A trust merger is a financial transaction in which two or more trusts, which manage assets on behalf of beneficiaries, combine their operations to form a single entity. This can lead to increased efficiency and other benefits, as well as potential challenges. Trust mergers play an important role in the financial industry, as they enable trusts to grow, expand, and improve their services. Mergers can also help trusts to navigate regulatory requirements and changes in the market landscape. Trust mergers have been a part of the financial industry since the early 20th century. They have evolved over time as regulatory frameworks, market conditions, and the overall structure of the financial industry have changed. One reason for trust mergers is to achieve economies of scale, where the combined trust can benefit from reduced costs and improved efficiency due to its larger size. This can result in cost savings and increased profitability for the merged entity. Trust mergers can lead to streamlined operations, as the merged entity can eliminate redundancies and optimize processes across both organizations. This can lead to improved operational efficiency and effectiveness. Another reason for trust mergers is to increase market share by combining the assets and customer base of two or more trusts. This can help the merged trust to establish a stronger presence in the market and potentially attract more clients. Trust mergers can provide a competitive advantage by allowing the merged entity to offer a wider range of products and services, leverage shared expertise, and capitalize on the strengths of both organizations. This can help the trust stay ahead of its competitors in the market. Trust mergers can help trusts to diversify their asset allocation by combining different investment strategies and asset classes from each trust. This can lead to a more balanced and risk-adjusted portfolio for the merged trust. By diversifying assets through a merger, trusts can reduce their exposure to specific risks and improve their overall risk management. This can help protect the trust and its beneficiaries from market volatility and other potential threats. Trust mergers may be driven by the need to comply with evolving laws and regulations in the financial industry. By merging, trusts can pool resources to better address compliance requirements, reducing the risk of potential legal and financial penalties. Trust mergers may also be motivated by antitrust concerns, as regulatory authorities may require trusts to combine operations to prevent excessive concentration of market power. This can help maintain a competitive and fair market environment. Horizontal trust mergers occur when two or more trusts operating in the same market segment combine their operations. An example of this would be the merger of two wealth management trusts that both focus on high-net-worth individuals. The benefits of horizontal trust mergers include increased market share, cost savings, and improved operational efficiency. However, challenges can arise from potential antitrust concerns, integration issues, and the need to preserve the unique value proposition of each trust. Vertical trust mergers involve the combination of trusts that operate at different stages of the same value chain. An example would be a trust that manages investments in real estate merging with a trust that specializes in property management. Vertical trust mergers can lead to increased efficiency, cost savings, and improved coordination along the value chain. However, they can also face challenges such as potential conflicts of interest, operational complexities, and the need to preserve the unique value proposition of each trust. Conglomerate trust mergers involve the combination of trusts that operate in unrelated markets or industries. An example would be a trust that specializes in managing investments in technology companies merging with a trust that focuses on managing investments in consumer goods companies. Conglomerate trust mergers can provide benefits such as diversification, risk reduction, and potential cross-industry synergies. Challenges may include integration difficulties, potential conflicts of interest, and the need to manage disparate business lines. When considering a trust merger, it is essential to evaluate the strategic fit between the potential partners. This includes examining their investment strategies, client bases, and operational capabilities to ensure that the merger will create value for all parties involved. Financial feasibility is another critical factor to consider when evaluating potential trust merger partners. This involves assessing the financial health of each trust, the potential cost savings and synergies, and the ability to finance the merger transaction. During the due diligence process, it is important to review the legal and regulatory compliance of both trusts. This includes examining each trust's adherence to relevant laws and regulations, as well as assessing any potential legal or regulatory risks that could arise from the merger. A comprehensive financial and operational review should be conducted during the due diligence process. This includes analyzing each trust's financial performance, asset quality, and operational efficiency to ensure a successful merger. Determining the appropriate valuation and pricing for each trust involved in the merger is crucial. This can involve complex financial modeling and negotiation to reach an agreement on the value of each trust and the structure of the transaction. The terms and conditions of the merger agreement need to be carefully negotiated and documented. This includes defining the legal structure of the merged entity, addressing the rights and obligations of all parties, and outlining the steps required for successful integration. Regulatory approval is an essential step in the trust merger process, and antitrust concerns may need to be addressed. Trusts must demonstrate to regulatory authorities that the merger will not result in an excessive concentration of market power or negatively impact market competition. In addition to antitrust concerns, trusts must also comply with other regulatory requirements related to the merger. This may include obtaining approvals from relevant financial regulators, addressing tax implications, and ensuring compliance with industry-specific regulations. Following the approval of the merger, the trusts must begin the process of combining their operations. This can involve consolidating investment portfolios, streamlining processes, and integrating technology systems to create a cohesive and efficient merged trust. Cultural integration is a critical component of a successful trust merger, as it can significantly impact employee morale and productivity. Trusts must work to align their organizational cultures, values, and ways of working to ensure a smooth transition and continued success. One potential risk associated with trust mergers is the possibility of antitrust concerns, which can result in regulatory intervention or even the blocking of the merger. Trusts must carefully consider the potential impact of the merger on market competition and take steps to address any concerns raised by regulatory authorities. Another potential challenge is ensuring compliance with all relevant laws and regulations during and after the merger. Trusts must be diligent in monitoring and adhering to the legal and regulatory requirements to avoid potential penalties and reputational damage. Overvaluation is a financial risk associated with trust mergers, as it can lead to the merged trust carrying an excessive amount of goodwill on its balance sheet. This can negatively impact the trust's financial performance and potentially lead to impairments in the future. Integration costs are another financial risk associated with trust mergers, as they can be significant and may exceed initial estimates. Trusts must carefully plan and budget for integration expenses to ensure that the merger remains financially viable and beneficial. One operational risk associated with trust mergers is the potential loss of key personnel, as employees may leave the organization due to uncertainty or dissatisfaction with the merger. Trusts must actively engage with and support their employees to retain critical talent and ensure the success of the merged entity. Integration challenges are a common operational risk in trust mergers, as the process of combining operations and cultures can be complex and time-consuming. Trusts must develop a comprehensive integration plan and allocate sufficient resources to manage the process effectively. Trust mergers play a vital role in the financial industry, as they can drive growth, improve efficiency, and help trusts to adapt to changing market conditions and regulatory requirements. By understanding and managing the potential benefits and risks, trusts can successfully navigate the merger process and achieve their strategic objectives. The potential benefits of trust mergers include cost savings, increased market share, diversified assets, and improved risk management. However, trusts must also carefully consider and address the potential risks and challenges, such as legal and regulatory issues, financial risks, and operational risks. The future outlook for trust mergers remains positive, as trusts continue to seek opportunities for growth and consolidation in the financial industry. By learning from past experiences and adopting best practices, trusts can successfully navigate the merger process and unlock value for their clients and stakeholders. Estate planning is a critical aspect of ensuring your assets are managed and distributed according to your wishes, and your loved ones are protected in the future. An experienced estate planning lawyer can provide invaluable guidance, helping you navigate complex legal and financial issues with confidence.What Are Trust Mergers?

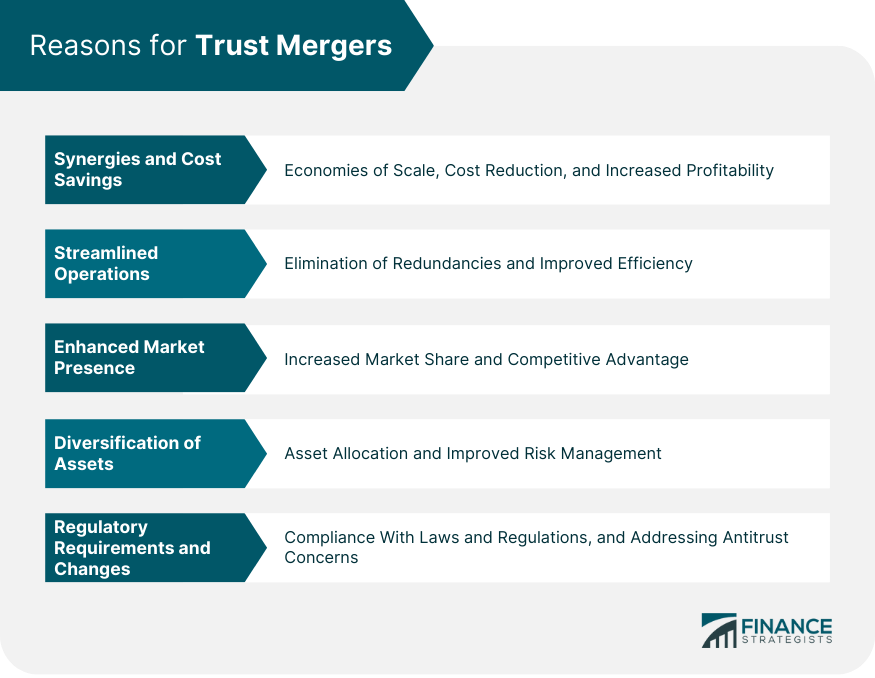

Reasons for Trust Mergers

Synergies and Cost Savings

Economies of Scale

Streamlined Operations

Enhanced Market Presence

Increased Market Share

Competitive Advantage

Diversification of Assets

Asset Allocation

Risk Management

Regulatory Requirements and Changes

Compliance With Laws and Regulations

Antitrust Concerns

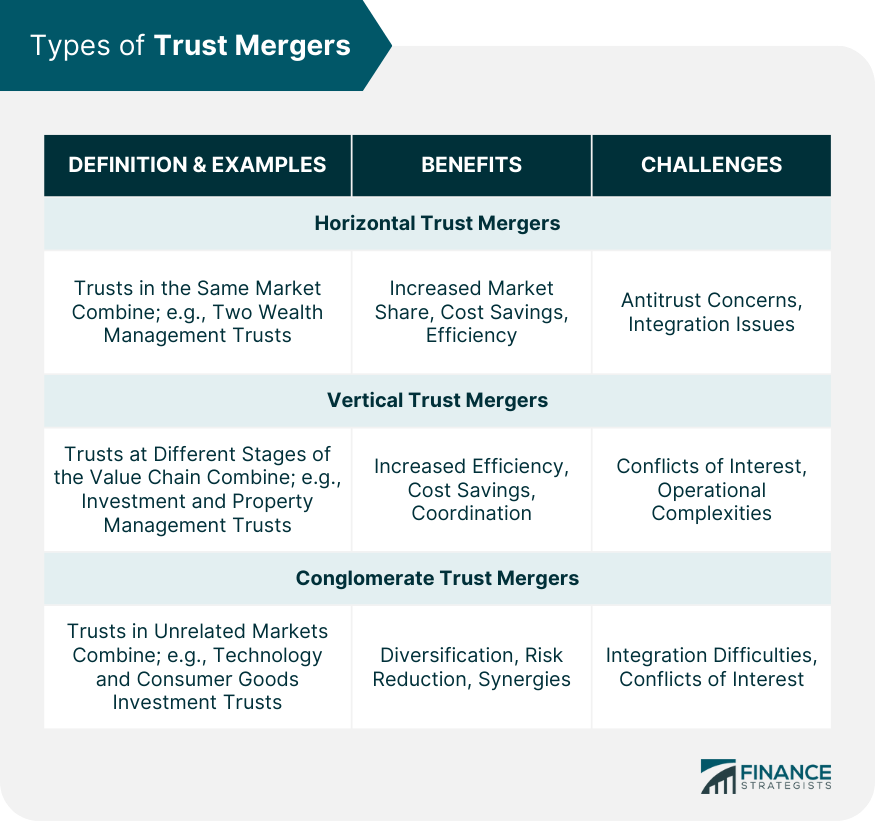

Types of Trust Mergers

Horizontal Trust Mergers

Definition and Examples

Benefits and Challenges

Vertical Trust Mergers

Definition and Examples

Benefits and Challenges

Conglomerate Trust Mergers

Definition and Examples

Benefits and Challenges

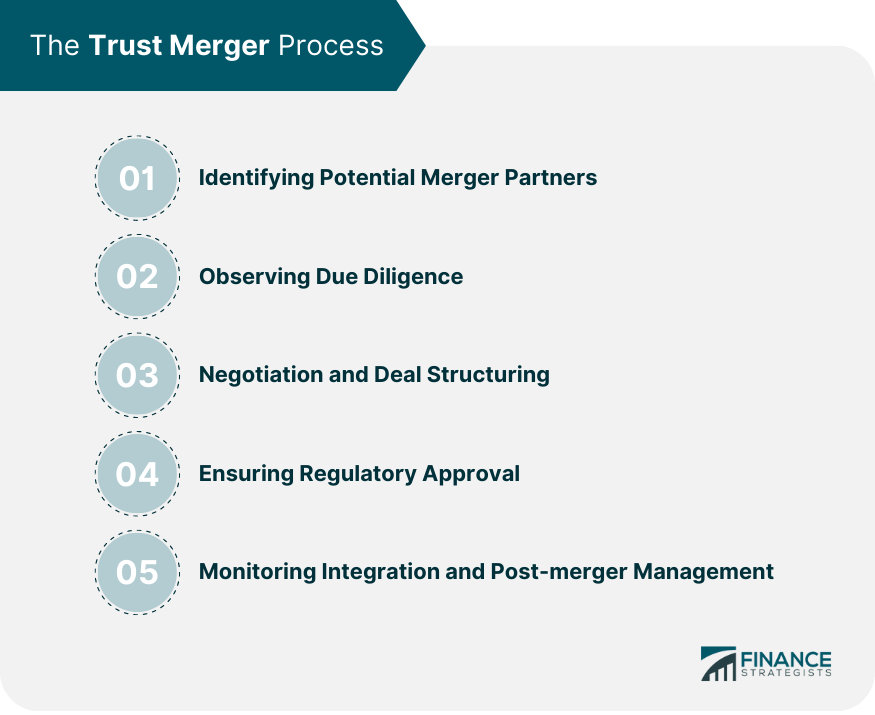

The Trust Merger Process

Identifying Potential Merger Partners

Strategic Fit

Financial Feasibility

Observing Due Diligence

Legal and Regulatory Compliance

Financial and Operational Review

Negotiation and Deal Structuring

Valuation and Pricing

Terms and Conditions

Ensuring Regulatory Approval

Antitrust Concerns

Other Regulatory Requirements

Monitoring Integration and Post-merger Management

Combining Operations

Cultural Integration

Potential Risks and Challenges

Legal and Regulatory Issues

Antitrust Concerns

Compliance With Laws and Regulations

Financial Risks

Overvaluation

Integration Costs

Operational Risks

Loss of Key Personnel

Integration Challenges

Final Thoughts

Trust Mergers FAQs

Trust mergers involve the combination of two or more trusts, which manage assets on behalf of beneficiaries, into a single entity. They play a vital role in the financial industry by driving growth, improving efficiency, and helping trusts adapt to changing market conditions and regulatory requirements.

Trusts typically engage in trust mergers for several reasons, including synergies and cost savings, enhanced market presence, diversification of assets, and compliance with regulatory requirements and changes.

There are three main types of trust mergers: horizontal trust mergers, which involve trusts operating in the same market segment; vertical trust mergers, which involve trusts operating at different stages of the same value chain; and conglomerate trust mergers, which involve trusts operating in unrelated markets or industries.

Trusts should carefully consider potential risks and challenges, such as legal and regulatory issues (e.g., antitrust concerns and compliance), financial risks (e.g., overvaluation and integration costs), and operational risks (e.g., loss of key personnel and integration challenges).

By examining case studies of both successful and unsuccessful trust mergers, trusts can gain valuable insights into best practices, potential benefits, and potential pitfalls associated with these transactions. These lessons can inform the due diligence process, deal structuring, integration planning, and post-merger management, ultimately contributing to a more successful trust merger outcome.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.