Certified Public Accountants (CPAs) embody an elite group of finance professionals, distinguished by their rigorous education, intensive training, comprehensive examinations, and commitment to a strict code of ethics. Aspiring CPAs must first earn a degree in a relevant field like accounting or finance, then fulfill the prerequisites for the Uniform CPA Examination, which is administered by the American Institute of Certified Public Accountants (AICPA). CPAs are frequently relied upon for their expertise in auditing, tax preparation, financial analysis, and advising on financial strategies. They tend to earn more compared to their non-certified counterparts. This discrepancy in salary can be attributed to the rigorous process of becoming a CPA, as well as the enhanced knowledge and skills they bring to their roles. The exact figures of CPA salaries can vary widely based on various factors, such as location, industry, experience, and more. However, one constant remains – CPAs are well-rewarded for their dedication and hard work. A key determinant of a CPA's salary is their level of education and the certifications they hold. Higher educational qualifications, such as a Master's degree or Ph.D., in related fields can influence the starting salary and the overall career progression of a CPA. Furthermore, additional certifications beyond the CPA, like the Certified Management Accountant (CMA) or Certified Financial Analyst (CFA), can lead to salary increases and more diverse career opportunities. The value of these advanced degrees and certifications lies in the specialized knowledge they impart. They are recognized markers of expertise in specific areas of finance and accounting, making their holders highly desirable to employers. CPAs who choose to further their education or gain additional certifications are often able to negotiate higher salaries. As CPAs gain practical experience, they also accumulate a wealth of knowledge and skills that are highly valuable to employers. Over time, these professionals learn to navigate complex financial scenarios, understand industry-specific accounting practices, and develop strategies to optimize financial performance. The expertise that comes with experience is particularly crucial for CPAs because their roles often involve decision-making that directly impacts a company's financial health. Hence, experienced CPAs are frequently offered higher salaries due to their proven track record and ability to navigate and advise on complex financial matters. Geographical location and the industry a CPA works in can greatly influence their earning potential. In regions with high costs of living, such as metropolitan areas, CPA salaries tend to be higher to compensate for the increased living expenses. Similarly, industries with high-profit margins like technology, finance, or pharmaceuticals often pay their CPAs more compared to lower-margin industries such as education or non-profit organizations. This trend of variation in salaries across different regions and industries is tied to economic principles of supply and demand. Locations with a higher concentration of businesses typically have a greater demand for CPAs, leading to higher salaries. Similarly, industries that generate significant profits have the capacity to pay more for skilled professionals like CPAs. Larger corporations often have more complex finances to manage, which require more specialized and experienced CPAs. Similarly, prestigious companies that are well-established in their industry typically pay higher salaries to attract and retain top talent. In larger companies, the sheer volume of financial transactions and the complexity of financial management often require a more extensive accounting team and a higher level of expertise. This complexity, combined with the higher revenue of large corporations, tends to result in higher salaries for CPAs. Reputable companies often provide higher compensation to uphold their image and attract the best talent in the field. Entry-level CPAs often begin their careers in public accounting firms or smaller businesses where they garner vital experience. Entry-level CPAs with less than one year to three years of work experience can expect to earn an average salary of $46,000 to $68,000. Entry-level CPAs can expect their salary trajectory to rise steadily as they acquire more experience and take on more responsibilities. Gaining exposure to a range of financial tasks and challenges early in their careers equips them with the skills and knowledge to command higher salaries in the future. Moreover, this period can also provide valuable opportunities for networking and professional development, further enhancing their career prospects. As CPAs progress in their careers and accumulate experience, their salaries tend to see significant increases. Mid-career CPAs often occupy managerial positions, overseeing teams, departments, or even entire organizations' financial operations. These increased responsibilities, coupled with their extensive experience and skillsets, allow them to command salaries that reflect their elevated roles. Mid-career CPAs with seven to nine years of experience can expect to earn an average salary of $85,000 to $155,000. A significant leap often occurs in a CPA's salary when they transition from a senior accountant to a managerial role. This leap can be attributed to the complexity and scope of the tasks they're entrusted with, including strategic planning, business development, financial reporting, and leadership duties. Senior-level CPAs, including those in executive roles such as Chief Financial Officer (CFO) or Director of Finance, typically command the highest salaries in the accounting field. At this level, CPAs are responsible for making strategic financial decisions that directly impact the company's performance and growth. Their significant experience and proven expertise make them invaluable assets to their organizations, and their salaries reflect this importance. Senior-level CPAs with 10+ years of experience can expect to earn an average salary of $94,000 to $172,000. The high salaries of senior-level CPAs correlate with the responsibilities they shoulder. Their roles require a high degree of financial acumen, strategic thinking, leadership skills, and industry knowledge. They often play a crucial role in steering the company towards profitability and growth, making decisions that can affect every aspect of the business. Just as in medicine or law, specialization within the field of accounting can lead to increased earning potential for CPAs. Those who specialize in areas like forensic accounting, international tax law, or financial planning, for example, may find that their unique expertise allows them to command higher salaries. Additionally, possessing supplementary credentials such as the Certified Fraud Examiner (CFE) or Certified Information Systems Auditor (CISA) can further enhance a CPA's marketability and earning potential. Specializations provide CPAs with a competitive edge, offering in-depth knowledge and expertise in a specific area of accounting. This expertise often translates to higher salaries as it brings added value to their roles. Moreover, having additional certifications opens more doors for CPAs, providing them with broader opportunities in various sectors of the industry. A CPA's job title and the responsibilities that come with it significantly influence their salary. As they move up the corporate ladder, CPAs often see a proportional increase in their compensation. This increase reflects the greater responsibilities and higher-level tasks they undertake, such as strategic decision-making, business development, and risk management. High-ranking job titles such as Finance Director, Controller, or Chief Financial Officer (CFO) come with a notable salary hike. These positions involve overseeing the financial health of an entire organization and making strategic decisions that could affect its profitability and growth. Consequently, the compensation for these roles reflects the significant level of responsibility and expertise required. Beyond their base salary, CPAs often receive additional compensation in the form of performance bonuses and benefits. Performance bonuses serve as financial incentives for exceeding expectations or achieving specific company goals. These bonuses can be a significant portion of a CPA's total compensation, particularly in larger corporations or high-profit industries. In addition to bonuses, benefits such as healthcare coverage, retirement plans, and paid time off contribute to a CPA's total compensation package. Employers often provide these benefits to attract and retain top talent. While these benefits might not directly increase a CPA's salary, they add substantial value to their overall compensation and can significantly influence job satisfaction and loyalty. The state of the economy and market demand for CPAs can greatly impact their salaries. During strong economic times, businesses often expand, leading to increased demand for financial professionals like CPAs. On the other hand, during economic downturns, demand may decrease as companies tighten their budgets and slow hiring. However, the essential nature of financial management means that CPAs are always in demand, regardless of economic conditions. The principle of supply and demand applies here. When the demand for CPAs is high and the supply is low, salaries tend to rise. Conversely, when the market is saturated with CPAs, salary growth may slow. It's essential to note that despite economic fluctuations, the demand for experienced and highly skilled CPAs remains consistently high, supporting robust salary prospects. Major metropolitan areas, characterized by their high concentration of businesses and corporations, often offer higher salaries for CPAs. This salary increase can be attributed to the higher cost of living and the intense competition for talent in these densely populated regions. Cities like New York, San Francisco, and Chicago are known for their high CPA salaries, reflecting their status as financial hubs with a wealth of job opportunities. Despite the higher cost of living, many CPAs are drawn to these metropolitan areas due to the career opportunities they present. These cities are often home to large corporations, promising start-ups, and prestigious accounting firms, all of which require the expertise of CPAs. The robust job market combined with the higher salaries make these areas attractive to many finance professionals. In contrast to their metropolitan counterparts, rural or less populated areas often have lower salary ranges for CPAs. These regions typically have fewer businesses, resulting in less competition for talent and lower living costs. While the salaries might be lower compared to metropolitan areas, it's essential to consider the lower cost of living that often accompanies these roles. That said, rural areas may offer unique advantages, such as a slower pace of life, close-knit communities, and lower costs for housing and other necessities. For some CPAs, the lower stress levels, combined with the quality of life in these areas, may compensate for the lower salary ranges. Comparing CPA salaries across different regions offers valuable insights into the impact of geographical location on earning potential. It's clear that salaries vary significantly, with metropolitan areas typically offering higher compensation than rural or less populated areas. However, these disparities are often balanced by the differences in cost of living and lifestyle factors. Therefore, when considering salary prospects, CPAs should also factor in the cost of living and the quality of life each location offers. Higher salaries in expensive cities may not stretch as far as lower salaries in more affordable areas. It's crucial to balance financial considerations with lifestyle preferences to make the best career decisions. These services may include tax preparation, auditing, business consulting, and more. Within these firms, CPAs can expect competitive salaries, especially in well-established firms known for their extensive client bases and wide range of services. In the public accounting sector, salary growth often comes with increased responsibilities and moving up the firm's hierarchy. For instance, making partner at a public accounting firm can result in a substantial salary increase. Additionally, performance bonuses linked to bringing in new business or exceeding performance targets can also boost a CPA's overall compensation in this industry. CPAs in the corporate sector often work in-house for a single organization. They might be involved in various tasks such as preparing financial statements, budgeting, tax planning, and strategic financial decision-making. CPAs in corporate accounting and finance often earn substantial salaries, especially when they occupy senior roles like Chief Financial Officer (CFO) or Finance Director. The corporate sector offers diverse opportunities for CPAs. Whether it's a multinational corporation or a burgeoning start-up, CPAs play a critical role in steering the financial health of the company. Given the high stakes associated with their responsibilities, their compensation packages in the corporate world are often very competitive, especially at senior levels. CPAs working in government or non-profit organizations often have a different compensation structure compared to their counterparts in corporate or public accounting. While the base salaries might be lower, these roles often come with attractive benefits like job security, retirement plans, and work-life balance. Despite lower base salaries, many CPAs are drawn to government and non-profit roles due to the stability, work-life balance, and the opportunity to make a societal impact. In addition, these roles often offer robust benefits packages, which can add significant value to the overall compensation. Thus, while the direct monetary compensation might be lower, the comprehensive rewards can make these roles attractive to many CPAs. Retirement plans and pension benefits are important elements of a CPA's compensation package. Many employers offer 401(k) plans, and in some cases, they match a portion of the employee's contributions. These retirement benefits can significantly boost a CPA's total compensation and provide financial security for their future. Pension plans and other retirement benefits are essentially long-term investments in a CPA's future. They allow CPAs to accumulate wealth over their career span, providing financial stability when they decide to retire. Thus, while they may not immediately affect a CPA's take-home pay, they represent a substantial part of their overall compensation and long-term financial health. Health insurance is another crucial aspect of a CPA's total compensation. In addition to basic health coverage, some employers offer dental and vision insurance, wellness programs, and mental health support. Other common benefits include paid time off, flexible work schedules, remote work options, and parental leave. Employee benefits like health insurance not only provide a safety net for CPAs but also contribute to their well-being and job satisfaction. Employers often provide these benefits to retain and attract top talent. Though these benefits do not directly increase a CPA's salary, they enhance their quality of life and can have a significant financial value. CPAs, like all professionals, need to keep up with the latest industry trends and regulatory changes. Therefore, professional development and training opportunities are a valuable part of a CPA's compensation package. These might include tuition reimbursement for further education, attendance at industry conferences, access to professional development courses, and more. Providing opportunities for professional growth not only benefits the CPAs but also the organization they work for. It enables CPAs to continually hone their skills and stay at the forefront of the industry, thereby bringing more value to their roles. It's a win-win situation: CPAs receive the tools they need to grow in their careers, and organizations benefit from having well-trained, knowledgeable professionals on their teams. CPAs earn competitive salaries that vary based on several factors. Entry-level CPAs with less than three years of experience can expect to earn an average salary range of $46,000 to $68,000. Mid-career CPAs with seven to nine years of experience earn an average salary range of $85,000 to $155,000. Senior-level CPAs with 10+ years of experience can expect an average salary range of $94,000 to $172,000. These salary ranges reflect the progression and expertise gained throughout a CPA's career. However, it's important to note that salaries can vary based on factors such as location, industry, company size, job title, and specialization. Factors like education, certifications, and performance bonuses also contribute to salary fluctuations. Ultimately, CPAs are rewarded financially for their rigorous training, expertise, and ability to make strategic financial decisions.What Are CPAs?

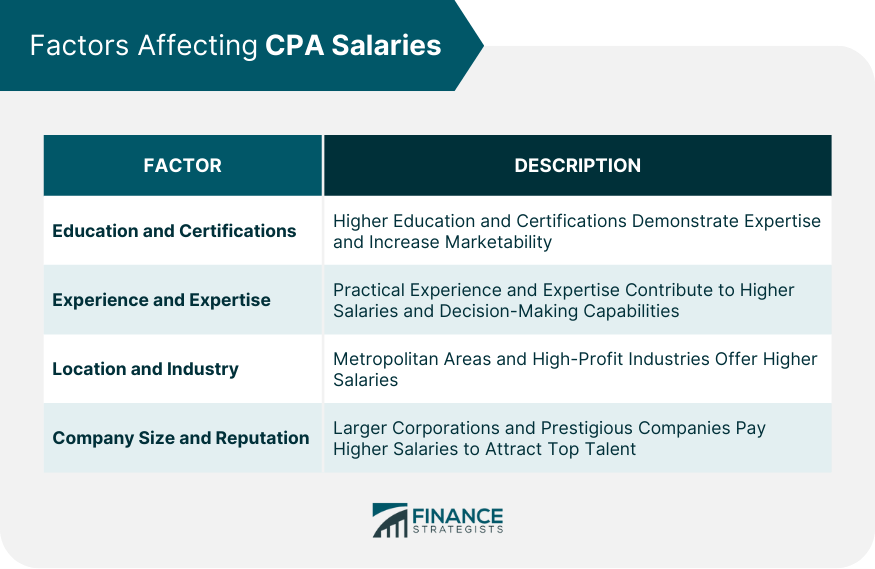

Factors Affecting CPA Salaries

Education and Certifications

Experience and Expertise

Location and Industry

Company Size and Reputation

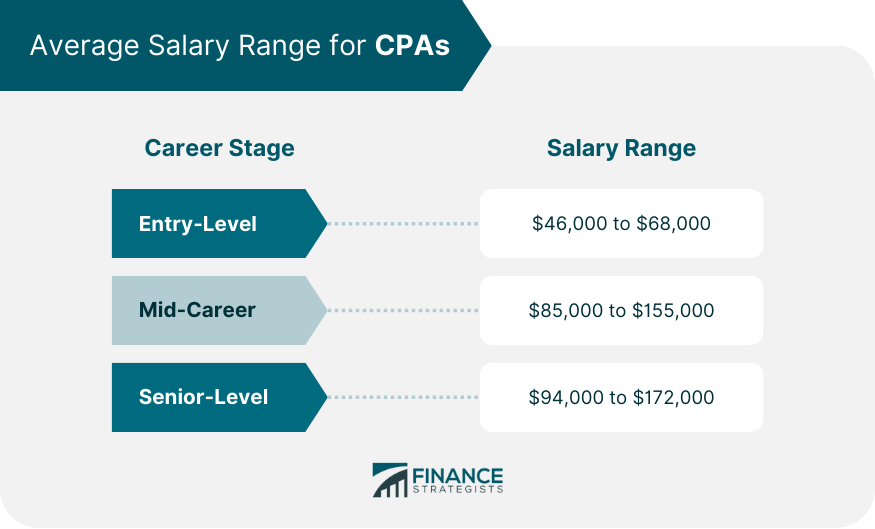

Average Salary Range for CPAs

Entry-Level Salaries for CPAs

Mid-Career Salaries for CPAs

Salaries for Senior-Level CPAs

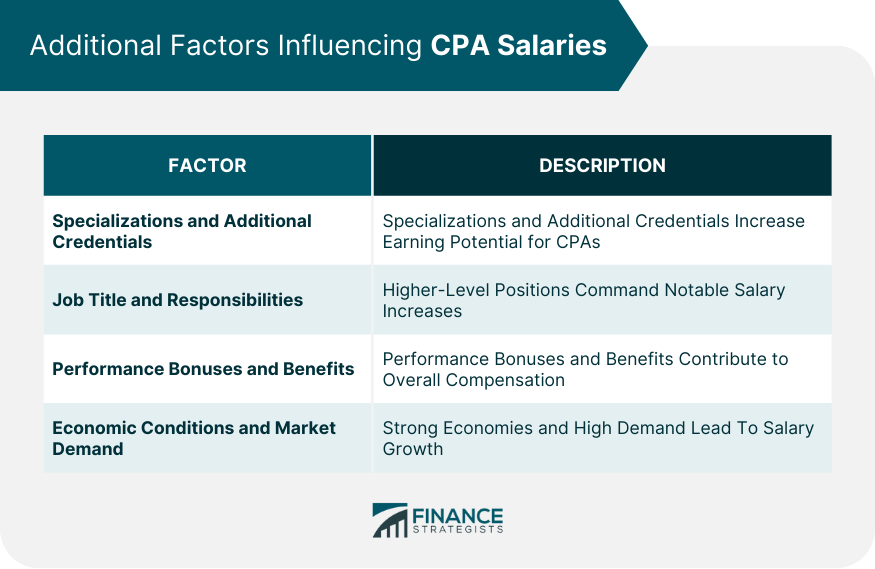

Additional Factors Influencing CPA Salaries

Specializations and Additional Credentials

Job Title and Responsibilities

Performance Bonuses and Benefits

Economic Conditions and Market Demand

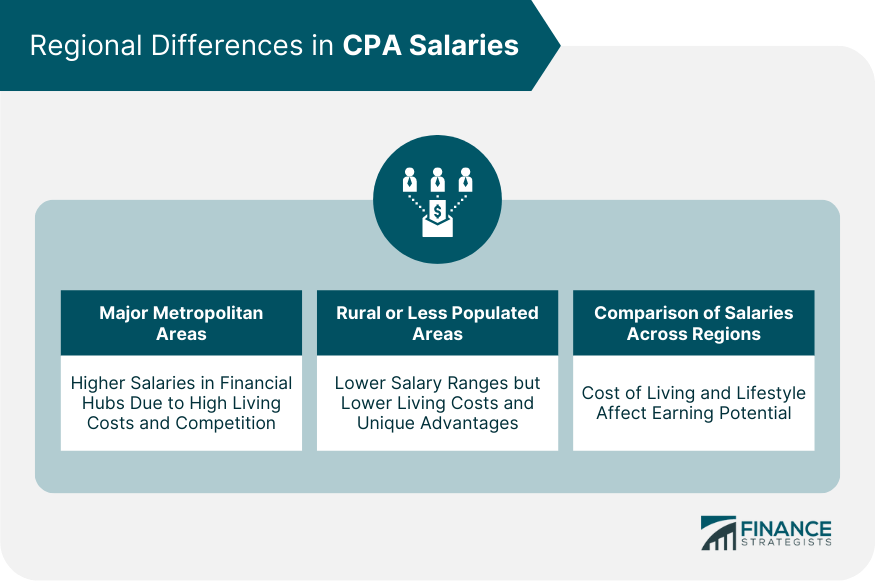

Regional Differences in CPA Salaries

Salaries in Major Metropolitan Areas

Salaries in Rural or Less Populated Areas

Comparison of Salaries Across Different Regions

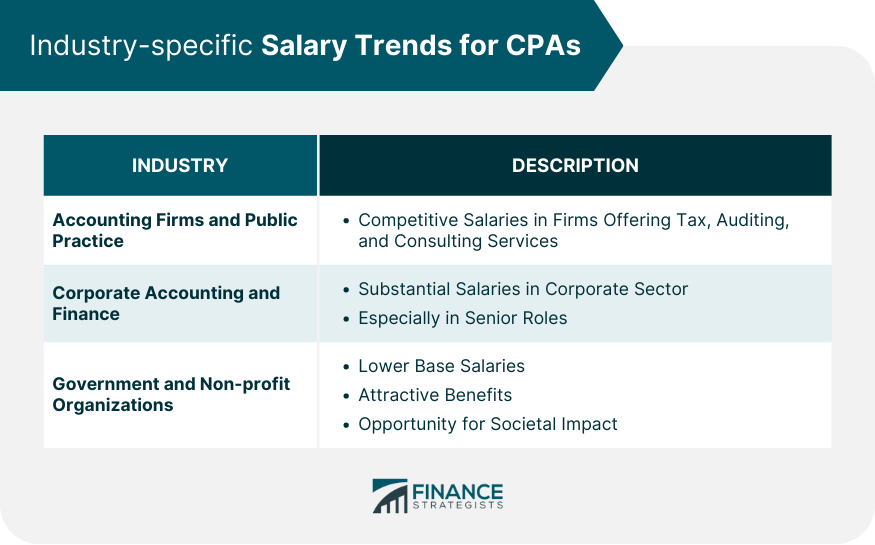

Industry-Specific Salary Trends for CPAs

Accounting Firms and Public Practice

Corporate Accounting and Finance

Government and Non-profit Organizations

Other Compensation Aspects for CPAs

Retirement Plans and Pension Benefits

Health Insurance and Other Employee Benefits

Professional Development and Training Opportunities

Conclusion

How Much Do CPAs Make FAQs

Several factors can influence a CPA's salary, including their level of education and certifications, professional experience, geographical location, the industry they work in, and their specific job title and responsibilities. Additionally, performance bonuses, benefits, economic conditions, and market demand can also play a role.

CPAs working in major metropolitan areas, with a high concentration of businesses and high cost of living, tend to earn more than those working in rural or less populated areas. However, the cost of living and personal lifestyle preferences should also be taken into account when considering salary potential.

The salary range for CPAs can vary widely, with entry-level positions typically earning less than mid-career or senior-level positions. However, these ranges can be influenced by factors such as location, industry, and additional certifications or specialties.

Yes, salaries for CPAs can vary by industry. For example, CPAs working in public accounting firms or corporate finance roles may earn higher salaries than those working for government or non-profit organizations. However, the latter may offer other benefits like job security and work-life balance.

Beyond their base salary, CPAs may receive performance bonuses, retirement plans, health insurance, and other benefits. Additionally, many employers provide professional development and training opportunities, which can enhance a CPA's career growth and job satisfaction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.