When considering safe and reliable ways to grow your money, CDs and high-yield savings accounts are popular choices. Both offer benefits such as guaranteed returns and protection of your principal. CDs, or certificates of deposit, provide higher interest rates, especially for larger deposits, and offer the advantage of compound interest. On the other hand, high-yield savings accounts offer better liquidity and easier access to your funds. Understanding the differences between these two options can help you make an informed decision that aligns with your financial goals and risk tolerance. Once you've opened a CD and made your deposit, you're expected to leave your money untouched until the maturity date. This is the date at which the CD term ends. Once the CD matures, you'll receive your initial deposit back, along with any accrued interest. If you need to withdraw your money before the maturity date, you'll typically face a penalty. Traditional CDs are the most common type. When you open a traditional CD, you agree to deposit a fixed sum of money for a specific period and receive a predetermined interest rate. The term can range from a few months to several years, and typically, the longer the term, the higher the interest rate. Jumbo CDs are similar to traditional CDs but require a significantly larger deposit, typically $100,000 or more. Due to the larger deposit, banks usually offer a higher interest rate on Jumbo CDs than on traditional CDs. Bump-up CDs offer the option to increase your interest rate if the rates go up during your term. This feature can be particularly useful in an environment where interest rates are on the rise. However, these CDs often start with lower interest rates than traditional CDs. Liquid CDs, also known as no-penalty CDs, provide more flexibility by allowing you to withdraw part of your deposit without facing a penalty. This can be an attractive feature if you think you might need access to your funds before the CD's maturity date. However, the trade-off is typically a lower interest rate compared to other CDs. Callable CDs come with a call feature that allows the bank to terminate or "call" the CD after a set period, rather than waiting until maturity. If interest rates fall, the bank might call the CD and issue a new one at a lower rate. While these CDs may offer a higher interest rate, they also carry more risk due to the call feature. Brokered CDs are sold through brokerage firms. They can offer higher rates because brokers can negotiate with several banks to get the best rates. However, they can be more complex and may have additional fees compared to CDs bought directly from a bank. One of the major advantages of CDs is their provision of guaranteed returns. When you open a CD, the interest rate is often fixed. This means that you know from the outset what your return on investment will be, irrespective of market fluctuations. CDs usually offer higher interest rates compared to regular savings accounts. This is especially true for long-term CDs where you commit your money for several years. This makes CDs a compelling option for investors looking to earn more on their savings. Like other deposit accounts at banks, CDs are insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per institution. This offers a significant level of security and means that you can invest with confidence knowing that your money is protected. CDs offer a variety of terms, from as short as three months to as long as five years or more. This gives you the flexibility to choose a term that aligns with your financial goals and timeline. CDs are considered low-risk investments because they offer guaranteed returns. This makes them a great choice for conservative investors who want to avoid the volatility of the stock market. With penalties for early withdrawal, CDs discourage dipping into savings, thus promoting a disciplined savings habit. If you struggle with saving, investing in a CD can be a good way to enforce discipline and grow your savings. One of the most significant drawbacks of CDs is their limited liquidity. When you invest in a CD, your money is tied up for a specified period, known as the term. If you need to withdraw your funds before the end of the term, you'll usually be charged a penalty. This could make CDs a less attractive option for those who may need to access their savings on short notice. While CDs generally offer higher interest rates than traditional savings accounts, they usually provide lower returns than riskier investments like stocks or bonds. Therefore, if you're looking for high growth or you're investing for a long-term goal like retirement, CDs might not be the most suitable choice. The interest rates on CDs are fixed for the term of the deposit. This means that if inflation rises significantly, your CD might not keep up, effectively reducing your buying power over time. This phenomenon, known as inflation risk, can eat away at your earnings from a CD. CDs come with a fixed term, and you receive the best interest rates when you choose longer terms. However, this means you miss out on potential higher rates in the future during your CD term. If interest rates increase, your money is still locked into the lower rate. You can deposit and withdraw funds from a high-yield savings account as you wish, up to the limits imposed by federal regulations. The bank pays you interest on your balance, typically compounded daily or monthly. The advent of digital banking has brought about the rise of online high-yield savings accounts. These accounts are primarily offered by online banks with no physical branches. Due to lower overhead costs, online banks are often able to offer interest rates much higher than those provided by traditional banks. Key features of online high-yield savings accounts include: High interest rates compared to traditional savings accounts Access to funds via electronic transfer, ATM, or mobile check deposit Lower fees due to less overhead Typically no or low minimum balance requirements Credit unions are nonprofit, member-owned financial institutions that often provide high-yield savings accounts. Similar to online banks, credit unions can offer higher interest rates because they aim to provide profits back to their members. Features of credit union high-yield savings accounts include: High-interest rates, usually higher than traditional banks but often slightly lower than online banks Access to a nationwide network of ATMs Often require membership in a credit union, which can sometimes involve fees or eligibility criteria Are a type of high-yield savings account that typically require a higher minimum balance but, in return, offer higher interest rates. They are a blend between a savings and checking account, as they often come with check-writing privileges or a debit card. The primary advantage of high-yield savings accounts is in the name: of the high yield. These accounts typically offer interest rates much higher than traditional savings accounts, allowing your money to grow faster. Unlike other types of savings vehicles, such as CDs, high-yield savings accounts typically allow for easy access to your funds. This means you can withdraw your money without facing any penalties, making it a convenient option for emergency funds or other short-term savings goals. With a high-yield savings account, your principal is protected. This means you won’t lose the money you originally put into the account, unlike other forms of investments like stocks or mutual funds that come with a degree of risk. Most high-yield savings accounts offer compound interest, which means that not only do you earn interest on the money you deposit, but you also earn interest on the interest. This can help your savings grow faster over time. Like traditional savings accounts, high-yield savings accounts are insured by the Federal Deposit Insurance Corporation for up to $250,000. This provides a safety net in the unlikely event that the bank or credit union fails. High-yield savings accounts offer the flexibility to deposit or withdraw money as needed. This is an advantage if you need a safe place to store your money but also need the ability to access it quickly. One of the primary drawbacks of high-yield savings accounts is that the interest rates are variable. While this can be a benefit when rates are on the rise, it also means that your rate could go down. In contrast, a Certificate of Deposit (CD) offers a fixed rate that doesn't change for the term of the CD, providing more predictability. Federal regulations limit the number of certain types of withdrawals and transfers from high-yield savings accounts to six per statement cycle. Exceeding these limits may result in fees or the bank could even close your account or convert it into a checking account. While many high-yield savings accounts are fee-free, some banks do charge fees. These can include monthly maintenance fees if you don't maintain a minimum balance, excess transaction fees, and even paper statement fees. It's crucial to read the fine print before opening an account to understand any potential costs. Some high-yield savings accounts require a minimum balance to open the account or to earn the highest advertised interest rate. If you're not able to maintain the minimum balance, you could earn a lower interest rate or incur fees. Even though high-yield savings accounts provide better accessibility compared to other savings products like CDs, they may not be as convenient as checking accounts for regular transactions. They typically don't come with checks or a debit card, making it less convenient to spend money directly from the account. While high-yield savings accounts often provide better interest rates than traditional savings accounts, there's always a risk that the rate won't keep up with inflation, reducing your purchasing power over time. It's essential to monitor inflation and interest rates regularly to ensure your savings are growing in real terms. Typically, CDs offer higher interest rates than high-yield savings accounts, especially for longer-term CDs. However, high-yield savings account rates are variable and could potentially rise, while CD rates are fixed for the term. High-yield savings accounts offers more flexibility, as you can make withdrawals when needed. In contrast, CDs require you to keep your money in the account until the maturity date or face penalties. Both CDs and high-yield savings accounts are low-risk options, as they are insured by the FDIC. However, the risk of not keeping up with inflation can be a concern, particularly with long-term CDs. CDs are ideal if you have a specific savings goal in mind and won't need to access your funds for a while. On the other hand, high-yield savings accounts are more suited for emergency funds or savings goals where you might need to access your money more regularly. Your financial goals will greatly influence whether a CD or a high-yield savings account is right for you. If you're saving for a short-term goal, a high-yield savings account might be better. For long-term goals, a CD could be a more suitable choice. While both CDs and high-yield savings accounts are safe places to keep your money, they offer different levels of risk and return. Assess your risk tolerance to determine which one aligns with your comfort level. Your time horizon is also crucial in making a decision. If you'll need your funds within the next few years, the accessibility of a high-yield savings account could be beneficial. However, if your time horizon is longer, a CD could provide a better return. If you need easy access to your money, a high-yield savings account is the better choice as it provides more liquidity. CDs, in contrast, are designed for longer-term savings where you won't need to touch your money for a specified period. Certificates of Deposit (CDs) and High-Yield Savings Accounts are both valuable financial tools for saving money, each with its advantages and drawbacks. CDs generally offer higher fixed interest rates and are a great option for long-term savings goals where you won't need immediate access to your funds. However, they come with penalties for early withdrawal, making them less flexible. On the other hand, High-Yield Savings Accounts offer variable but typically lower interest rates. They provide more liquidity, allowing for withdrawals and deposits at any time up to federal limits. However, their interest rates can decrease, impacting your returns. The choice between CDs and high-yield savings accounts ultimately depends on your financial goals, time horizon, need for liquidity, and risk tolerance.CDs vs High-Yield Savings Accounts: Overview

How CDs Work

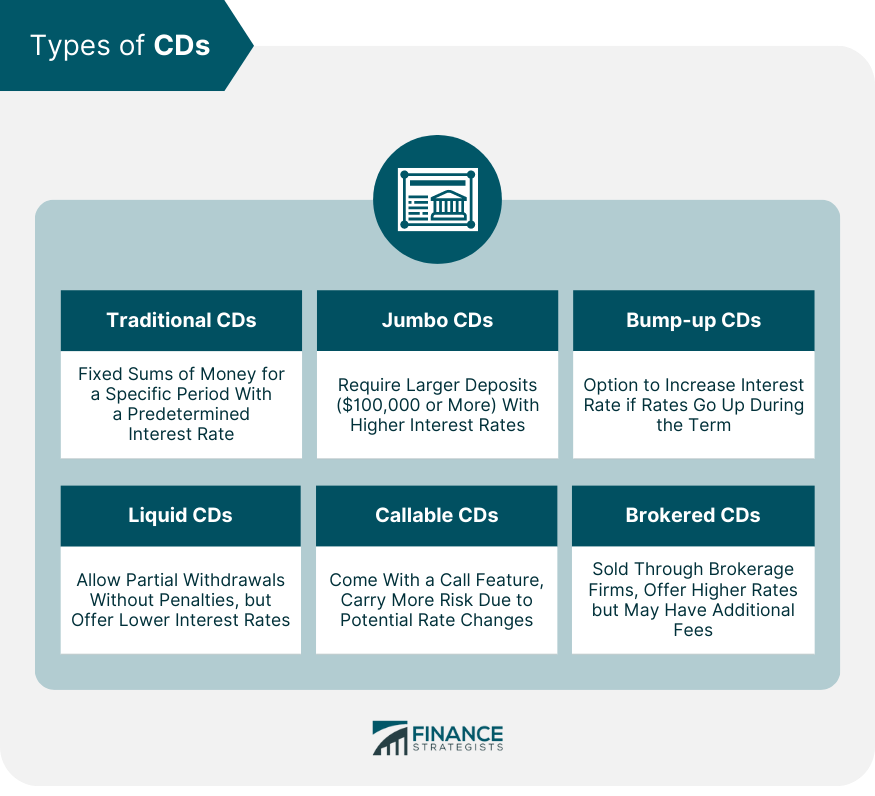

Types of CDs

Traditional CDs

Jumbo CDs

Bump-up CDs

Liquid CDs

Callable CDs

Brokered CDs

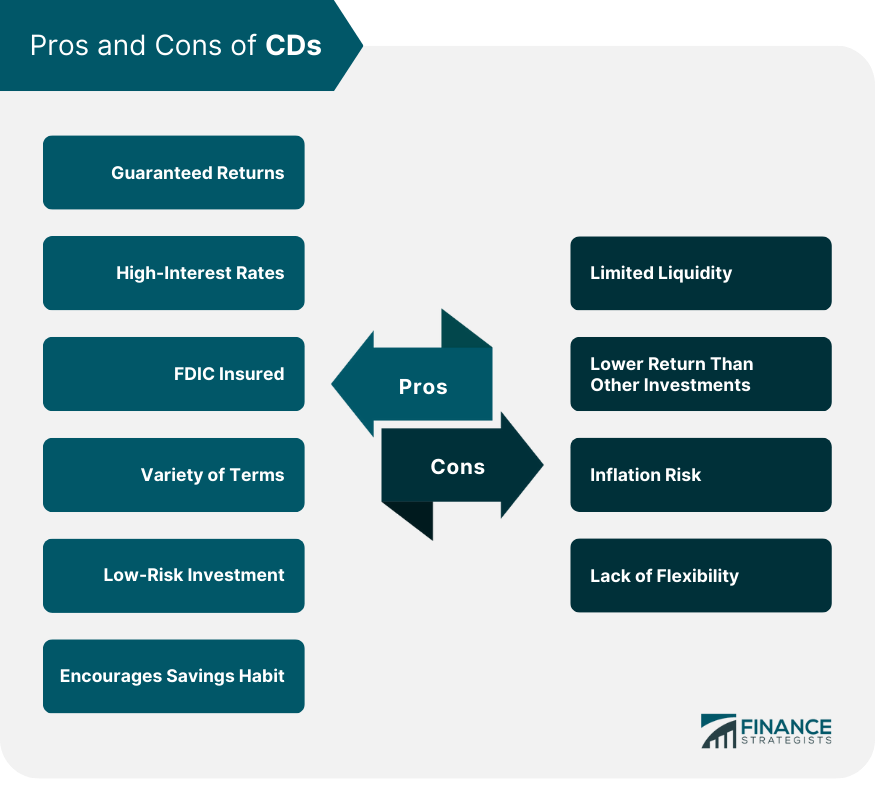

Pros of CDs

Guaranteed Returns

High-Interest Rates

FDIC Insured

Variety of Terms

Low-Risk Investment

Encourages Savings Habit

Cons of CDs

Limited Liquidity

Lower Return Than Other Investments

Inflation Risk

Lack of Flexibility

How High-Yield Savings Accounts Work

Types of High-Yield Savings Accounts

Online High-Yield Savings Accounts

Credit Union High-Yield Savings Accounts

Money Market Accounts

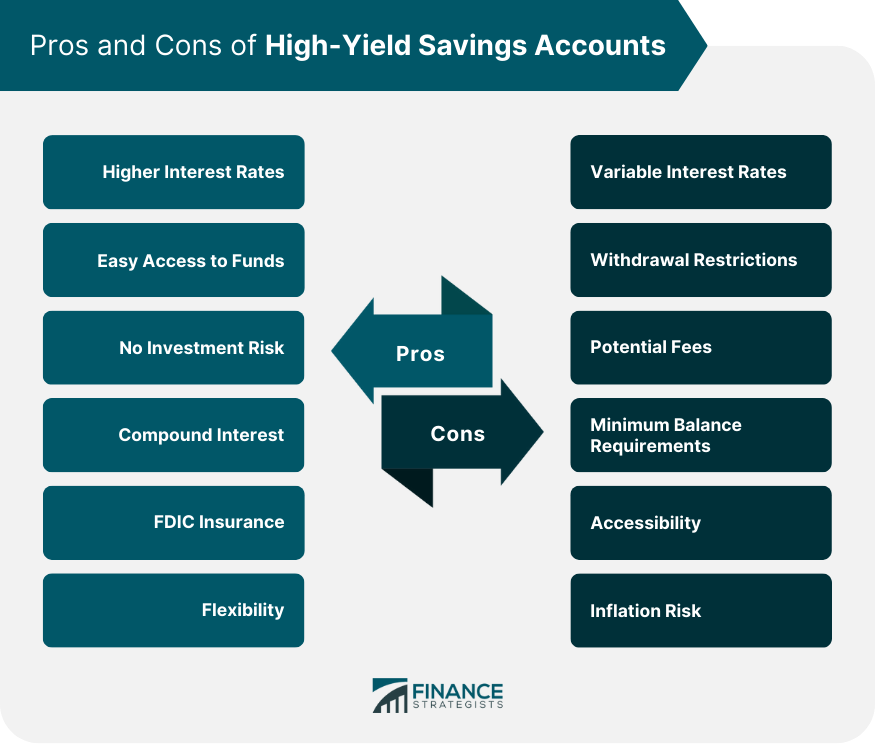

Pros of High-Yield Savings Accounts

Higher Interest Rates

Easy Access to Funds

No Investment Risk

Compound Interest

FDIC Insurance

Flexibility

Cons of High-Yield Savings Accounts

Variable Interest Rates

Withdrawal Restrictions

Potential Fees

Minimum Balance Requirements

Accessibility

Inflation Risk

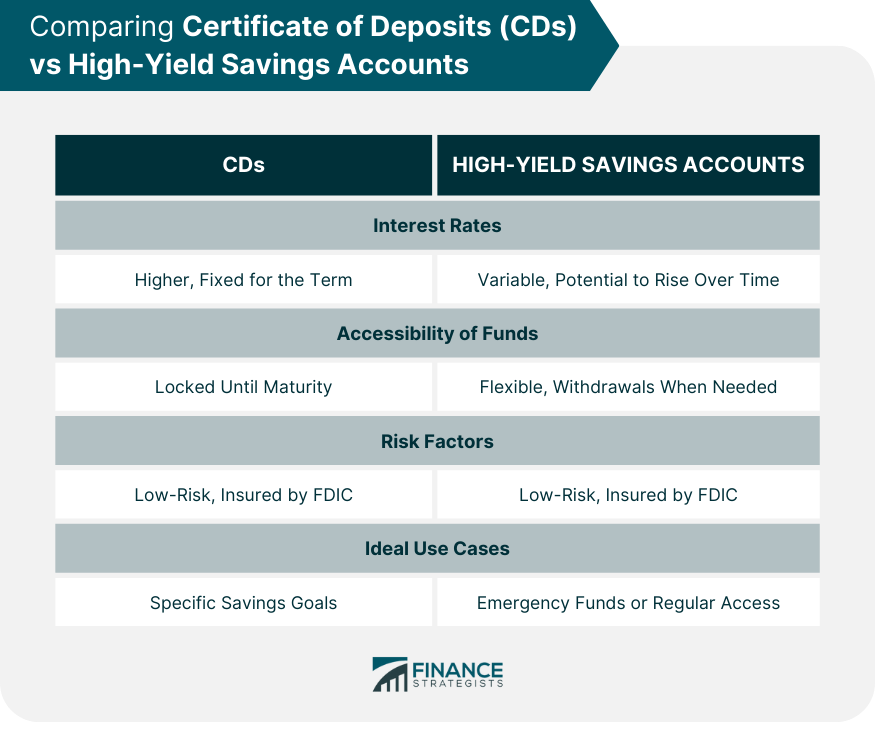

Comparing CDs vs High-Yield Savings Accounts

Interest Rates

Accessibility of Funds

Risk Factors

Ideal Use Cases

How to Choose Between a CD and a High-Yield Savings Account

Determine Financial Goals

Understand Risk Tolerance

Consider Time Horizon

Evaluate Need for Liquidity

Conclusion

CDs vs High-Yield Savings Accounts FAQs

CDs have higher interest rates, compound interest, and less liquidity. High-yield savings accounts have lower interest rates, more flexibility, and easier access.

It depends on your goals, risk, and time. CDs are good for long-term savings with a fixed return. High-yield savings are good for short-term savings with more liquidity.

Traditional CDs have fixed rates and terms. Jumbo CDs have larger deposits and higher rates. Bump-up CDs have the option to increase rates. Liquid CDs have no penalties for withdrawals. Callable CDs have a call feature and more risk. Brokered CDs have higher rates but more fees.

Both are insured by FDIC or NCUA up to $250,000 per depositor, per institution, per category. Anything above the limit is not insured.

You need to find a bank or credit union that offers them and compare their rates and terms. You also need to provide personal information and make a deposit that meets the minimum requirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.