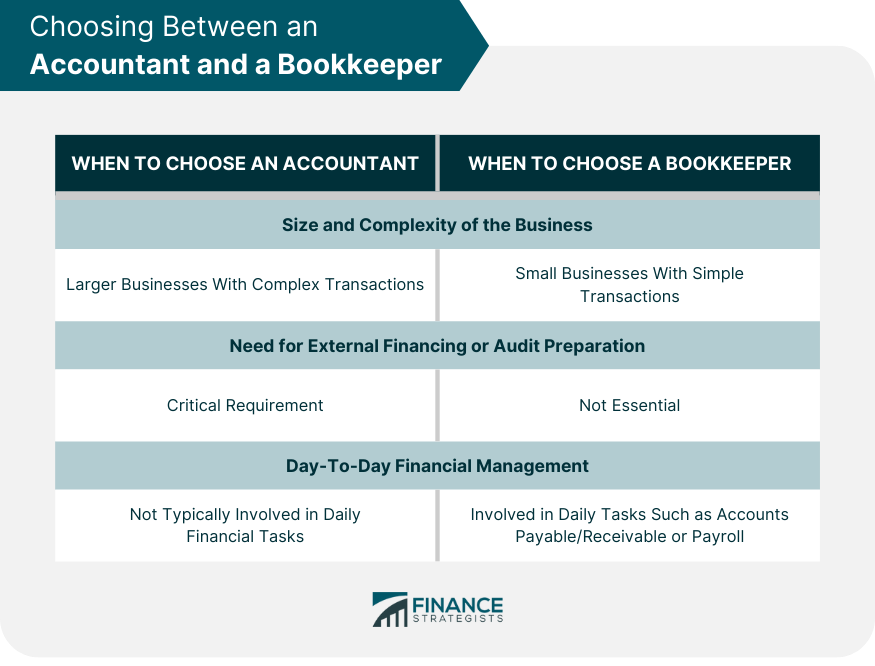

Choosing Between an Accountant and a Bookkeeper

Factors to Consider

Situational Examples

Synergistic Relationship of Accountants and Bookkeepers

Working Together

Benefits of Collaboration

The Bottom Line

Accountant vs Bookkeeper FAQs

An accountant evaluates and summarizes a business's financial activities, offering advice on cost reduction, revenue increase, and profit improvement.

A bookkeeper needs a keen eye for detail, solid math skills, and a methodical approach to accurately record and manage financial transactions.

While both work with financial data, bookkeepers record and classify transactions, whereas accountants interpret, analyze, report, and summarize financial data.

Larger businesses with complex transactions, those planning for growth, or needing external financing or audit preparation typically require an accountant's expertise.

Yes, accountants and bookkeepers often work together to ensure accurate and timely financial management, combining transactional details with strategic financial advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.